Explore the ScaleUp Annual Review 2023

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

The ScaleUp Landscape

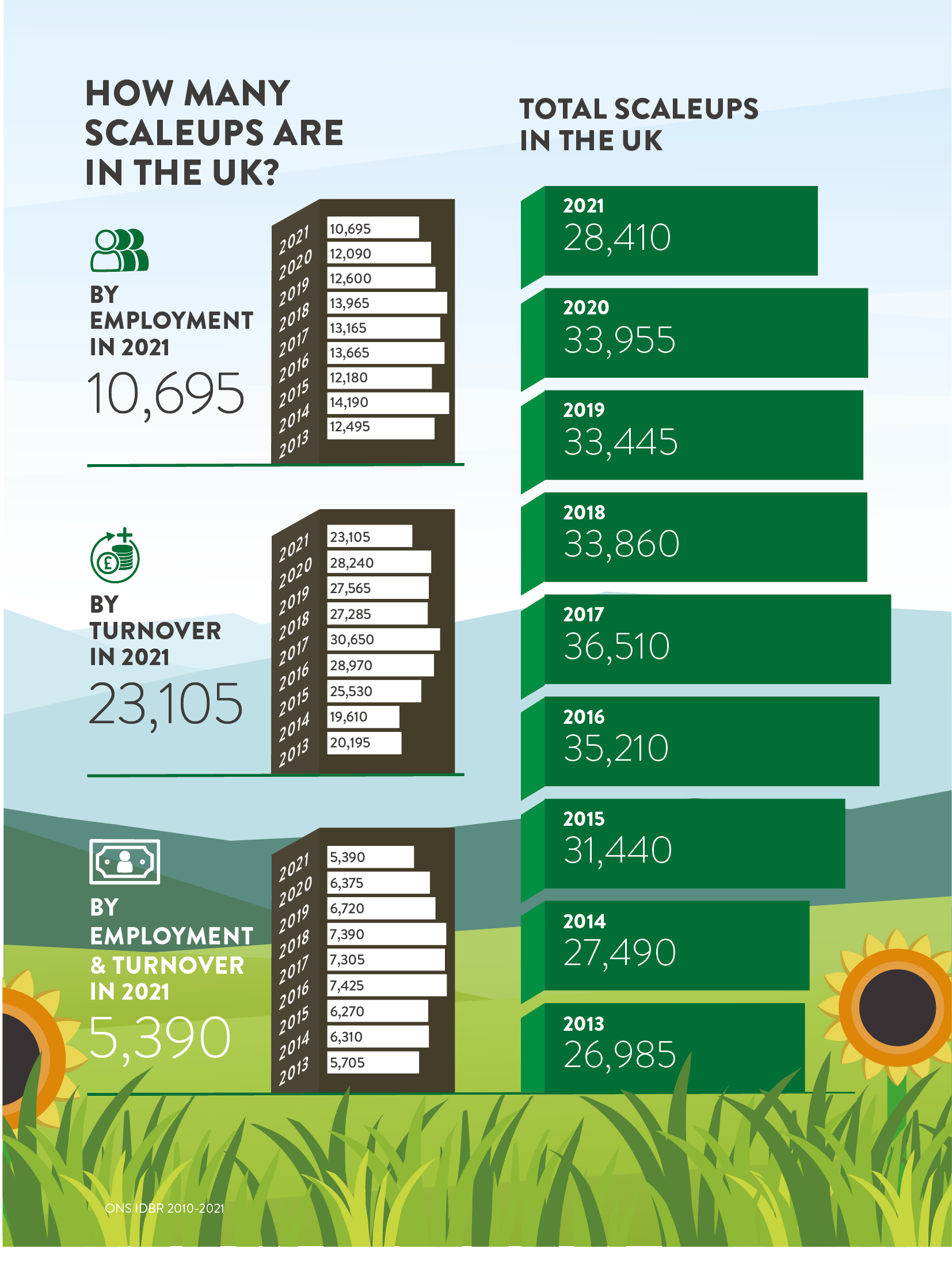

The ScaleUp Institute’s analysis of the latest ONS data showed that in 2021 there were 28,410 scaleups in the UK.

The total number of scaleups decreased by 16.3% from 2020, reflecting the impact of the pandemic on the UK’s scaleup population. This was driven by a 18.2% decrease in the number scaling up by turnover, while the number scaling up by employment fell by 11.5%.

The total number of scaleups is 5% higher than it was in 2013.

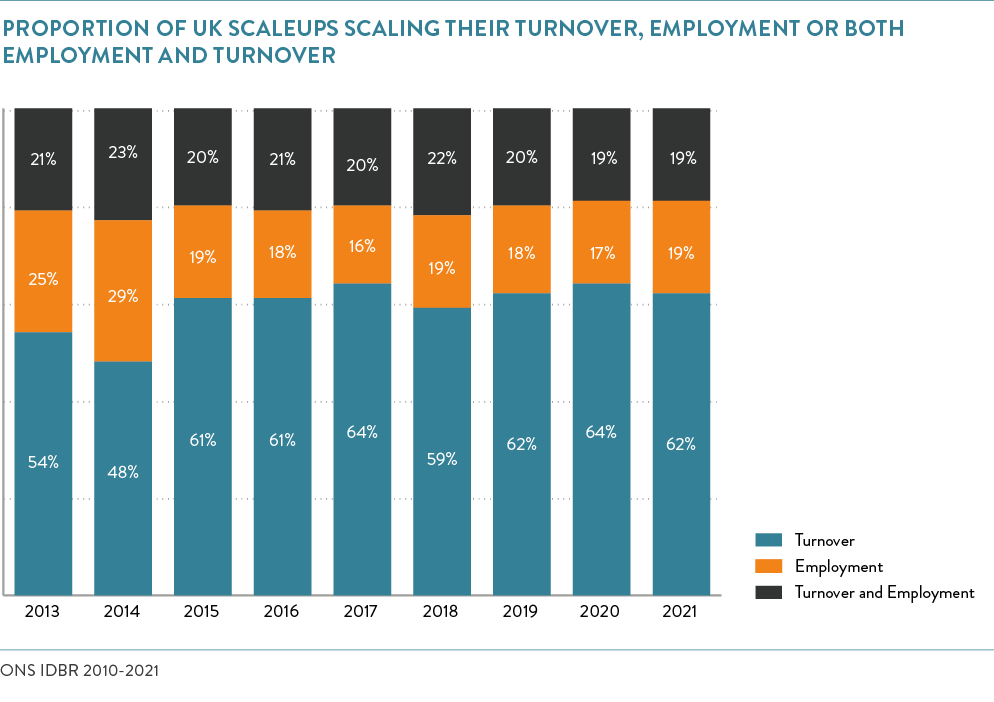

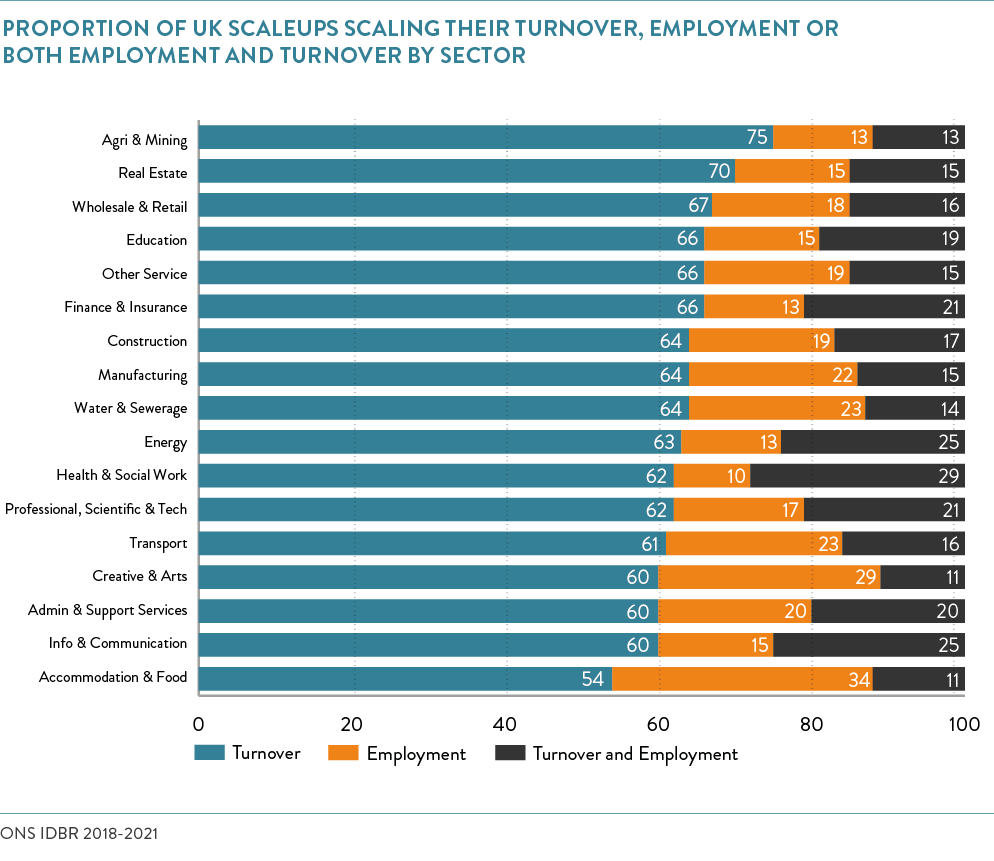

The pattern by which scaleups grow remains relatively steady. Since 2015, approximately six in ten scaleups have grown by turnover, two in ten scale by employment and a similar proportion scale by both turnover and employment.

Scaleups continue to be the growth and productivity champions in the SME ecosystem

As seen in previous years, the value scaleups contribute to the UK economy remains substantial. In 2021, scaleups employed 2.6 million people and generated a total turnover of £1.3trn for the UK economy. The average turnover per scaleup was £46.8m with an average of 93 employees. The average turnover per employee was £503,902 – a 35% increase since 2020. This is indicative of the resilience shown by scaleups during the tumultuous year of 2021 – even with a reduction in the total scaleup population from 2020, they continue to be highly productive and contribute significantly to the UK economy.

The UK’s 5.6m SMEs generate a total turnover of £2.3trn – scaleups generate £1.3trn in turnover, equivalent to 58% of this total output, despite making up just 0.5% of the SME population, emphasising the critical need for segmentation and tailored policy, solutions and services for scaling firms in our public, private and education sectors.

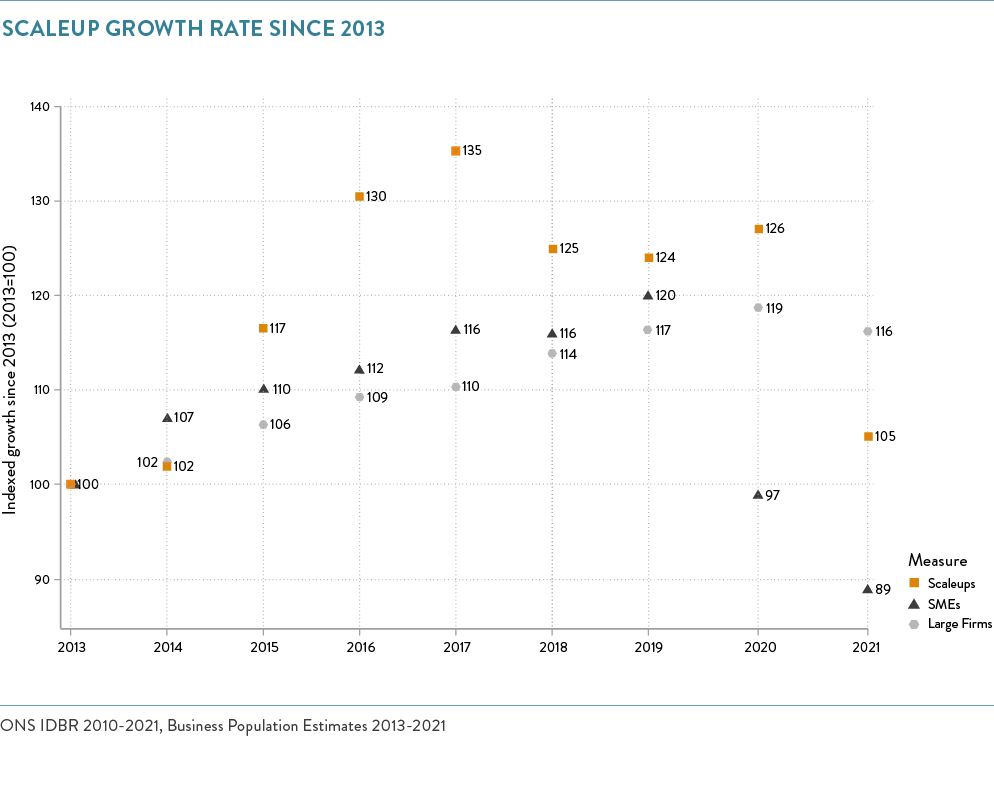

Scaleup growth continues to exceed SME growth in 2021

In the eight year period between 2013 to 2021, the number of scaleups has grown by 5.3%. Over the same period, the number of SMEs fell by 11%.

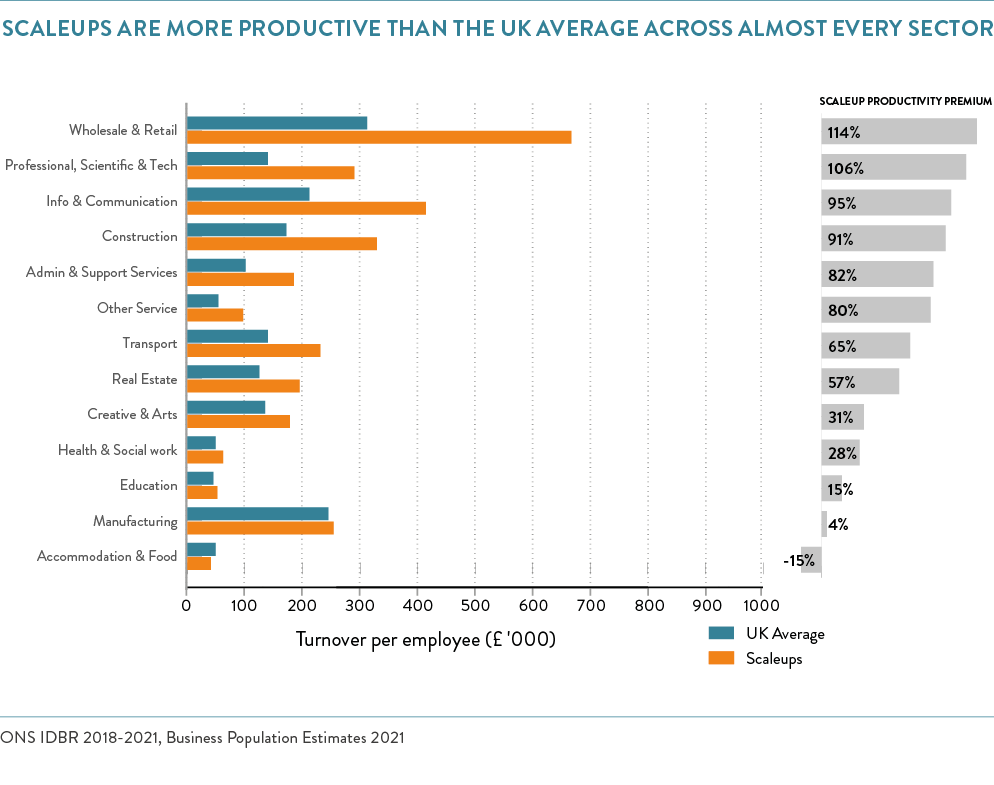

Scaleups driving productive growth

In every single sector of the economy, scaleups are more productive than all other UK businesses. In 2021, the productivity premium of scaleups across all sectors was 65%. Sectors which demonstrate notable levels of productivity performance were Wholesale & Retail; Professional, Scientific & Technical; Information & Communication; and Construction. Scaleups from Accommodation & Food showed a negative productivity premium indicative of the massive impact of the pandemic on the sector.

Patterns of Turnover and Employment Growth

BY SECTOR

- Health & Social Work continues to be the sector with the highest proportion (29%) of companies scaling by both turnover and employment.

- The Accommodation & Food sector (34%) continues to remain as the most likely to scale exclusively by employment followed by the Creative & Arts sector (29%) which interestingly is the sector least likely to scale by both turnover and employment (11%). The prominent sectors most likely to exclusively scale by turnover are Wholesale & Retail and Finance & Insurance.

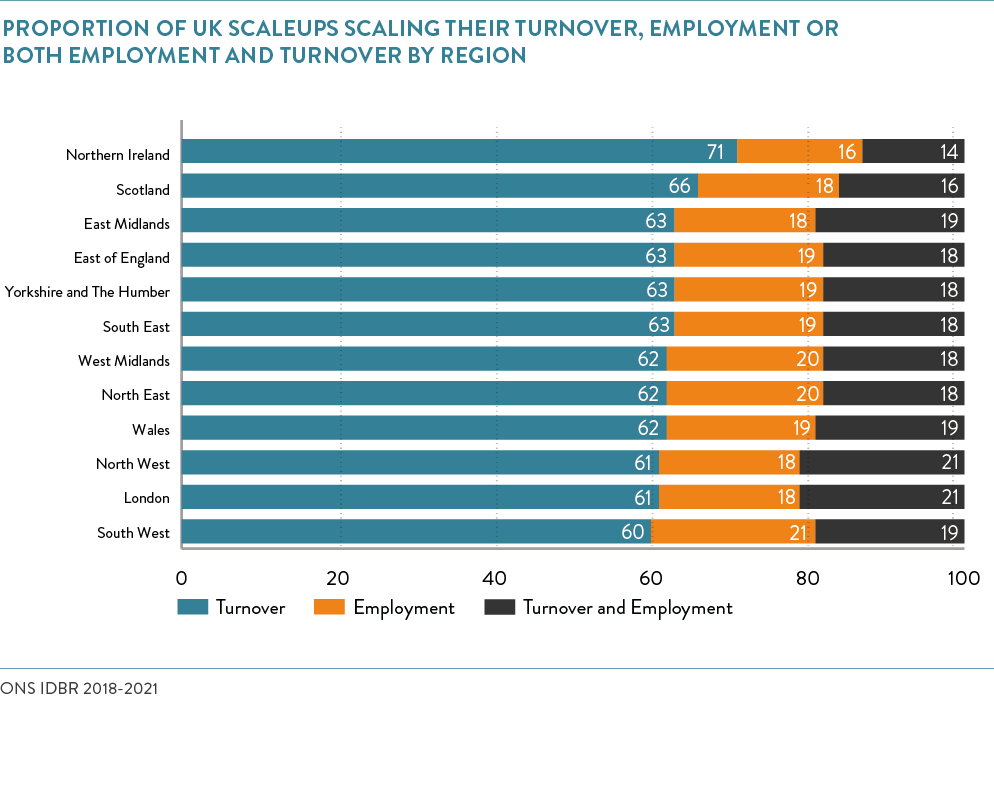

BY REGION

In 2021, a greater proportion of scaleups across the regions grew by turnover when compared to 2020. Across the regions, the proportion of turnover scaleups was just under two in three (63%), while the North West (21%) and London (21%) were the two regions with the greatest proportion of scaleups that scaled by both turnover and employment.

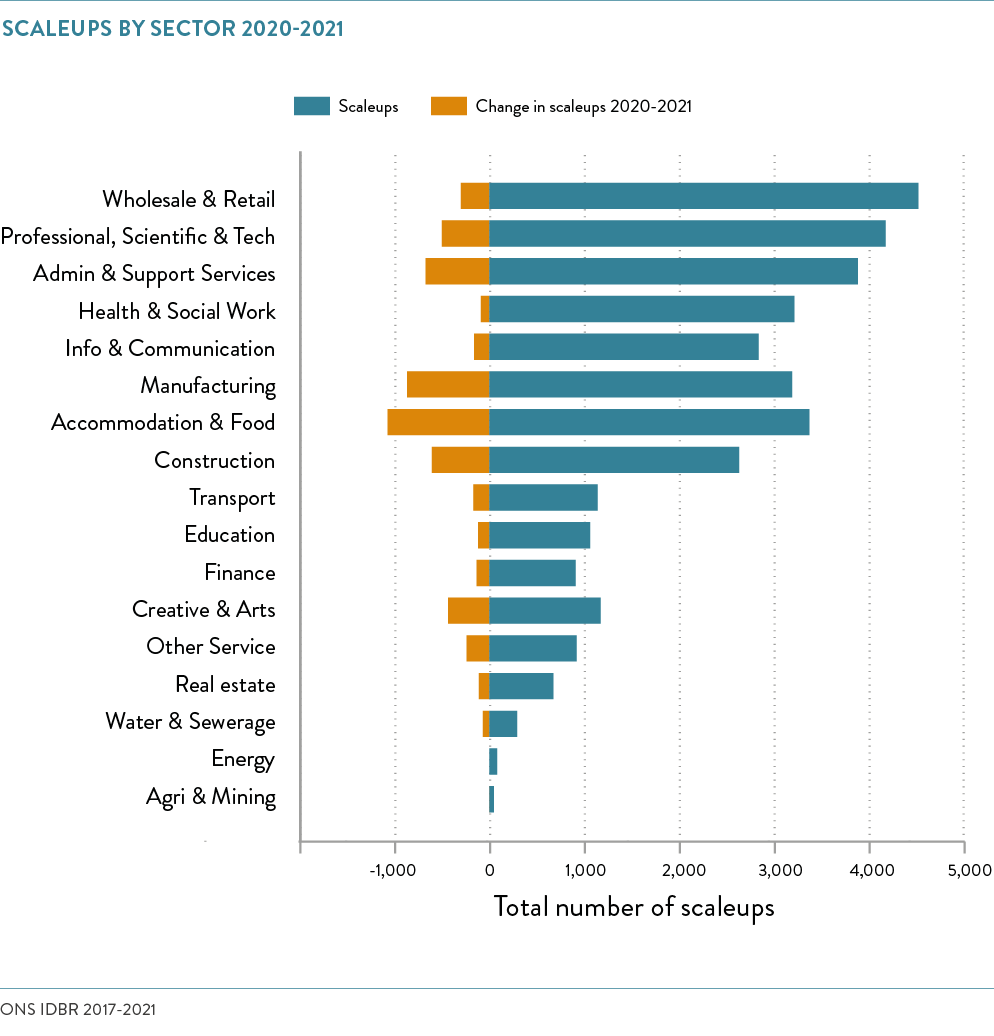

Scaleups reach out across the entire economy

The top three sectors across the UK for scaleups remained the same in 2021 from 2020. Wholesale & Retail; Professional, Scientific & Technical; and, Information & Communications make up over a third of scaleup population; when combined with Accommodation & Food, Manufacturing, and Health & Social Work, these represent 64% of the scaleup population.

It is notable that significant falls in scaleup numbers are in sectors most affected by the COVID pandemic and associated supply chain issues:

- Creative

- Accommodation

- Manufacturing

- Construction

Scaleups by sector in 2021 and change from 2020

SECTORS WITH SIGNIFICANT GROWTH OVER TIME

Since 2013, Wholesale & Retail and Admin & Support Services have been among the top three sectors with the most number of scaleups, while the Professional, Scientific & Tech sector replaced Manufacturing in 2021. Since 2013, Wholesale/Retail and Admin & Support Services have been two of the top three sectors for the greatest number of scaleups. The Professional, Scientific and Technical sector has seen the highest growth in scaleups since 2013 and now accounts for the second largest number. Other sectors that saw the highest growth in number of scaleups since 2013, are Health & Social Work, and Information & Communication.

| Top three sectors in 2013: | Top three sectors in 2021: |

|

|

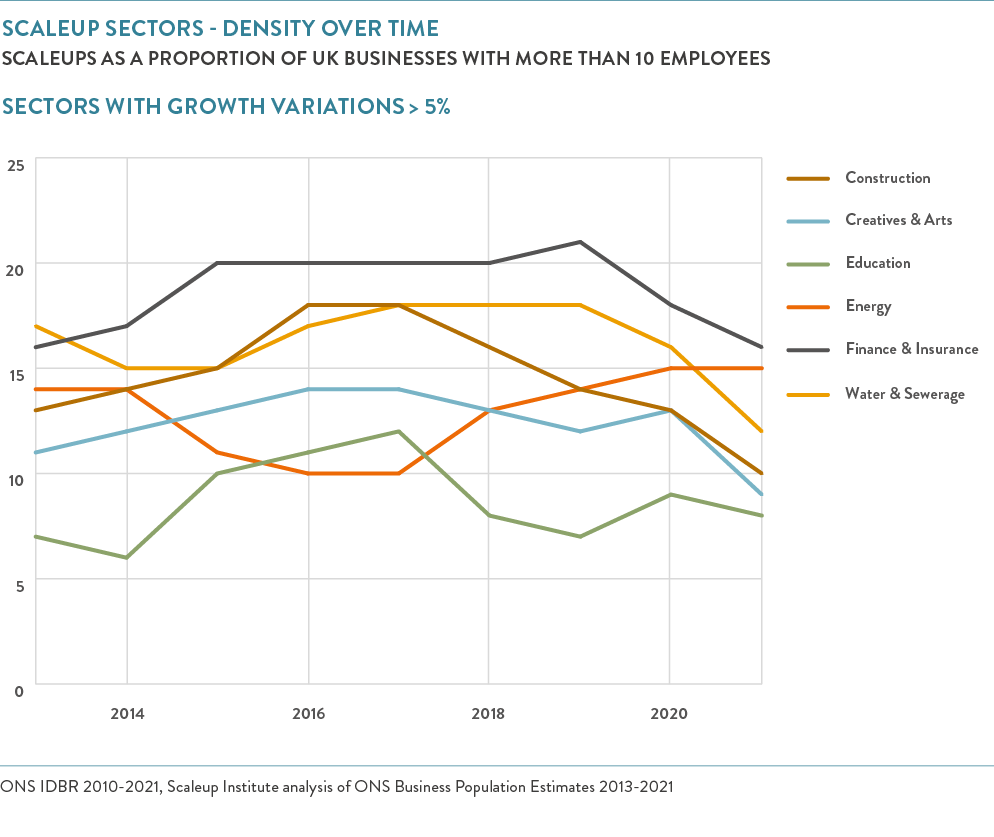

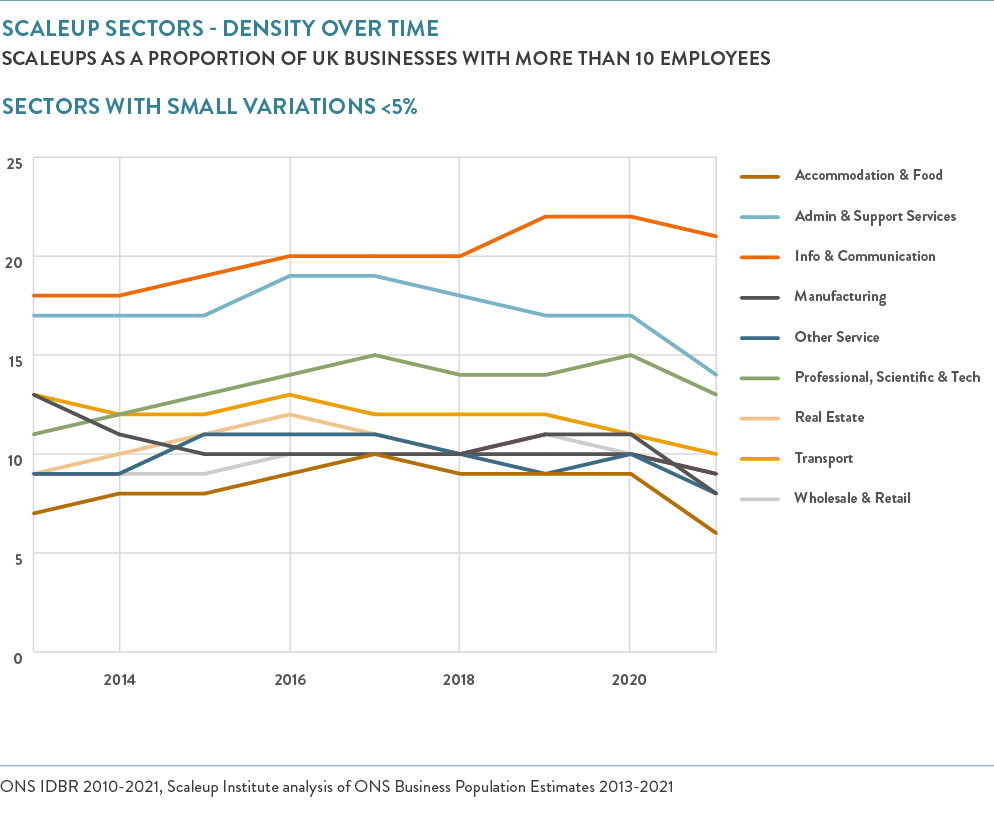

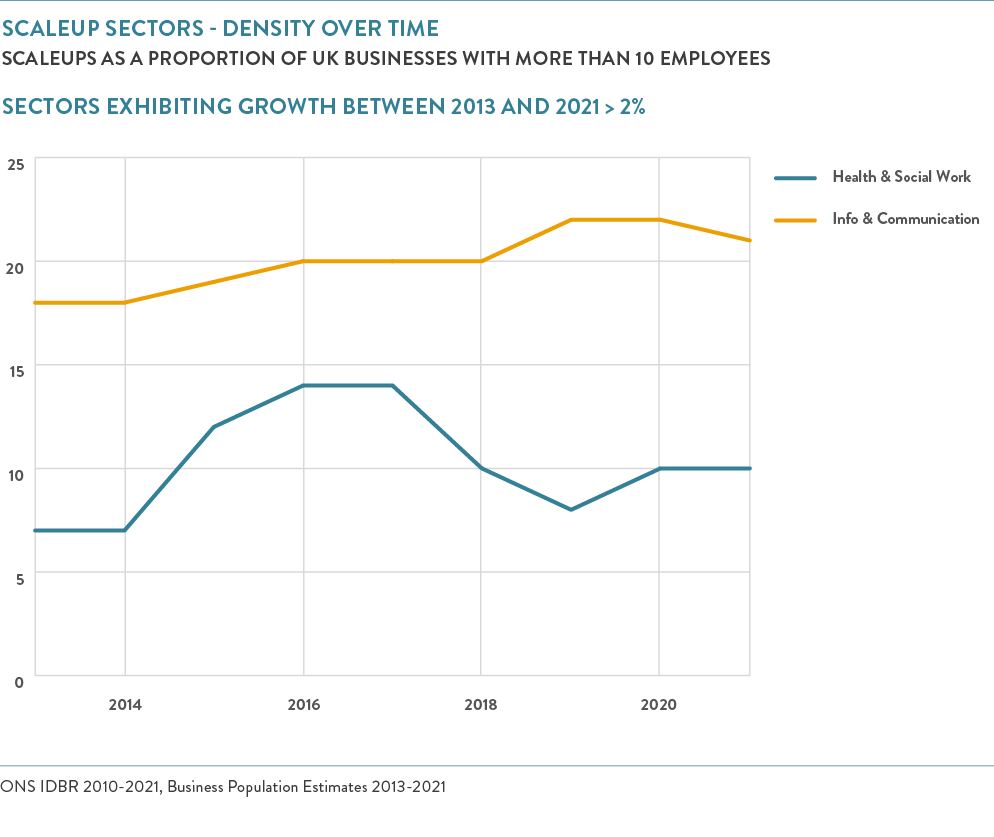

SECTORAL SCALEUP DENSITY OVER TIME

In this section, we look at the proportion of scaleups to all UK businesses with minimum 10 employees and examine the time trends that scaleups in each sector exhibit in reference to the overall UK business population.

The majority of sectors (9 out of 17) show a stable trend – a variation of less than 5% in the eight year period – in relation to their peers across the economy.

Info & Communication and Health & Social Work are the two sectors that have shown more than a two percentage point growth in proportion to all businesses with more than 10 employees since 2013. However the Health sector is currently below the peak seen in 2016-17. Sectors that have shown positive growth – but less than 2% – are the Professional, Scientific & Tech; Energy; Education; Wholesale & Retail; and Finance & Insurance sectors.

Construction sector has shown the most volatility over the years and is now at a significantly lower level than its peak in the 2016-2017 period. Other sectors to show volatile patterns are Education; Construction; Water & Sewerage; Creative & Arts; Energy; and Finance & Insurance. Unlike the other sectors experiencing volatility, the Energy sector is currently growing in proportion to its peers across the economy.

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Share