Explore the ScaleUp Annual Review 2023

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

SMALL HIGH GROWTH BUSINESSES: OBSERVING THE SCALING PIPELINE

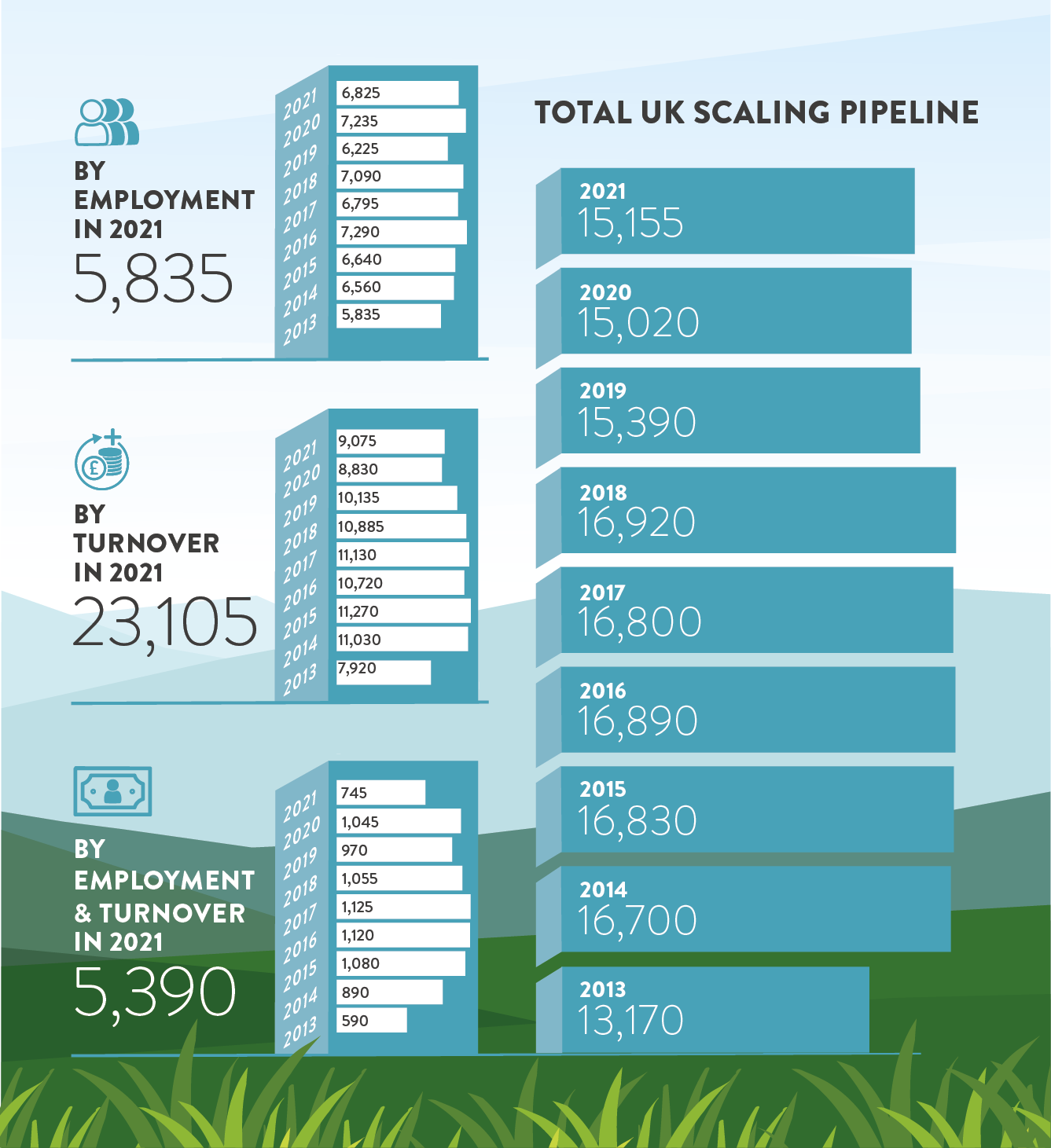

The “scaling pipeline” includes businesses that grow by turnover and/or employment at 15-19.99% annually in the last three-year period (i.e. between 2018-2021), and have the potential to convert into scaleups.

In 2021 there were 13,170 scaling pipeline businesses – generating £414bn through their turnover and employing over 1.3 million. After years of consistent performance, this is a 21% decline. It is largely driven by a fall in the number growing by turnover (-28%).

Turnover and Employment Trends

While there has been a decline in the number of businesses in the UK scaling pipeline, their contribution to employment and turnover remains significant. Indeed, the turnover of the scaling pipeline shows a slight increase by 1% in 2021 to £414bn. It remains key to further investigate the conversion of the scaling pipeline to scaleup levels of growth which would inform the actions to be taken to support this cohort of growing businesses.

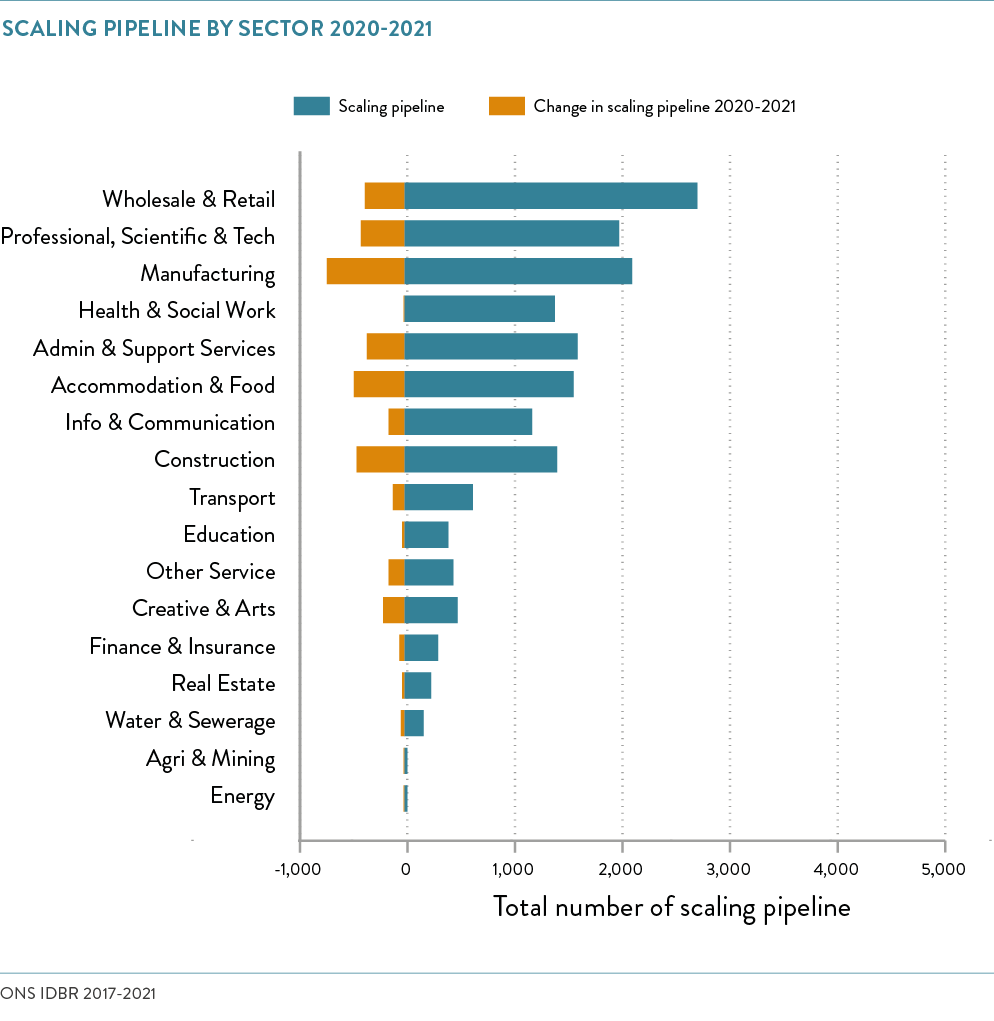

The Scaling Pipeline by Sector

Wholesale & Retail remains the largest sector while the Professional, Scientific and Tech sector is the second largest sector for both scaleups and the scaling pipeline.

Between 2020 and 2021:

In 2021, Health & Social Work scaling pipeline businesses experienced the smallest decline compared to 2020, followed by those in the Education and Real Estate sectors. On the other hand, the number of businesses went down the most in the Creative & Arts, Energy, Mining Manufacturing sectors.

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Share