Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Scaleup Survey 2022

This report focuses on the views of 338 scaleup leaders. Scaleups are a key engine for growth in the UK economy: the scaleups in our survey generated on average £201k of revenue per employee.

Despite ongoing macroeconomic challenges affecting the wider business landscape in the UK and beyond, UK scaleups remain ambitious for growth.

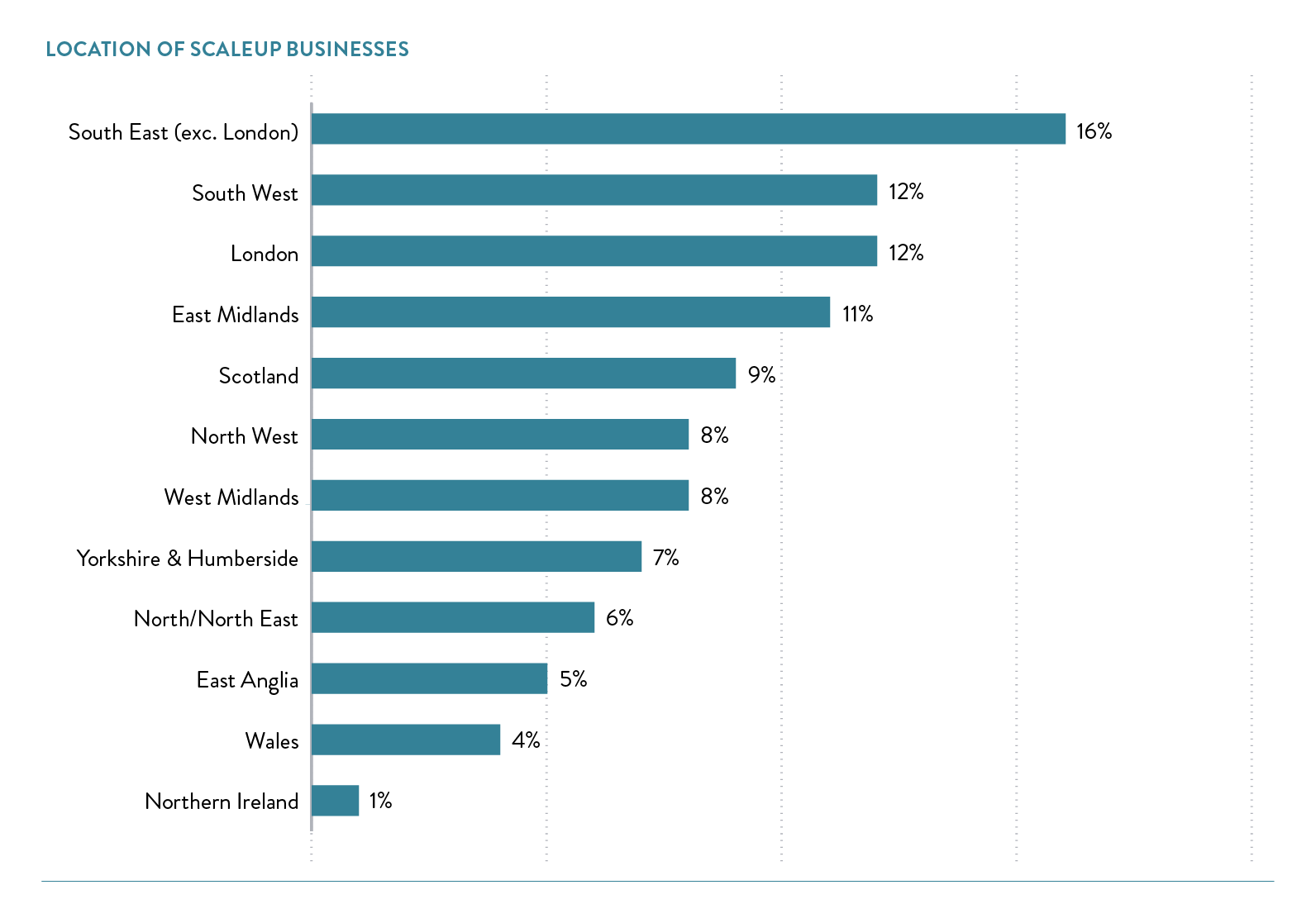

Scaleups are found across the UK Scaleups Operate in Every Sector

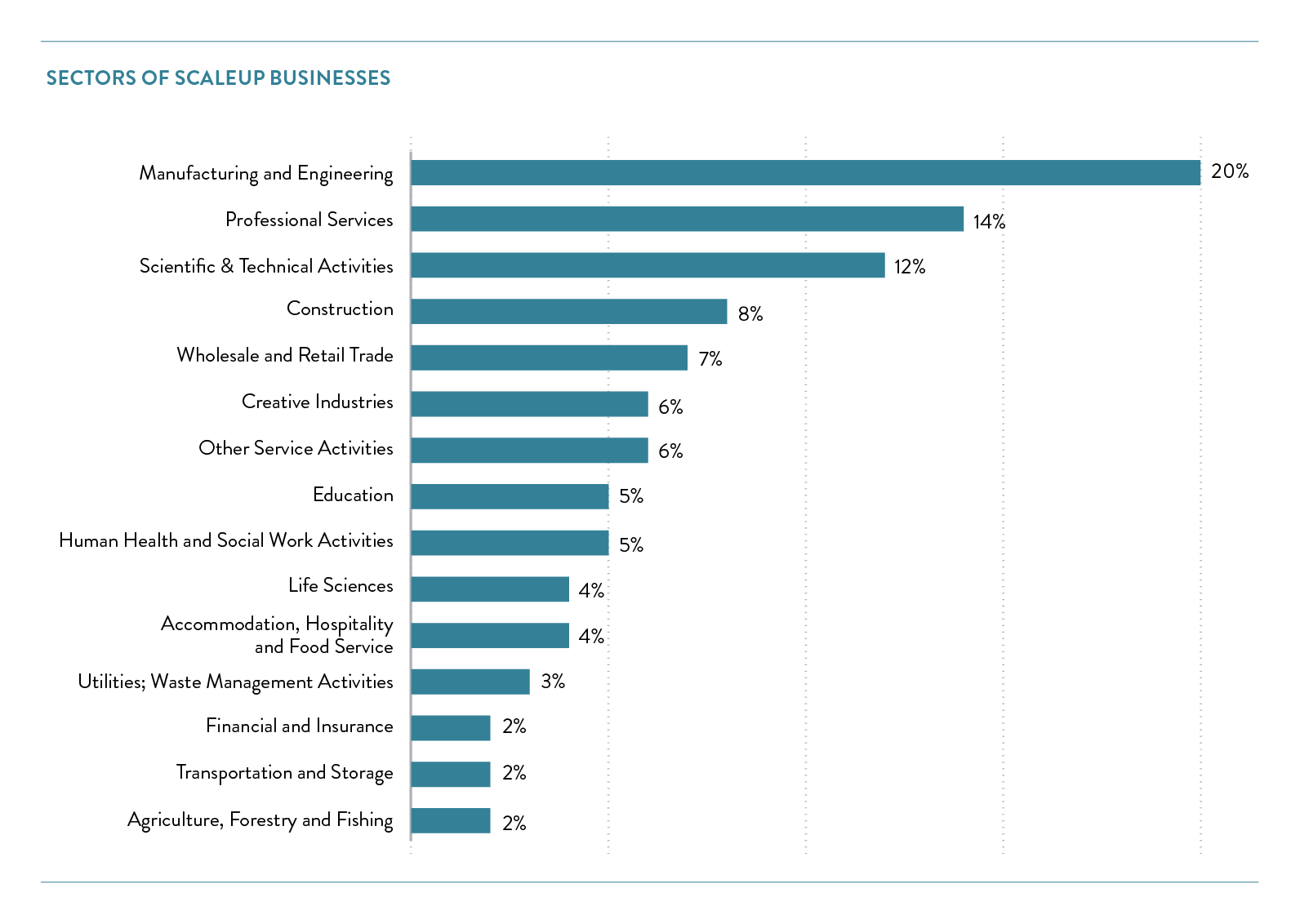

Scaleups Operate in Every Sector

Scaleups cover the entire economy in diverse sectors from engineering and manufacturing to professional services and from the life sciences and wholesale/retail activities to construction and the creative industries.

They are helping to meet ongoing challenges to society – 3 in 10 scaleups reported operating in the green economy (33%), and a similar proportion considered themselves a social business (30%), while 28% considered themselves ESG compliant (Environmental, Social and Governance). Overall, half of scaleups (51%) felt they met at least one of these criteria.

Scaleups are well established and can be sizeable businesses

- 62% of scaleups have been trading for ten years or more

- 1 in 10 in this cohort of CEOs have a turnover in excess of £10 million

- 41% have 20+ employees, with 19% have over 50 employees and 9% having 100 or more.

THERE ARE HEADWINDS BUT SCALEUPS ARE FOCUSED ON THE FUTURE

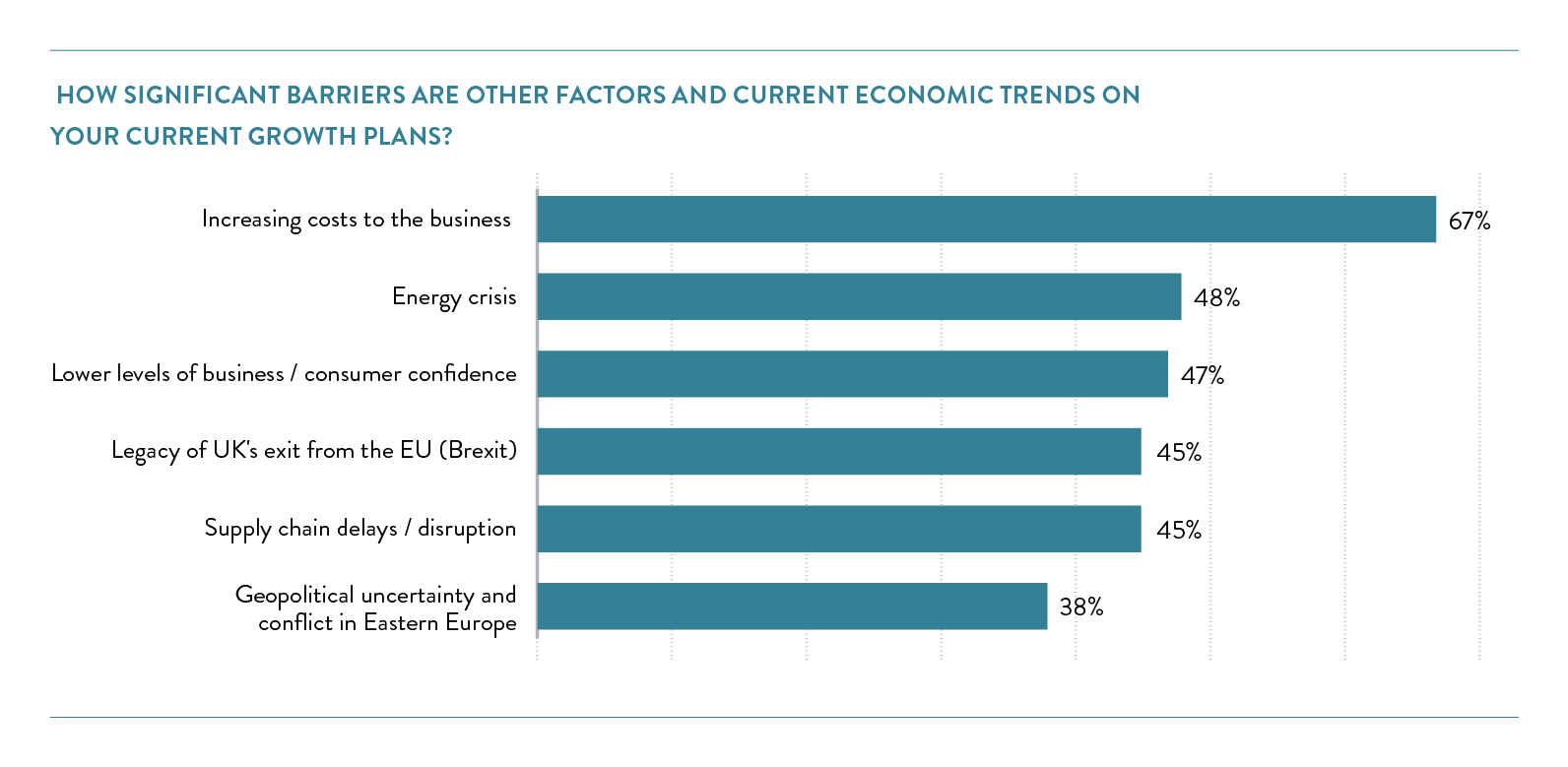

The resilience of scaleups in the face of increased uncertainty in the business environment is borne out through their growth expectations and perception that they continue to outperform their peers. However they are most apprehensive of increasing costs alongside other concerns around the energy crisis and lower consumer confidence.

The ongoing effects of Brexit and the disruption to supply chains and markets through geopolitical uncertainty also play on the minds of our scaleup leaders and their growth plans.

These macro trends are affecting scaleups in different sectors in different ways, with those in consumer trades (including wholesale, retail, hospitality, etc.) significantly more concerned about increasing costs to business (81%) and the energy crisis (67%), and given the nature of the industry often being reliant on discretionary spend by consumers they are also more conscious of changes in consumer confidence than their peers. Manufacturers are also more concerned about increasing costs (75%) and supply chain issues (68%) – the latter also being a key concern for the construction industry (58%).

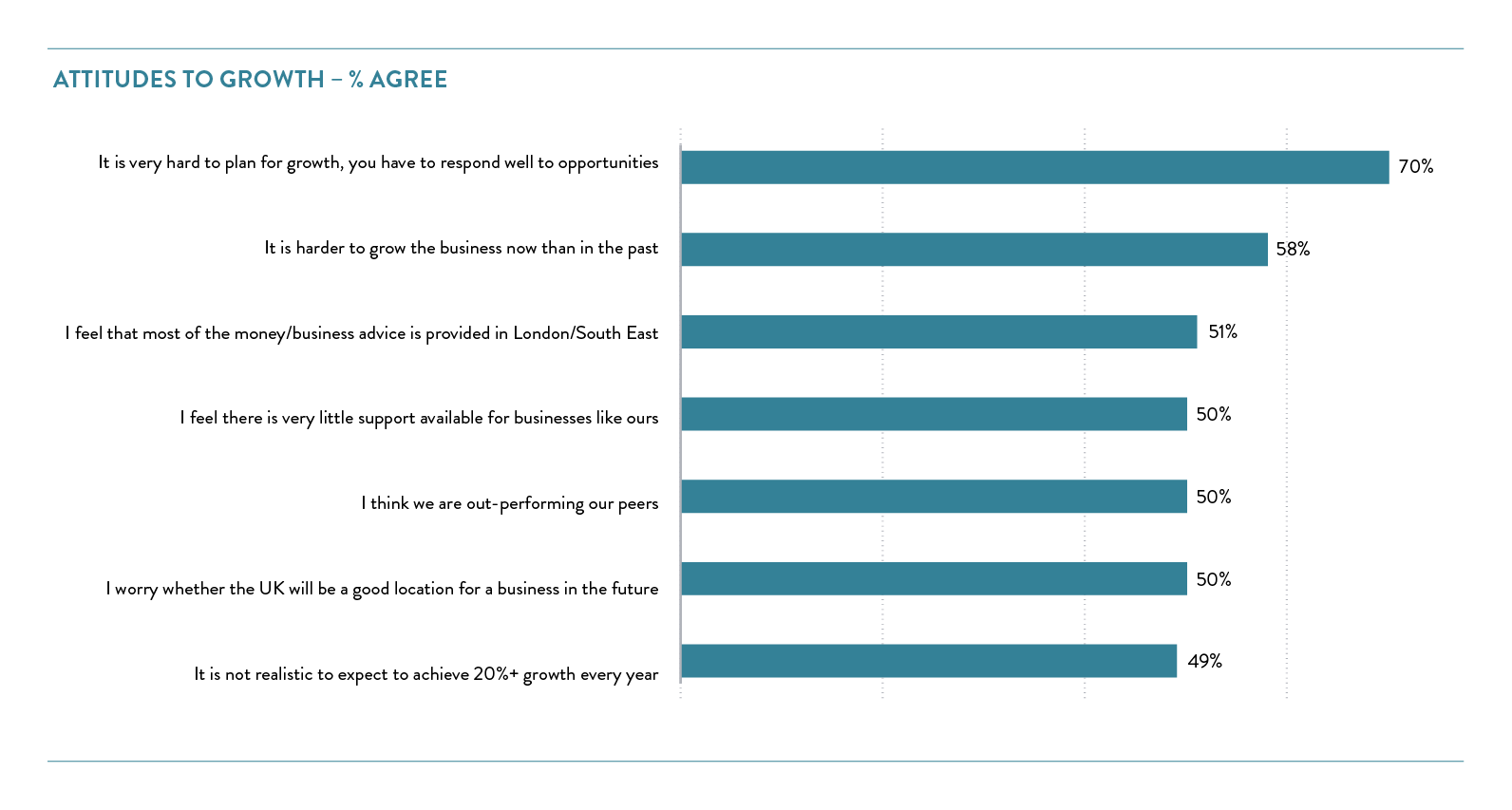

Compared to 2021, scaleup leaders are less confident about the economic outlook with 58% perceiving that it is harder to grow the business now than in the past, significantly up from 41% last year. There are also concerns about whether the UK will be a good location for a business in a few years’ time and a continuing perception that there is very little support available for businesses like theirs.

Despite this, 5 in 10 agree that they are out-performing their peers and a similar proportion continue to think that it is realistic to expect 20%+ growth each year.

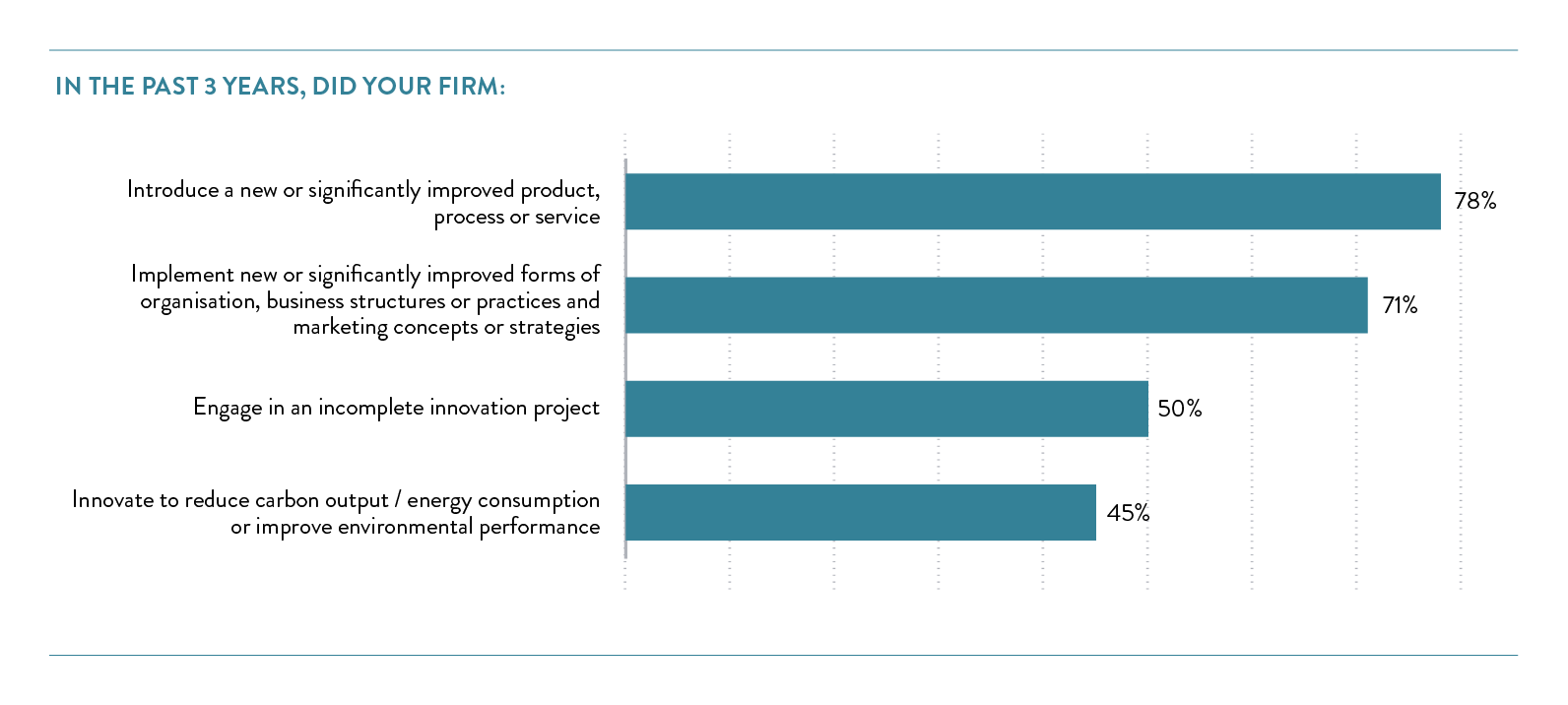

To support current and enable future growth, scaleups continue to innovate, pivot and adopt new technologies and working practices. 8 in 10 introduced a new or significantly improved product, process or service and over 7 in 10 implemented a new or significantly improved business structure in 2022. Half of the scaleups responding to the survey have also innovated specifically to reduce their energy consumption or improve their environmental performance (up from 3 in 10 in 2021). While 53% have formed collaborations and partnerships with universities, corporates or public sector to develop a new product or service.

Last year, almost all scaleups expected the changes they made to their business operations in response to Covid to last (90%). In doing so, we continue to see the vast majority (72%) implementing remote/hybrid working practices in 2022.

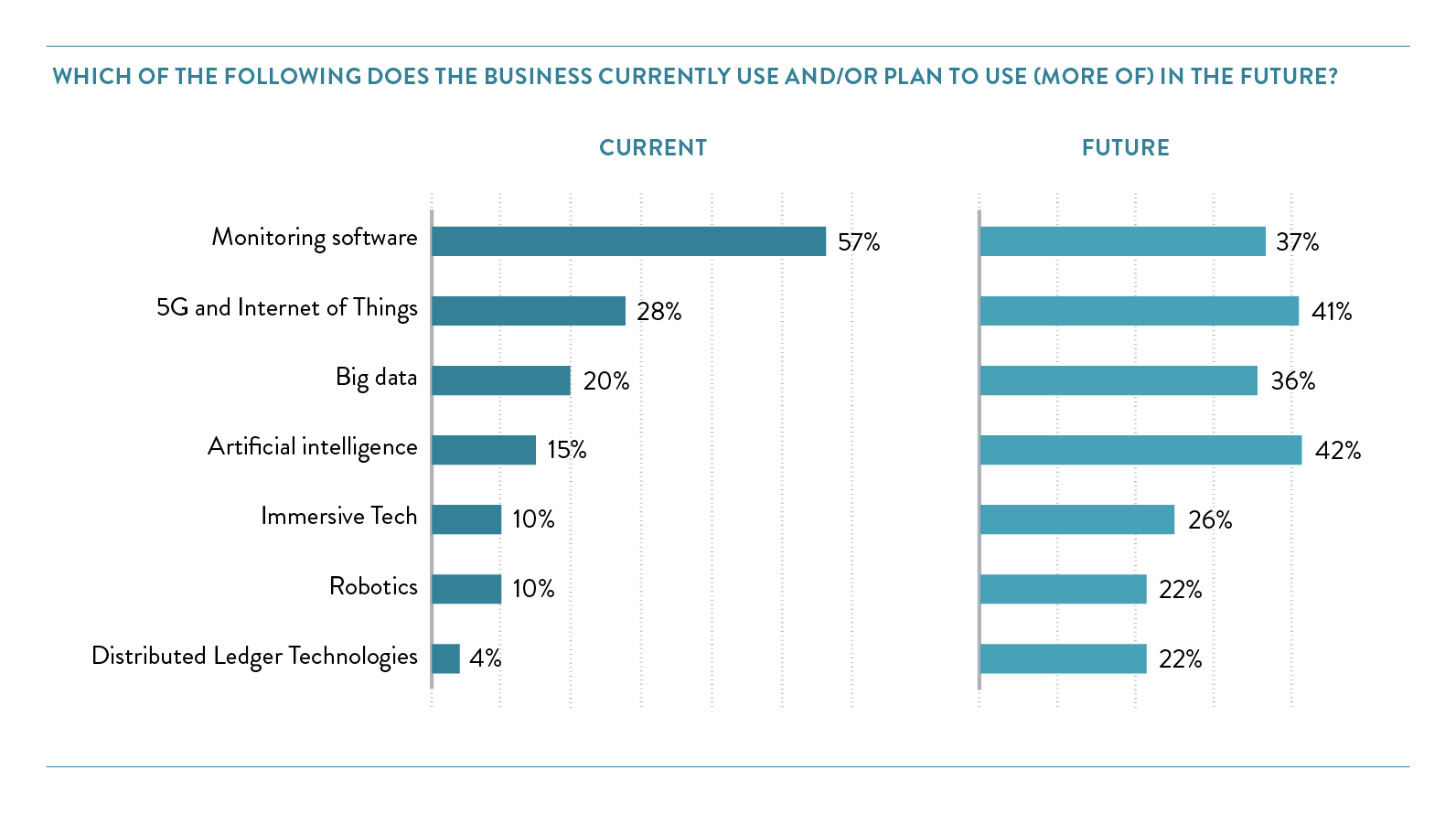

Scaleups are at the forefront of new technologies with 6 in 10 currently using software to monitor performance and productivity, 59% are also seeking to increase automation of certain roles and tasks to improve efficiency and job quality for their staff. They are already adopters of 5G and Internet of Things, big data and artificial intelligence but are keen to leverage these even more in the future. Their use of immersive technologies (such as VR, AR and the metaverse) and robotics are both set to double and the exploitation of Distributed Ledger Technologies, including cryptocurrencies like Bitcoin, will increase fivefold.

To support in their growth journey scaleups are seeking effective relationship management and want to be recognised and ‘put on the map’

Having a single point of contact to act as a relationship manager and help businesses navigate support from government and the private sector is increasingly important to scaleups with 70% seeking this type of arrangement in 2022, up from 63% last year.

Being recognised as a scaleup is also important and business leaders feel this would help their business grow even further with three fifths wanting to be identified by players in the private sector and 5 in 10 wanting the government to share their scaleup status internally with other departments and agencies. 8 in 10 would be happy for their scaleup status to be shared on public record, with 5 in 10 stating this should be on an opt-in basis.

For the third year running access to markets in the UK and internationally is perceived to be the single most important factor for business growth.

When asked to rate the importance of factors for future growth, access to markets was seen as vital/very important by 91% of scaleups, significantly ahead of the talent challenge (72%). Unsurprisingly, it is also the number 1 priority when scaleup leaders were asked to rank it against the other barriers, with 1 in 3 placing access to market in the top spot retaking this position from access to talent for the first time since 2020.

Access to finance and growth capital continues to be an important factor for many scaleups with 1 in 5 considering it their biggest challenge. Challenges around infrastructure are of increasing importance to scaleups, potentially indicating the changing needs for ‘place and space’ following the pandemic, and compounded with this are the dynamics around access to the right facilities for innovation and R&D. Building leadership capacity and capability within scaleups continues to be a challenge however as with previous years this remains the fifth most important factor in their growth plans – despite an ongoing desire for greater resources to support access to peers, mentors and Non Executive Directors.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share