Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

SECTORAL AND REGIONAL CLUSTERING

ScaleUp Institute research has shown that the development of clusters and hubs is a key enabler of local scaleup growth. Therefore it is important we track our cluster evolution across the country and what is enabling them.

SECTOR CLUSTERS

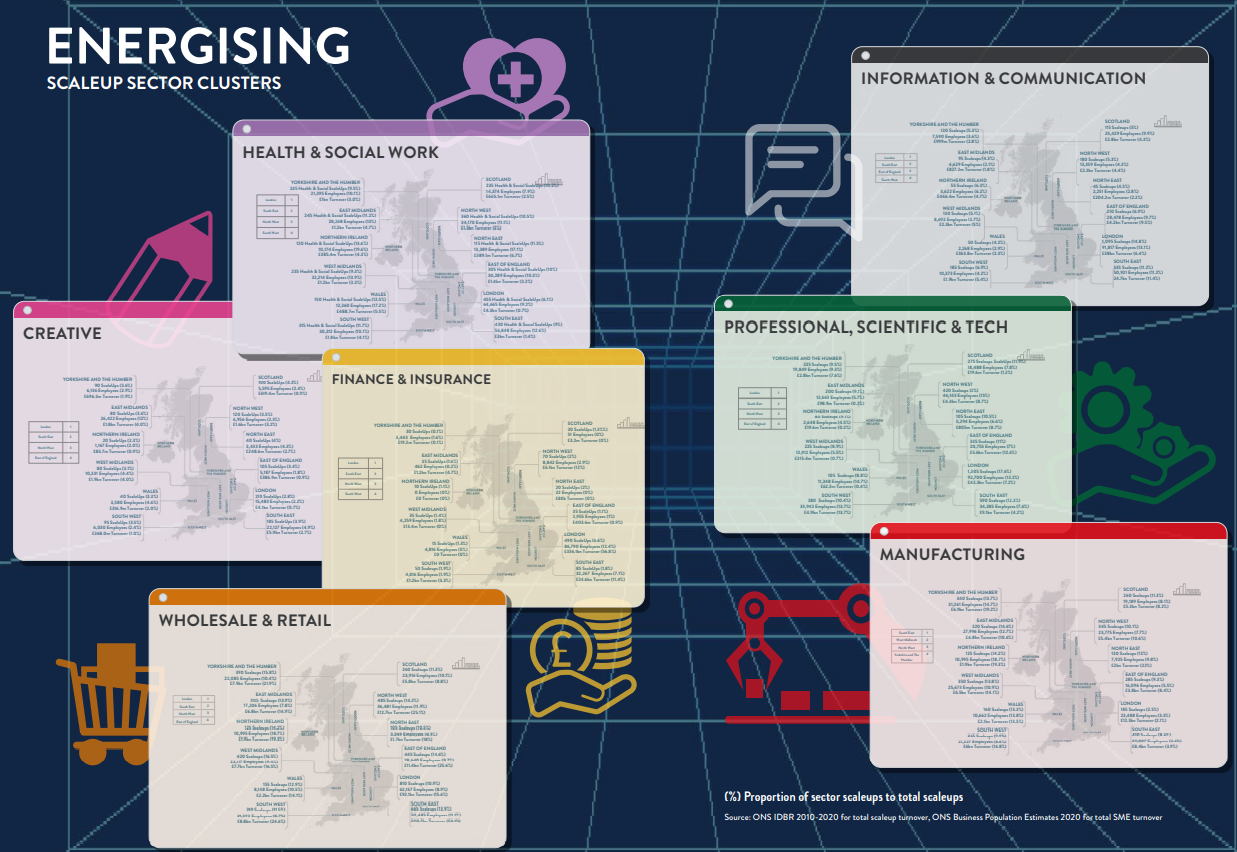

In 2022, we have further analysed how scaleups from 7 key sectors are clustering around the country and their contribution to their local economies. Most sectors including Wholesale/Retail, Manufacturing, Health and Social Work and Creative/Arts are spread across the regions fairly evenly in terms of proportion of scaleups to all scaleups in the region. Professional, Scientific & Tech and Information & Communication are a slight exception as they are heavily concentrated in London.

However, the turnover contribution varies significantly between different regions and sectors. Wholesale/Retail contributes 52% of the turnover in the South East while making up only 14% of scaleups in the region. 7% of London scaleups are from the Finance & Insurance sector however they contribute 57% to the region’s turnover.

Health and Social scaleups, across most regions, have a lower contribution to turnover compared to the proportion of scaleups. However, as seen above, more health sector scaleups are scaling by employment which plays out in their frequent over contribution to regional employees, e.g. in Northern Ireland where they represent 13.6% of all scaleups but 19.6% of employment.

REGIONAL PERSPECTIVE

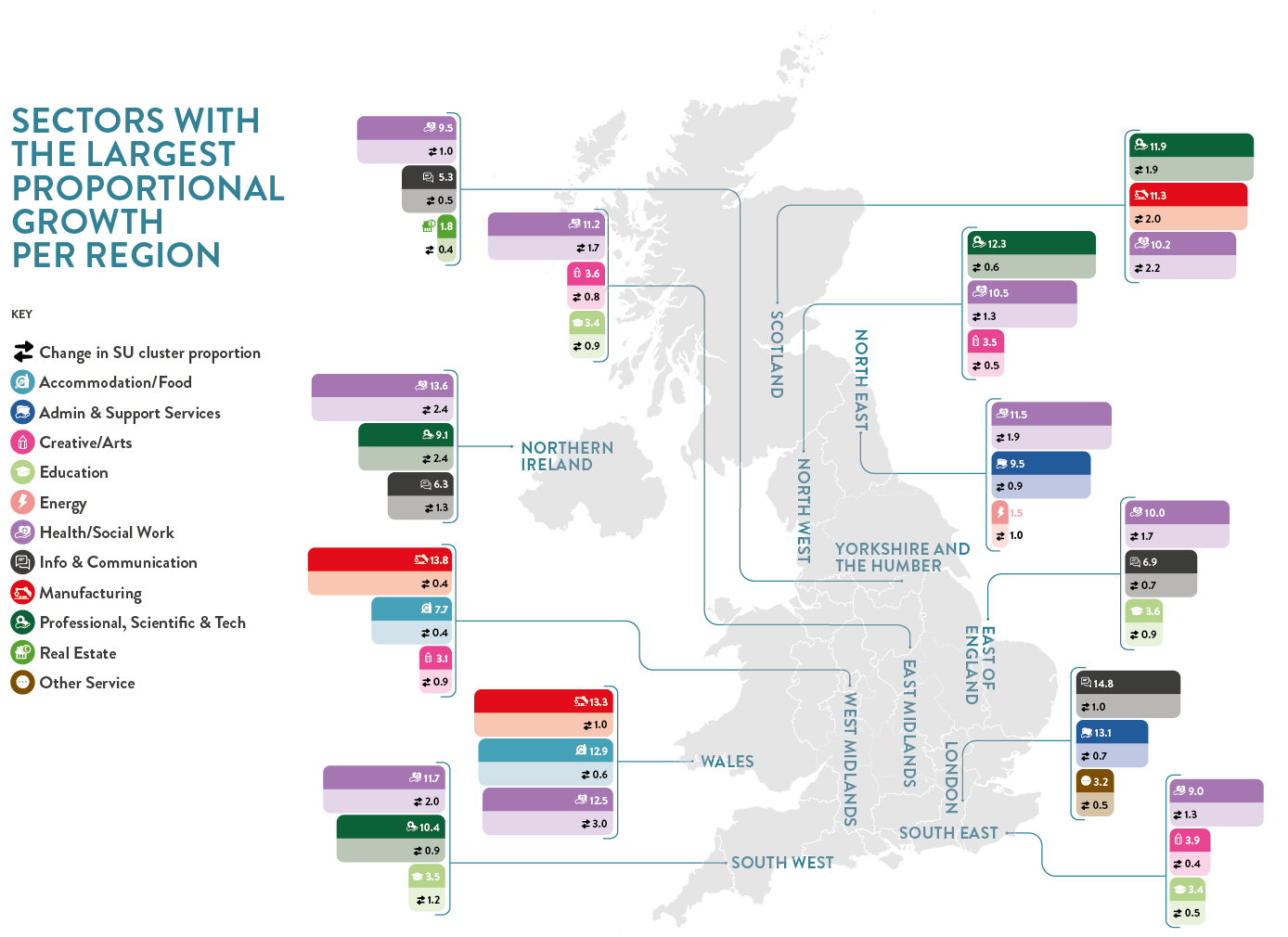

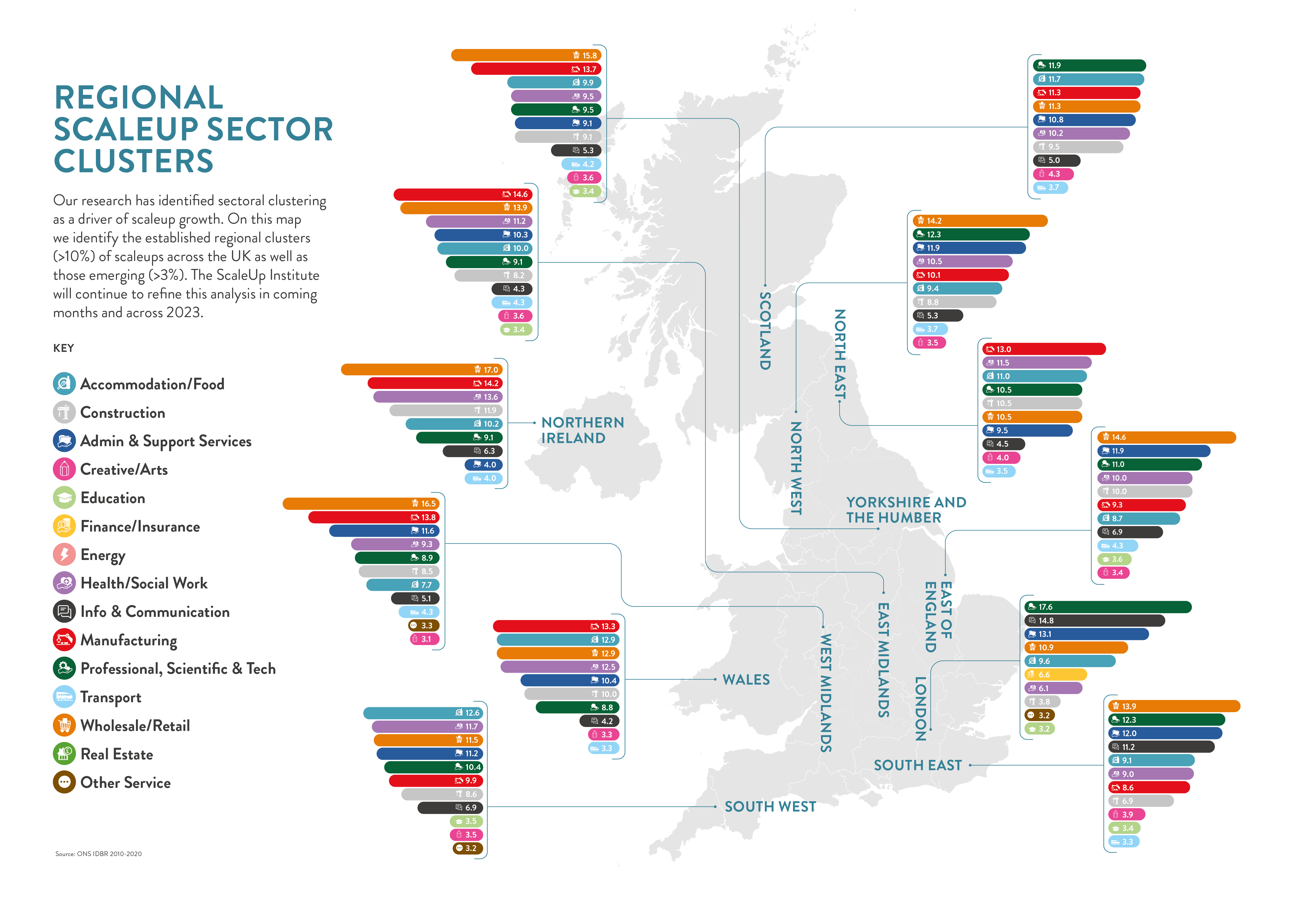

The figures below show the sectors with more than 3% proportion of scaleups in each region and nation of the UK along with the top 3 growth sectors in each locality.

5 out of 12 regions – North West, West Midlands, London, Yorkshire and Humber and East of England show steady sectoral proportions, i.e. their top 3 clusters are the same in 2020 as were in 2019.

Top sectors by coverage

Manufacturing appears as one of the top sectors in 8 out of 12 regions with significant proportional growth from 2019 in Scotland and Wales. It also showed notable growth in 3 regions – Scotland, Wales and West Midlands.

Wholesale/Retail remained one of the top sectors in all regions, though it ranked lower in 5 regions when compared to 2019 rankings – Scotland, Wales, South West, North East and East Midlands. It slightly increased in proportion in Northern Ireland and Yorkshire and the Humber.

Health & Social Work noted the biggest increase in 2020 in the number of scaleups and now represents more than 10% of total scaleups in almost all UK regions and nations except for the West Midlands and London. Professional, Scientific & Tech followed Health & Social Work in an increase in the number of scaleups – and the combination of these make up 22% of the UK economy. It is a top growth sector in 4 regions – Northern Ireland, Scotland, South West and North West.

Info & Communication is also one of the top growth sectors in 4 regions – Northern Ireland, London, East of England and Yorkshire and Humber. Creative/Arts is growing in clusters across the country particularly in the West Midlands, East Midlands, North West and South East.

All of which helps inform what local sectoral scaleup actions we should take as we move forward.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share