Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

SMALL HIGH GROWTH BUSINESSES: OBSERVING THE SCALING PIPELINE

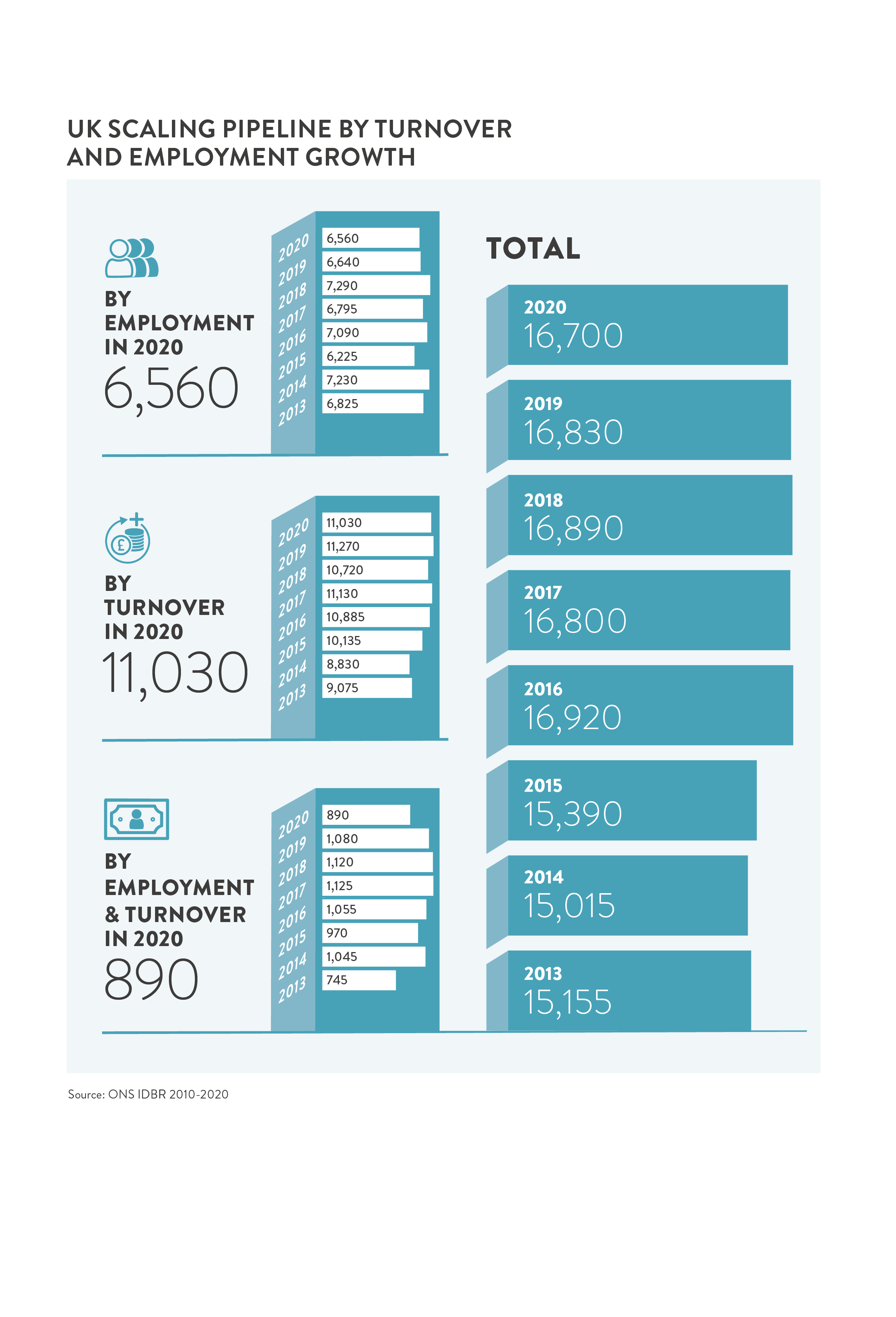

The “scaleup pipeline” includes businesses growing either or both turnover and employment at 15-19.99% annually in the last three-year period (i.e. between 2017-2020) and have the potential to convert into scaleups.

The total number of these businesses has remained broadly consistent over the past five years. In 2020 there were 16,700 – generating over £410bn through their turnover and employing over 1.4 million albeit with slight declines in both (employees down 11%; turnover down 13.5%) – which potentially indicate effects of the pandemic across 2020.

Turnover and Employment Trends

The scaling pipeline is a significant contributor to the UK’s overall SME universe – as shown across the past 7 years. In 2023 we plan to further investigate the dynamics of this business population focusing a critical lens on the conversion of scaling pipeline to scaleup levels of growth – which might be one of the reasons for the fluctuations observed in pipeline numbers, employment and turnover year on year.

| Year | Employees | Turnover (£bn) |

| 2013 | 1,580,147 | 502 |

| 2014 | 1,452,556 | 390 |

| 2015 | 1,552,261 | 283 |

| 2016 | 1,742,564 | 301 |

| 2017 | 1,763,565 | 381 |

| 2018 | 1,882,731 | 592 |

| 2019 | 1,676,370 | 474 |

| 2020 | 1,439,552 | 410 |

The Scaling Pipeline by Sector

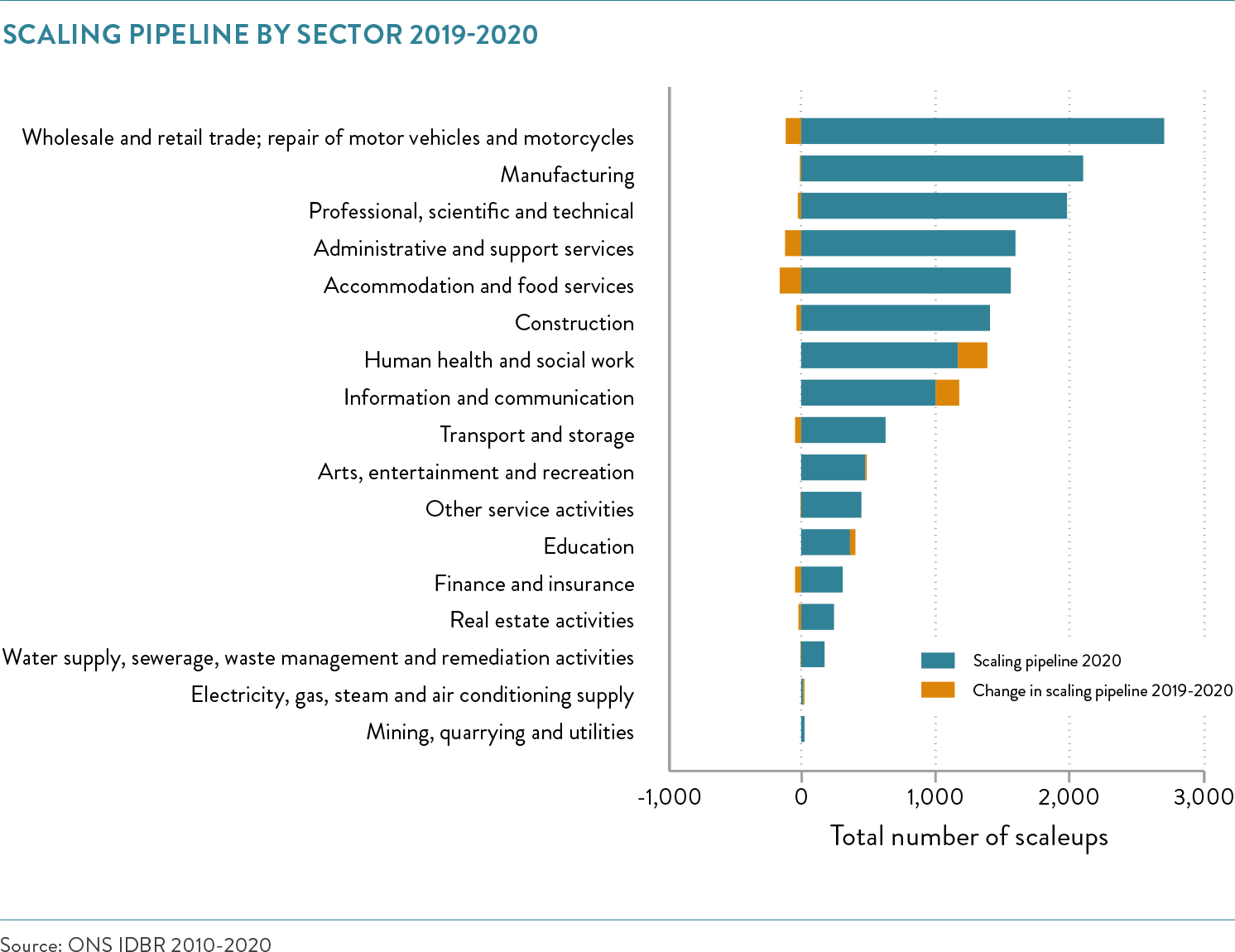

Wholesale and retail is the largest sector for both scaleups and the scaling pipeline, while Manufacturing is the second largest pipeline sector (it is the 6th largest for scaleups).

Between 2019 and 2020:

- The biggest growth was seen in Health and Social work for scaling businesses followed by Information & Communication, and Education. (These were among the top growth sectors for scaleups as well.)

- Continuing a trend seen since 2018 businesses in Accommodation & food services showed the biggest decline in overall number. The higher level of decline in 2020 potentially indicates the onset of the global pandemic which forced many hospitality businesses to close doors while they adapted their business models.

- Admin & Support Services scaling businesses also declined but scaleups in the sector remained steady.

- Professional, Scientific and Tech declined slightly for scaling businesses but was a top growth sector for scaleups – perhaps as a result of graduation from pipeline to scaleups – a matter we will be investigating further.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share