Explore the ScaleUp Annual Review 2023

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Access to Markets

Scaleups sell to and collaborate with customers and partners across a broad range of markets. 8 in 10 are primarily focused on B2B sales with the remainder selling directly to consumers. They are key parts of supply chains to government and large corporates as well as being ambitious internationally, exporting goods and services to all parts of the globe. However on all counts there is a desire to do more.

Yet gaining access to these markets continues to be a mounting challenge for our scaleups. When scaleup leaders are asked to rank these factors for growth, markets once again tops their priority lists with 1 in 3 placing it in the top spot (on par with access to talent). And it features in the top three barriers to growth for 6 in 10 scaleup leaders (64%).

Supporting scaling businesses to break into new markets is a critical imperative. As an ecosystem we must act to break down those persistent barriers to enable scaleups to achieve and surpass their growth ambitions.

Domestic Markets

The UK market is critical for scaleup success, with 45% rating access to domestic markets among their top 3 barriers and 22% saying that access to government and corporate procurement and supply chains is a significant barrier.

Other businesses and institutions continue to be the primary marketplace for scaleups with 80% selling to large corporates, government, their peers and/or the third sector.

Large corporates are the biggest customers for B2B scaleups with 7 in 10 currently selling to them, either directly (57%) or as a part of their supply chains (25%). And they are keen to do even more. Only one in ten do not consider large corporates to be a target market.

When it comes to working with Government however the picture is markedly different with only 3 in 10 (28%) working with UK Government and 1 in 3 (34%) working with local government. But there is considerable appetite to do much more – scaleups want to double their sales to Government over coming years.

One way to access markets is through collaboration and once again we find that rates remain stubbornly low. Only 27% of scaleups have collaborated with large corporates in the past three years to develop a new product or service, with a similar number collaborating with government. Universities and research institutions remain the most common partners for collaboration (37%). Facilitating greater collaboration is a vital part in fostering a more dynamic and innovative scaleup ecosystem.

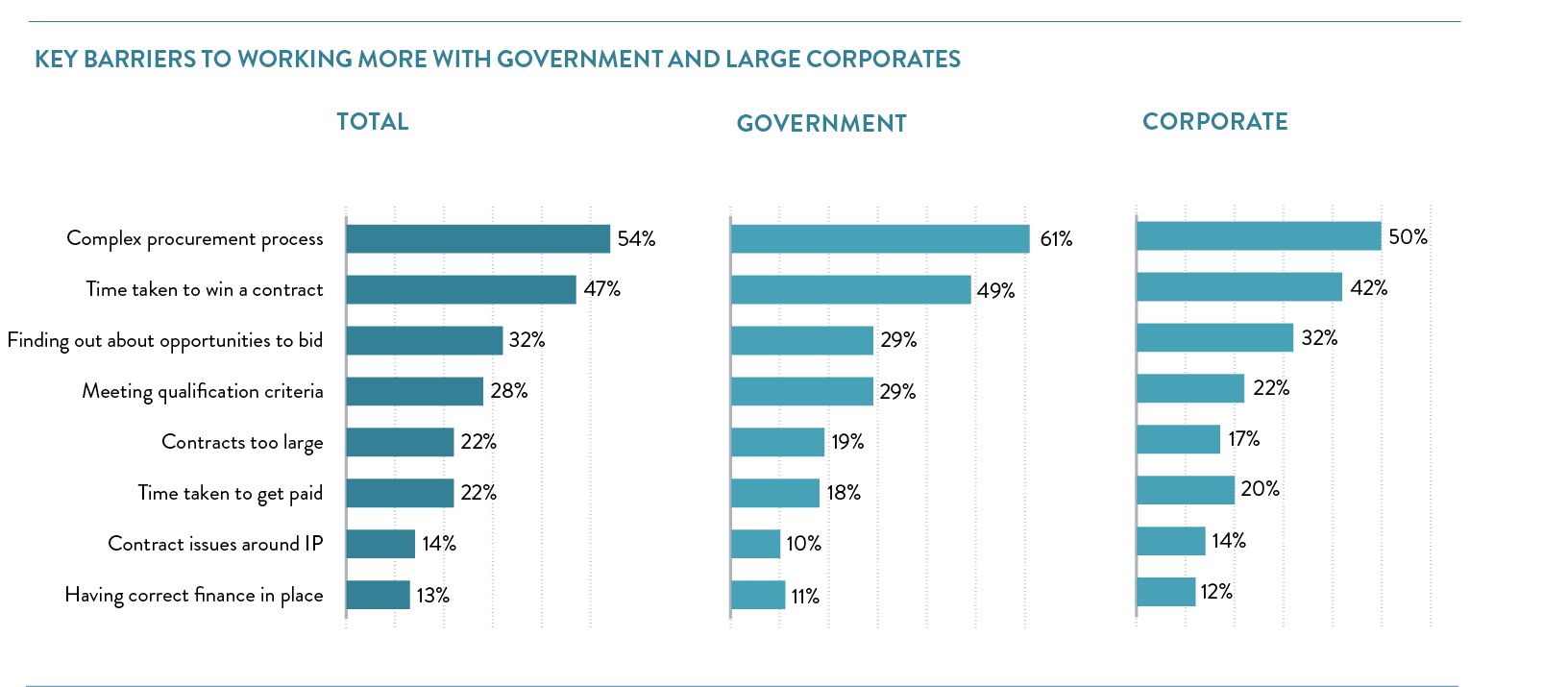

Over recent years the top barriers to working with corporates and government have been persistent. Once again the complex nature of procurement processes is the leading frustration for scaleups – significantly more so when it comes to working with Government. The time it takes between submitting a bid and the contract award is also a source of frustration for scaleups as is discovering suitable opportunities to bid for.

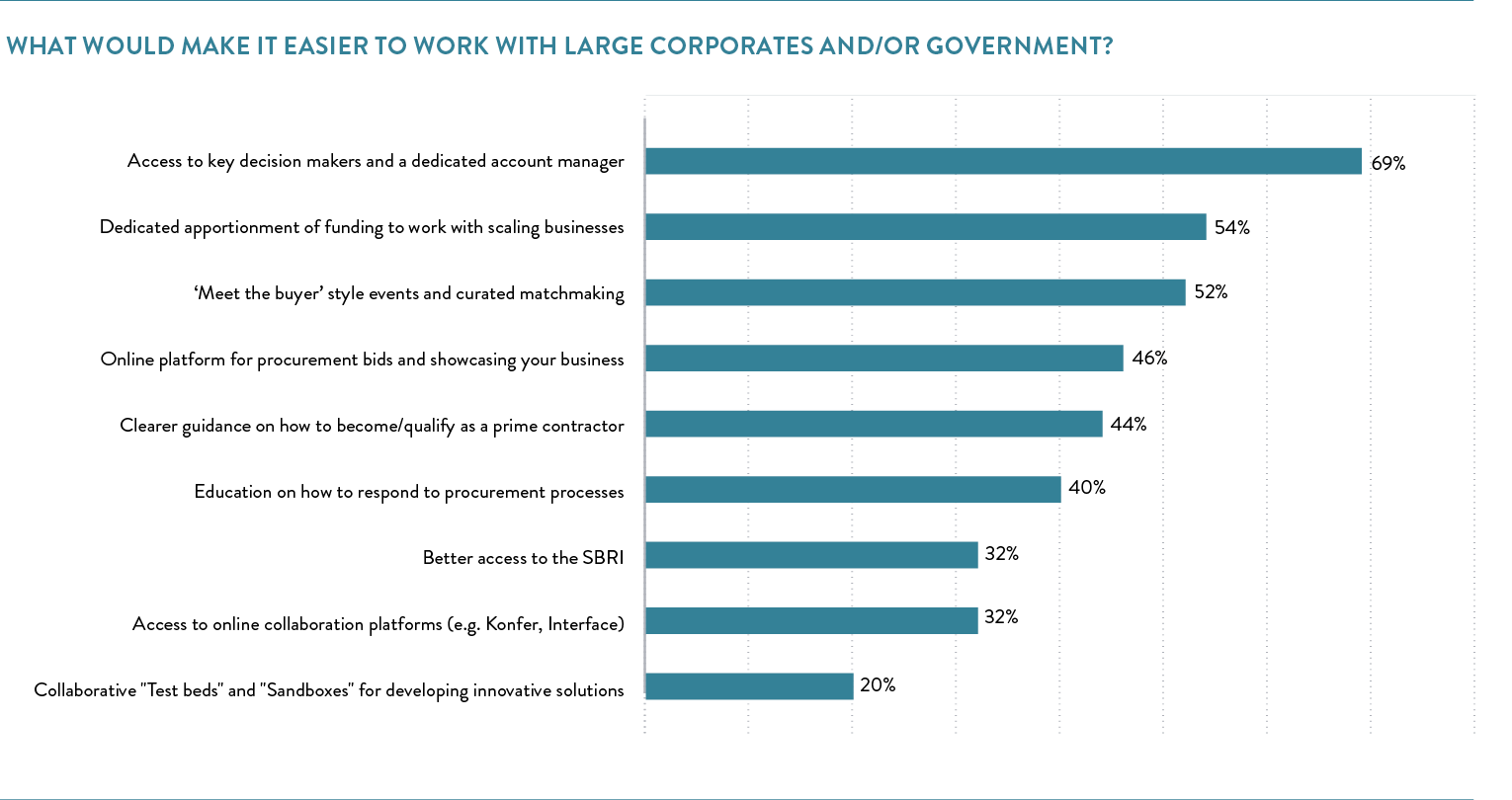

Being able to access key decision makers and having an account management structure would go some way to alleviating these challenges, with many scaleups also believing that large corporates and government bodies should have dedicated resources and funds for working with high growth innovative businesses like theirs. Having the opportunity to “meet the buyer” and showcase goods and services is sought by 5 in 10 scaleups. 4 in 10 would like clearer guidance on how to become prime contractors.

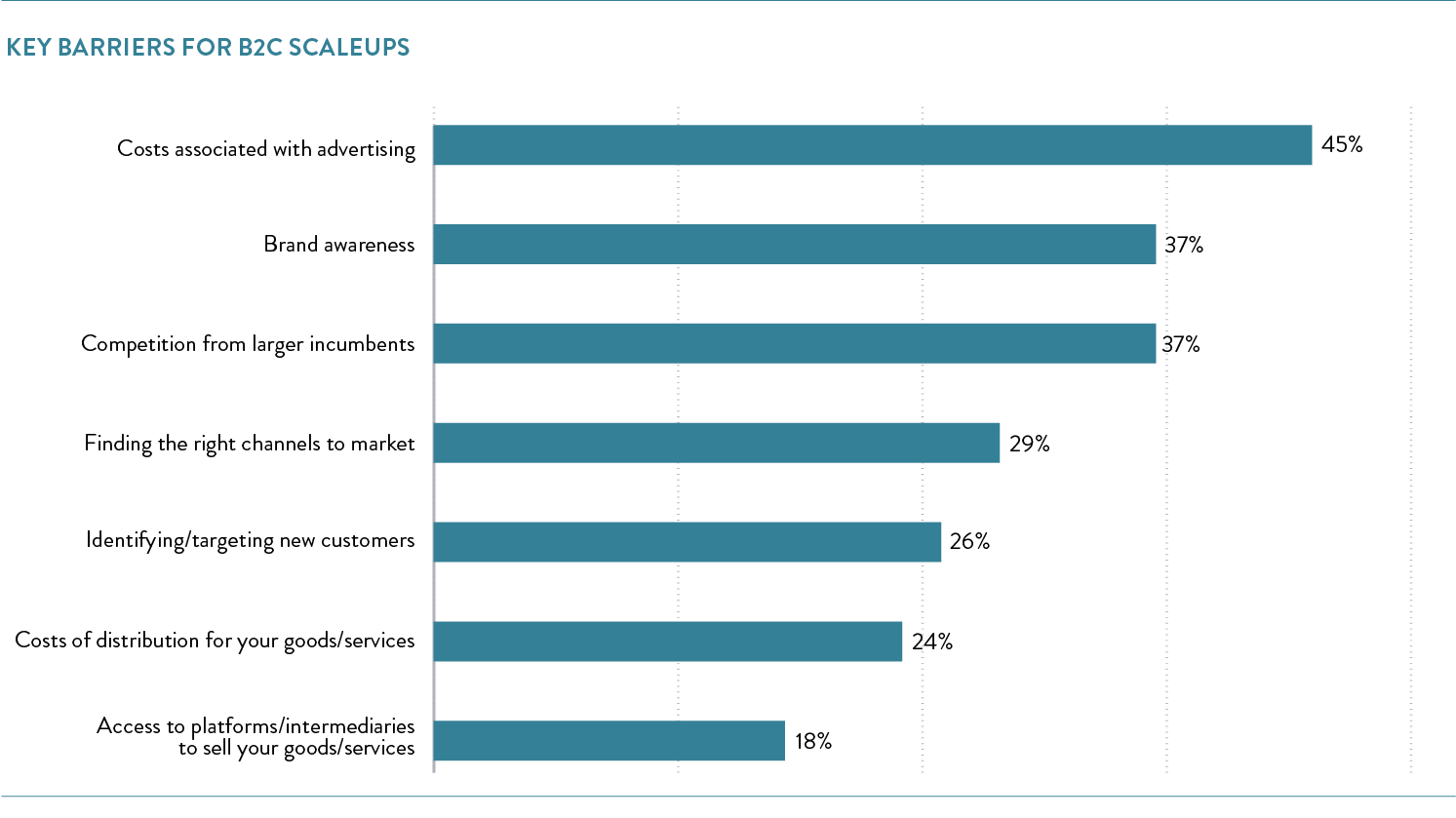

When selling direct to consumers, the most significant barriers reported by scaleup leaders are around the costs of advertising (45%). They also face challenges of standing out in what may be a crowded marketplace, with brand recognition and competition from larger incumbents identified as the second biggest challenge.

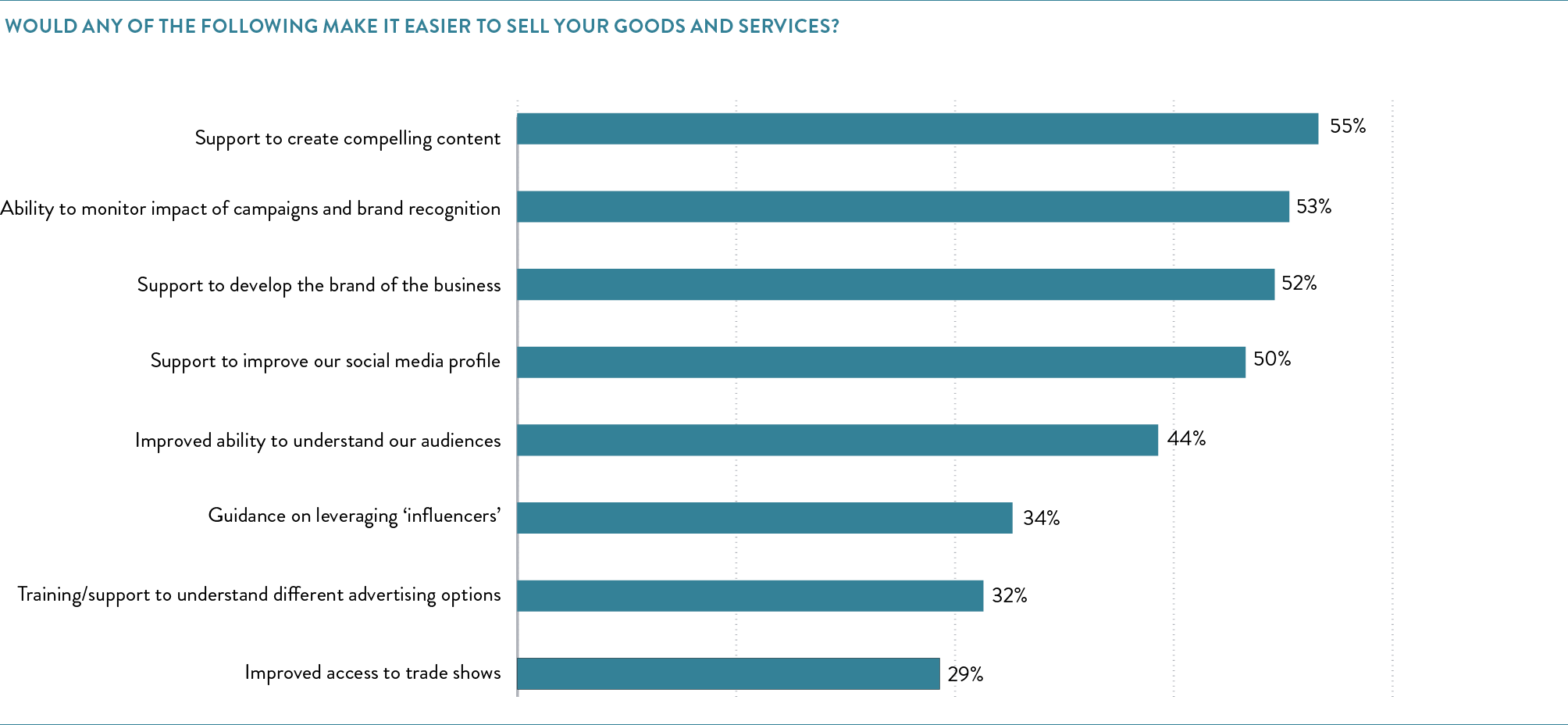

To overcome these challenges they are seeking greater support to create compelling content and develop their brands, including through the use of social media. Being able to understand and analyse the impact of their campaigns is also key.

To overcome these challenges they are seeking greater support to create compelling content and develop their brands, including through the use of social media. Being able to understand and analyse the impact of their campaigns is also key.

Export aspirations and the level of internationalisation of a business is a key predictor of scaleup growth. In 2023 5 in 10 scaleups are currently exporting and 7 in 10 are looking to expand (further) into overseas markets in the future. However, a third of scaleup leaders cite that gaining access to international markets is a key barrier to ongoing growth.

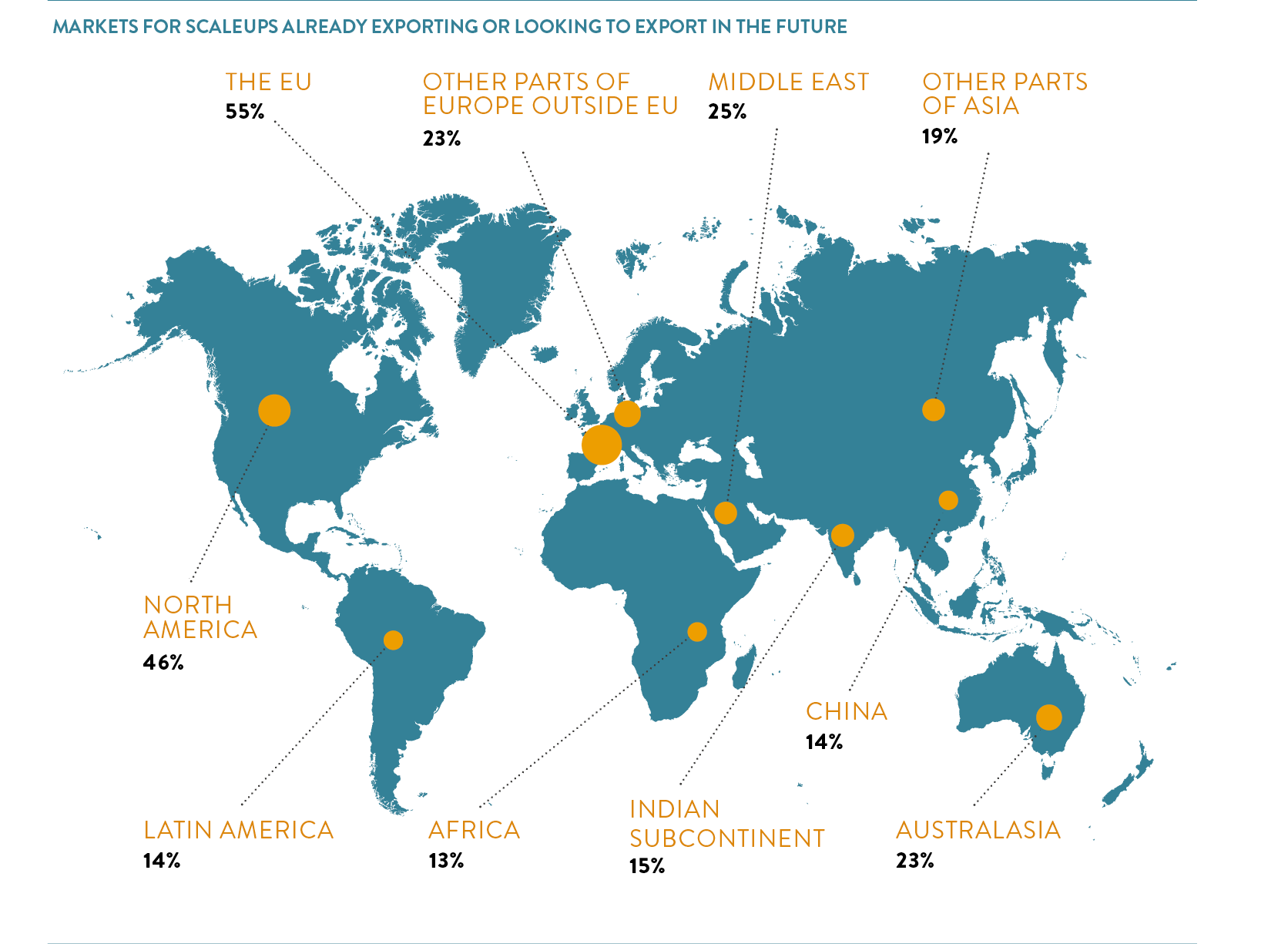

The EU and North America are key markets for UK scaleups, however they are also looking towards emerging markets as they seek to export their goods and services in the future, with half (46%) focusing on other markets. 1 in 4 scaleups are looking to the Middle East, Australasia, and other parts of Europe outside the EU.

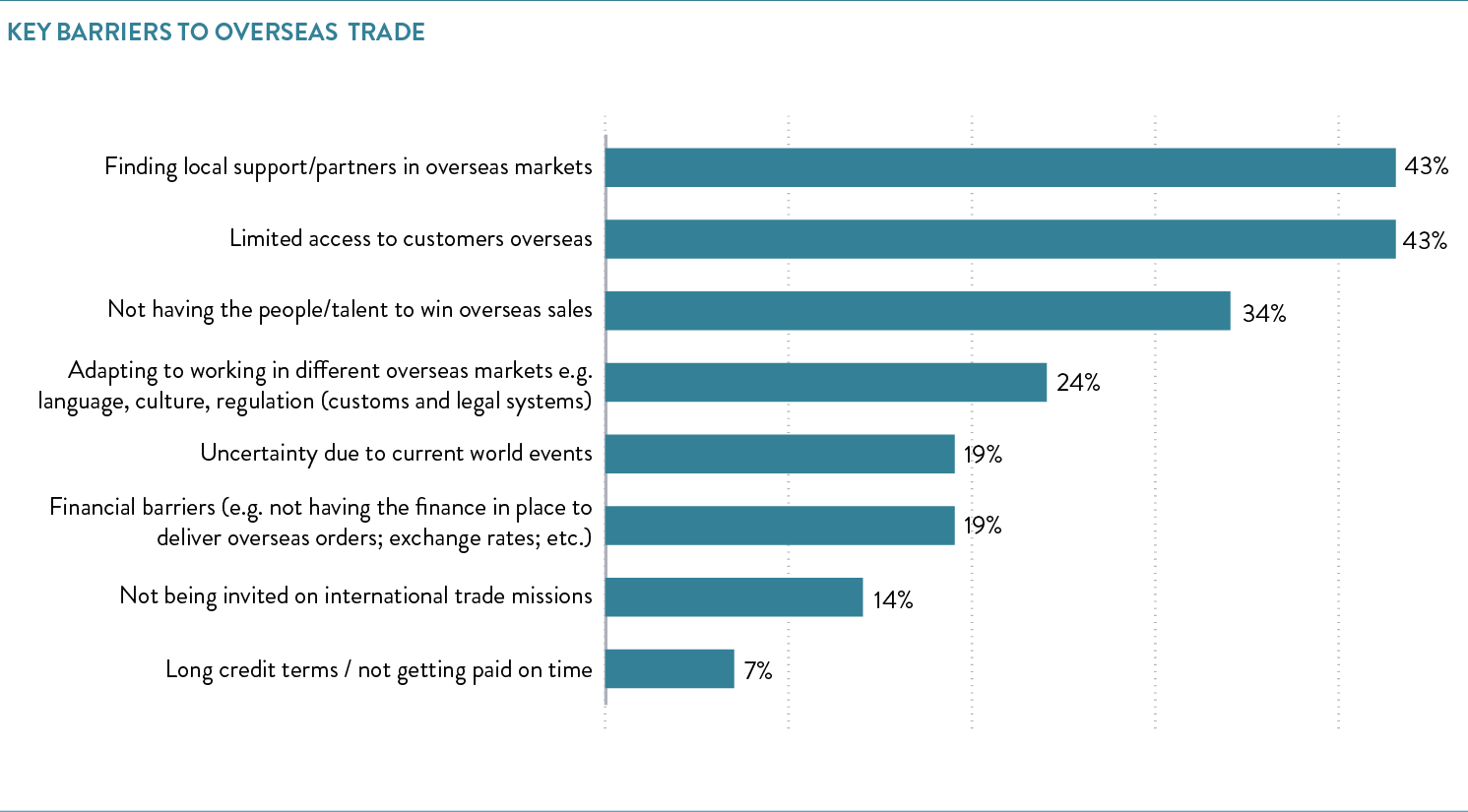

Challenges to export highlighted by scaleups have remained largely consistent each year, however in 2022 we saw an increasing number of leaders concerned about the knock on effects from world events like the war in Ukraine. This has dialled back in 2023, however scaleup leaders are increasingly concerned about their limited access to customers overseas and continue to find it difficult to engage local support and partners within their target markets.

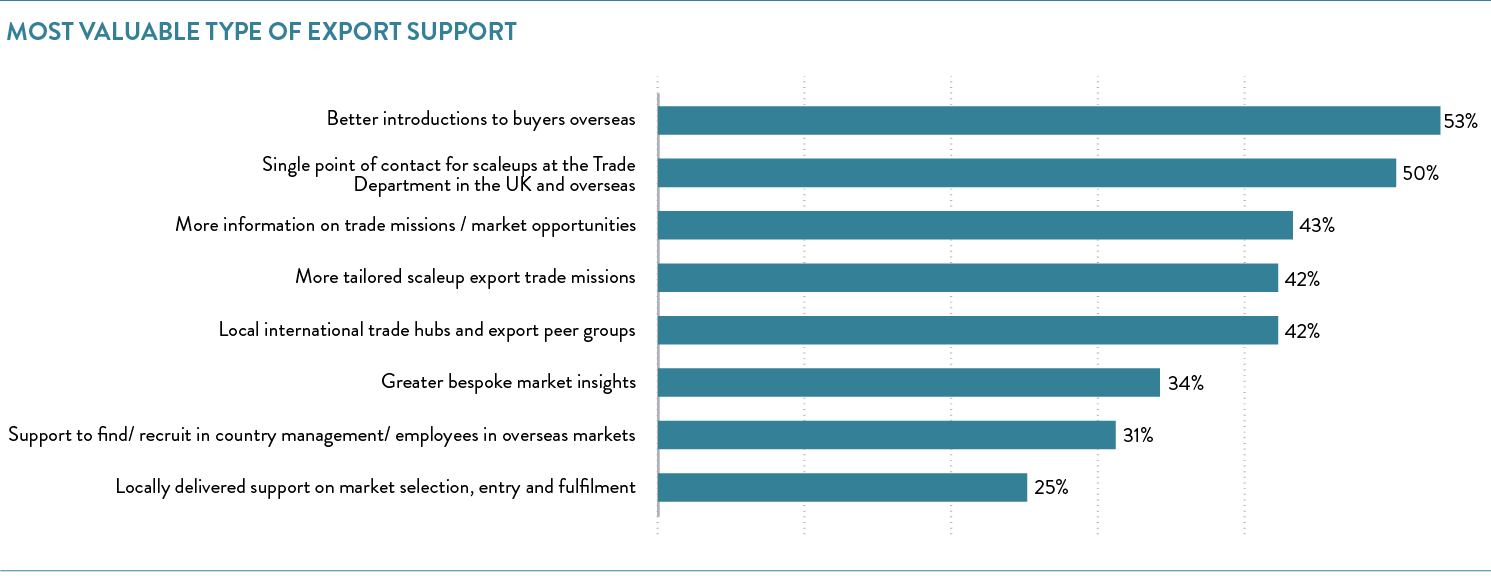

Scaleup leaders want more support to overcome these challenges including curated introductions to overseas buyers and direct support from the Trade Department, with a relationship management structure. Tailored trade missions and bespoke information on target markets and opportunities is also much sought after, potentially delivered via a local trade hub alongside export focussed peer groups.

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Share