Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Access to growth capital

Access to finance remains one of the top challenges to scaling highlighted by ambitious scaleup business leaders, with half of those surveyed placing this as one of the three most critical factors to their future growth. As well as ensuring that companies can be connected with finance as they begin their growth journey, it is also important to ensure that ambitious companies have the right runway to fuel future growth.

We know that 8 in 10 scaleups use external finance, and we can see that 49% of these do not think they have the right amount / type of funding in place to support their scaling ambitions – this has increased from 41% last year, and the year before. Further, there is an increase in the perception that most of the money and advice resides in London and the South East, from 35% in 2021 to 49% in 2022, and more than half (55%) now saying it is harder to grow a business now than in the past (up from 41% in 2021).

Of those utilising finance 4 in 10 are using or planning to use equity finance, with 57% using VCs and 55% angel investors. From our 2022 ScaleUp Index, we can also see that BGF remains the largest investor in visible scaleups with 128 deals that amounted to £1.10bn between 2012 and 2021 – with peer platforms having further impact. Angel Network & Business Angels’ accounted for 395 deals over the same period. However, by value 7 in 10 of the investors in our visible scaleups come from overseas. Only 3 of the top ten investors by value are based in the UK, with Japan’s Softbank the top investor by amount over the period, having invested £2.54bn across 12 deals.

Despite clear concern about the UK and the macroeconomic factors – with inflationary pressures on materials and supply chain costs, and wage increases particularly noted – scaleup businesses remain highly optimistic about their growth prospects in 2023. 8 out of 10 scaleups are expecting to grow their turnover – with 1 in 5 expecting to scale by more than 50% – and 6 in 10 to grow their staff numbers, 10% of which are expecting to increase staff numbers by more than 50%.

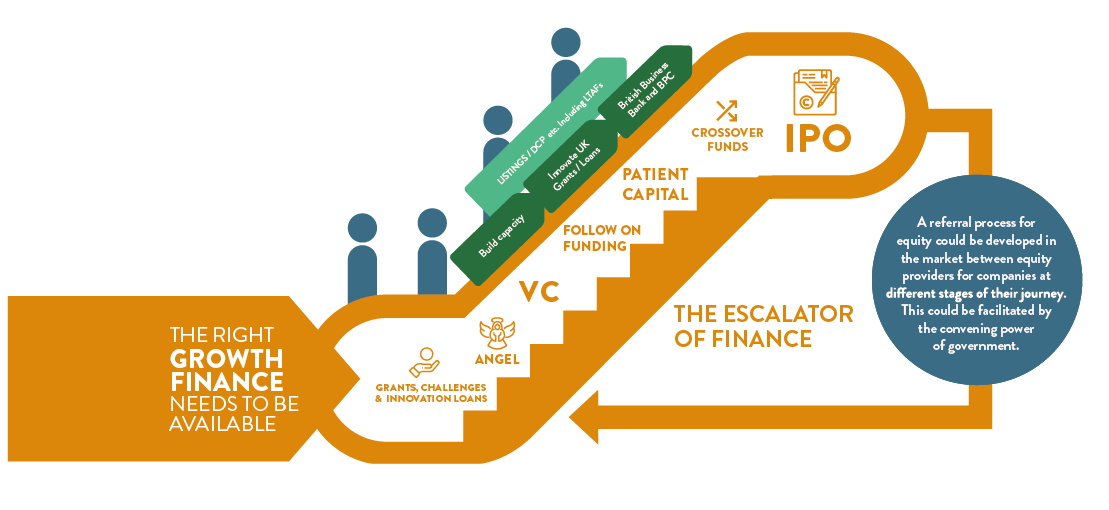

Against a turbulent macroeconomic and geopolitical backdrop, this optimism shows that it is even more important to address the concerns raised by scaleups and ensure that the UK investment ecosystem is able to meet the needs that scaleups highlight throughout their growth journey from grant, seed and angel, right the way through to IPO, with appropriate follow-on options along the continuum of finance. Continued efforts to address the supply of growth capital must also be matched by efforts to ensure there is the right knowledge, analyst capacity and regulatory framework to enable effective deployment of capital to key sectors and in all areas of the UK.

We are therefore pleased that concerted efforts to address the supply of growth capital continues, with progress made on a range of issues. The work undertaken by the recent CST, Fintech and Life Science reviews, which the SUI was engaged on, has been acted on and the Government and regulators confirmation to progress with addressing the regulatory barriers to greater levels of UK institutional investment flowing to scaling firms. For instance the planned regulatory reforms that would provide the option for defined contribution schemes to remove performance-based fees from the pensions regulatory charge cap, is welcomed. As is the ongoing work of the Bank of England’s Productive Finance Working Group; and the evolution of Regional Funds and development of Future Fund: Breakthrough. The Capital Markets Industry Taskforce chaired by the London Stock Exchange will also play a key role here as reforms under the Wholesale Markets review are progressed

The announced uplift in funding for Innovate UK by £1bn for 2024/25 is also key here, as is the additional funds for expanding the British Business Bank’s Regional Funds and Regional Angel Fund1 programme. The Long-term Investment for Technology & Science (LIFTS) competition announced in the recent ‘Mini-budget’ and currently being consulted upon by the British Business Bank could also play a key role in this space, and we will work closely with Government and the British Business Bank as it is developed further.

In the current challenging environment the money allocated to these entities and programmes is even more critical, with the potential to form a clear backbone to both investment activity and the wider support framework needed to effectively deploy this money, and support businesses in their wider growth Journey.

Maintaining these publicly committed budgets under the Spending Review 2021 will be an important signal to crowd in private sector investment at a challenging time. As we have previously highlighted, our evidence shows the importance of having long term interventions at scale: we believe that this should involve placing the British Business Bank and Innovate UK on a clear long term footing to provide permanency to their programmes, confidence to investors, and clarity for businesses. The US Small Business Administration, for example, has been operating since 1953 – turning 70 next year – with a clear mandate across this whole period.

It will also be important to look creatively at solutions, such as enabling the British Business Bank to ‘follow on’ investment for Future Fund companies with similar co-investment terms, maximising long term portfolio returns. We can – this Autumn – See the value of initiatives such as this, with the early assessment of the future fund published by the British Business Bank showing that:

- 48% of Future Fund companies may have closed during the pandemic without the economic lifeline;

- 62% of Future Fund companies said they would not have been able to raise similar funding from elsewhere;

- 85% of Future Fund recipients have undertaken research and development activities since receiving the funding.

There is a critical need for momentum and pace to be maintained if we are to fully implement the initiatives needed, learn from our international counterparts and all work – on a sustainable basis – to close our Growth Capital Gap at national and regional level, as well as face off against the headwinds currently at play in the global environment.

To ensure each of these initiatives can work effectively, policy solutions need to be joined up at different levels of Government, and at a regional level to ensure that the capacity exists to support scaleup growth. The Labour Start-up Review that has been launched to look at this, is also a positive step as it shows parties of all colours are focusing upon how to make the UK the best place in the world to start and grow a business, as does the work of the Treasury Select Committee, which undertook a review of UK equity finance over the summer.

It is also – therefore – important for the Government to provide clear market signals that ensure confidence is maintained at a time when there is substantial uncertainty for both companies and investors. As we await the next fiscal statement during a volatile period for the UK economy, these signals will be even more important.

However, the private sector has a key role too, and must seek to work more closely together, to step up with new solutions and collaborations to foster larger scale growth capital pools and work to meet the challenges which we face as an economy and a country with equal vigour. It is key that greater connectivity is fostered, particularly on a local level, to address asymmetries in knowledge, and ensure that businesses know where they can go for investment, or investment readiness support, and also ensure that investors nationality, and within local areas, have the right knowledge themselves to invest with confidence in businesses across sectors, and in areas and communities currently less well served investment.

THE INVESTMENT ENVIRONMENT

Macroeconomic factors within the UK and globally have seen a more subdued investment environment in 2022 than 2021, which was a record year for investment. Whilst 2021 saw a lot of dry powder and pent up demand from constraints during 2020, inflationary pressures, global supply chain challenges and broader instability each for a backdrop to the 2022 investment landscape, which has seen 34 IPOs up to Q3 taking place in 2022, raising £1.2bn (H1 2022 – 26 IPOs – £595m; Q3 2022 – 8 IPOs – £565.5m), a notable drop compared to 85 at the same point in 2021.

Despite the constrained investment environment, interest in ESG based investment continues with substantial efforts being undertaken across the finance sector to address and meet wider commitments made by Prime Minister Sunak when he was Chancellor attending that summit to have a Net Zero Financial System. This is a world leading commitment and places the UK at the forefront of efforts to achieve this2. This area will be a focus for the ScaleUp Institute working with its partners in 2021., creating a huge potential to foster innovation. It is also important to note that across listed companies, the Green Economy Mark now has 108 companies and funds accredited with a combined market capitalisation of £156bn.

Investor Incentives

The current tax incentives in the UK have been essential to building capacity across venture asset classes from angel to VC to VCT and it is positive that the recent mini budget emphasised the Government’s interest in maintaining and potentially expanding these. If we are to maintain a growth focus during the predicted economic downturn across 2023, it is important for this to remain the case, and for them to be extended and as necessary evolved.

For instance, the Enterprise Investment Scheme (EIS) continues to be pivotal in driving the supply of early-stage risk capital to some of the UK’s most exciting companies, while also offering attractive tax breaks to investors. We know from our survey that 22% of scaleups have made use of EIS / SEIS and that a further 19% plan to make use of it in the future, and we also know that 51% and 54% respectively are keen for the schemes to be easier to apply for, and for there to be greater awareness of them. Recent stats released by HMRC are also evidence of its success. For example, in 2019 to 2020, 4,215 companies raised a total of £1.9 billion of funds under the EIS. There is currently a “sunset clause” in place in relation to income tax relief that is offered by the EIS (and indeed the Venture Capital Trust scheme, but not the Seed Enterprise Investment Scheme (SEIS)). This means that without Government approval, this relief will cease to exist from 6 April 2025.2– This is clearly reflected in scaleup leader’s views, with 74% are keen for greater clarity over the duration of the scheme.

Given the current state of the UK and global economy and the need to ensure the continued engagement of private sector investment players to maintain and increase the much needed growth capital it is positive that this scheme was indicated that it would be retained in the September ‘mini-budget’ it is critical that clear and stable investment signals are given to investors, and that this continues to be the case to support investor confidence and deployment of capital so that investors can develop a forward pipeline with confidence and early stage scaling businesses attain the benefit of critical finance.

Employee share schemes – including Enterprise Management Incentive (EMI) – are also important to retain and have a key role in the democratisation of wealth and can play a key role at earlier stages of a company’s growth to attract the skilled talent which a company needs to grow.

Regional Investment

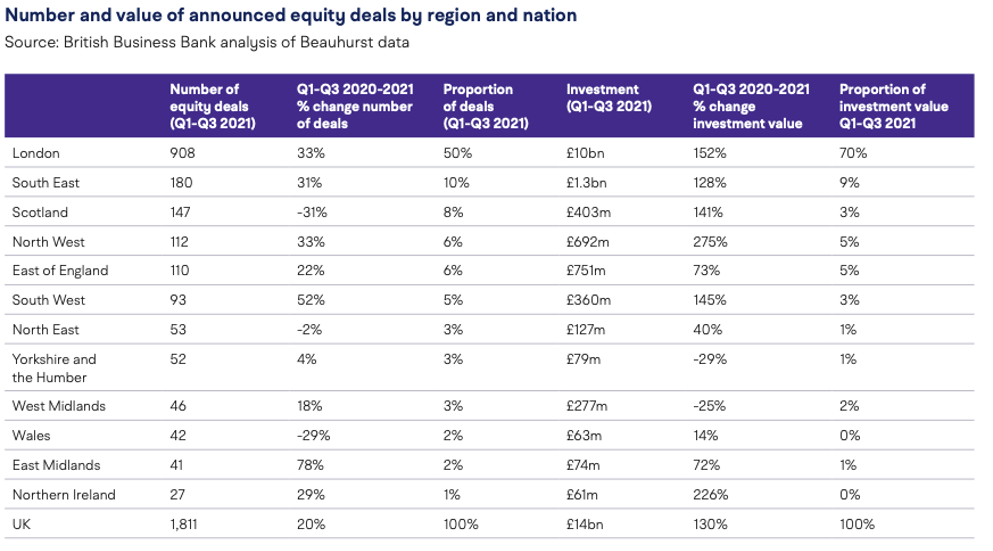

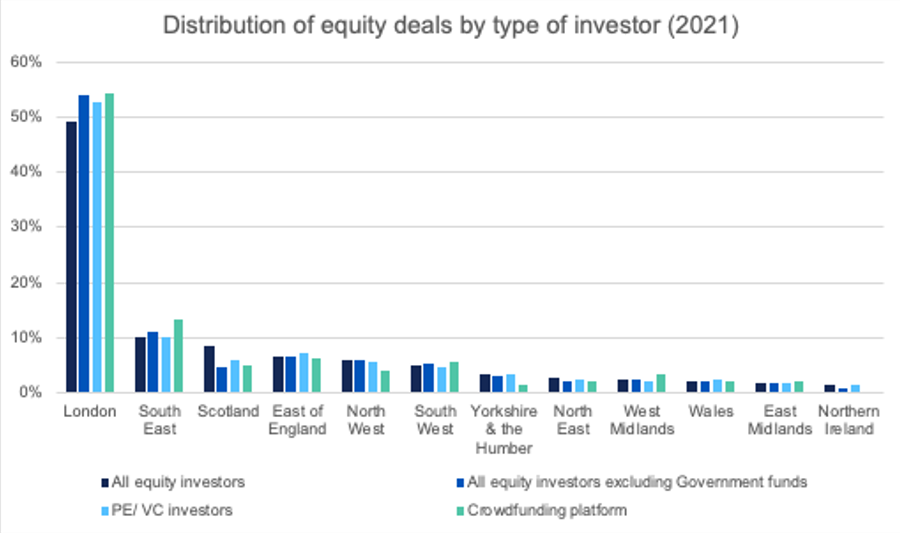

Regional disparities continue across the UK, though there is some evidence that there have been some shifts. The British Business Bank Small Business Finance Markets Report 2021/22 highlights that whilst London continued to see the largest proportion of equity deals (50%), The South West saw a 52% increase in the number of deals, and the North West saw a 33% increase in the number of deals taking place.

Source: British Business Bank analysis of Beauhurst data

The Importance of the announced additional investment to the Regional Angel Programme and the additional investment committed to the British Business Bank’s Regional Funds in the 2021 budget are particularly important in this context. It is through initiatives such as this that the needle can be moved to improve availability of equity at a regional level and to develop scale up ecosystems in the regions that will attract further private capital.

We have seen the importance of these initiatives as part of our 2022 Regional Finance Programme which we have been undertaking with the British Business Bank, visiting key areas of the country and providing access to finance seminars and undertaking roundtables with key local actors to assess the situation.

These highlighted a number of common factors relating to funding including:

- the importance of better connectivity between Scaleups and Funders;

- the ability to create Increased visibility of scaleups and growing businesses, particularly in regions outside of London to attract investors to that region; and

- the importance of targeted regional funds that can be flexible to the needs of particular emerging clusters / businesses within a particular locality.

This is particularly so given that despite strong investment figures in 2021, 2022 is a more constrained funding environment. Given ongoing market uncertainties, it will be important to ensure that we have all of the levers at our disposal to support UK growth over the coming period.

This awareness and knowledge dissemination is also important for investors, as the Invest Creative programme which we undertook with UKBAA and DCMS showed. We believe that this approach could be further leveraged to boost investor knowledge in relation to key sectors, such as Life Sciences, and the growth economy overall.

The Sector Investment Perspective

The UK has a strong track record of attracting foreign investment, however this has often flowed toward specific sectors. It is also important to ensure that companies are able to find the patient money that they need in the UK if we are to retain them, and build critical mass in our scaleup ecosystem – particularly within emerging sectoral clusters.

In looking at the UK equity gap as part of their 2022 Small Business Equity Finance Monitor, they highlights that – as observed in our own work on this – relative to GDP, the UK has a lower proportion of VC investment going towards deep tech and R&D intensive companies than China, Sweden and the US, noting that this specific sectoral shortfall accounts for the majority of the overall UK-US VC funding gap. This echoes our own research undertaken in 2021, and which we are refreshing this year, which shows that within the sub-sector of ‘tech’ investment we have observed a significant bias towards investment in Internet Platforms, Mobile Apps and SaaS, leaving substantial gaps in funding for Life Sciences and newer areas of growth such as clean energy. Given the priorities of the Government and the UK drive to close the gap overall, it is important that efforts to close the growth capital gap take particular account of these observable sectoral biases, and ensure that there is a concerted drive to increase investor awareness, knowledge and connectivity – including amongst the analyst community – and a joined up approach to deployment of funds that enables the development of clusters of expertise.

It is hugely positive for the UK to be able to attract capital, but it is also important to ensure that we can foster key industries to grow and remain located in the UK, and this will need to involve a more focused approach to ensure that businesses are able to find the funding and wider resources they need within the UK, and help to retain these companies, the jobs that they create, and their IP here, enabling these to be recycled in to the wider growth.

Tackling these capital deployment issues are at the heart of unblocking investment towards the UK growth economy, and ensuring that key, strategic sectors are funded. A targeted approach to this can help to build a critical mass, and develop clusters across the UK in line with both national economic growth and regional development goals.

Some progress continues to be made in this regard. Deployment is underway of the previously announced £200 million LifeScience investment fund run by British Patient Capital. The recently announced Long-term Investment For Technology and Science (LIFTS) initiative may also be an important route towards a more targeted approach and we will work closely with the British Business Bank and private sector partners as this is more fully defined.

Europe and the international perspective

One of the key persisting challenges in the UK is developing the continuum of capital and release of UK based institutional monies to the growth businesses. Currently overseas investors are one of the most critical sources of capital for growth firms, forming a part of 45% of all growth stage deals in 2021, and representing 56% of Limited Partner (LP) commitments by value into UK VC funds raised between 2017 and 2021, including the European Investment Fund (EIF)3.

Over the last 10 years there has been a fall in the commitment of UK pension funds to equity assets. Equities represented 73% of UK pension funds’ assets in 1999, this had reduced to 12% in 20184.

Therefore, despite healthy, buoyant public markets, it is important to note that with ongoing supply chain challenges expected to last until at least 2023, and the spectre of inflation present and growing, with a recession now predicted by the Bank of England in to 2024, investors pulled $9.2 billion out of UK-focused equity funds in 2021. This compounds 6 years of outflows since 2016 with the percentage of UK equities held by British Retail investors falling from 23% to 14% between 2015 and 2020. It is this story which underlines the vital importance of the work being undertaken to unlock UK rooted institutional investment.

As noted by the British Business Bank in the latest Small Business Equity Tracker:

Pension funds represented 72% of all capital committed to US VC funds, compared to 10% in the rest of Europe and 10% in the UK. VC funds in the UK and rest of Europe are much more reliant on public funding, with funding from the EIF and other public sources (including the British Business Bank) representing 47% and 45% of capital raised by VC funds located in the rest of Europe and UK respectively.

The report further notes that:

Pension fund participation in the UK VC market does not appear to be improving over time, and in fact the UK appears to be converging with the rest of Europe on this metric. In 2017, 35% of UK VC funds involved at least one pension fund, compared to 16% in the rest of Europe. By 2021, this had dropped to 6%, compared to 8% in the rest of Europe5.

Whilst important work is underway to address these issues it needs to come to fruition quickly and leverage understanding from other markets such as Canada which has worked hard to unlock pension fund capital, where Canadian pension funds collaborate together and employ specific internal high growth expert teams in growth sectors to put capital to work in a mix of fund investments, co-investments and direct equity deals6. Canada Pension schemes are also investing in UK scaleups (e.g. CPP Investment Board investment in 2018 of £675m to BGL Group).

International Comparisons

When we review our international counterparts, we note several factors among those who are ahead of us in the scaleup league table. These include:

● Long term, at scale interventions, such as the Small Business Administration in the US, and significant depth of capital, including greater use of Venture Debt and institutional funding, which may be supported by a Sovereign Wealth Fund;

● Strong federated structures at a regional level close to the scaling businesses to enable effective engagement;

● A vibrant escalator of finance from grant to angel to venture debt / VC market and cross over funds and, importantly, access to long-term institutional patient capital be it via corporates or pension funds such as in Canada; alongside this there are public markets that enable a high growth company to transition from a private company to a listed company as smoothly as possible.

It is also critical to recognise the connections between public sector procurement and corporate venturing as part of the overarching investment solution. Countries such as the US use this to great effect.

Embedding successful institutions at scale for the long term will be vital to support the overarching deployment of capital to key sectors, and the UK growth economy as a whole.

The French ‘Tibi’ SchemeThe French ‘Tibi’ Investment scheme makes strong use of pre-qualification to crowd in private sector investment, and is an important international example to consider in this regard. This scheme also seeks to attract investment expertise from overseas alongside the capital deployed, encouraging those firms who are taking part to have a French physical presence and staff on the ground.

France has earmarked €6 billion for the Tibi initiative, to support a so-called ‘fourth industrial revolution’ in France, attracting foreign sources of capital to locate in France and issue mandates for asset managers based in France to invest in French companies. An internal 18 month review of this, published in June 2021, suggests the scheme has been a notable success so far, with over €3.5 billion pledged by partner investors, and over €18 billion from approved investment funds when third party investors are taken into account. This strategy has a stated objective to finance French Scaleups and the success of the scheme so far has caused them to increase their medium term objectives for the scheme noting “These developments strengthen our determination to establish France as a leading European centre for private financing of scale-ups”.

The UK could easily emulate this scheme as part of the broader suite of policies tuned to improve the investment environment for UK scaleup businesses. Such anchoring of human capital here in the UK will help to create a critical mass of investment activity, and a wider halo effect within the scaleup economy as staff move between different funds and scaleup businesses.

The Canadian Pension Plan Investment Board

In Canada a different approach has been taken, creating a specific Canadian Pension Plan Investment board which was incorporated in 1997 by an Act of Parliament and made its first investment in March 1999. The Board’s purpose is to invest the assets of the Canada Pension Plan in a way that maximises returns without undue risk of loss. As noted elsewhere, this has led to an active approach to investing in long term assets and equities, and the development of in-house teams with the expertise to engage and invest in a mix of fund investments, co-investments and direct equity deals.

Much of this has also been observed in wider research: the Venture Capital Industry notes that 63% of investment into Tech businesses of all sizes came from overseas in 2020 (up by 50% from 2016), and from the British Business Bank’s Small Business Equity Finance Monitor highlights that 29% of all equity deals in 2021 involved an overseas investor, with this number rising to 45% of deals at the growth stage / later stages of financing.

Unlocking Institutional Funds to Support Patient Growth Capital

The access to finance challenge reported by scaleups is a long-standing issue pre-dating the current economic landscape with the UK has faced specific and defined challenges in relation to Growth Capital for decades. This is well documented7, with a number of substantive reports highlighting the growth and patient capital issues in the UK and how this challenge has persisted and evolved.

Over recent years, the substantial efforts made in response to Covid were necessary and have aided scaleups through that period. However, as we set out in our joint Future of Growth Capital Report and 2021 Annual Review, work to deliver the practical solutions needed to close the longer term – structural – growth capital gap for scaleups must be a key part of ensuring the UK’s future economic prosperity.

There is a concerted effort being made by Government and Regulators to alleviate regulatory barriers to institutional investment to our scaleup economy – which must be processed at pace, and wider initiatives to make the UK the most attractive place to grow a business, including the implementation of the Listings Review and wider initiatives such as the Wholesale Markets Review, the next stages of work on Long Term Asset Fund Class, and the newly announced Long-term Investment For Technology and Science (LIFTS) initiative. The Private sector must also work more closely together, to step up with new solutions and collaborations to foster larger scale growth capital pools, through initiatives like the Capital Markets Industry Taskforce, led by the LSEG, to further enable the UK to close its gaps in the funding continuum. There is also a continual education drive needed to showcase the opportunities a London listing brings, for founders investors and the wider ecosystem within the UK and abroad.

This is even more important when we witness the current slow down and tightening of scaleup investment and the ongoing regional, diversity, and sectoral disparities.

The key is how we create a continuum of capital (see diagram below) across the scaling life cycle with sufficient depth at each stage and in each region – including cross over funds – and release of institutional monies to growth businesses and sectors. Policy initiatives must recognise and continue to support Angel, VCT and specific Crossover fund investors as well as strengthen and build on the ongoing regional and British Patient Capital work of the British Business Bank alongside risk funding from Innovate UK to foster the scaleup economy in all regions and nations of the UK.

Total pension wealth in the UK was estimated by the ONS to be in excess of £6 trillion during the April 2016 to March 2018 period and is one of the largest single components of UK financial wealth. Using a very modest portion of the total wealth held here will make a substantial difference to closing the gap in UK patient growth capital. The proposed adjustments to regulations that will provide the option for defined contribution schemes to remove performance-based fees from the pensions regulatory charge cap, is welcomed, but it is also only part of the picture. As noted above, deployment of capital is critical, as is ensuring that there is the right culture and understanding of growth companies within UK Institutional Investors.

As noted above, over the last 10 years there has been a fall in the commitment of UK pension funds to equity assets. Equities represented 73% of UK pension funds’ assets in 1999, this had reduced to 12% in 2018. This is part of a wider trend across Europe, but it is important for this trend to be carefully considered and addressed as part of wider initiatives to unlock funds.

Using structures such as BPC, which is establishing a strong track record and is helping to develop later stage venture markets, to potentially act as an aggregation vehicle for the deployment of institutional money into the Growth ‘scaleup economy’ should be further considered by the Government as we noted in our Future of Growth Capital Report in 2020 and as was highlighted in wider reviews such as the Fintech Strategy Review and Life Science Scaleup Taskforce. Such structures should also have the flexibility to be deployed across growth sectors and it will be important to also gain learning from international markets on pre-identifying ‘fast tacking’ potential private co-investor partners to better crowd in wider funding for scaleup firms. These structures can also act as a wider catalyst to nurture new talent, expertise and knowledge within the investment industry through the way in which they engage with investors. We should also consider the potential for the development of a UK Sovereign Wealth Vehicle to provide targeted investment.

Increasing Investor Knowledge and analyst capacity

Increasing Investor Knowledge of the Growth / ScaleUp Economy is a key part of evolving the UK investment culture to enable effective deployment of capital to key growth sectors.

To ensure that efforts to tackle regulatory challenges have maximum impact, knowledge asymmetries must also be addressed across the whole value chain – including within suppliers of capital and intermediaries. This requires attention through the entire escalator – from angel to IPO. Knowledge asymmetries have long been recognised on the demand side for equity but supply side knowledge gaps and a lack of expertise about the nature of the UK growth economy also serve to amplify an embedded culture of ‘risk caution’ amongst institutional investors. This represents a critical vulnerability within wider plans for the deployment of UK based institutional capital, even if regulatory and ‘structural’ barriers are removed.

If left unaddressed, it is likely that institutional money will flow to asset classes that are already well understood by institutional investors – such as infrastructure projects – rather than toward UK based high growth firms and scaleups. This kind of investor behaviour is also evident within the sectoral analysis we have highlighted above.

As further noted in the recent FinTech Strategy Review “absence of a strong domestic growth-oriented investor base has led the UK’s capital environment to be less welcoming and experienced than asset managers focussed on US markets for example.”

Initiatives which could be undertaken here include:

- Encouraging greater use of the Chartered Financial Analyst qualification here in the UK

- Developing scaleup economy guidance for institutional investors: from trustees to executives

- Ensuring representation of the growth economy on institutional boards e.g,by scaleup economy leaders taking non executive positions on such boards;

- broader development of sectoral playbooks / investor focused education – from roadshow; to hubs to development of such initiatives as the Invest in Creative Toolkit which s a programme we have worked upon with UKBAA and DCMS and has had substantial success in attracting new investors across the continuum of funding (from Angels through Family Offices, and VCs to international players) for creative firms;

- Creating fellowship programmes to accelerate the development of talent. This could be based upon the Kauffman Fellowship which provides an interesting model for helping people to begin careers in the Venture Capital Industry;

- Creating an incentive to encourage the fostering of a new generation of analysts within UK funds, with specific goals for them to be focused upon the UK growth economy; ( expand)

- Utilising data such as HMRC VAT/ NI records to identify high growth potential companies sooner, and lean in to them more quickly to fast track them to relevant private and public support initiatives. This will also help to bring them together with investors more frequently.

The Scaleup Visa also has a potential role to play here, with it important for clear connection points to be made between companies that are receiving investment and the visa system to ensure that they are able to attract the right talent they need to continue their growth, and that Venture Capital funds are also able to attract the right talent from abroad.

It is important for a pool of up and coming, diverse and regionally focused analysts to be fostered within the private sector and to ensure that the UK is training the next generation of analysts and fund managers. This could include providing an incentive framework for this new talent to be adopted within the UK investment community such as a possible Tax/R&D credit for larger institutional funds, encouraging them to bring in fresh talent with knowledge of the growth economy.

ENSURING DIVERSE COMMUNITIES ARE ABLE TO SCALE BUSINESSES

There are also continued, focused efforts to tackle diversity taking place with ongoing work to implement the Rose Review, and the expansion of the Investing in women code continuing

Each year the SUI tracks the sentiments of our female founded scaleups and monitors their progress. We have also commenced that for BAME founded scaleups and will have more data to share on this in the new year.

The barriers highlighted by female founded scaleups in our survey track very strongly with the wider sentiments of all scaleups. When asked about their biggest challenges to growth, these scaleups highlight key barriers around accessing Markets and finding the right Talent and Skills, followed by access to Finance and Growth Capital, showing more needs to be done in connecting them to market opportunities at home and overseas, alongside skills and funding. They are also keen to have greater access to education through grants to enable them to take on trainees, and they would also like to see better understanding of different industries in careers advice.

A summary of their key barriers and views as recorded by 144 scaleup female founders in our November 2021 survey can be seen in our 2022 Female Founders Index. In this, we show that the number of visible female founded visible scaleups – companies surpassing £10.2m in turnover or £5.1m in assets, – continues to grow, and that these businesses demonstrated a deep resilience through the pandemic. Our 2022 report shows that the number of scaleups that have crossed the £10.2m turnover and/or £5.1m in assets threshold and have at least one female founder now stands at 261 – representing a 34.5% increase on the number since our 2020 Index. Their collective turnover is £14bn – more than 41% greater compared to 2020 – and the total number of people employed by these businesses is 64,995. They have also attracted £5bn in investment.

On average, UK entrepreneurs that are white and male are more likely to be successful than women or Black, Asian or Other Ethnic Minority Entrepreneurs. Institutions must recognise that they will have to take additional steps to avoid unintentional or unconscious bias, and to avoid reliance on existing networks to disseminate advice rather than working to engage with broader communities.

There are welcoming signs that institutions are recognising this. Following evidence that all female founder teams get less than 1% of venture capital (VC) funding, and mixed teams getting only 10%, a significant number of angel groups, VCs and banks have now signed the Investing in Women Code to encourage best practice approaches.

The recent update to the Rose Review highlights that more women are forming businesses and our Index shows more are scaling. Indeed, the demographic makeup of the Index is increasingly wide-ranging: nearly four in ten female-founded scaleups are businesses that are 5 to 10 years old; with two in ten over 20 years old.

In providing more coordinated interventions in order to move the needle it is important to look at how some of the successful institutions in countries like the US are operating. As noted elsewhere the US Small Business Administration has dedicated hubs with Account Management and a specific focus on how they help female led businesses. This help includes advice, support and mentoring, help accessing investment and also a specific programme on helping them to win procurement contracts. This is supported by a target for 5% of all federal contracting dollars to women-owned small businesses each year, with a set-aside for this as part of the Women-Owned Small Business Federal Contracting Program (WOSB).

We have various vehicles and initiatives which could be harnessed in order to do this in the UK, but these ingredients need to be better coordinated, aligned and / or expanded. For example, some Angel Hubs already have an investment focus upon women, and rolling these out across the country would also help to raise awareness and unlock investment towards women-led scaling businesses, with the potential to develop a dedicated Women’s Forum. This can bolster investor connectivity and engage closely with institutions and government to ensure female led businesses are factored into the way programmes are designed. Innovate UK has a Woman in Innovation programme which could be further utilised as part of this.

We are undertaking work on each of these issues, including additional work on ethnic diversity and the barriers faced by BAME founded and led scaleups through our survey which is in the field at the moment and the SME Finance Monitor which we are analysing for our Annual Review 2022 (to be published in November).

The findings of the British Business Bank Alone Together Report provides a very important window on to the funding challenges faced by BAME founded businesses, as does the recent Time to Change report published by CREME and Natwest which highlights the importance of ensuring an inclusive approach to enable access to finance, but also business support for ethnic minority founders.

INNOVATION

Scaleup Businesses remain highly innovative, with 8 in 10 developing a new product or service in the last 12 months, and they continue to highlight Innovate UK as the key government agency to which they would like easier access.

R&D Tax Credits also have a key role in the UK scaleup economy and Innovation landscape and are vital to scaling businesses who regularly cite R&D as a key, priority need from the Government. 44% of our 2022 Scaleup Business Survey respondents are currently utilising them with a further 15% planning to start using them in the future.

There have been several reforms to R&D tax credits recently and these need to be maintained, with 80% of scaleups wanting clarity on the maintenance of the scheme. It is positive that Cloud Computing and data costs are now eligible as these are core to many innovative scaling firms. It is also important to ensure that R&D embraces all sectors, and for wider evolution to be in line with the Frascati Manual and the bolder interpretation of this by some countries. 81% of scaleups want the amount that can be claimed for to be increased, and 71% want the range of things that can be claimed for to be broadened.

We also believe that making the system easier to understand will help remove barriers for innovative companies, including greater clarity on the way that R&D Tax credits operate, with increased guidance and case studies across sectors, to increase uptake. We believe it is important to better equip businesses to understand when they are eligible to benefit from the schemes, and that the schemes themselves fully embrace the various stages of scaleup growth and size. This is something respondents to our survey also cite, with 60% wanting them to be easier to understand.

The UK (Government) can further facilitate the uptake of R&D schemes through proactive outreach activity, and targeted engagement with scaling firms, utilising relevant Government data points as outlined in the DECA project, through direct messaging and expansion of relationship management models such as that operating within Innovate UK Edge and some localities.

State Aid and Horizon Europe

At this time of political, EU and global economic uncertainty, it is ever more important to maintain business and investor confidence by keeping key policy measures stable and addressing the implications of State Aid Rules, and ensuring that investors can be confident in the ongoing existence of these schemes to support their investment to UK firms.

Horizon Europe has played an essential role in the development of elements of our scaleup economy and there needs to be clarity on how this will be taken forward, or replaced with an equivalent scheme to stimulate innovation and cooperation. If it is to be replaced, Innovate UK will need to have a further enhanced budget in order to fill this gap.

In Summary

There is substantial work underway to address many of the growth capital gaps which have been identified and it is pleasing to be able to highlight the Government as a driving force behind many of these initiatives. In a time of substantial economic uncertainty, it is ever more critical for stability across core institutions and mechanisms to be maintained, and for committed programmes to continue to deliver in order to maintain investor confidence.

This is important across the whole continuum of finance, and it is important to maintain a healthy pipeline right through from grant, angel and seed funding up to IPO. Therefore the focused action we have seen so far must continue, and efforts to unlock institutional capital, and find the right mechanisms to deploy it should now be brought to fruition. We will be monitoring the development of the LIFTS initiative, and wider institutional regulatory changes closely, and will continue to work with both Government and Industry as solutions continue to be considered and implemented.

It is critical that we provide certainty, and develop permanency within our institutional frameworks, building upon what works and guided by clear long-term objectives that have a tangible impact for scaleup businesses. We believe that both the British Business Bank and Innovate UK should be given a clear statutory footing, with independence to focus upon growth, closing the funding gap, and delivering for scaleup businesses.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share