Explore the ScaleUp Annual Review 2023

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Scaleup indicators from a national and local perspective

The ScaleUp Institute’s mission is to act as a national data observatory, providing insight on the scaleup ecosystem across the UK. We work collaboratively with stakeholders from the public, private and third sectors, including local players at combined and local authorities, regions and devolved nations, to address the barriers to scaleup growth through timely analysis of relevant data.

The ScaleUp Institute with the collaboration of the Office for National Statistics has undertaken a detailed analysis of the ONS 2021 data – the most recent available – against three elements of the OECD high-growth (scaleup) definition. These include the following:

- Scaleups growing by more than 20% per annum by employee growth

- Scaleups growing by more than 20% per annum by turnover growth

- Scaleups growing by more than 20% per annum in both employees and turnover.

In 2023, the ScaleUp Institute has continued to explore the regional, sectoral trends in the data on scaleups and on the scaling pipeline, who are growing their turnover and/or employee headcount by between 15 and 19.99%.

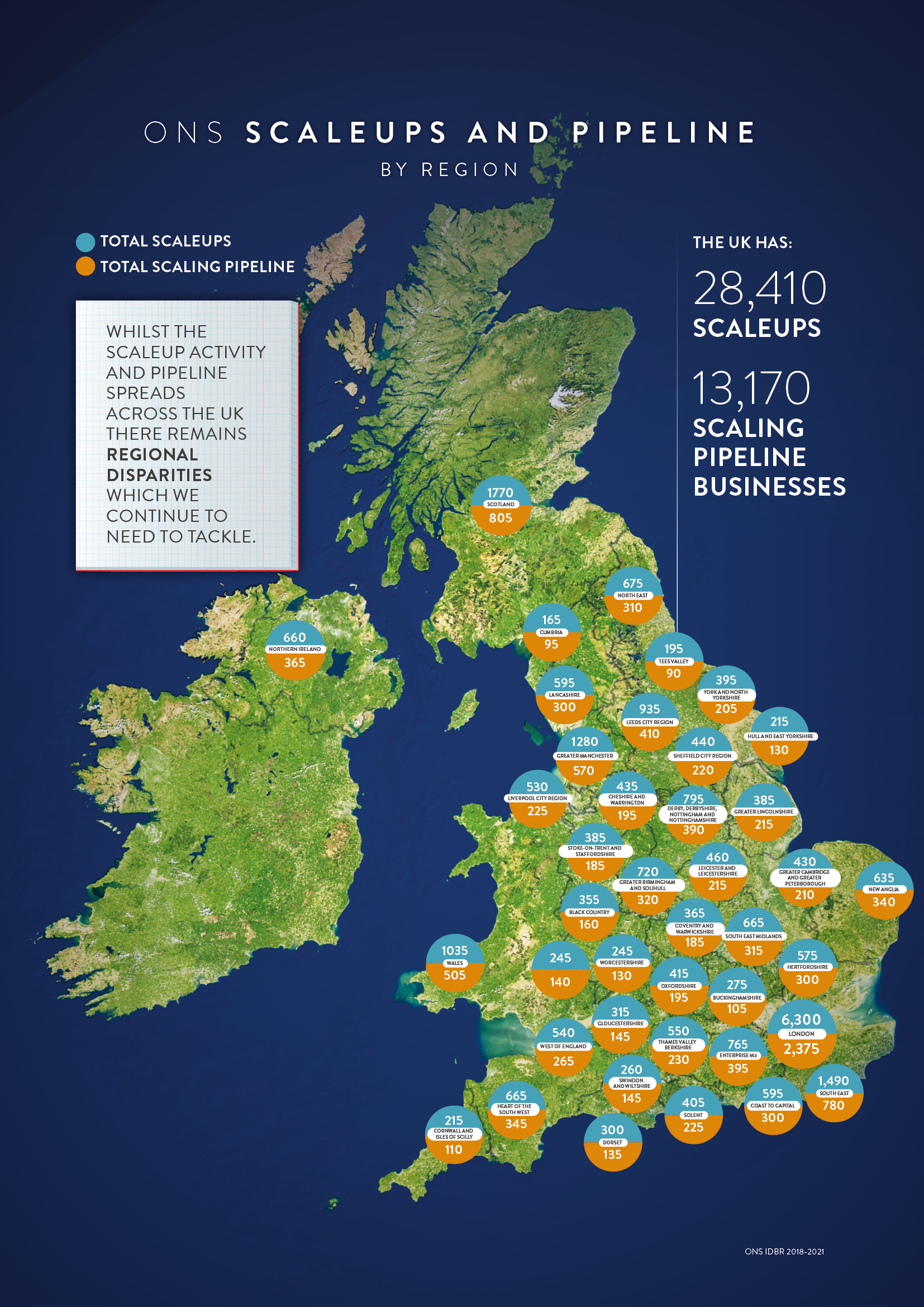

The year 2021 posed significant macroeconomic challenges to our scaleup economy resulting in a decrease in the number of scaleups compared to 2020. There were 28,410 scaleups in 2021 marking a 16% decline compared to previous year. They continue to be growth champions for the UK economy generating £1.3 trillion in revenue and employing 2.6m people. Even though the number of scaleups have declined, their contribution to the economy is striking – 28,410 scaleups making up less than 0.5% of the SME population, generate approximately 60% of the total SME turnover.

The pipeline of scaling companies who fall just outside the definition of a scaleup – with turnover and/or employment growth of 15-19.99% in the past three years in 2021 numbers 13,170 generating £414bn through their turnover and employing over 1.3 million.

The ScaleUp Institute will continue to examine this further to better understand the growth journey of the scaling pipeline.

Scaleups and scaling pipeline businesses reach out across the entire economy. They operate across all sectors and geographies and are significant drivers of local employment. The map below shows the spread of scaleups and scaling pipeline businesses across the UK by number. While there is an excellent regional distribution throughout the UK, with 64% of the scaleups outside London and South East, when looking at density there remains a slowdown in regional growth of scaleups per 100,000 of population. This emphasises the importance of pipeline convergence and regional disparities, where progress has been consistent in some areas but lacking and fluctuating in others. We explore these trends further in this chapter.

We also look at sectoral spread around the country in detail to unpack the clusters around different regions and their contribution in terms of employment and turnover. It is now crucial to ensure the sectoral and regional support provided is aligned with the cluster makeup of the scaleups.

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Share