Explore the ScaleUp Annual Review 2022

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Access to Markets

Scaleups sell to and collaborate with customers and partners across a broad range of markets. Three quarters are primarily focused on B2B sales with the remainder selling direct to consumers. They are key parts of supply chains to government and large corporates as well as being ambitious internationally exporting goods and services to all parts of the globe. However on all counts there is a desire to do more.

Yet gaining access to these markets continues to be a mounting challenge for our scaleups. Markets emerged as the most vital factor for scaleups’ future growth in 2019 when it was on a par with access to talent. In each subsequent year though the gap has widened and in 2022 9 in 10 scaleups consider it to be the most important factor for growth. When scaleup leaders are asked to rank these factors for growth, markets once again tops their priority lists with 1 in 3 placing it in the top spot (compared to 1 in 4 for access to talent). And it features in the top three barriers to growth for nearly three quarters of scaleup leaders (73%).

As an ecosystem we must act now on the longstanding issues which scaleup leaders have continuously highlighted over recent years. The world has emerged from the pandemic lockdowns but fresh macroeconomic and geopolitical challenges have arisen affecting the costs of doing business and disrupting supply chains. Therefore it is more vital than ever before that we doubledown on efforts to break down those persistent barriers and support scaleups to achieve and surpass their growth ambitions.

Domestic Markets

The UK market is critical for scaleup success, with 8 in 10 rating access to domestic markets as vital to their future growth.

Other businesses and institutions continue to be the primary marketplace for scaleups with 75% selling to large corporates, government, their peers and/or the third sector.

Large corporates are the biggest customers for B2B scaleups with 7 in 10 currently selling to them directly (56%) or in their supply chains (28%). And they are keen to do even more. Only one in ten do not consider large corporates to be a target market.

When it comes to working with Government however the picture is markedly different with only 4 in 10 (39%) selling to or supplying national or local government entities. Breaking this down even further we can see that only 1 in 4 (24%) are working with UK Government and 1 in 3 (32%) are working with local government. But there is considerable appetite to do much more – scaleups want to triple their sales to Government over coming years.

One way to access markets is through collaboration and once again we find that rates remain stubbornly low. Only 3 in 10 scaleups have collaborated with large corporates in the past three years to develop a new product or service, with 1 in 4 collaborating with government. Universities and research institutions remain the most common partners for collaboration (34%). Facilitating greater collaboration is a vital part in fostering a more dynamic and innovative scaleup ecosystem.

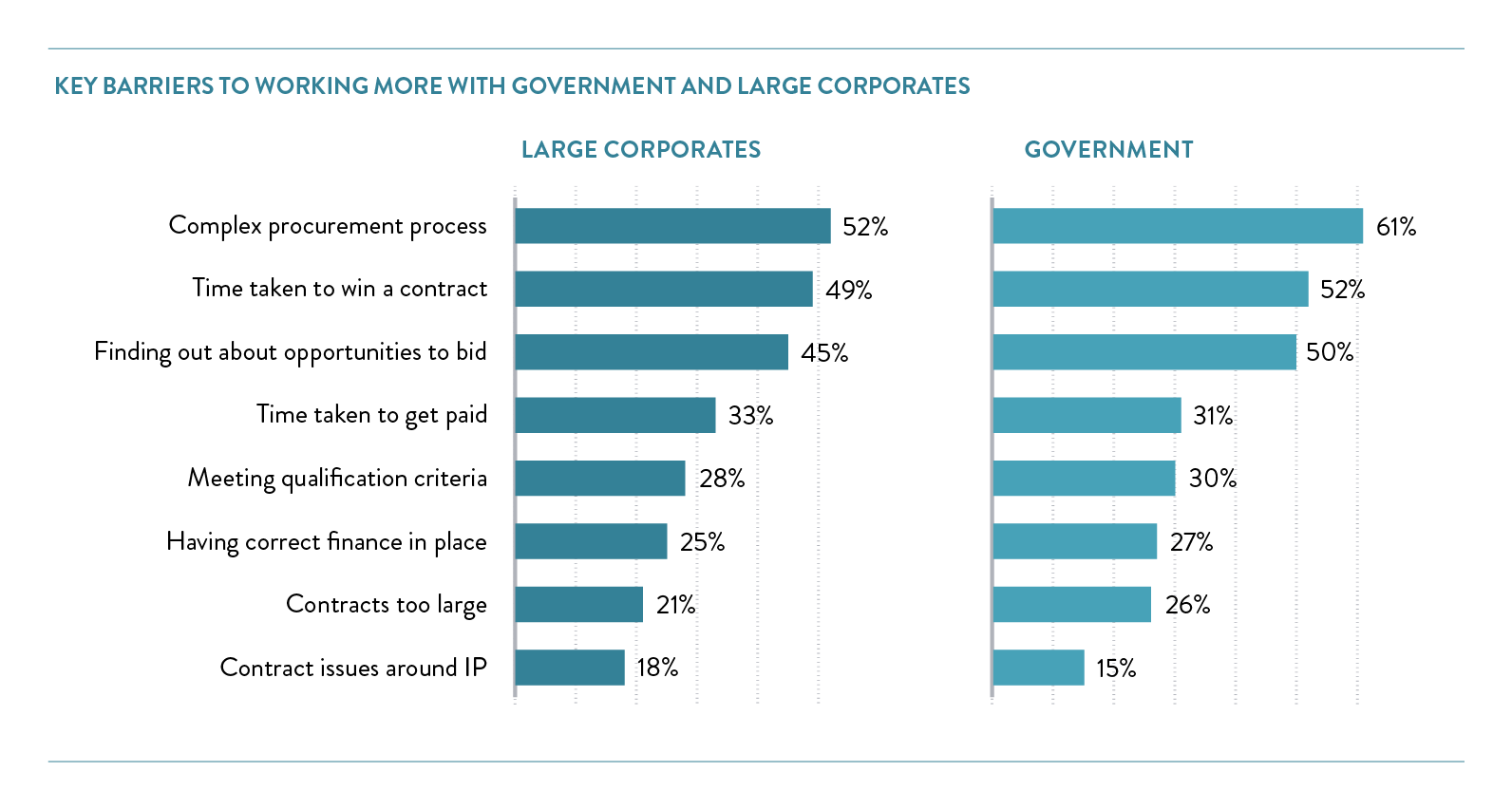

Over recent years the top barriers to working with corporates and government have been persistent. Once again the complex nature of procurement processes is the leading frustration for scaleups – particularly when it comes to working with Government. Compounding this is the long lag times between submitting a bid and the contract award, with scaleups also finding it a challenge to discover suitable opportunities to bid for.

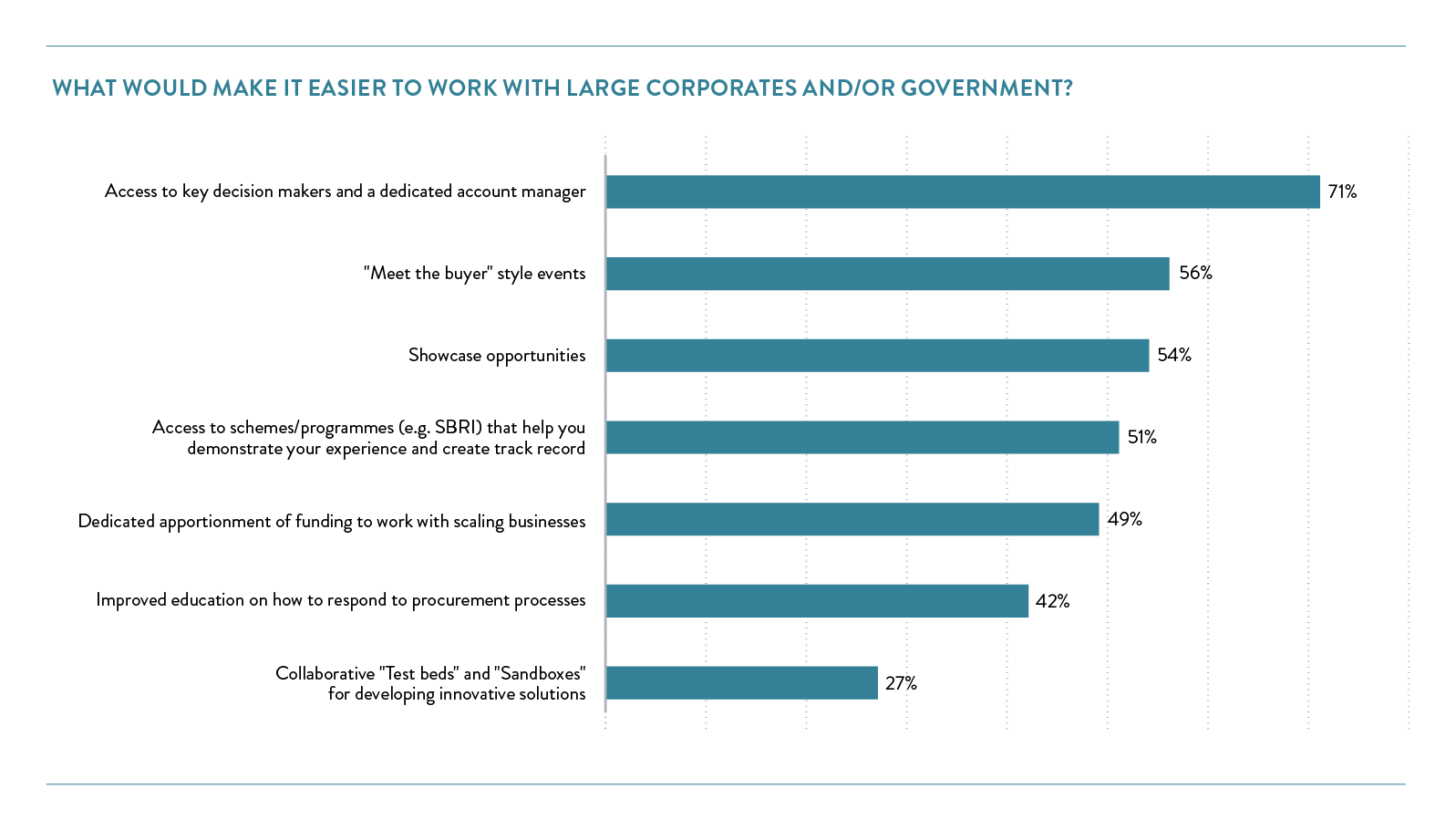

While simplifying and streamlining procurement processes is required to overcome these challenges, scaleups are also seeking greater access to key decision makers and account management structures to help them navigate procurement. Opportunities to encounter buyers and showcase their goods and services are also in demand. 5 in 10 scaleups are also keen to access support to help them develop the track record which is often an essential requirement of being successful in tendering opportunities. Many also believe government and corporates should have dedicated funds for working with high growth innovative businesses like theirs.

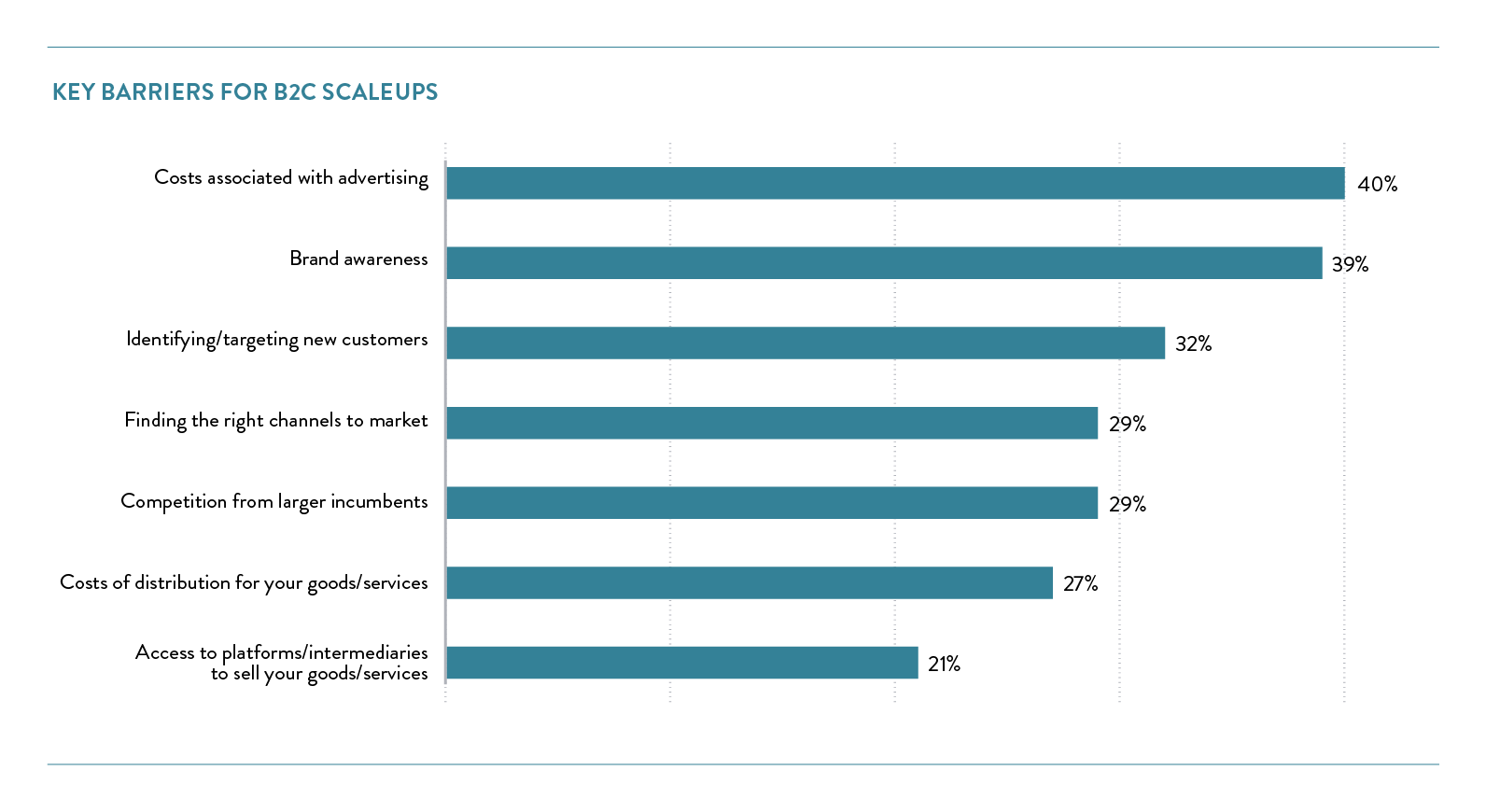

When selling direct to consumers, scaleups equally face a range of challenges. Most notably the costs associated with advertising and the ability to create brand recognition in what can be a crowded marketplace, particularly when competing against larger incumbents. They also experience challenges related to identifying and targeting new customers, picking the right channels and increasing cost of distributing their goods once a sale has been made.

International Trade

One predictor of scaleup growth is the level of internationalisation of a business and its export aspriations. The scaleups in the survey are no different with 5 in 10 currently exporting and an increasing number looking to overseas markets in the future. 4 in 10 scaleup leaders consider access to international markets as a vital or very important factor in their future growth.

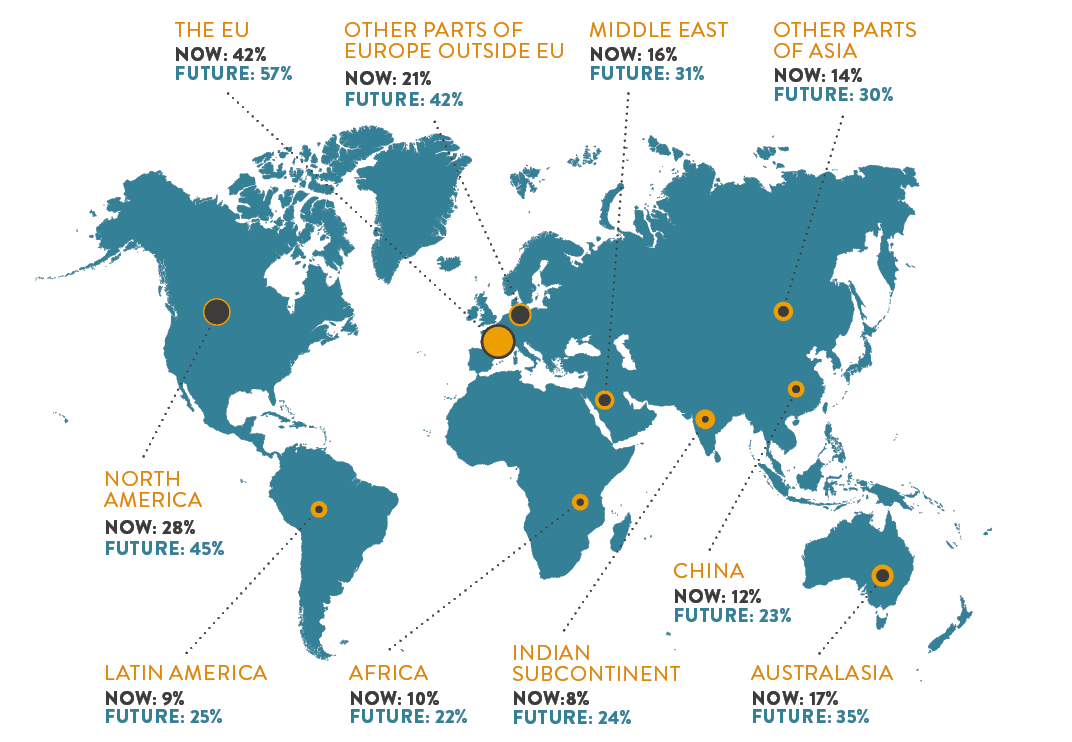

These exporting scaleups are active globally however the EU remains the largest single international market with 42% currently trading with the bloc. 39% are engaged in trade outside of the EU, with North America a key marketplace for 3 in 10 scaleups.

Looking to the future, 6 in 10 scaleups are seeking to engage or expand their international trade activities. Emerging markets are of increasing interest to our scaleup leaders as they look beyond Europe and North America (where activity is also planned to increase) to Australasia, the Middle East, China, India, Latin America and Africa.

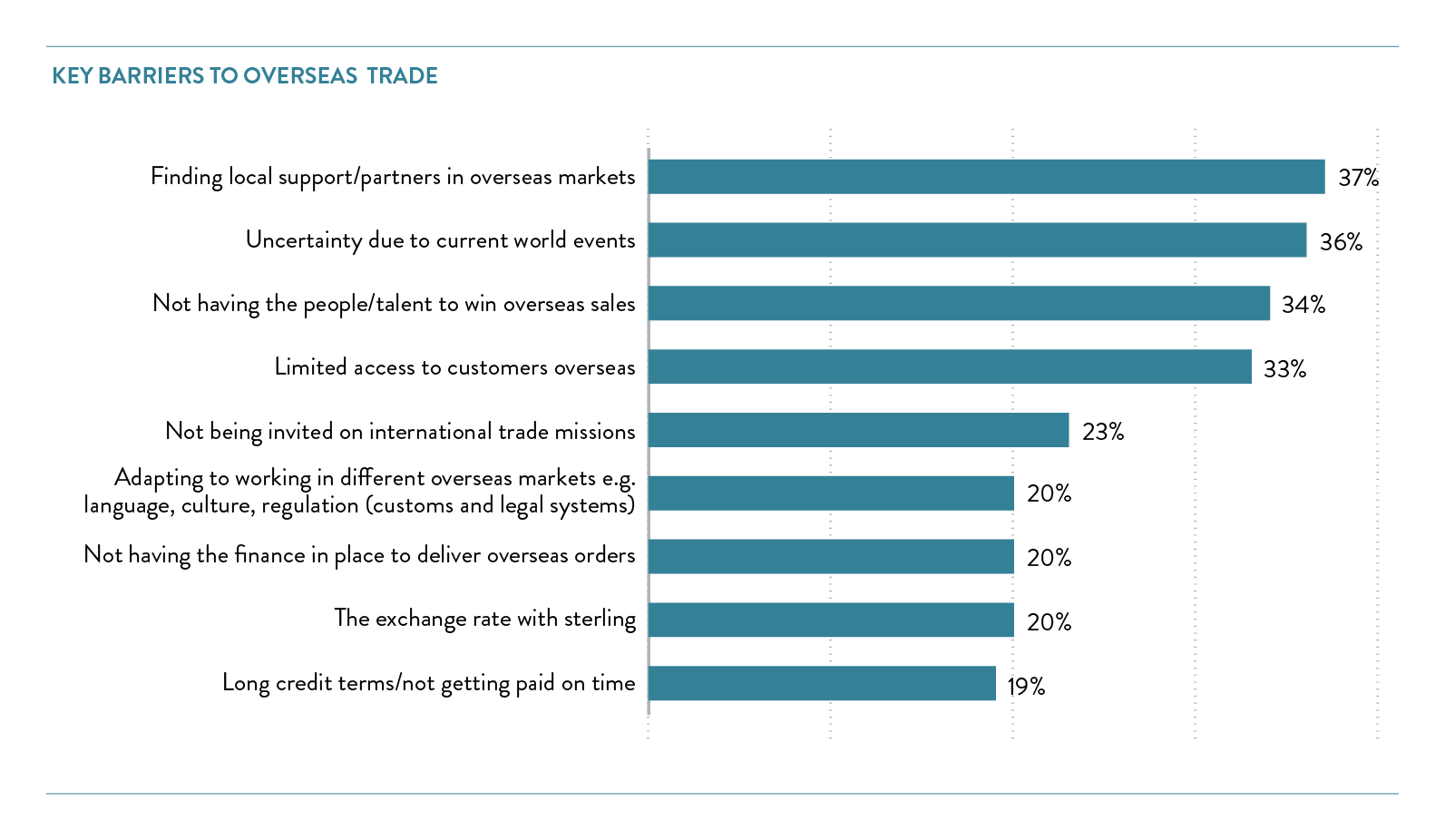

Similarly to the domestic market, many of the challenges to exporting flagged by scaleup leaders have been persistent over recent years, however there is increasing uncertainty due to current world events, such as the war in Eastern Europe. They continue to face difficulties in finding local support (37%), a lack of people with the right skills to make overseas sales (34%) as well as gaining access to customers in foreign markets (33%).

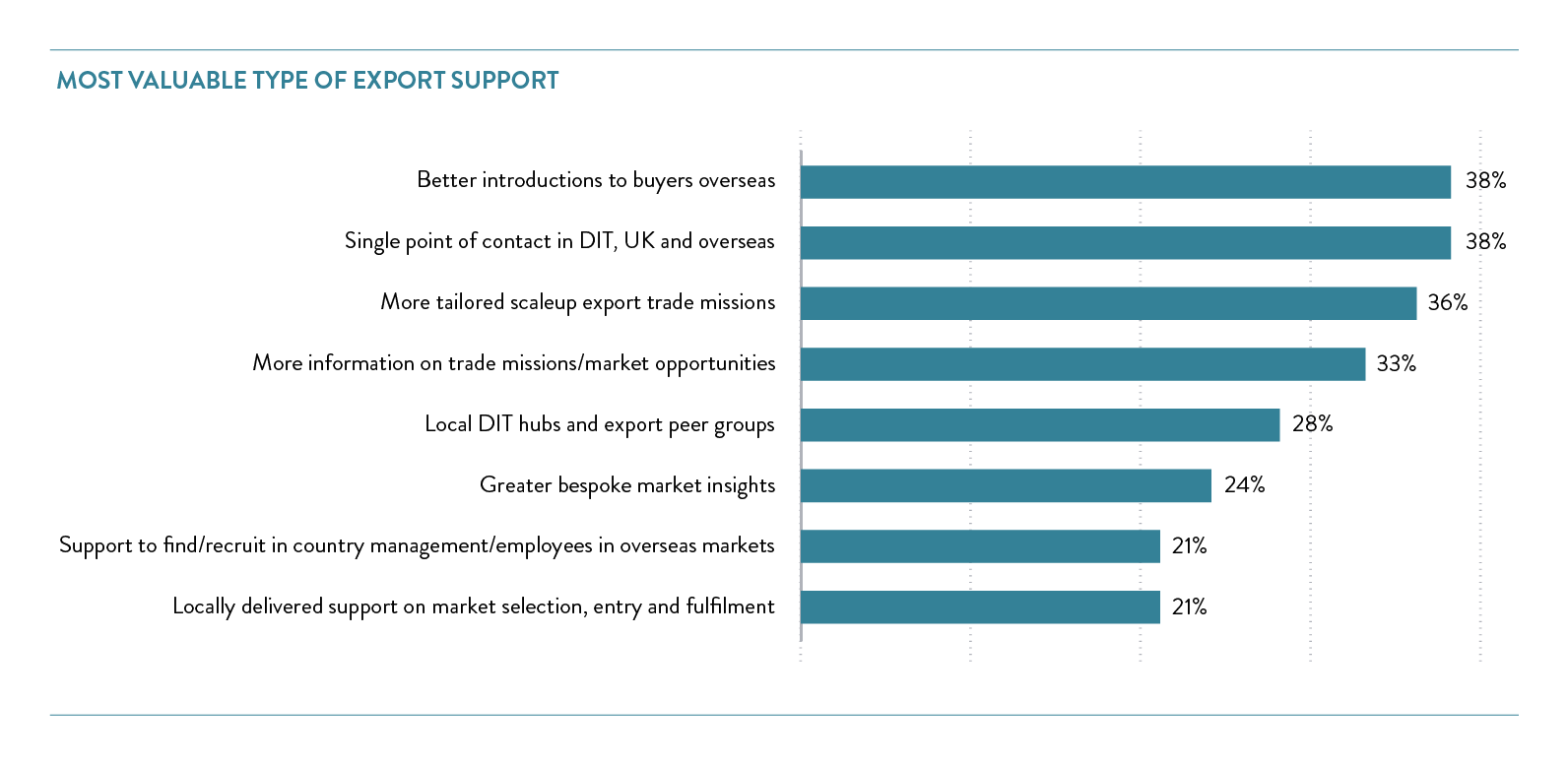

We need to break down these barriers through enhancing trade missions and making these more scaleup specific (36%) and providing the right introductions to buyers (38%). Scaleup leaders are also eager to work closely with the Department for International Trade and have a relationship manager who can be their single point of contact to manage their needs and facilitate connections. Access to information and resources to gain insights and understand opportunities is also a key component alongside the ability to learn from peers who are already exporting.

CONTENTS

Introduction 2022

Chapter 1 2022

The ScaleUp Business Landscape

Chapter 2 2022

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2022

The Local Scaleup Ecosystem

Chapter 4 2022

The Policy Landscape

Chapter 5 2022

Looking forward

Annexes 2022

SCALEUP STORIES 2022

Previous

Previous

Share