Explore the ScaleUp Annual Review 2023

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

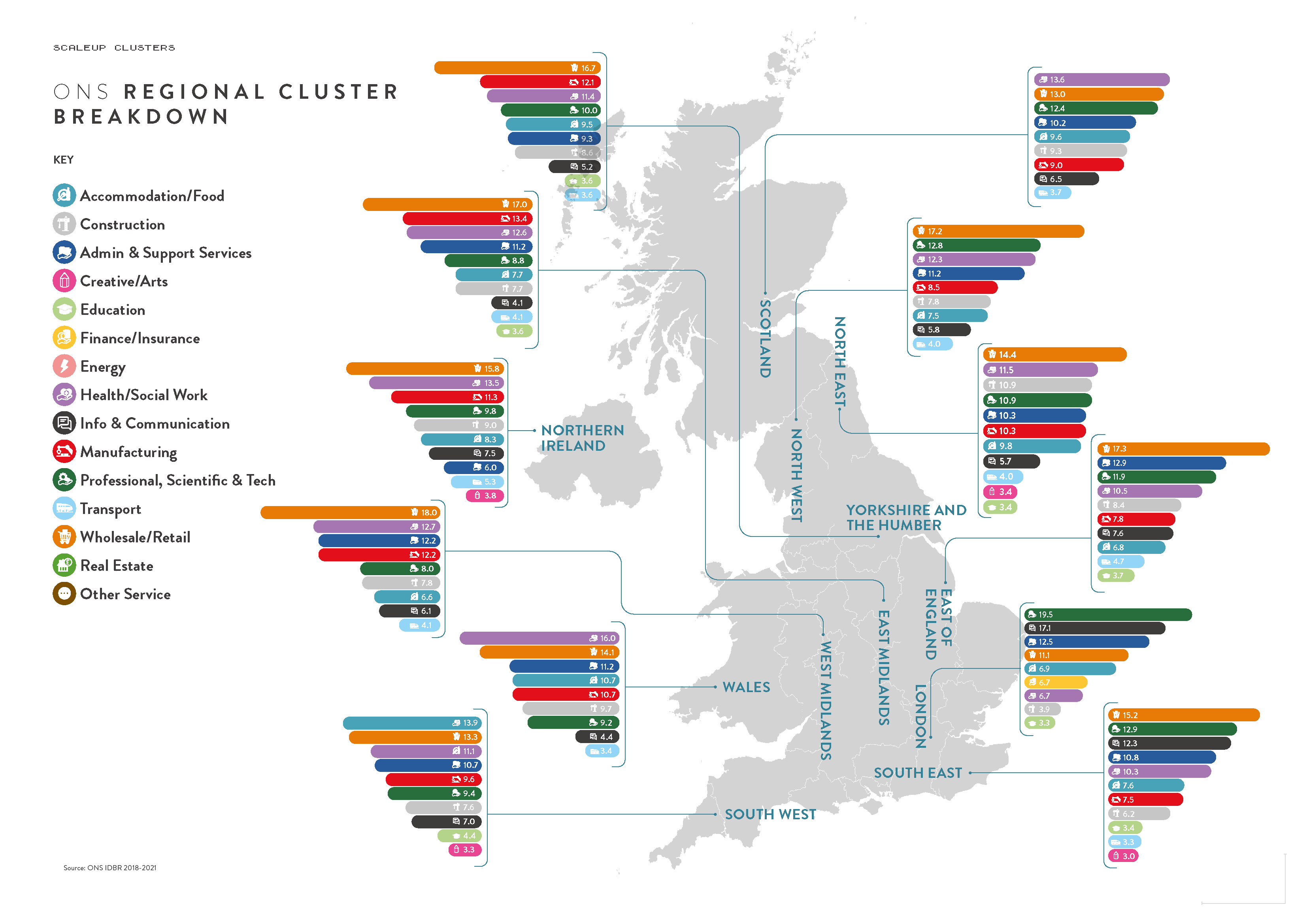

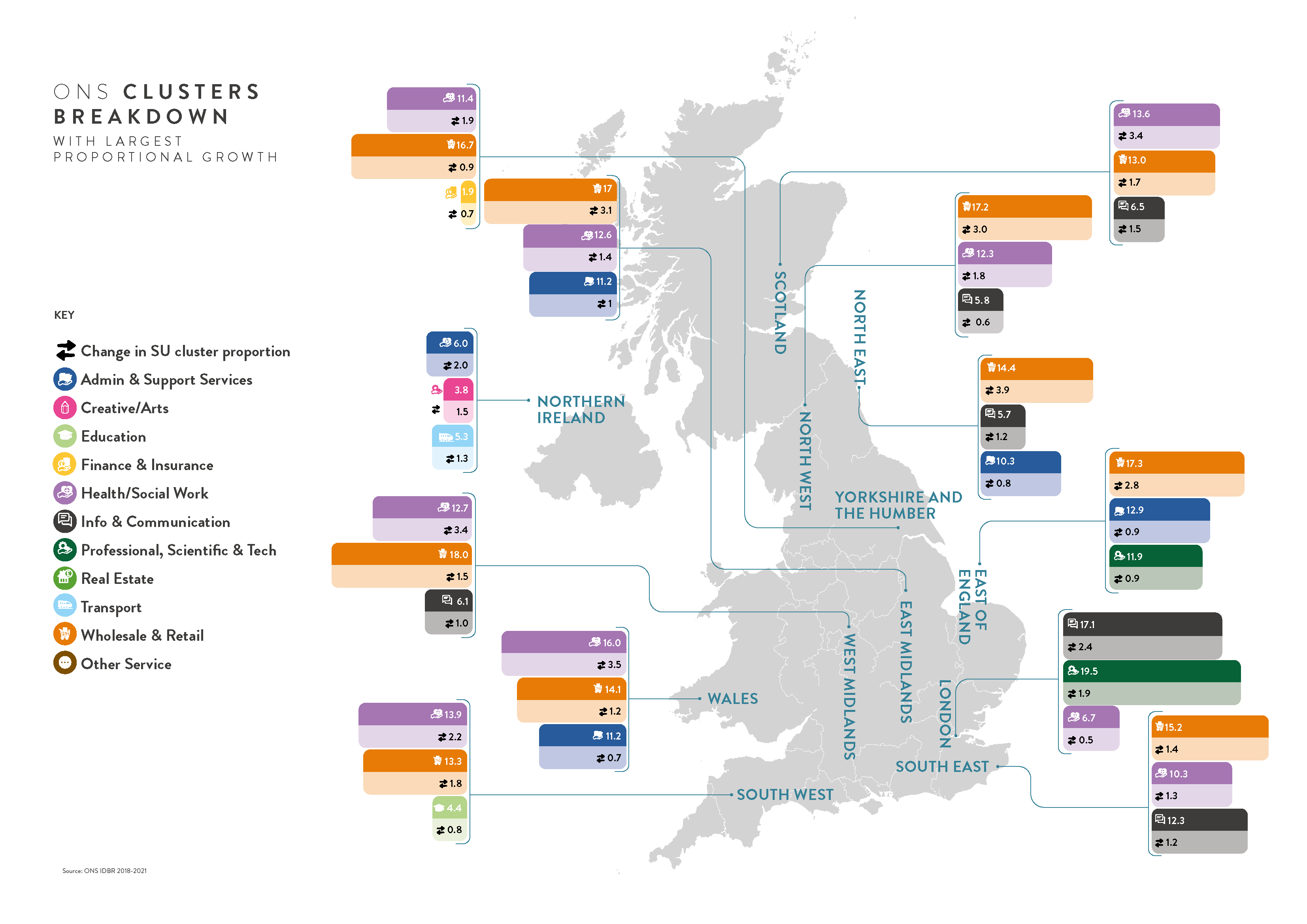

SECTORAL AND REGIONAL CLUSTERING

In the ScaleUp Institute’s research on Drivers of scaleup growth, one of the 3 key factors that was seen as a driver of local growth is the presence and development of clusters[1]..

Hence it is crucial to understand the sectoral scaleup clusters emerging across the country, their regional concentrations and interplays between each other and the presence of hubs and scaleup support, whether these be sectoral, corporate or university-led.

KEY FINDINGS FROM REGIONAL PERSPECTIVE

- Wholesale & Retail remained one of the top three sectors in all regions except London where it ranked as the fourth biggest sector. It also increased in proportion throughout, with only a slight decrease in Northern Ireland.

- Health and Social work continued to grow in most regions in 2021 increasing its rank in ten regions compared to its rank in 2020. It now appears as one of the top three sectors in 9 out of 12 regions.

- Apart from Wholesale & Retail and Health & Social work, the two sectors that have shown significant proportional growth are Professional, Scientific & Tech and Information & Communication.

- Professional, Scientific & Tech saw proportional growth in almost all regions except the Midlands and South West. It remained in the top three sectors in five regions – London, South East, North West, East of England and Scotland.

- Info & Communication also grew proportionately in all regions -except for a slight decline in East Midlands – and notably became the highest growth sector in London.

These findings help to inform what local sectoral scaleup actions we should take as we move forward.

SECTOR CLUSTERS

We are continuing to analyse how scaleups from seven key sectors are clustering around the country and how they contribute to the employment and turnover in different regions. We have looked at each sector in proportion to all scaleups in the region, and while most sectors are evenly spread, there are certain clusters that are evident from the data.

- Wholesale & Retail, being the biggest sector, falls in the range of 11% of scaleups in London to 18% in the West Midlands of total scaleups and is the biggest contributor to turnover in most regions. In the East Midlands and South East, the sector generates 36% and 32% of the scaleup turnover respectively.

- Manufacturing and Health & Social Work are evenly distributed through the majority of regions.

- As in previous years, Professional, Scientific & Tech and Information & Communication represent the largest clusters in London. And it is the only part of the UK where Manufacturing does not have a significant presence.

- Creative & Arts scaleups remain at around 2-3% of total scaleups in all regions and contribute less than 1% turnover in all regions except North East (2.7%) and West Midlands (2.4%).

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Share