Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Leadership remains central to scaleup growth

Leadership development, access to peer to peer networks, and access to high quality mentors remain an essential part of a company’s scaling journey. The perception of access to leadership development as a barrier has fallen consistently since we were founded and first started tracking this amongst the scaleup population. Whilst this year without force ranking it has risen slightly compared to last year and 2020 when it is force ranked only 24% of scaleup leaders now see access to leadership development one of their top 3 barriers. This is a testament to the hard work of local ecosystems, Growth Hubs, LEPs and the private sector in creating programmes to meet this demand.

We are pleased that our work to help ecosystems build scaleup programmes has been well received, and we will be undertaking a further series of our Driving Economic Growth through Scaleup Ecosystems course (DEG) in 2023 utilising online tools and virtual seminars to provide a modular course for LEPs, Growth Hubs and the wider ecosystem to develop the next stage of scaleup support programmes. We have continued to bring together alumni of those programmes to share best practice and insights as local areas have developed solutions for their businesses, and will continue to do this in order to support local areas.

To enable scaleup leaders understand what support exists to help them overcome barriers to growth and build capacity, the ScaleUp Institute has endorsed and raised awareness of high-quality programmes. These include the Goldman Sachs 10,000 Small Businesses UK programme. A recently published impact report has analysed the effect that participation on the leadership programme has had on businesses. Alumni have proved to be highly resilient – with 48% having increased their turnover over the past 12 months compared to 31% of similar high growth peers.

Another endorsed programme is the Royal Academy of Engineering’s Shott Up Accelerator. Engineering or technology business leaders can now apply for this opportunity relaunched by the Enterprise Hub free six-month programme, which can prepare business leaders for the challenges of scaling a business by providing a £10k leadership training grant, six months of expert-led leadership support, mentoring opportunities and personal development coaching to navigate growing pains.

Tech Nation has launched Growth Platform, which it describes as “a digital hub for the tools, knowledge, network and data that leadership teams need to problem-solve and scale a tech company,” with services such as personalised content and masterclasses and virtual networking.

We will also watch with interest Women Scaling Up, which has been launched by Two Zero, Lancashire County Council’s scaleup support service, to help female entrepreneurs take their business and leadership skills to new levels. The programme, which began in September 2022, will provide female entrepreneurs with an initial six months of support, including boardroom masterclasses on scaling their business as well as executive coaching, one-day retreats and bi-monthly support sessions for a further year.

The Government is also delivering both Help to Grow Management and Help to Grow Digital: two strands of leadership development which are providing support to businesses earlier in their growth journey.

To support business leaders seeking to navigate relevant support, the ScaleUp Institute publishes a Support Finder that provides an inventory of our endorsed and “Ones to Watch” programmes. We believe this could be used effectively to reassess the support provided across the ecosystem to identify gaps. This inventory should also be augmented with additional tools and link off to broader hubs.

MAINTAINING BUSINESS SUPPORT FOR THE LONG TERM

Whilst the availability of programmes means it is no longer seen as a critical barrier, it is important to note that 1 in 3 of all scaleup programmes have been supported in some capacity by EU structural funds. With this funding now coming to an end, it is essential to ensure that high quality programmes with impact continue to receive funding in order to ensure that scaleups are still able to meet their leadership development needs.

This means that the UK Shared Prosperity Fund and Levelling Up funding must be utilised effectively by Local Authorities and other regional bodies, in order to ensure that companies within local areas are able to continue their growth pathways, and access the support which they will need to do so. There is a risk that high quality programmes will be lost, or that new programmes will create confusion for businesses, or crowd out those which are working. This must be avoided.

The availability of suitable programmes is a crucial part of the ecosystem, and whilst accessing leadership development is currently not seen as the most fundamental barrier to growth, we know that scaleups remain focused upon finding and developing their leadership skills, with a clear crossover with the skills being sought in the talent they are wanting to bring in. If programmes that are currently having a positive impact for scaleups cease to exist, then the positive progress that has been made will quickly be undermined.

Importantly, whilst the current availability of leadership development programmes means that scaleups are less worried about it, we know that 8 in 10 scaleups rate People management; and, Resilience & flexibility as key traits needed now and 7 in 10 are focussed on Judgement & decision making; Cognitive Flexibility; and, Emotional intelligence. We also know that 8 in 10 scaleups are specifically increasing investment in retraining and re-skilling their workforce. This is all part of developing appropriate leadership capacity. We can also see that 71% of scaleups have a Board, or are looking to implement one, and that accessing mentors is still important with 4 in 10 looking for easier access to Non-Executive Directors, and 3 in 10 still wanting easier access to peer to peer networks, mentors and flexible leadership programmes despite the current breadth of options in the marketplace.

In this light, it is unfortunate that the Enterprise Strategy, which was in development in 2021 and due for publication in early 2022, has not yet been published. Based upon discussions undertaken during its development, this was due to provide clarity and coordination for local areas considering their next steps for business support, and follow up on the review of business support undertaken in 2019 and 2020. In order to ensure that scaleups have access to the right leadership skills, we believe that there is still merit in publishing a strategy in this area.

This may be particularly critical to ensure that UK SPF and Levelling Up fund money is apportioned in a way that maintains the availability of high quality programmes for scaleups and the growth economy overall.

PEER TO PEER NETWORKS, MENTORING AND NON-EXECUTIVE DIRECTORS

Peer networks and mentors are consistently highlighted by scaleups as important. Half of scaleup leaders have a mentor, who provides guidance and support to senior management, 92% of those with a mentor find their guidance valuable and 35% consider access to non-executive directors as important for leadership development. While some leaders feel that they do not need a mentor, 45% of those who do not currently have such a relationship would like one. It is important that scaleups have access to each of these resources, and that they are able to develop the right trusted relationships with their peers as part of the programmes which they are engaged in.

Peer networks are especially valued and often sit at the heart of Hub and Cluster environments, such as Alderley Park, Scale Space, Engine Shed and the Stevenage BioScience Catalyst, which we have newly endorsed this year. There are also helpful peer to peer dynamics within wider programmes, such as the market development opportunities that come with the London Mayor’s International Business Programme and the Manchester Global Scale-up Programme, and we are pleased to be working closely with Innovate UK EDGE to ensure they have a high quality peer to peer network offering for the UKs most innovative firms.

Peer-to-peer support is not simply networking with peers, but rather a structured, trusted intervention built around a small cohort of businesses with similar growth trajectories. It is critical for these dynamics to be actively curated, to ensure that these groups are trusted ‘safe spaces’ where issues, challenges, concerns, opportunities – and even financials – can be shared with other group participants in order to seek guidance and solutions that can be actively applied as part of a growth plan.

As we have previously identified, guiding principles should be:

- Participants should always drive the agenda for discussion;

- It must have effective, trained, independent curation;

- Discussions must be kept confidential;

- Each member should be accountable to each other and the group;

- Any outside experts should be invited in by agreement of the participants – and to impart knowledge, not sales;

- Keep it local and focussed on businesses on similar growth paths.

DEVELOPING LEADERSHIP SKILLS

Many scaleups see barriers in broadening and strengthening the wider leadership team. As a business grows, moving from one team to a wider structure, bringing in more support functions such as business development or a back-office admin team brings management challenges.

We have undertaken a detailed assessment of the different ways that scaleups grow, and what this means for their leadership development, and not all scaleups take the same approach to senior talent and leadership skills. During our research we discovered two scaleup personas with each having different approaches: ‘Structured’ and ‘Spontaneous’.

More Highly Structured scaling businesses tended to have CEOs with deeply transferable business skills, who are focussed on growth no matter what the sector or business or company they are engaged with. These scaleups had very clear and precise objectives and a clear picture of who they need and when because their business plan is intrinsically linked to the access to talent.

The second group is spontaneous scaleups that when describing their growth talk about being able to take advantage of an opportunity that has presented itself or reacting to a change at a moment of time, such as new legislation. As, at times, growth was not planned for per se, their talent needs would also arise on an ad-hoc basis, which has sometimes brought its own challenges.

At the Board level, highly structured scaleups often have a very clear expectation of the desired individual or a specific person in mind, whereas spontaneous scaling businesses often seek external guidance to help them understand the different paths. For the senior leadership team, a key question remains whether to recruit internally through promoting from within the business, for example promoting someone with strong technical skills but without the required management traits, or externally when an individual might struggle with the culture change of joining a high growth business.

The desire for certain skills develops according to the stage of the business, with scaling businesses whose turnover was under £1m reporting greater need for finance and fundraising skills (39%) and those over £10m turnover less likely to seek sales and business development skills (36%), however, in the latter case it appears their focus remains firmly on building market presence through brand development (64%). Demand for skills around innovation appears to increase as the business scales.

Scaleups with female or BAME founders/CEOs were slightly more likely than their peers to be seeking skills around finance and fundraising (36% vs 29%), however, they were far less likely to be looking for innovation and product development skills (31% vs 43%).

Scaleups also want to be connected to experienced leaders that they can bring into the business. They are looking for individuals who have been there, seen it, and scaled a business, who can bring deep connections or insights and support the business’ scaling plans by exploiting opportunities as they develop. However, finding such skilled individuals can be difficult.

We must break down the barriers to scaling businesses accessing NED, Advisors and board talent, by joining up and connecting solutions more easily. Across the country there is an imperative to map pools of talent at this level and open them up. Access to certain skills might not always equate to a full-time position for a scaling business. Scaleup leaders should consider the opportunity to augment their teams with key skills at the right time through fractional/advisory resources. A range of institutions and stakeholders can play important roles in mapping these skilled individuals, including among others professional services, financiers and expert recruiters supporting placement of senior talent; trade bodies and associations with fellowship schemes; and universities through their alumni base and academic resources.

Additionally, tools to support scaleup leaders to critically review the skills they require to evolve boards and top teams, including through formal board review/assessment processes, should be made available.

The ScaleUp Institute is currently working with its partners to make these improvements by mapping pools of talent and creating new initiatives to link scaleups with NEDs, providing greater access to effective board review tools and increasing understanding of the use of fractional/advisory resources, including how to locate them.

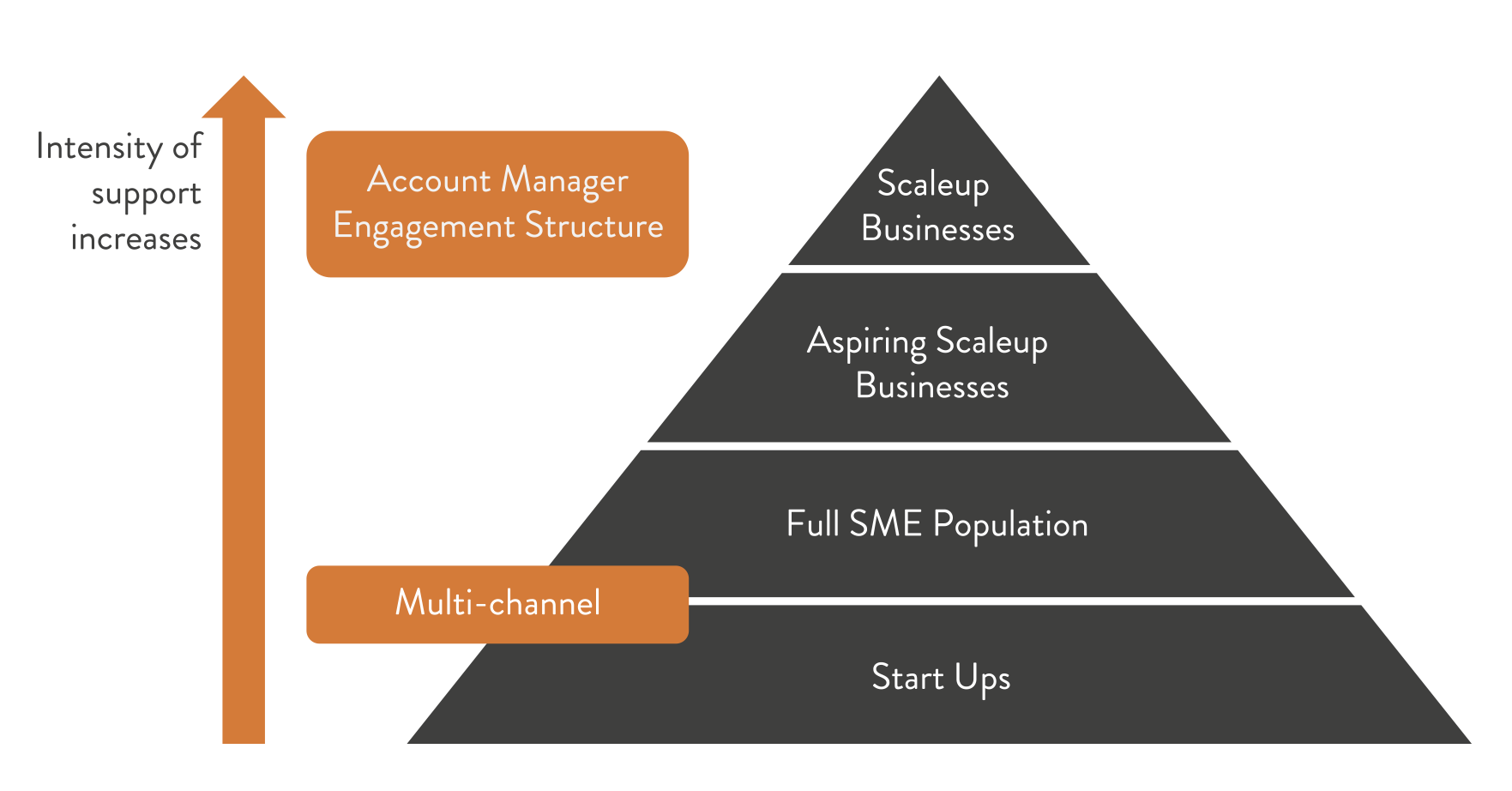

THE IMPORTANCE OF SEGMENTATION AND EFFECTIVE ACCOUNT MANAGEMENT

Scaleup leaders want to be identified as scaleups, as this is perceived to be helpful to further business growth, with 8 in 10 scaleup leaders stating that their scaleup status should be shared on public record (5 in 10 say this should be an on an opt-in basis), and would welcome the government sharing internally with other government departments that they were a scaleup or fast-growing company.

This sharing of data, and identification of scaleup businesses should sit at the heart of better targeted programmes and more coordinated engagement with scaleup firms. We have seen positive adoption of clearer segmentation, such as the British Business Bank’s ‘Start-up / Scaleup / Stay Ahead’ codification of their offerings in Innovate UK and in other areas. We are also seeing greater development of High Growth Teams in the private sector, and also at local level to proactively account manage these scaleup businesses.

This Proactive Relationship Management is key to effective Hubs and Clusters, and enables scaleups to be connected to the services, and capital they require, and engage in procurement and export opportunities. Several countries do this well such as Denmark, the US and Scotland. There are also more private sector high growth relationship teams emerging alongside the progression of such in some Government entities, such as Innovate UK EDGE, the British Business Bank’s segmentation of products, and their regional team structure. In addition, some Growth Hubs have engaged the concept such as Lancashire, Thames Valley Berkshire, Greater Manchester, Coventry & Warwickshire, Worcester and ScaleUp North East.

Scaling businesses value relationship management as a means to fast track them and to engage with them through their growth cycle. Doing this effectively leads to good outcomes as Denmark’s growth hub system has shown.

The UK has the ingredients to dial this up much more, and the opportunity to be more rigorous with this approach across Government, utilising data, CRM systems and high growth account / relationship management across teams more readily. Government entities (Growth Hubs, DIT, UKEF, BBB, IUK) should be centred around ‘joined up’ proactive relationship management engagement with scaling businesses, drawing upon central government datasets such as VAT and NI data, enabling High Growth Teams teams to then reach out to companies who are displaying scaling characteristics rather than relying upon a company to self identify. As described above, this can then fast track the business through to export, procurement, investment, talent and innovation opportunities. The core lead Relationship Manager for the scaling firm can be local to the business in a ‘scaleup hub’, and then bring the high growth team product specialists in when needed. This could be based on the Innovate UK Edge model and can mirror approaches in the banking industry, such as that now seen in Natwest and Barclays.

SCALEUP CHAMPIONS, ENABLERS AND THE ROLE OF MAYORS

Developing a strong local ecosystem is not a one size fits all approach. It is important for local areas to be enabled to build upon their strengths, be that sectoral, institutional or academic and connect each of these parts together in a way that is easy to navigate for growth businesses. The Levelling Up White paper provides some elements of help here and, as we note elsewhere, we see potential in the Local Skills Improvement Plans it highlights to better equip local areas with what they need to fill gaps.

Mayors also have a key role to play and can act as a catalyst for the development of local programmes, a source of information for business, a connector between institutions, such as Universities, Business Schools and LEPS and Combined Authorities, and they can champion local role models to showcase what can be achieved by local companies to other local businesses and to investors. By helping to build a more visible, uniform identity for the business population, scaleup businesses are able to more strongly identify with the benefits of where they are located, which in turn helps to attract and retain the talent they need, bring in investment and encourage investors to set up offices within the area, and provide a clearer pathway for businesses to engage with corporates. This has been strongly echoed across the detailed series of roundtables we have run across the last two years with the British Business Bank, where identity and a coherent map of a local ecosystem has been seen as a fundamental part of boosting business growth and attracting investment. This kind of codified approach will also help local areas to maximise their engagement with the enhanced British Business Bank regional funds which will be launched in 2023, and also better support the development of local angels who play an important role in earlier stages of scaleup growth.

SUMMARY

Leadership development remains fundamental to scaleup growth. It is positive that accessing programmes is not currently perceived to be a substantial barrier to scaleup growth, but we need to be highly aware of the risks, should the number of high quality leadership programmes reduce, particularly as funding sources are now adjusting away from EU structural funds, and the routes for UK SPF and Levelling Up funding are yet to be tested. It is critical for these funds to provide long term certainty for local areas, so that they can develop durable offerings, and crowd in private sector funding to support businesses as well.

Local leadership is also a key part of developing healthy ecosystems, and we know that engagement from each part of an ecosystem is important to galvanise growth, be that Universities and Business Schools, Educators, LEPs, Growth Hubs, Financiers, or businesses themselves. With Local Authorities and Mayors taking a greater role in the development and apportionment of plans to support their local business environment, it is essential for them to build upon what is working, and seek to develop strong local identities, which enable businesses to access the support they need, from trusted sources.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share