Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Leadership

The importance of building the right team with the right skills at the top of the business has long been recognised by scaleup leaders. Many more support offerings to enhance leadership capabilities and capacity have come online in recent years however local support particularly that offered by networks of peers, mentors and non-executive directors remains key.

Many scaleups have governance structures in place, with six in ten (59%) having a board of directors and a further 12% having plans to establish one in the near future. Their top teams are diverse with 37% having a female founder, 22% a female CEO and 36% have women on their boards, however less than 10% have a founder or CEO from an ethnic minority background and only 8% have representation on boards. In response to this 4 in 10 scaleups are seeking to increase the diversity of their senior leadership.

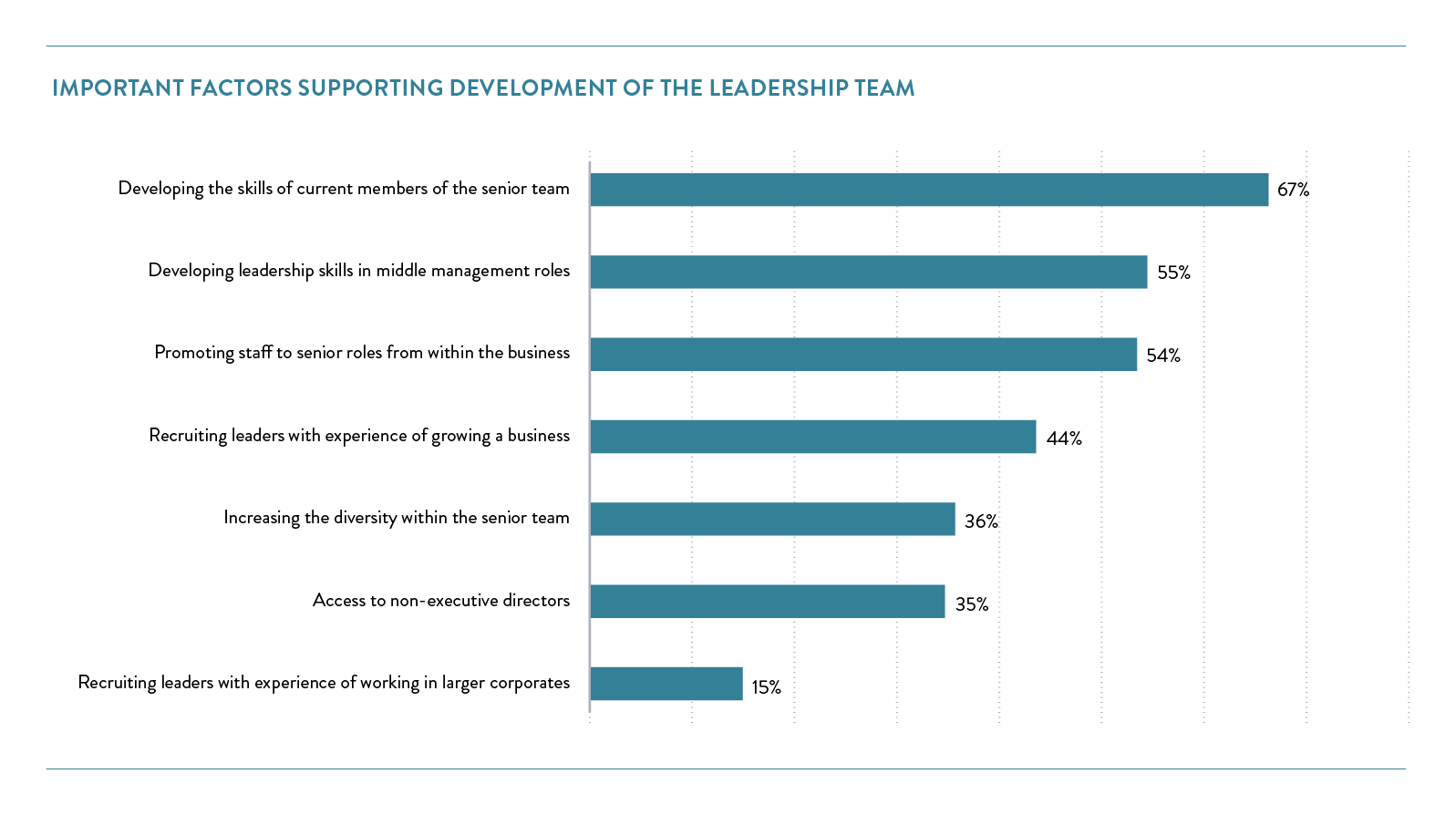

Developing skills of the current senior team (67%) remains the top factor that scaleup leaders feel will aid their growth. Scaleup leaders are also keen to improve leadership skills throughout their businesses with 55% stating the importance of building capacity of those who are in middle management roles. When it comes to sourcing new members of the top team 54% are keen to promote staff to senior roles from within the business (54%), however they are also looking suitable candidates externally to augment their teams prioritising those who have experience of growing a business (44%) over those that have worked in a larger corporate (15%).

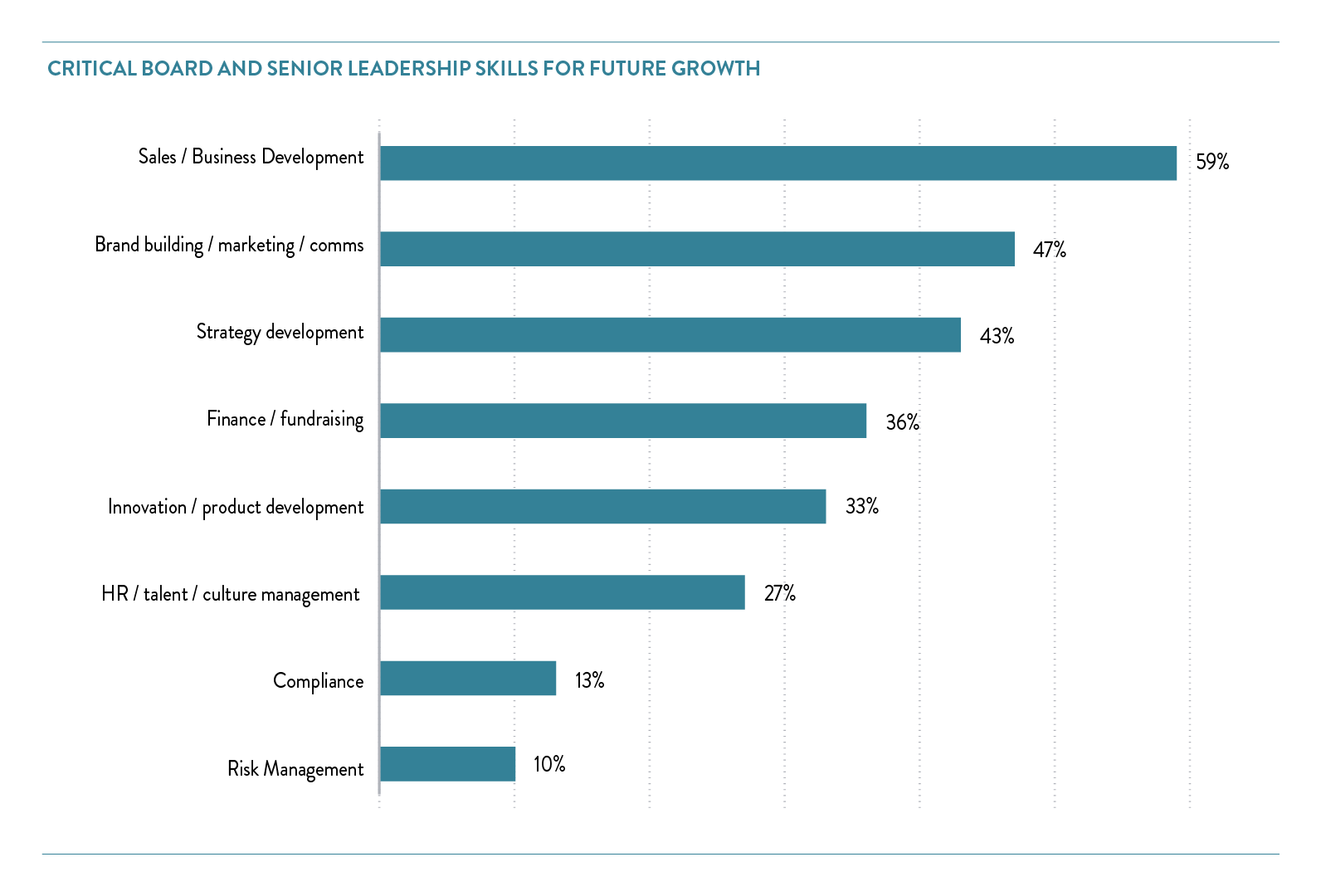

Perhaps reflecting the ongoing challenges around access to markets, scaleup leaders consider sales and business development skills (59%) as the most critical for future growth and want to develop these across their leadership team and board. Brand building, marketing and communications (47%), and Strategy development (43%) are also recognised as important. Perhaps indicative of the highly innovative nature of scaleups and their frequent use of different financial products, skills associated with these are slightly less in demand. There has been a significant increase in those seeking HR, talent and culture management skills since 2021 with 27% deeming this as important compared to only 12% in 2021.

LOCAL SUPPORT IS VITAL – FUNDING AND SUPPORT FOR INNOVATION, TAILORED GROWTH SUPPORT, PEER NETWORKS AND NEDS ARE IN DEMAND

External support comes in a wide range of forms, importantly though scaleup leaders are seeking to access this at a local level. However only 1 in 5 (21%) scaleups say they have accessed a growth-focused support programme in the last two years. To help them navigate what can be a complex landscape 7 in 10 want to have a single point of contact / relationship manager, while 6 in 10 consider a specific ScaleUp website and/or proactive contact to inform them about new initiatives as important mechanisms through which they can access the right support at the right time.

Following trends seen in recent years once again support from Innovate UK and funding for innovation and R&D is the top demand from 5 in 10 scaleup leaders. 4 in 10 think it is vital to access dedicated, tailored scaleup support and a similar proportion are seeking access to networks of NEDs. Curated peer networks, flexible management programmes as well as support to access procurement contracts and international markets are seen as vital by 3 in 10 scaleups.

When it comes to mentoring, half of all scaleup leaders have a mentor who provides valuable guidance and support to their management team. While a number of leaders don’t feel the need for a mentor, for those who are seeking this type of support challenges remain to find suitable individuals to take on the position.

Scaleups want this support available to them locally. From the private and education sector scaleups want easier access to support from banks and other financiers (39%), professional services (33%), universities / business schools (29%), and from large corporates (24%). While they see key agencies to access in the public sector as Growth Hubs and Devolved Enterprise Agencies (33%), Local and Regional Government (30%) and the UK’s development banks, including the British Business Bank, Scottish National Investment Bank and Development Bank of Wales (24%).

Scaleup leaders recognise the role that targeted European funding has played in the UK with 4 in 10 considering it vital that the government replaces schemes like the European Regional Development Fund which has match funded a range of local business support programmes. 1 in 4 want continued access to the large scale research and innovation fund, Horizon Europe.

Support for collaboration is also in demand. For 5 in 10 scaleups, growth is being fostered through partnerships and collaborations with universities (34%), large corporates (27%), government (25%) and international partners (21%) to develop new products or services. 1 in 3 scaleups consider it vital that more universities and corporates open up their R&D facilities to them for the purposes of collaboration and innovation.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share