Explore the ScaleUp Annual Review 2021

Select a section to expand and explore this year's review.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Access to markets

Access to markets at home and abroad remains a key challenge for scaleups – in 2021 78% of scaleups see it as critical for their growth. As well as being integral to scaling a business, market access is fundamentally linked to the broader talent and finance challenges that scaleups face as they grow. It is not therefore surprising that talent, market access and finding the right finance are now consistently the three challenges cited as priorities to overcome in scaleup CEOs minds as they head into 2022 and realise their scaleup plans.

This year has seen a notable number of consultations relevant to scaleup market access including the Green Paper on Transforming Public Procurement, the Fintech Strategy Review, consultations on R&D Tax Credits, the Innovation Strategy, the forthcoming Export Strategy Refresh from DIT, and the Enterprise Strategy expected from BEIS. Much of this activity is in line with recommendations which we have made, including the need to ensure that we have at scale, long term institutions in the UK. In prior years, we have called for expansion of support from Innovate UK and the British Business Bank, and we see it as very positive that a strong recognition of the importance of these two institutions is present in the Innovation Strategy, and in the Autumn Budget and Spending Review 2021. We broadly welcome this momentum and will monitor progress closely as implementation of the Government’s Plan for Growth takes place.

Last year we emphasised that market access must form an active part of the Government response to Covid-19 and as part of the UKs new trading relationship with the EU. With data now available from the Covid-19 affected period, this has proven to be the case: action is now action more critical than ever. The Pink Book 2021 shows that the pandemic had very wide-ranging impacts on UK transactions, including a stark impact on UK trade flows in particular sectors, though others were less affected. Imports and exports of finished manufactured goods, for example, fell by £40.1 billion and £43.3 billion respectively. This was somewhat offset by other sectors such as services which (outside of travel services) were less impacted by travel restrictions and saw an increase from £117.5 billion in 2019 to £133.0 billion in 2020. These broad swings caused the UKs total trade balance to switch from a deficit of £20.7 billion (0.9% of GDP) in 2019 to a surplus of £4.3 billion (0.2% of GDP) in 2020.

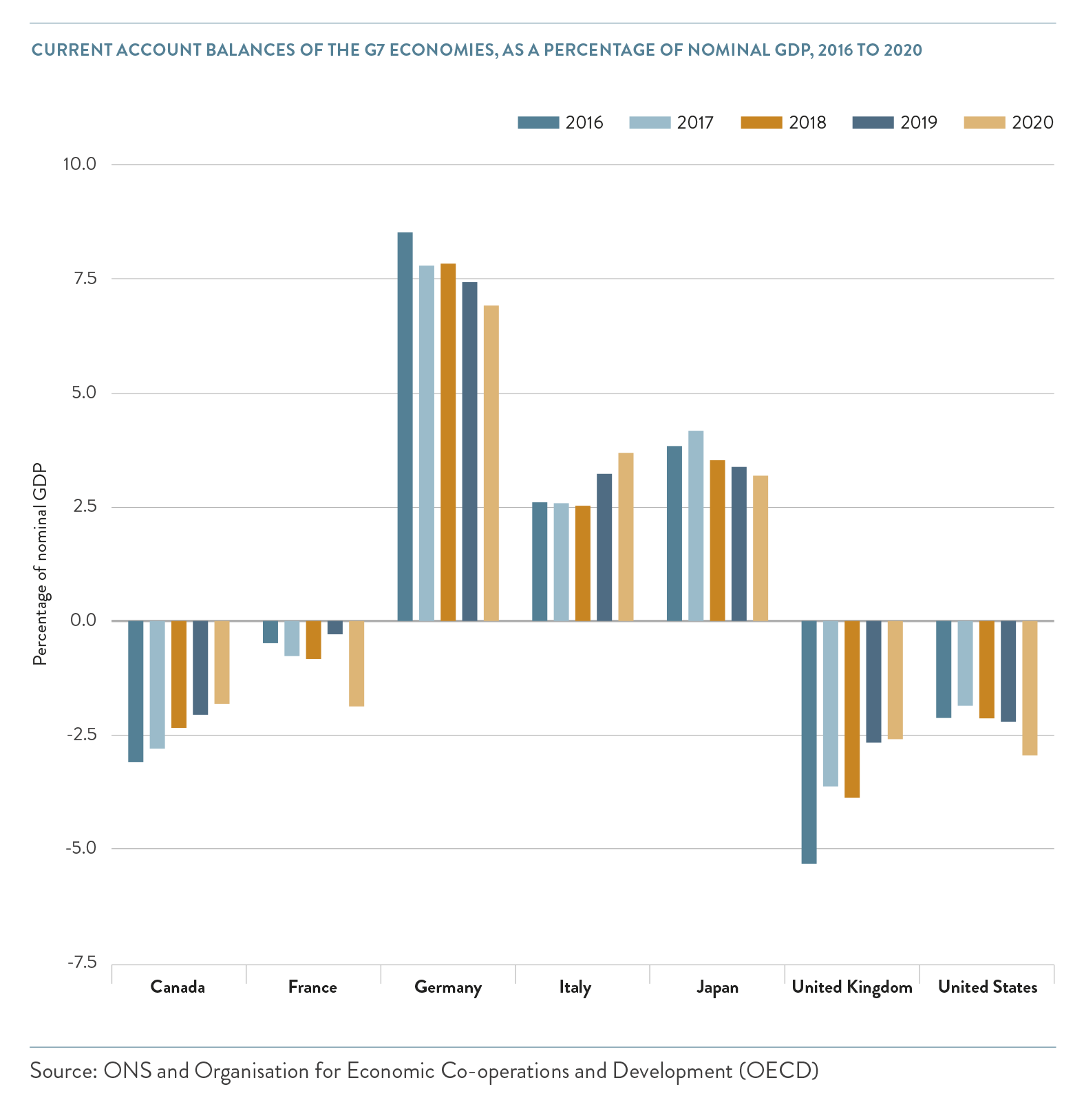

Because of this the UK’s overall current account deficit – proportionate to GDP – narrowed slightly in 2020 placing the UK as second to the US amongst G7 economies in terms of the size of the deficit being managed, compared to last in 2019.

However, the narrowing of the overarching current account deficit as a proportion of GDP indicated by these figures was driven by a dramatic reduction in economic activity rather than an increase in UK exports.

Therefore, as the UK and the world begins to look beyond the pandemic, it is critical that the barriers which scaleups indicate, such as finding the right market intelligence, buyer introductions and opportunities to bid, are addressed as a priority.

We know that more than half of our scaleups are already exporting, with a further 6 in 10 planning to do so next year. Now is the time to ensure that the UKs growth champions are provided with the right support as they lead the charge on economic growth, both domestically and internationally.

Whilst the interplay between markets, talent and finance is broadly recognised to be central to scaleup growth, these very links create more complex challenges than are faced at different business stages when growth is slower. This can seem insurmountable to a business if access to the right support is not possible and scaleups often report that the services that do exist are not geared towards them, with 46% suggesting this is the case in 2021, feeling that they are underserved by the business support on offer. Moreover, this seems to be a systemic issue: as we have reported previously – there are fewer scaleup programmes relating to market access than other areas.

However, there are some notable programmes with impact: the London Mayor’s International Business Programme, and the Manchester Global Scale-up Programme are each scaleup focused initiatives geared towards exports. Demand for these programmes is strong, even during the pandemic, with the London Programme supporting more than 200 businesses over the last year, and the Manchester programme – reporting that cohort members have entered 74 new markets over the same period. We believe that these should be rolled out to all areas of the UK as part of a push to ensure that scaleups are able to consider going global, no matter where they are based.

We are also pleased that the FCA Sandbox programme – which we endorsed in 2017 – was explicitly recognised in the recommendations of the Kalifa Review of UK Fintech published in February of this year suggesting further ‘Scale box’ solutions. These should be considered across all highly regulated sectors, such as health, and geared toward encouraging innovative, scaleup companies to take part in them: we note that recent NHS Digital Regulatory Sandbox trial (part of the broader ICO sandbox beta) was re-scoped in order to support the Covid-19 vaccine rollout – this shows the power of such initiatives. However, to make best use of this kind of innovation, as well as being directly targeted at growth potential firms, participating scaleups need to be connected to the broader ecosystem as well so that companies which engage in a sandbox are then proactively linked to appropriate procurement opportunities, or available trade missions for companies at their stage of development.

In moving beyond Covid-19 and helping companies to engage in the ‘new normal’ in which they are now operating, it is more important than ever to ensure that a segmented approach to scaleup businesses is adopted across Government, and that proactive account management structures are embraced. This will provide the best chance for scaleup companies to access fast track services as they seek to grow internationally, or access procurement and corporate contracts at home despite the existential challenges faced.

EXPORTING FOR GROWTH: From ‘Just in Time’ to ‘Just in Case’ Global supply chains under pressure

Current market conditions are placing substantial strain upon supply chains within the UK and globally. This turbulence has a direct impact upon scaleup businesses looking to plan their growth and enter new export markets.

The Covid-19 pandemic has caused some of these challenges, but many are bottlenecks rooted in more fundamental structural pressures within the Global economy. Policies implemented to address market access challenges that scaleups highlight need to be developed with a clear view of the overarching global context within which these companies are now operating.

The knock-on effects of the 2020 Suez Canal blockage have revealed the stretched nature of shipping supply routes, and the dramatic swings in demand for products caused by Covid-19 lockdowns – and the shortages that have resulted – show just how reliant much of modern manufacturing is on a very specific raw materials (such as rare earth elements) and primary components (including the sourcing of microchips).

Ongoing geopolitical concerns around trade flows provide a further backdrop to a period that has seen increased levels of protectionism and tariff increases globally, particularly between China and the US. As well as being a core driver of global demand for products, the US / China relationship has a deep structural linkage to both many of the critical raw materials highlighted above (for instance, China maintains a notable dominance of the rare earth elements market critical to most modern manufacturing – and emerging technologies such as 5G). The current instability of this relationship has been flagged as the number one risk to global growth in 2022 by the Economist Intelligence Unit Risk Outlook Report, which is notable as China is seen as a key market for future growth by UK scaleups, particularly as they look for alternative trade partners outside of the EU.

For scaleup companies these overarching issues can be particularly acute. From our 2021 scaleup business survey we can see that 6 in 10 scaleups are already exporting, and 7 in 10 are aspiring to do so in the next year with 28% looking at the Middle East, 25% at India and 24% at each of China and South America. However, for those manufacturing and/or shipping products, managing supply chain variability can require stockpiling components or completed products. This can drag growth down and may require additional financing arrangements or expertise. It is important for policies in this area to reflect these growing challenges, with appropriate support from UKEF an important consideration, as well as available expertise within DIT and wider support services.

For UK businesses that are still primarily exporting to EU partners, many of the noted supply chain challenges are further amplified. The UK’s new trading relationship has yet to be fully ‘priced in’ by many companies previously taking advantage of frictionless trade within EU boundaries. With ongoing disruption and red tape expected, some companies are now looking at how they can maintain or develop an office presence within EU boundaries to regain the benefits of frictionless trade within the region – particularly amongst those manufacturing or trading in goods with components sourced across multiple different countries.

Government needs to tackle these issues head on to maintain confidence, and provide firms with a strong growth trajectory with the help that they need to access markets abroad. The forthcoming Export Strategy refresh due for publication by the end of this year must address these points as a priority and maintain a clear segmented approach to businesses to ensure that scaleups are given the direct help which they need in the services it sets out.

There are also some roles which only Government can deliver, such as working as an impartial source of market information globally and the export strategy provides a further opportunity to set out how these kinds of services can be made more consistent and better integrated with wider services. Currently, scaleups still report substantial variability in the services they receive through both DIT representatives in the UK, and from ‘in market’ services such as the market intelligence provided by Embassies and Consular staff. It is therefore important for these to be better codified. As we called for in previous years, we believe that a ‘scaleup desk’ should be in every Embassy/Consulate with a mandate to provide clear market information to companies looking at their export options. Trade representatives should also work actively with companies to convene the right package for them including finance, diplomatic support and wider wraparound services alongside the private sector when firms are exploring complex export opportunities – particularly when bidding for competitive contracts abroad.

As a balance to those services available overseas, at home, it is important to ensure that scaleups in local areas across the whole of the UK are able to access the right services as part of this journey, including scaleup focused trade missions. As noted above, the London Mayor’s International Business Programme and the Manchester Global Scale-up Programme have had substantial impact for scaleups and we believe there is merit in considering how they can be replicated in every area of the UK. It is also important to create a stronger link between the global innovation programmes of Innovate UK and the support provided by DIT ensuring a more joined up innovation to export pathway for scaleups. This should help them explore international market opportunities and build collaborations and partnerships at an earlier stage linked to export opportunities as well as – in the current trading environment – clear expert advice on technical challenges which companies are facing as a result of changing nature of trade rules and wider supply chain issues. To do this effectively it is also important for the Government to provide clear market signals to exporters.

UKEF

The latest reports from UK Export Finance (UKEF) show that a record £12.3 billion of new loans were provided for UK exporters in 2020/21. The reported figure of 79% of businesses supported by these loans being SMEs is also positive. However, the total number of businesses supported remains low, at just 549. In a challenging global environment, it is important for UKEF to be better accessed, and made more available to scaleup companies looking to export. Greater transparency on these numbers would be welcome, with some suggesting that the number of SMEs supported may be lower than expected. Transparency will both provide confidence to businesses looking to export, and ensure that the services being provided can be effectively tailored to have maximum impact for exporters and those with export potential.

Some progress is being made, and the expansion of the UKEF to include the General Export Facility (GEF) in December 2020 is an important step forward in providing flexible support for exporters and improving accessibility to companies through the provision of delegated authority to participating banks of up to £25 million per exporter. This can substantially speed up the process for companies, which is particularly welcome for scaleup businesses. The Government has indicated that they are looking for further partners to deliver this facility which would represent a positive step with a greater choice for companies considering their options.

Further evolution of trade finance solutions is ever more important in the current challenging environment. The announcement that UKEF will be carbon neutral by 2050 is a helpful recognition of the importance of emerging economic activity in this space, which many scaleups are a part of as we have reported in our Green Economy Index, however there needs to be further effort made to ensure that UKEF is actively working with the growth economy.

Last year we recommended that additional efforts are made to ensure that UKEF staff have the right skillsets to engage with scaleups and the challenges that they face, and we believe that this is still the case, with similar training to that we suggest for officials involved in Government procurement relevant for UKEF as well. Looking forward, the GEF and other innovative products need to be a standard part of discussions with companies when they are considering their exporting options. This means closer links being developed between UKEF, DIT trade advisors, in market representatives and the emerging Account Management models we are observing such as Innovate UK EDGE, and those at a local level, to ensure that access to the right finance is as simple as possible for exporting scaleups.

THE ROLE OF GOVERNMENT: ANCHOR, CONVENOR AND CONNECTOR

Innovation and R&D

Innovation is fundamental to scaleups, 75% have continued to invest in R&D innovation throughout the pandemic 9 in 10 involved in some form of innovation activity in the last three years. Further, 32% pivoted their business model as a result of the pandemic to take advantage of shifting market opportunities. The government’s continued investment in R&D indicated in the 2021 Autumn Budget with spending increasing to £20 billion per year by 2024-25, as well as the delivery of long awaited reforms to the R&D tax credit system, are therefore welcome, particularly the inclusion of cloud computing and data costs: One in five scaleups are now using big data or AI as part of their day to day operations and in the future they plan to further exploit these technologies for growth even more with 4 in 10 expecting to use AI and 3 in 10 planning to use big data.

Further, the recognition of the critical role that Innovate UK plays in this vital ecosystem, with core funding reaching £1.1bn per year by 2024/25 sends a clear signal to the market. Access to Innovate UK is now the top ask from scaleups in terms of the support they are seeking from Government. It is therefore important for wider initiatives, such as the proposed Advanced Research and Invention Agency (ARIA) to be clearly defined and not create confusion for either businesses or investors, or bifurcate existing resources.

Collaboration is key to innovation. However rates remain low. Almost 6 in 10 scaleups selling B2B sell to large corporates but far fewer (3 in 10) have worked with them to develop a new product or service and it is a similar picture with Government where 2 in 10 have collaborated. With collaboration – including across borders – a critical part of the innovation process it is to be commended that the Government remains committed to being part of the Horizon Europe is programme. It is essential for companies to be able to access this now as part of creating the right environment for UK companies to thrive and participate throughout the whole lifecycle of the projects it supports and to ensure integration in future supply chains. In light of this recent reports of UK companies and research institutions being unable to take part whilst wider negotiations take place are of particular concern and should be an immediate priority for government to resolve with our European partners. Scaleups also recognise the significant opportunities that exist to build partnerships and collaborations with organisations in regions such as North America and Asia. It is therefore important that the government continues to invest through Innovate UK in Eureka and bilateral programmes helping UK scaleups to develop the relationships and access the markets at an earlier stage, building for the longer-term and future export potential.

Procurement can also play an important part in capitalising upon innovation, enabling companies with strong products and ideas to gain an anchor client early in their growth journey. To achieve this, it is important to recognise that innovation always entails some element of risk, but that this is not always understood at all levels with public bodies tending to opt for low-risk solutions. This means that established players have an entrenched advantage, even if they do not have the best solutions. Ensuring that risk and reward is accounted for in the right way in supply chains and in the way that Government assesses bids will be an important part of both public procurement reform, and the way in which scaleup companies are engaged with. Risk should not simply be shifted down to lower tiers. At the same time Innovation should be more appropriately valued within the procurement system. This is an important end goal, and should be closely tied to broader government strategies.

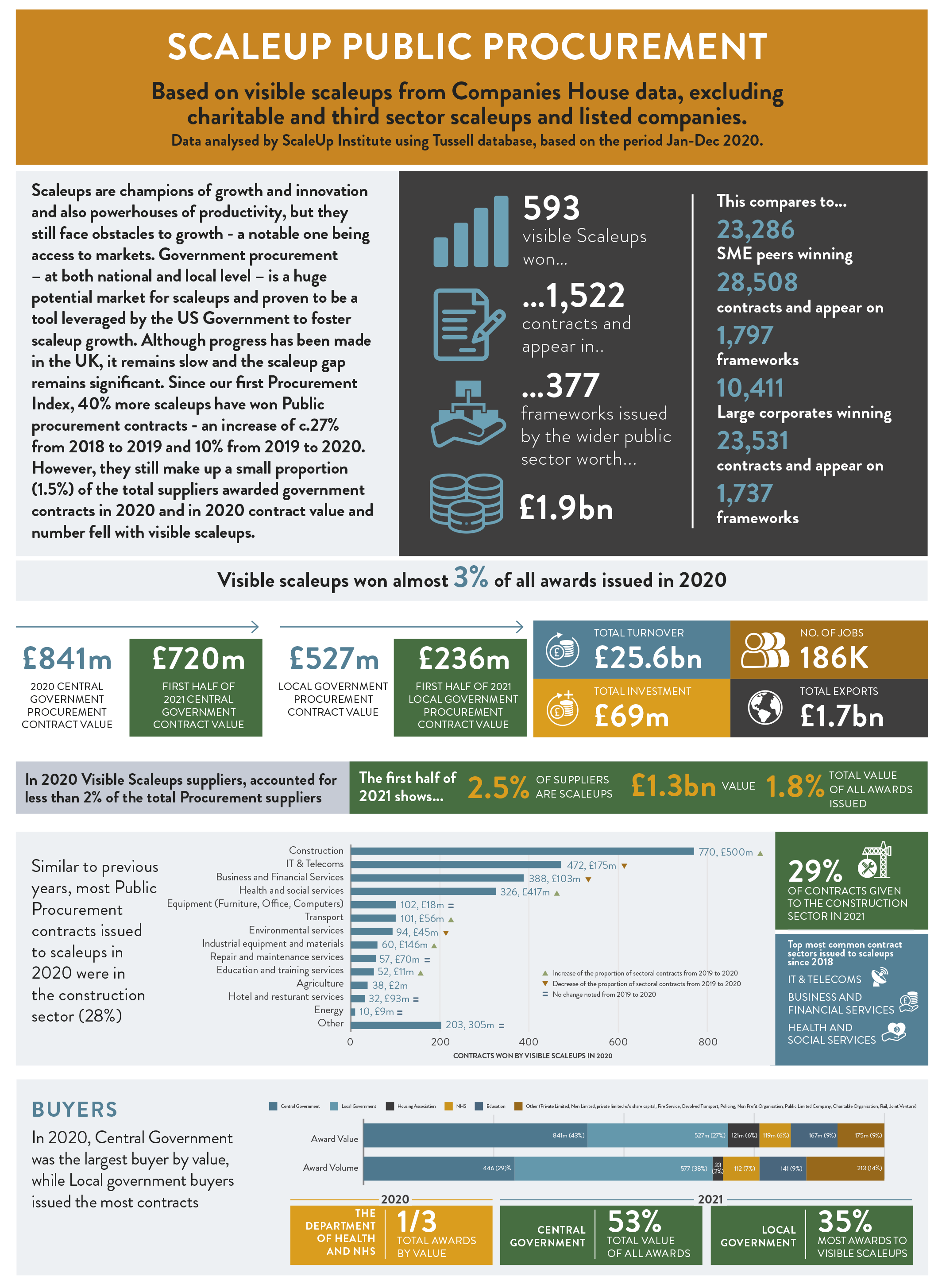

Procurement

Public sector procurement can be a powerful catalyst for scaleup growth if it is well utilised. Indeed, many countries that are ahead of us in scaling companies – such as the US – use procurement much more actively than the UK to aid companies as they grow.

The USA uses long standing institutions to focus procurement towards scaling businesses. This is exemplified in the US Small Business Administration which has been in place for more than 60 years. We must equally harness the power of public procurement alongside broader programmes geared towards growth. This does not mean additional spending, but we suggest that a portion of existing departmental procurement expenditure is ring fenced for strategic use with UK scaleup companies.

This year the Government published a Green Paper on Transforming Public Procurement. This is very timely and the recommendations it makes should be used to full effect as part of the broader growth strategy that Government has indicated it is pursuing.

As we emphasised in responding to the Green Paper consultation, Government can be an effective anchor client through the award of procurement contracts and provide a cornerstone to scaleup growth and overseas potential; as can OEMs who work with Government, provided they actively work with their scaleup supplier community. In the US these routes to market are often closely linked to the finance available to a company, and the public markets – such as Nasdaq – which have a well understood track record, particularly in relation to certain sectors such as the Life Sciences.

It is therefore important for the UK to more effectively deploy public procurement alongside wider efforts to support UK companies as they grow and specific initiatives, such as the ongoing implementation of recommendations from the listings review.

Government is also uniquely placed to both lead by example and use its significant buying power to encourage good behaviour across those Tier 1 suppliers with which it has enduring relationships. Adjustments to the procurement framework should reflect this ability and enable it to act as a catalyst for change and build on its convening power to increase the visibility of scaleup companies from whom others can buy.

To deliver this effectively, the outcomes from the Procurement Green Paper should result in the development of a comprehensive education programme for procurement officials, including up to date information on scaleup businesses, their characteristics and the challenges that they often face in accessing procurement opportunities.

The Green Paper proposed the creation of a new procurement body. This could be hugely powerful changemaker, but it must have and monitor clear targets for working with scaleup companies, that are well understood at Board level. These must also be tracked across the whole of the procurement chain within Government, including relevant support functions of legal, compliance and finance. There should also be greater use of ‘procurement playbooks’, with better segmented advice and ‘digital assistants’ to improve understanding of scaleups and innovative firms within procurement bodies. However it will be very important to avoid adding a layer of complexity to an already complex system, something which is especially important for scaleup businesses given the expense, resources and time required to engage with the public sector procurement bidding process.

Government departments themselves should also be encouraged to build stronger strategic partnerships with scaleup companies. Procurement champions and managers should be given specific objectives which are aligned and measured to a common standard. A more coordinated approach to meet the buyer and scaleup focused showcase events will also be important. Emerging Relationship Management approaches, such as Innovate UK EDGE, provide the opportunity to create the links between scaleups and public sector procurers such as the NHS, as well as with corporates looking for innovative solutions.

There is also an opportunity to use UKRI/Innovate UK contacts and experience in this area and to link up with University access for scaling firms aiding in collaboration and innovation activity. Existing tools such as the Small Business Research Initiative (SBRI) and Public Procurement of Innovation (PPI) must be much better used and embedded across government departments. The USA Small Business Administration ‘anchor client model’ should also be considered as part of implementing the review. Sandboxes, such as that run by the FCA should also be better utilised, with businesses which go through such programmes automatically linked to procurement and export opportunities.

Government can also do more to use its relationships with large corporates to encourage them to engage, support and buy from scaleups. Those ‘pitching’ for Government contracts should be required to evidence how they will engage scaleups in delivery of the service as part of their supply chain ‘tiers’. Government should seek to extend this further to include ensuring that the larger corporates from which it is buying are encouraged to support their supply chains more effectively by corporate venturing, peer networks and/or specific targets for onward spend. From our survey we know that scaleups exist across the supply chain with many in Tiers 1 and 2; ensuring that both terms and payment times cascade downwards is important. The Government should both lead by example and – where necessary – enforce this approach among Tier 1 suppliers and across the supply chain.

There should also be a clear effort to gain visibility of whole supply chains, with Government enabling more appropriate engagement between different parties, stimulating innovation and new opportunities, and aligning incentives so that procurement bodies are also empowered to seek innovative firms to deliver contracts. It will also be worth considering how the Open Contracting Data Standard can be incorporated or drawn upon to increase the interoperability of systems, the visibility of contracts and the overall quality of data collected and published in relation to procurement.

Corporates

Corporate engagement can be key to the development of hubs and clusters. Corporates again do better than Government in the 2021 survey in terms of having a simpler bidding process. However as we noted last year, greater transparency from corporates on who they are buying from and the broader supply chains they foster will help those clusters and hubs that are developing to better align to their needs, and provide signals to scaleups locally about the opportunities that may be open to them. This can create a halo effect, boosting aspiration amongst local businesses, and building a pipeline of future scaleups.

Last year we highlighted platforms such as WEConnect and MSDUK as key routes to help foster opportunities for female and ethnic minority led scaleups. These are still key platforms and we would further emphasise the role of initiatives such as Silicon Valley Comes to the UK (SVC2UK) which can significantly help to boost access for growing companies to collaboration opportunities. These programmes continue to show impact (See Chapter 2 for more detail).

We have previously called for corporates that are engaging and buying from scaleups to be much more transparent about this process; and there is more work to be done. Building a strong understanding of what is needed as part of collaboration between corporates and scaleups is important to engender success. More modern and transparent collaboration models in supply chains can be developed, based on the ISO 44001: Collaborative Business Relationships Standard for corporates, which we have called for previously.

For a number of years we have set out 10 top tips for corporates on how they can better work with scaleup partners, and this is still highly relevant to the current market place.

IN SUMMARY

Market access is a fundamental part of business growth. As the UK, and the world, moves beyond the Covid-19 pandemic it is essential for UK scaleup companies to be afforded the right support as they engage with challenging global supply chains, and fast-track opportunities for procurement and export to energise the UKs national and local economies.

The support which has been announced for innovation in the 2021 Autumn budget is very welcome. To ensure that it has maximum impact in both the short and the long term, it must be coupled with effective joined up policy, including substantial reform of public procurement to ensure that it can be better utilised as a tool to both catalyse and support innovative scaleup businesses. We urge ministers to keep up the momentum and to recognise that greater transparency and accountability will be essential to effect change in the delivery of procurement policy and the culture that has developed around existing regulatory frameworks.

Access to Markets is intrinsically linked to innovation, and the wider scaleup challenges of talent and finance. The support which is available for scaleup businesses needs to reflect the complexity that these different elements can bring. This is why a pro-active relationship management approach to scaleups is critical to unlocking market potential: a trusted, relationship driven route helping to create an innovation to export pathway and linking to procurement allows for the messy wiring associated with such complex areas to be minimised, letting scaleups get on with their growth.

Each corner of this triangle can become an enabler for further growth activity and fostering effective hubs and clusters enables businesses to tackle these issues together as we have shown through our analysis of the drivers of scaleup growth at a local level: developing productive relationships with each other through peer to peer networks, engaging with universities and corporates, and accessing the finance and advice that they need as they consider their next stage of growth, and innovate to meet the needs of new industry standards such as net-zero.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Previous

Previous

Share