Explore the ScaleUp Annual Review 2023

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Access to finance

Access to appropriate finance and growth capital continues to be a challenge for scaleups however after peaking during the pandemic in 2020 it maintained at the level seen in 2021 and continues to be the third key priority after access to markets and talent.

Scaleups remain far more likely than their peers to use external finance with 8 in 10 (78%) using at least one source of capital to fund their ongoing growth. They plan to invest in innovation and Research and Development. However, despite the broad range of forms of external finance used, half of scaleups do not feel they have the right amount of funding in place for their current growth ambitions.

Furthermore there are increasing concerns among scaleup leaders around the availability of capital, with many more perceiving that the majority of funding resides in London and the South East. In 2023, 59% of scaleups feel like this is the case, higher than the levels seen in 2021 and 2022.

EXTERNAL FINANCING USED

Debt products are the most common source of external finance with 57% of scaleups using this type of capital, including 45% using overdrafts, credit cards or loans and 34% using Leasing/Hire purchase. 4 in 10 scaleups use Tax credits and a similar number are using Government schemes (e.g. Energy Bill Discount Scheme; or Covid-19 Schemes).

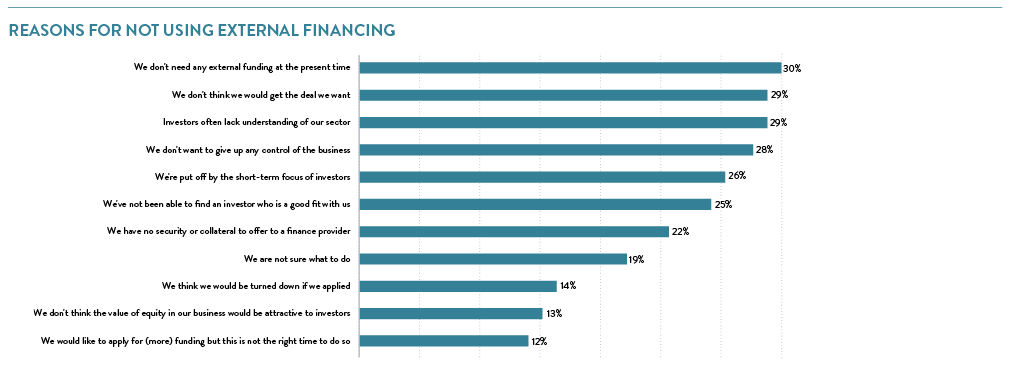

Of the scaleups not currently using finance, or who do not feel they have the right amount available to them, the reasons given for this include a perception that they will not be able to secure a deal that meets business needs (e.g. around the size or term of the facility, the cost, or the terms and conditions attached) (29%), a similar number feel that investors do not understand their sector. 1 in 4 have also reported that they are put-off by short-term focus of investors or have not been able to find a suitable investor compatible with the business. 1 in 5 cited lack of collateral (21%) as the reason and/or lack of knowledge about the process of applying for funding and who to apply to (19%) .

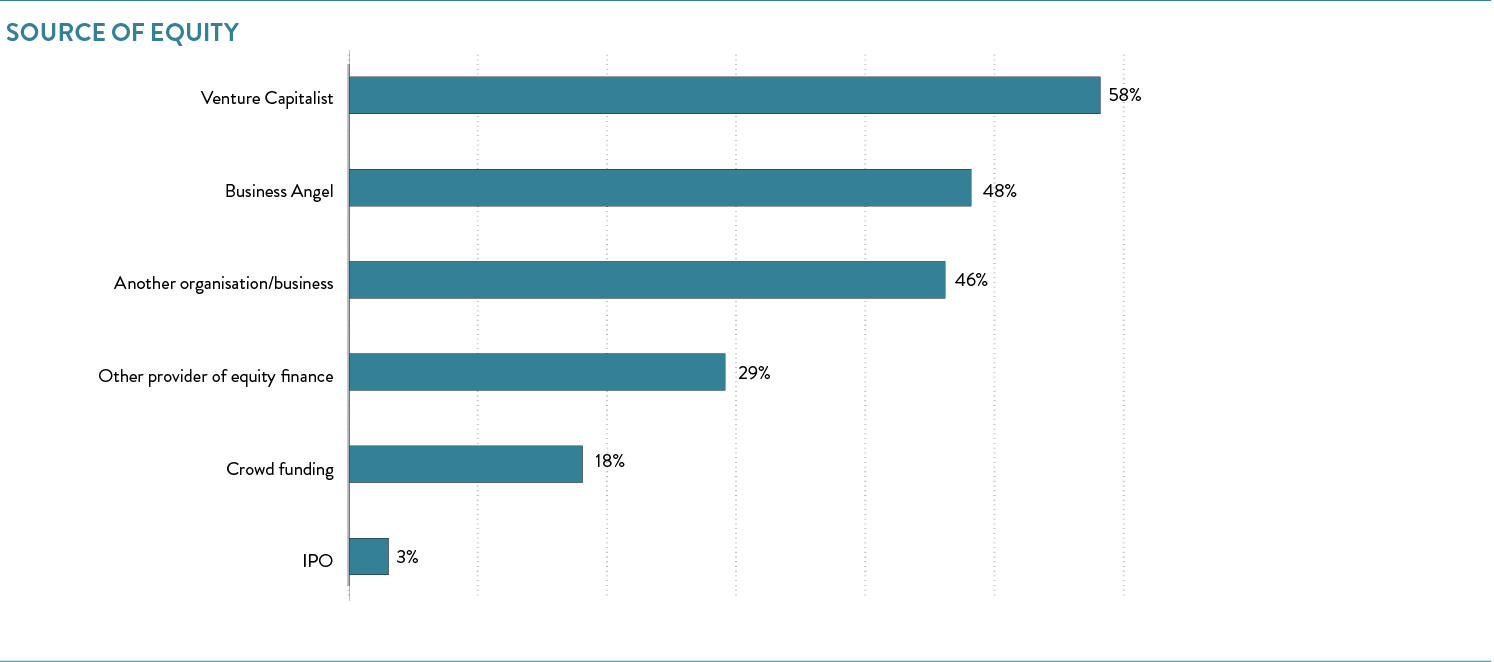

USE OF EQUITY FINANCE

Of the scaleups using external finance, 3 in 10 are currently using equity or planning to use it in the future. VCs and Angels are key sources of equity provision supplying growth capital to 7 in 10 scaleups with equity investment – highlighting the importance of these asset classes in the escalator of finance to enabling scaleup success. Majority of the scaleups plan to invest in changes to products and services (58%) or R&D (57%), suggesting they are highly innovative. 54% of them plan to use the funds for capital expenditure as they look to achieve their growth ambitions. Other use of funds include Infrastructure (40%), International expansion (32%) and Acquisition of another business (19%)

Majority of the scaleups plan to invest in changes to products and services (58%) or R&D (57%), suggesting they are highly innovative. 54% of them plan to use the funds for capital expenditure as they look to achieve their growth ambitions. Other use of funds include Infrastructure (40%), International expansion (32%) and Acquisition of another business (19%)

ATTITUDE TO INSTITUTIONAL INVESTMENT REFORMS AND SUPPORT REQUIRED

Scaleups were asked about their confidence in the range of activities taking place to unlock pension funds and institutional monies into the UK growth economy – whilst supportive of overall efforts to do this, only 1 in 5 (20%) scaleups said they are confident that such activities will see extra funds coming in from UK investors into businesses like theirs.

In terms of the support towards improving access to potential investors, 6 in 10 want Relationship managers in local investment zones (63%), “Meet the investor’ type events (63%) and Better access to finance mentors and peers (58%). Further, 5 in 10 want Regular investment briefings (52%), Structured referral process between investors (52%), Sector briefings and insights to investors (49%) and Relationship Managers at investors (48%). 3 in 10 also asked for better connections with educational institutions (34%).

GOVERNMENT TAX SCHEMES

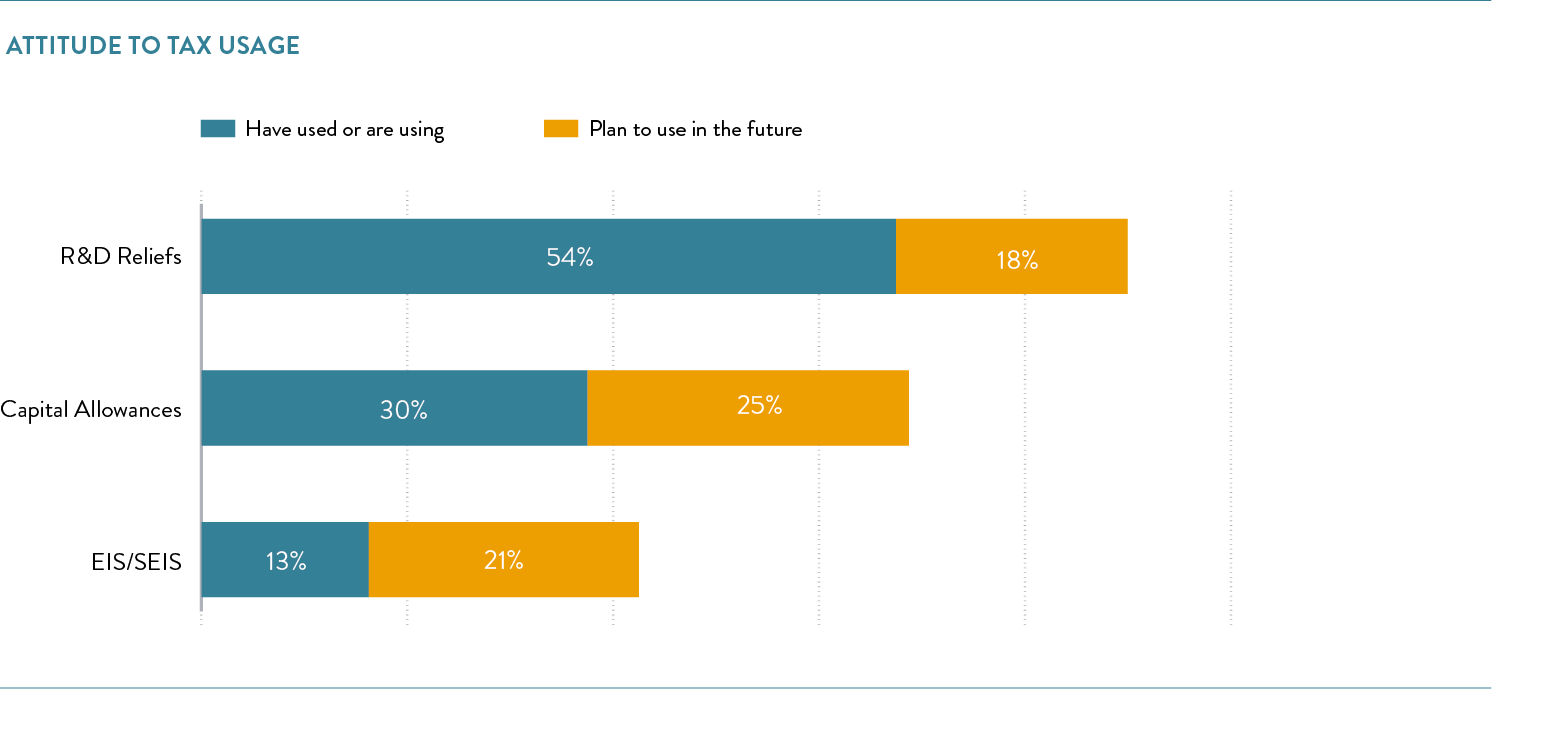

Recent economic and political developments across the UK have brought the tax system to the fore. From the perspective of our scaleup leaders the range of schemes on offer form a key plank to enable the scaling of their ventures. From R&D Reliefs to Capital Allowances and the Enterprise Investment Schemes (EIS/SEIS) – they have all played key roles in supporting scaleups investment opportunities – 8 in 10 scaleups have used or plan to use at least one of these schemes.

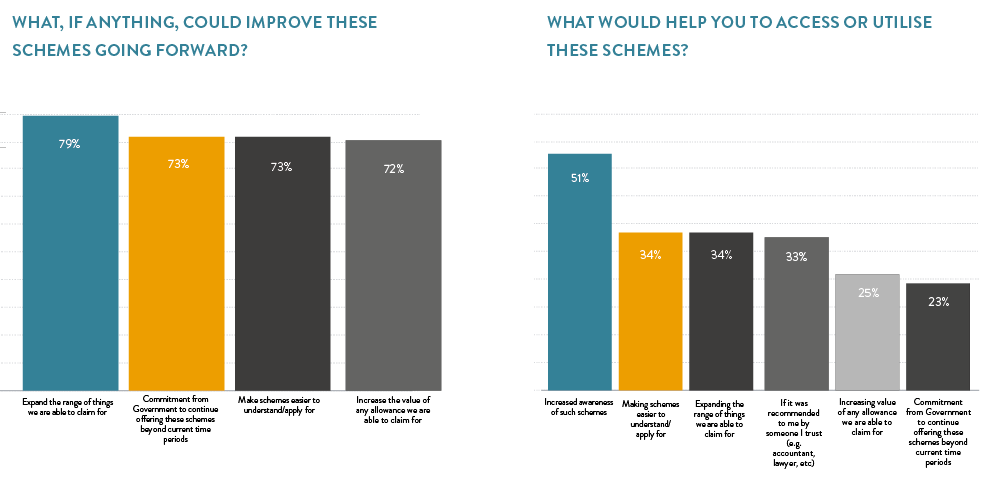

R&D Reliefs are the most popular with almost half of all scaleups making use of it; followed by Capital Allowances used by 1 in 3 and EIS/SEIS used by 13%. Many more scaleups are seeking to use each in the future.  However, scaleups want commitment from Government that they will continue and see scope for the improvement of these schemes, such as expanding the range of things they can claim for, increasing the value of allowances and simplifying the process of making a claim. For those not already using the schemes the key barrier to access are around awareness of their existence alongside the perceived complexity of the system.

However, scaleups want commitment from Government that they will continue and see scope for the improvement of these schemes, such as expanding the range of things they can claim for, increasing the value of allowances and simplifying the process of making a claim. For those not already using the schemes the key barrier to access are around awareness of their existence alongside the perceived complexity of the system.

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Share