Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Looking Forward

While there is ongoing turbulence caused by macroeconomic factors, scaleups across the UK are showing their resilience and are pushing forward with their growth plans. They are on the lookout for new opportunities to innovate and expand their core markets at home and overseas. However, they continue to face hurdles when it comes to accessing these markets. Challenges associated with finding the right talent and financing growth remain and as an ecosystem we must step up to support scaleups to overcome them.

Going forward we need to maintain existing levels of support and continue to evolve new solutions to the challenges faced. The message is clear, only by delivering this at a local level and reducing regional disparities will we create a resilient scaleup economy across the entire United Kingdom.

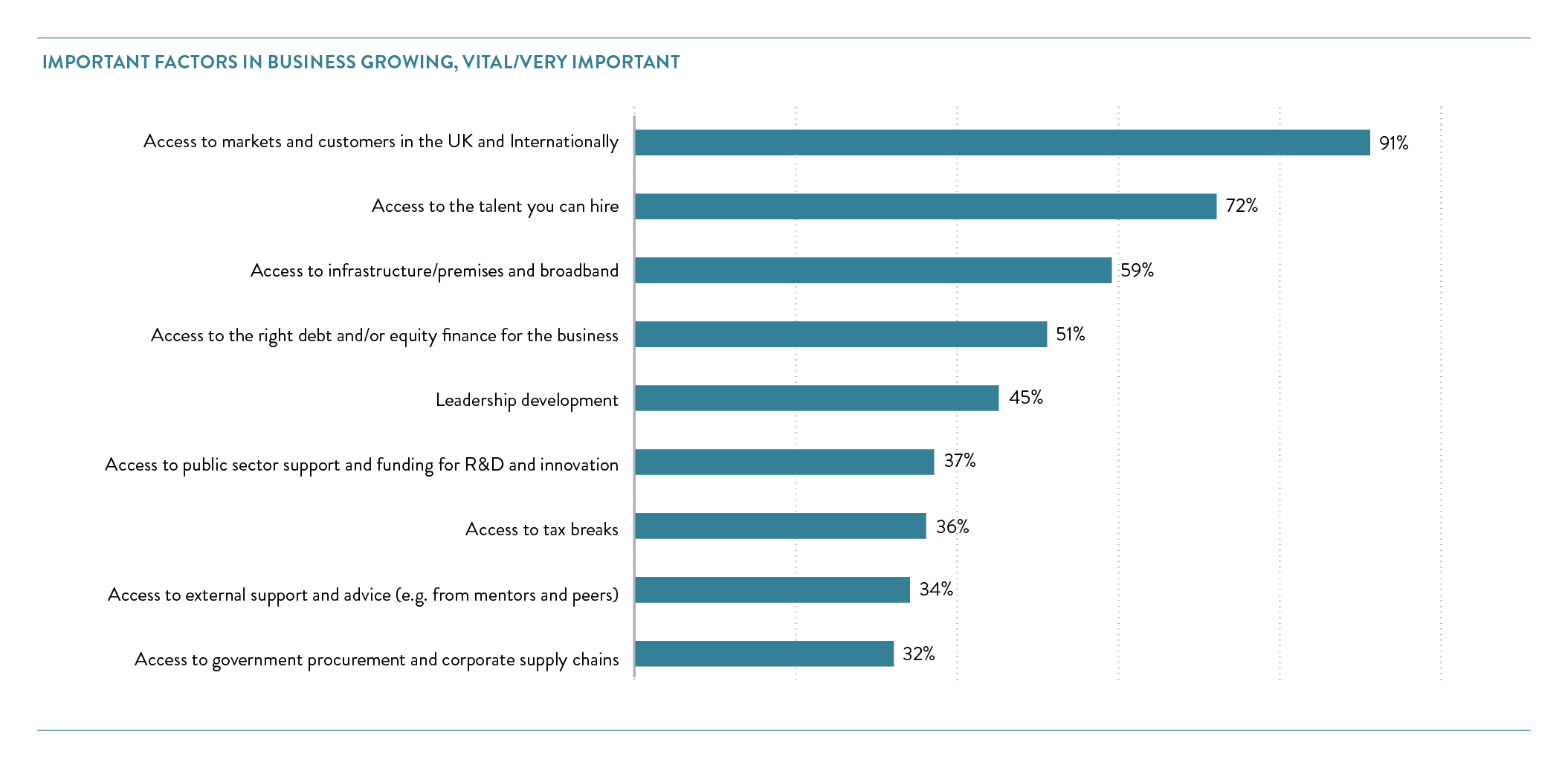

Scaleups continue to be concerned about their ability to access markets in the UK and internationally with 9 in 10 seeing this as vital or very important to their growth (91%) ahead of talent (72%), infrastructure (59%) and growth capital (51%).

SCALEUPS VIEW ACCESS TO MARKETS AS AN IMPORTANT BARRIER TO THEIR CONTINUED GROWTH

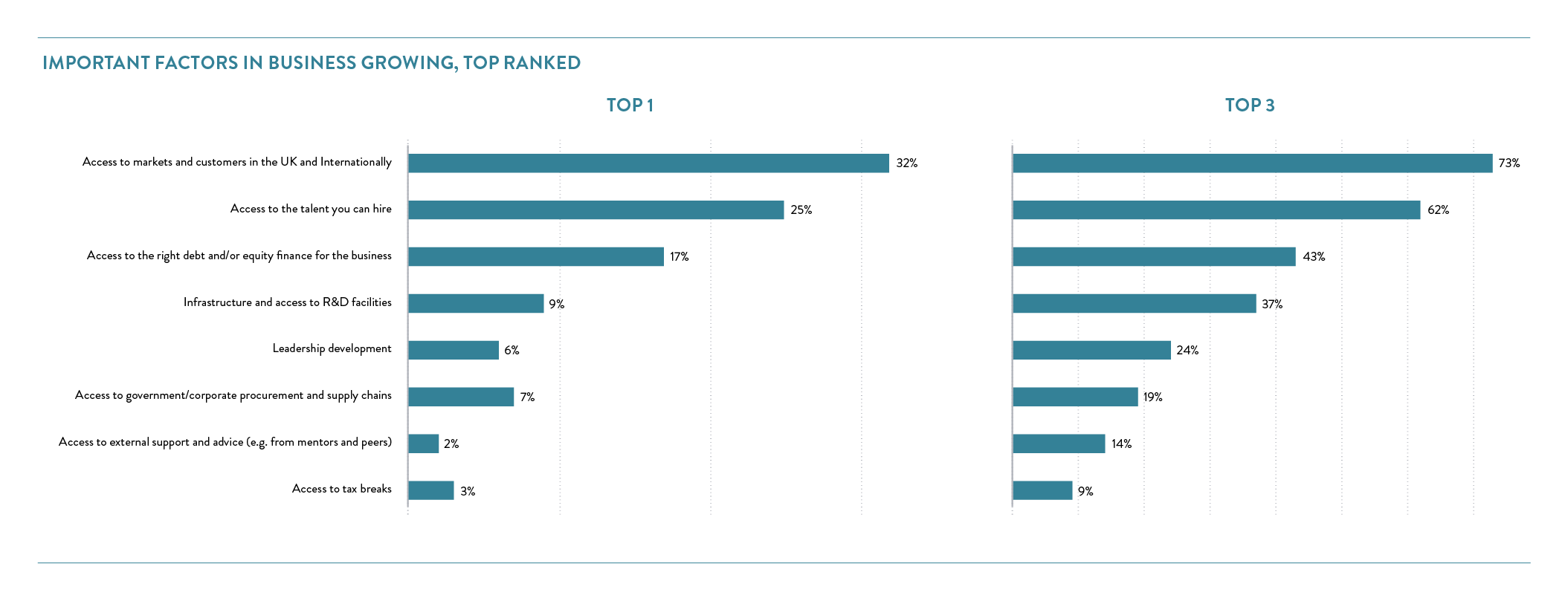

Each year we ask scaleups to select their top priorities, in 2022 markets once again returns to the number one position with 32% stating it is their biggest barrier and 73% placing it in their top 3. Talent is the top priority for 25% of scaleups and growth capital for 17%, while 62% and 43% place them in their top 3s respectively.

Looking more deeply at a sector level reveals how certain challenges dial up across parts of the economy with the markets challenge deepening for scaleups in professional services and consumer trades (including wholesale, retail and hospitality industries) with 47% of scaleups stating it is their number 1 priority and also for those operating in manufacturing and engineering (40%). While for those in Scientific and Technical industries access to talent becomes the overall number one concern (37%). Access to finance dials up for life science scaleups (23%) and the construction industry are far more concerned about access to public procurement than their peers.

As discussed earlier, despite these challenges 5 in 10 agree that they are out-performing their peers and a similar proportion continue to think that it is realistic to expect 20%+ growth each year. But confidence is fragile and concerns dialling up about whether the UK will be a good location for a business in a few years’ time alongside a continuing perception that there is very little support available for businesses like theirs.

So while some signs are positive, we must do all we can to enhance support, revitalise confidence and champion success in order to build a successful UK scaleup ecosystem.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share