Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

2022 Scaleup Leaders’ Views

The 2022 ScaleUp Survey was completed by 338 scaleup CEOs, collectively generating £2.5 billion and employing 12,400 people.

In this section we reveal the insights of these ambitious scaling businesses, from a diverse set of sectors across the country, shining a light on their aspirations and barriers they are facing while scaling up.

These CEOs reflected on the macro economic factors affecting their growth trajectory today from the cost of living as inflation rises, to energy bills, to consumer confidence, to supply chain disruption as the global economy deals with pandemic aftermath and rising global tensions and the UK adjusts to a new relationship with Europe.

In 2022 they are much more concerned at the outlook in the UK itself as a place to grow and remain of a view that insufficient support is available to them from the ecosystem.

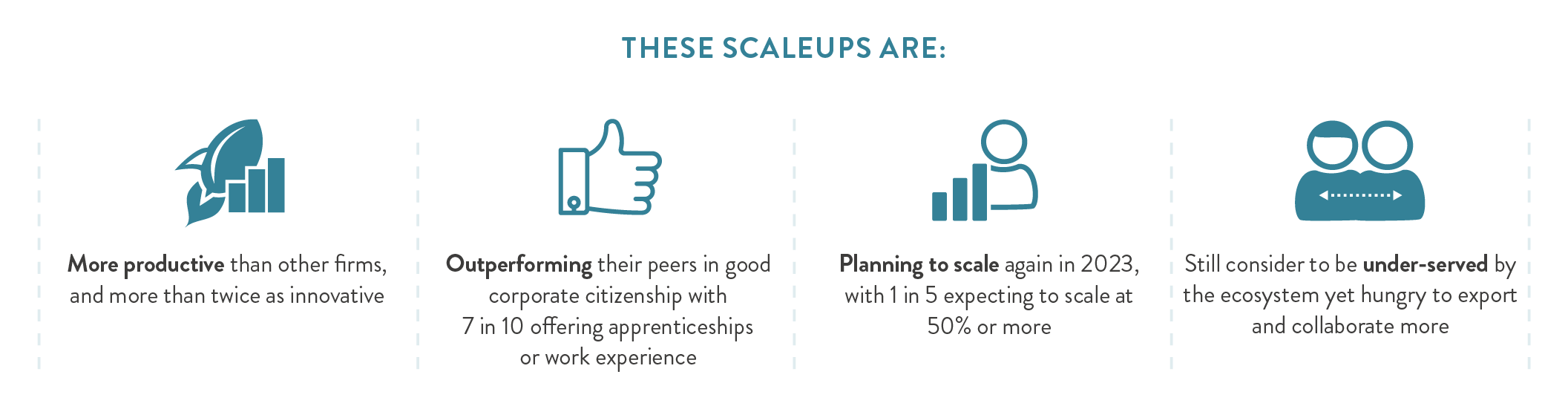

However, irrespective of these significant headwinds, scaleup leaders remain resilient, focused and ambitious with 9 in 10 expecting to grow their businesses even further in 2023 with 1 in 5 expecting to scale at 50% or more.

In the following pages we focus on the survey responses from scaleup business leaders whose companies are cumulatively generating £2.5bn turnover – a significant and diverse group.

In addition to rapid growth, scaleups are sizable and often well-established companies. They remain highly innovative, international, and focussed on the future. Despite challenges across the wider national and international landscape they have pivoted and evolved with half introducing new innovations specifically to improve environmental performance of their business, and are continuing to adopt new technologies and ways of working (8 in 10 introduced a new or significantly improved product, process or service). They remain focused on growth and moving into new markets – scaleups are seeking to triple their ability to sell into Government and double their levels of collaboration as well as work more with large corporates and international export markets.

The 2022 ScaleUp Survey provides detailed and comprehensive insight into the issues that scaleups regard as vital to their future growth and development.

Beyond wider economic considerations, scaleup leaders remain focused on the key issues and barriers to further growth with, for the third year running and dialling up, access to markets recognised as their single greatest challenge followed by access to talent, finance, and infrastructure.

Key Takeaways

- Scaleups remain resilient, ambitious and looking forwards despite wider macro-economic factors affecting the business environment.

- 7 in 10 are apprehensive about increasing costs of doing business, including from inflation.

- with 5 in 10 concerned about the energy crisis, lower levels of business / consumer confidence, the ongoing legacy of Brexit, supply chain disruptions and current geopolitical uncertainty.

- There are increasing concerns about the UK being a good location to do business with 50% of leaders expressing this, up from 38% in 2021.

- Despite these headwinds, scaleups expect to grow and perceive that they are outperforming their peers

- 9 in 10 scaleup leaders expect growth next year, with:

- Turnover growth is expected by 8 in 10 scaleups in the next 12 months, while 7 in 10 expect to grow by employment.

- 1 in 5 expecting this growth to be 50% or more

- However, 6 in 10 scaleup leaders believe it is now harder to grow a business than it has been in the past – a significant increase from 4 in 10 in 2021. And 5 in 10 feel underserved by the business support on offer.

- 9 in 10 scaleup leaders expect growth next year, with:

- Scaleups are diverse – overall two fifths of scaleups surveyed (38%) have a female or ethnic minority founder or CEO.

- 37% of the scaleups responding to the survey had a female founder, 22% have a female CEO, 36% have women on the Board and 54% have women in other senior management positions.

- However only 6% had a founder from a BAME / Ethnic Minority background, 3% CEO, and 8% represented at Board level. 1 in 5 have individuals from BAME / Ethnic Minority backgrounds in the wider senior leadership team, with 4 in 10 stating it is important to their future growth to increase diversity in their top team.

- Scaleups are good corporate citizens.

- 3 in 10 scaleups reported operating in the green economy (33%) while 28% considered themselves ESG compliant (Environmental, Social and Governance).

- 30% also considered themselves a social business (i.e. directly responding to social or environmental problems as an established part of their business/trading model).

- Overall, over half of scaleups (51%) felt they met at least one of these criteria.

- Scaleups are highly innovative. They are twice as likely as their peers to be involved in some innovative activity, and are significant adopters of new technologies. They are also collaborative working with public and private sector partners across the UK as well as universities and research institutions and international players.

- 9 in 10 have engaged in some form of innovation related activity: 8 in 10 (78%) scaleups have introduced a new or significantly improved product/process/service in the last 3 years and 7 in 10 (71%) introduced significantly improved forms of organisation, structures and processes. Just under half (45%) have undertaken innovative activities to meet green ambitions through reducing carbon output and energy consumption or improving environmental performance.

- When it comes to new technologies, scaleups continue to remain at the forefront of adoption. 6 in 10 scaleups (57%) currently use some type of software to monitor their activities and/or productivity. While 3 in 10 are currently using 5G and Internet of Things and 2 in 10 use big data or AI, scaleups are seeking to leverage these technologies to a greater extent with 4 in 10 planning to use them. They are also looking to further exploit Immersive Tech, Robotics and Distributed Ledger Technologies.

- Collaboration plays a significant role in many scaleups growth journeys as they develop new products or services, however much more can be done. 44% are either currently collaborating or aspire to collaborate with universities, 41% with large corporates, 37% with government and 34% with international partners.

- 6 in 10 use or are planning to use R&D Reliefs, however 8 in 10 want greater clarity that these schemes will continue and a similar proportion would like to see an increase in the amounts that can be claimed for. For those not using the schemes, the key barriers are lack of awareness and understanding how to apply.

- Ease of access for scaleups at a local level to funding and support for innovation and R&D remains critical with 5 in 10 (48%) seeking this. Additionally access to the right R&D facilities and infrastructure is important with 4 in 10 placing this among their top 3 barriers to future growth. 1 in 4 are seeking access to Horizon Europe, or a similar UK based scheme.

- Access to Markets, both in the UK and overseas, is the most critical challenge for scaleups.

- 73% state that it is one of their top 3 challenges significantly ahead of other barriers in 2022 as we have seen over the last three years.

- Three quarters of scaleups primarily sell to other businesses or government (B2B), with large corporates representing their largest client base, while one in four are selling directly to consumers (B2C).

- Scaleups are seeking to triple their ability to sell into Government and double their collaboration. 3 in 10 are also seeking to work more with large corporates.

- However the system has too much friction in it which needs addressing, scaleup leaders cite complex procurement processes, the time it takes to win a contract and finding opportunities to bid for as barriers to working both with Government and corporates.

- To make access easier across the public and private sector: 7 in 10 want access to key decision makers and a dedicated account manager; 6 in 10 want more “Meet the buyer” style events; and, 5 in 10 are seeking Showcase opportunities.

- Scaleups are international. 5 in 10 scaleups currently export – reinforcing the international nature of their footprint compared to SMEs generally. The EU remains their largest market followed by North America but an increasing number are looking to other markets – 39% now trade with countries outside the EU. 6 in 10 scaleups are seeking to engage in (more) international trade in 2023. They see key opportunities in emerging markets with exporting rates to Latin America and India tripling and doubling to other parts of Europe outside the EU, Australasia, the Middle East, other parts of Asia, China, and Africa. Overall, 54% aspire to export (more) to countries outside the EU.

- The challenges in securing skilled talent continue for our scaleup leaders. 1 in 4 now rates access to talent as their number one priority. Scaleups remain diverse employers and are exploring new ways to ensure they can recruit, retain and train their staff.

- 7 in 10 scaleup leaders rate access to talent as a vital/important factor in their future growth with 6 in 10 ranking it in their top 3 challenges (62%) behind access to markets (73%).

- As significant UK employers, scaleups are hungry for talent. They employ graduates, post-graduates and school leavers, and offer experience through internships, work placements and apprenticeships. They are also significant employers of international workers with 4 in 10 (42%) employ staff from the EU and 3 in 10 (36%) employ staff from outside the EU. 1 in 5 scaleups have at least 10% of their employees based outside of the UK. Of those currently employing overseas staff, 6 in 10 say it is very important that they continue to hire talent from the EU and over half say the same about hiring overseas candidates from countries outside the EU. 4 in 10 think access to the Government’s new Scaleup Visa is vital or very important to help them secure this talent.

- When considering key skills, scaleup leaders are overwhelmingly looking for softer social skill sets (72%) and management capabilities (59%) followed by more technical skills (55%). They are seeking employees who can demonstrate effective people management, resilience and flexibility as well as staff with the ability to use their judgement and make decisions – however only half are confident that they will be able to find individuals with these skills. They are more confident in finding people with the ability to work with / adapt to new technology with 6 in 10 stating this.

- Scaleup leaders remain keen to work with the education system to help the next generation as they enter the workforce. In particular through improving the quality of careers guidance (7 in 10) and increasing the number of employer encounters (6 in 10) to help young people understand the opportunities that exist with businesses like theirs. However they are also looking for support and funding to be able to offer work placements, traineeships and/or apprenticeships (7 in 10). When it comes to the curriculum, 5 in 10 scaleups would like to support its future development to ensure relevance to current business needs and are keen to see the inclusion of entrepreneurship modules, with four in ten seeking clearer forms of accreditation for digital skills.

- Developing skills of the senior leadership team remains a priority, with a particular focus on skills for sales / business development (59%) followed by brand building (47%) and strategy development (43%) skills. 6 in 10 are also focussed on upskilling their middle management teams. 4 in 10 are keen to augment their top teams with individuals who have experience of growing a business but they are also keen to promote internally with 5 in 10 stating that this will be an important factor in their future growth.

- Finance and access to growth capital remains a priority issue for scaleups.

- Scaleups remain far more likely to use external finance than their SME peers, 82% of scaleups use external funding as part of their growth strategy – yet more needs to be done as 47% do not feel they have access to the right funding to support their growth ambitions.

- There are deepening perceptions of regional disparities with 51% of scaling companies outside of London and the South East of England believing that the majority of funding resides in that part of the UK, a significant increase since last year (41%). This perception is significantly stronger in the North of England with 71% of scaleup leaders in the North West, 70% of leaders in the North East and 59% in Yorkshire & Humber with this viewpoint.

- 4 in 10 scaleups are using or planning to use equity finance – Angels and VCs continue to be key early stage investors being the most common source for 6 in 10 scaleups.

- 6 in 10 scaleups think that the current UK corporation tax rate is internationally competitive. And 7 in 10 have used or plan to use at least one of R&D Reliefs, Capital Allowances or EIS/SEIS schemes, however there is a desire for a greater commitment from Government to continue them, an increase in the amounts that can be claimed, and making the schemes easier to understand and apply for.

- Relationship management is increasingly demanded by scaleups. They also value being ‘put on the map’.

- Up from last year, 70% of scaleups would like a single point of contact to act as a relationship manager for them when dealing with the government and other public sector support.

- Scaleups are happy to be identified on a public record, with 8 in 10 stating that their scaleup status should be shared, with 5 in 10 stating this should be on an opt-in basis. Half also feel it would be beneficial to their growth if government was able to share their scaleup status internally with other government departments and agencies, with a similar proportion feeling the same if the government could share this identification externally with companies outside government.

- 6 in 10 think that it would help their business grow if the private sector could identify them as a scaleup.

The Top Challenges

- Access to markets – both at home and abroad – for the third year running this continues to be the most significant issue that our scaleup leaders are grappling with.

Boosting sales to and collaboration rates with the government and large corporates is top of mind for scaleups however barriers still remain. The complexity of procurement processes, as well as the time it takes to win a contract are common challenges, alongside being able to find out about suitable opportunities to bid for. Action and concerted effort is needed now to resolve these issues. To help overcome these scaleup leaders are seeking a clear line of sight to key decision makers and effective account management, they also want better opportunities to showcase their products and services and opportunities to ‘meet the buyer’ at curated events.

Being connected with peers working in the same supply chain is also valued. Out of all the scaleups that are currently a part of a government’s or any private sector’s supply chain, only 1 in 10 (12%) are connected via a formal network with their peers. Half have created informal networks with 3 in 10 feeling it would be beneficial to their business if a more formal arrangement existed.

For scaleups primarily selling direct to consumers the key barriers to their ongoing growth are the costs associated with advertising, brand awareness, and identifying new customers.

Scaleups are leading exporters and are hungry to do more despite macroeconomic challenges affecting supply chains and the ongoing transition to new trading arrangements following Brexit. 5 in 10 are currently exporting with 6 in 10 planning to export (more). The EU remains a key overseas market for our scaleups with 42% trading with the bloc, 39% are currently trading with countries outside of the EU. Outside the EU, North America remains the largest export market however scaleups are seeking to dial up their activities in emerging markets such as Latin America, India, Australasia, the Middle East, China, and Africa. More support is needed to achieve their international ambitions and overcome barriers such as finding the right local support and partners overseas. They want more tailored scaleup export trade missions and increased engagement from DIT to help facilitate better introductions to international buyers.

- Access to Talent continues to be a key barrier to growth for scaleups. The ‘war for talent’ is dialling up and scaleups, who recruit from across the labour market in the UK and internationally, are stepping up their activities to find, train and retain skilled employees. 81% of scaleup leaders said they increased investment in training and reskilling with a similar proportion increasing focus on developing their “employee experience” (e.g. how they train and retain staff, and the non financial rewards in the company such as health memberships; social activities; negotiated discounts; etc.). They are also seeking to work more with the education system to ensure that the next generation possess the right mix of skills and attributes through careers advice, employer encounters and entrepreneurial education. Scaleups continue to offer valuable opportunities via apprenticeship and work experience, with 74% already doing so, however they are keen to access further funding and support to further their ability to take on young people.

8 in 10 scaleups report that they are currently finding it a challenge to recruit the right people either for a specific role or who have specific skills, ranging from digital to engineering and manufacturing roles through to sales, procurement and project management professionals. More broadly though, they continue to seek graduates and school leavers with social skills, management skills and technical skills. Looking to the future, key transferable skills such as people management skills, resilience and flexibility, and decision making are highly sought after, however only about 50% of the leaders are confident in finding individuals with these skills.

Access to international talent is also critical, 4 in 10 employ people from the EU with 3 in 10 employing individuals from further afield. While the vast majority of their employees are UK based, due to their international nature as leading exporters 1 in 5 have at least 10% of their workforce located in overseas markets. Being able to bring talent to the UK remains critical though with 6 in 10 saying it is important to access talent from the EU and 5 in 10 from the rest of the world – the new ScaleUp Visa is recognised as an important tool to help them do this.

- Access to finance and growth capital. Scaleups continue to be far more likely to use external finance than their SME peers: 82% of scaleups use external funding as part of their growth strategy, although an increasing number continue to feel (53%) they do not have access to the right funding for their needs. Perceptions of regional disparities are growing – 5 in 10 scaleups feel that the majority of funding resides in London and the South East of England, up from 4 in 10 in 2021. Of those using external finance, 4 in 10 are using equity or plan to use it in the near future – with VCs and Angels continuing to be identified as the key sources of equity provision. Amongst those who are not using equity finance the top reasons they cite are – reluctance to give up control, perceptions that it would be unsuitable for their business, and investors being too short term in their outlook.

Scaleups actively utilise the various tax schemes provided by the government such as the R&D reliefs, capital allowance and enterprise investment schemes. Current users of these three schemes want a further expansion of the time periods the schemes are offered for, availability of more range of things the schemes offer, increase the value of the allowance the businesses can claim from the schemes, and making the schemes easier to understand. For those not using the schemes they feel increased awareness of such schemes, recommendations from a trusted source, and higher value of claimable allowance from these tax schemes would encourage them to opt for these. With respect to the tax rate, overall 58% of scaleups think that the current UK corporation tax rate is internationally competitive.

- Infrastructure. Access to a flexible space to grow and facilities that support collaboration, innovation and R&D remains a key concern for scaleup leaders. Up from 47% last year, in 2022 59% of the respondents state that access to infrastructure/premises and broadband to be vital/very important for their business growth, despite 72% of scaleups continuing to enable their staff to work flexibly. When asked to pick the top three barriers as well 37% business leaders prioritised this. Access to advanced research facilities at universities and large corporates is also seen as vital or very important by 1 in 3 scaleups.

- Building leadership capacity through local support continues to be seen as a challenge for some and has slightly increased in importance since 2020 and 2021. 6 in 10 scaleups have a Board or similar governance structure in place and a further 12% have plans to establish one in the future. Input from mentors continues to be highly valued by those who have one, but a continuing challenge among the 5 in 10 without this type of support is the ability to find a suitable mentor.

Scaleup leaders remain keen to develop the skills of current members of their senior teams (67%), highlighting key gaps around sales/ business development, brand building and strategy development. They are also seeking to augment leadership capability across their whole business by developing leadership skills in middle management roles (55%) and promoting staff to senior roles from within the business (54%). 44% also want to recruit leaders with past experience of growing a business as a mechanism for developing their top teams.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share