Explore the ScaleUp Annual Review 2021

Select a section to expand and explore this year's review.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Access to growth capital

Accessing the right finance and growth capital is vital to scaling businesses. Ambitious business leaders have highlighted this as one of the top five challenges to scaling since 2014. In 2021, as the economy emerges from Covid and responds to the UK’s new relationship with Europe, the need for relevant growth capital for scaleups remains an ever-present issue, with 5 in 10 scaleup businesses stating it is in issue in this year’s scaleup business survey.

As well as traditional sources of finance, throughout the pandemic scaleups have utilised Covid Support Schemes with 87% of scaleups accessing one or more of the forms of support available. From CBILS, BBLS, Innovation grants, Local Authority Grants, and the Future Fund to the Furlough scheme – each have played their part showing the diversity of scaleup requirements – and the importance of these interventions.

Looking ahead to 2022, scaleups remain resilient and optimistic, with 9 out of 10 leaders expecting to grow next year by either turnover or employment, and a quarter of them expecting this growth to be over 50%.

Our 2021 survey also shows that 8 in 10 have used some form of external finance, with 5 in 10 using equity finance or planning to use it in the future. Scaleups are using a variety of forms of equity finance with venture capitalists (54%) and angel investors (49%) most common. We can also see that BGF remains the largest investor by number to visible scaleup businesses with 148 deals.

However, the access to finance challenge reported by scaleups is a long-standing issue pre-dating the current economic landscape. Despite the ongoing growth plans of scaleup CEOs, and the important role that finance support schemes have played in aiding scaleups during these unprecedented times, 4 in 10 report that they do not have the right finance to support their growth ambitions – unchanged from last year and 41% perceive that it resides in London and the South East.

The substantial efforts made in response to Covid were necessary and have aided scaleups. However, as we set out in our joint Future of Growth Capital Report and 2020 Annual Review, work to deliver the practical solutions needed to close the longer term – structural – growth capital gap for scaleups must be a key part of ensuring the UK’s future economic prosperity.

We are therefore pleased to see that in 2021 significant efforts are being be made in this area. The Listings Review launched by the Chancellor last November as part of the Government’s ambition to strengthen the UK’s position as a leading global financial centre and make the transition from private to public more seamless, came at a critical time and has resulted in a suite of detailed policy reviews which have been undertaken across Government and the Regulator. These include the closely linked consultation on reviewing Solvency II regulations, the HM Treasury review of Wholesale Markets Review and the UK Prospectus Regime, and the FCA’s work on Primary Markets all working to better join up the later stages of the continuum of finance to support growth. The work of the FCA and Bank of England on Productive finance is also vital, particularly as we seek to solve the key issue of unlocking institutional funding. This was the subject of a detailed roundtable we held with HM Treasury during Scaleup Week in May of this year. The attention being played at a holistic and sectoral level is also key and we also know that the growth capital challenge is also being closely looked at by the Prime Minister’s Council on Science and Technology – to which we submitted evidence earlier this year – the BEIS led Life Sciences Taskforce are each doing valuable work in this area.

In 2020 we called for substantial commitments to both Innovate UK and the British Business Bank as part of efforts to mitigate the economic scarring from the sharp decline in economic activity resulting from the pandemic. We also suggested the establishment of a Future Opportunity Fund to cater for emerging sectors such as Net Zero and critical sub sectors that are often less well catered for by existing funds. In July we saw the creation of the Future Fund: Breakthrough initiative which seeks to target exactly this space, particularly supporting larger high growth, innovative firms that are struggling to find the depth of capital that they require. Alongside this and the publication of the Life Sciences Vision, a £200 million life science fund was also launched. The 2021 Autumn Budget further responded to this call with substantial commitments to the core pillars of Innovate UK and the British Business Bank. Innovate UK will see budget for its core activities increased to £1bn by 2024/5 in line with broader efforts on R&D spending, and the British Business Bank mandate to foster growth – especially at a local level – has been broadened with additional money for existing funds and an expansion of funds in to new areas – including £660m for the Northern Powerhouse Investment Fund to expand it in to the North East of England, an additional £400m for the Midlands Engine, and £200m for a new South West Fund building upon the existing fund in Cornwall and the Isles of Scilly. There will also be £150m for a new Scottish Fund, £130m for a Welsh Fund and £70m for a Northern Irish Fund. There will also be an additional £150m for the Regional Angels programme over the next three years to invest alongside angel syndicates. This is critical as we know that Angels play a vital role in the finance journey of the majority of scaleup businesses.

The Budget further indicated the strong convening role Government is seeking to take in bringing institutional investors to the table to talk about the barriers to investing in scaleups and the ScaleUp Institute, as highlighted earlier, has been pleased to convene a discussion on this issue in May with HM Treasury. It is important that Ministers deliver clear market signals to investors and businesses, and give them the confidence to pursue their growth plans. We will monitor outcomes from these efforts closely.

This degree of action is hugely positive. As we have emphasised on multiple occasions, there is no silver bullet to solving the growth capital gap in the UK, it will require action on multiple fronts. However, if outcomes can be aligned from across each of the work areas that are now in train on multiple fronts – including reform of regulatory challenges flagged by pension funds, increasing knowledge and awareness of investment opportunities amongst investors and trustees, and ensuring the provision of equity at a local level for scaleup businesses – real progress on this long-standing issue could finally be made.

THE INVESTMENT ENVIRONMENT

Compared to expectations in 2020, the evidence is that 2021 has been a strong year for investment. Whilst there were notable constraints during 2020 and a reduction in liquidity – particularly for angel investors who focused their money on their existing investments – 2021 has seen substantial movement on the public markets with 85 IPOs up to the end of Q3 (the highest since 2014) raising £13.7 billion. Public markets have continued to be an engine of the UK economy, supporting the funding needs of global businesses at all levels with £39.7 billion raised to date in 2021 through IPOs and follow-ons. This is the highest year on year equity proceeds raised since 2009. AIM has also seen substantial success with over 20 founder-led businesses have listed in London so far this year across life sciences, software, energy and construction.

Social, Green and Diversity Dynamics

There has been an increased trend in investment to businesses with good Environmental, Social and Governance (ESG) principles, this is a significant opportunity for innovative scaleups. Investors are increasingly attuned to overarching global risk issues such as climate change, with Covid-19 showing just how damaging such events can be and Q3 2021 has seen an additional 3 companies at IPO recognised with the London Stock Exchange’s Green Economy Mark – Saietta Group Plc, Microlise Group plc and HydrogenOne Capital Growth plc. This brings the total number of issuers with this mark to 101 (comprising of 71 corporates and 30 closed end funds)1.

We have also seen the British Business Bank evolve its mission statement to drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by improving access to finance for businesses in these areas. And we can see that scaleups are already very active in this space in our Scaleup Green Economy Index, which we published earlier this year.2 This shows that there are 282 visible scaleups in this space, with a combined turnover of £9 billion employing more than 40,000 people.

Another major challenge in providing growth capital is the need to ensure that funding is equally available all to entrepreneurs regardless of gender or ethnicity.

On average, UK entrepreneurs that are white and male are more likely to be successful than women or Black, Asian or Other Ethnic Minority Entrepreneurs. Institutions must recognise that they will have to take additional steps to avoid unintentional or unconscious bias, and to avoid reliance on existing networks to disseminate advice rather than working to engage with broader communities.

There are welcoming signs that institutions are recognising this. Following evidence that all female founder teams get less than 1% of venture capital (VC) funding, and mixed teams getting only 10%, a significant number of angel groups, VCs and banks have now signed the Investing in Women Code to encourage best practice approaches.

Investment from overseas

However, there are substantial challenges still to overcome. Investment from overseas into scaleup businesses has been strong, and it is positive that UK firms are able to attract overseas investment at scale. However, as expanded on below, it is also important to ensure that the benefits of this growth can also be retained in the UK, especially if the IP for these firms has been born from UK resources geared to fostering innovation. If scaleups are unable to find the funding and wider services that they require in the UK they are likely to move their operations overseas, risking ‘innovation leakage’ where we fund the early stages of a process but miss out on the longer-term GDP and employment benefits created.

Moreover, in a time of global uncertainty it is particularly important to foster home grown sources of capital. International investment sentiments can be sensitive, and the IMF has forecast that the UK is likely to recover more slowly than other G7 nations from the pandemic3 . Therefore, despite healthy, buoyant public markets, it is important to note that with ongoing supply chain challenges expected to last until 2023, and the spectre of inflation present, investors pulled $9.2 billion out of UK-focused equity funds4 in 2021. This compounds 6 years of outflows since 2016 with the percentage of UK equities held by British Retail investors falling from 23% to 14% between 2015 and 20205. It is this story which underlines the vital importance of the work being undertaken through the Listings Review and broader efforts to unlock UK rooted institutional investment.

EUROPE AND THE INTERNATIONAL PERSPECTIVE

As we have previously reported, between 2010 and 2019, the EIF was the single largest investor to regional backed equity funds. Announcements in the 2021 Autumn budget that the British Business Bank will receive additional money to expand regional funds, and the Regional Angel Programme are therefore both welcome and necessary. The Shared Prosperity Fund and LevellingUp Funds also have an important role to play here in replacing EU structural funds – such as ERDF which has had a large footprint across UK regions. As all of these schemes are implemented it will be important to fully monitor how changes to the way that money at a regional level is cornerstoned, and consider how these programmes can be tweaked to better meet the needs of local areas, alongside wider consideration of sovereign wealth fund structures.

One of the most often quoted challenges in relation to EU structural funds – specifically ERDF – is the bureaucratic nature of the reporting process surrounding it, and the, often seemingly arbitrary, cut off points for the way that it could be applied. It is essential that money from the new Shared Prosperity Fund, the Levelling Up fund and efforts to replace seed capital from EIB / EIF avoid these same pitfalls, and are allowed to evolve to meet the on the ground needs of scaleup businesses, and fit with the local delivery of services for them. This should include long time horizons for support programmes at a local level which will better enable the private sector to partner with local areas and programmes over time, without facing the same stop/start cycles associated with many of those programmes funded through EU funds.

Our ongoing participation in Horizon Europe – the world’s largest collaboration exercise with a budget of €95 billion over 7 years – is hugely important. Recent reports that UK firms are being blocked due to wider disagreements over the Brexit agreement, specifically the Northern Ireland Protocol, must urgently be overcome6. Whilst there are commitments from the Government to apportion any UK money that would have been spent on Horizon to appropriate UK programmes if disagreements are not able to be worked out, this will not result in the scale or the breadth of collaboration, nor the economic opportunities afforded by association with the Horizon programme.

We should also seek to learn from our European partners, many of whom are looking closely at their own investment landscapes and seeking to attract both scaleup companies, and international funds to invest in them.

For instance, France has earmarked €6 billion for the Tibi initiative, to support a so-called ‘fourth industrial revolution’ in France, attracting foreign sources of capital to locate in France and issue mandates for asset managers based in France to invest in French companies. An internal 18 month review of this, published in June 2021, suggests the scheme has been a notable success so far7 with over €3.5 billion pledged by partner investors, and over €18 billion from approved investment funds when third party investors are taken into account. This strategy has a stated objective to finance French Scaleups8 and the success of the scheme so far has caused them to increase their medium term objectives for the scheme noting “These developments strengthen our determination to establish France as a leading European centre for private financing of scale-ups”. As we have highlighted elsewhere, the world is not standing still – the UK should seek to emulate the scheme as part of the broader suite of policies tuned to improve the investment environment for UK scaleup businesses.

SECTOR INVESTMENT PERSPECTIVE

Whilst investment in the UK has been solid across 2021, it is important to note that much of this activity has been focused upon a narrow set of sub sectors.

It is good that the UK is able to attract this kind of investment, and it is important that these sectors continue to receive funding to fuel their growth. However it is also important to have a greater depth of capital for deep R&D focused businesses and particular sectors including creative and life sciences to achieve the innovative growth economy envisioned in the Innovation Strategy and the Life Sciences Vision, each published earlier this year. Within the sub-sector of ‘tech’ investment we have observed a significant bias towards investment in Internet Platforms, Mobile Apps and SaaS, leaving substantial gaps in funding for Life Sciences and newer areas of growth such as clean energy. Given the priorities of the Government and the UK drive to close the gap overall, it is important that efforts to close the growth capital gap take particular account of these observable sectoral biases, and ensure that there is a concerted drive to increase investor awareness, knowledge and connectivity – including amongst the analyst community – and a joined up approach to deployment of funds that enables the development of clusters of expertise.

Indeed, some of those CEOs responding to our scaleup survey highlighted the specific challenges they have faced in raising money including a lack of knowledge of specific sectors amongst the investor community, and some reporting difficulty in finding development capital, or finding investors with the right complementary skillsets or onward market access to aid the businesses growth. The Future Fund helped a number of these businesses, but others report falling in to a gap at earlier stages of the growth journey (circa £1 million) where it is not economic for larger VCs to provide funding, but smaller players don’t have the right sector knowledge or experience to feel comfortable with the investment.

Some action has already been taken to address these issues, with the £200 million Life Sciences Investment programme a welcome part of the investment picture as are the announcements in the Autumn 2021 budget of £42 million in additional help for creative scaleups. However, there are deeper issues at play and – as we discuss below in relation to institutional investment – many in the investor landscape have clear knowledge gaps in relation to specific sectors.

It is for this reason that, working with the UKBAA, we have developed the Invest Creative Toolkit which has created a repository of knowledge in one place, and an interactive investment toolkit for those considering investing in the creative sector. This suite of tools – launched earlier this year – is already having substantial traction across the investor community at all stages, from individual angel investors up to institutional players. We believe that toolkits such as this, and investment work undertaken by the Life Sciences sector, should be built upon for the whole of the UK scaleup economy: collating and distilling sector specific information for an investment audience, and creating stronger links between investors and growth businesses in a diverse range of sectors

REGIONAL INVESTMENT

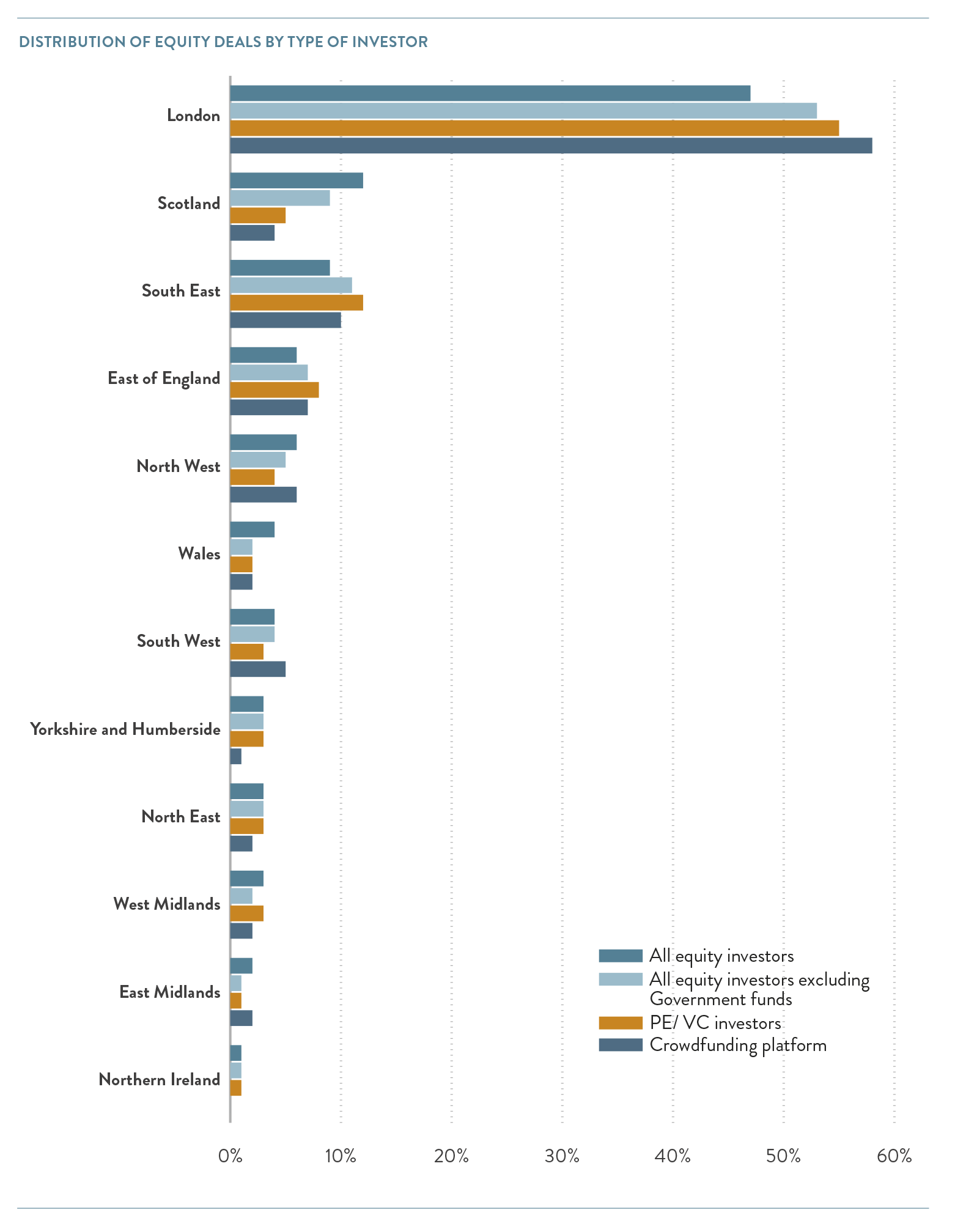

Regional disparities are an ongoing feature of the UK investment landscape. The British Business Bank Regions and Nations Report (the first issue of which was published in October of this year) highlights that the largest four regions within the UK, London, the South East, the East of England and the North West, host 55% of the business population but take in 86% of equity investment. These areas also outperform on private debt, attracting 69% of investment.

This report also re-emphasises the previous ScaleUp Institute work on the drivers of scaleup growth at a local level, with detailed analysis of locational data compared to deal flow to prove the vital importance of having equity rooted in areas close to the businesses9.

Indeed, as we have stated previously, we are aware from our detailed analysis of angel ecosystems across the UK that there are substantial differences in the depth of capital available at different stages of the value chain. This includes individual Angel groups on a regional basis, with the 2020 British Business Bank and UK Business Angel Market Report identifying that 56% of angels are based in London and the South East and over half of all UK angel investment. In Cambridge one syndicate alone undertakes £30m investments annually, whereas in analysis we have undertaken with UKBAA in Greater Manchester, West Midlands and West of England, across 20 angel networks in these areas a combined total of circa £29m is deployed.

This makes the expansion of regional funds announced in the 2021 Autumn budget timely and welcome, in particular the confirmation that £150 million will be available for the Regional Angel Programme to tap into the nascent Angel market outside London and the South East.

Across 2021 we have also been working closely with the British Business Bank on a regional Scaleup Finance initiative. This has brought together more than 400 investors, advisors and scaleup businesses as part of a structured programme of events that include policy roundtables and virtual education seminars. These events have explored remaining barriers present at a regional level, and have provided participants with a detailed breakdown of the current scaleup economy, including Q&A sessions and knowledge workshops with experts from across the continuum of finance. We will be continuing this work in 2022, including further direct engagement with scaleup businesses.

THE VALUE OF UNLOCKING INSTITUTIONAL FUNDS TO SUPPORT PATIENT GROWTH CAPITAL

When we review our international counterparts, we note several factors among those who are ahead of us in the scaleup league table. These include:

- Long term, at scale interventions such as the Small Business Administration in the US, and significant depth of capital, including greater use of Venture Debt and institutional funding which maybe supported by a Sovereign Wealth Fund.

- Strong federated structures at a regional level close to the scaling businesses, to enable effective engagement .

- A vibrant escalator of finance from grant to angel to venture debt / VC market and cross over funds and importantly access to long term institutional patient capital be it via corporates or pension funds such as in Canada; alongside public markets that enable a high growth company to transition from a private company to a listed company as smoothly as possible

It is also critical to recognise the connections between public sector procurement and corporate venturing as part of the overarching investment solution. Countries such as the US use this to great effect.

In addition to the notable examples of Canada and Australia, which have each managed to unlock portions of their domestic Institutional Investment Capital, the US and Singapore, we are also observing countries, such as France develop their own schemes with a a defined scaleup focus, such as the Tibi Initiative.

Indeed, as we have noted elsewhere, the UK Growth Capital Challenge is well documented and the Government is taking a range of welcome steps to unblock perceived supply side issues that have been identified including through the Listings Review, Solvency II Call for Evidence, creation of the Long Term Asset Fund class and the ongoing work of the Bank of England, and the efforts of HM Treasury to convene institutional investors. Total pension wealth in the UK was estimated by the ONS to be in excess of £6 trillion during the April 2016 to March 2018 period and is one of the largest single components of UK financial wealth. A very modest portion of the total wealth held here will make a substantial difference to closing the gap in UK patient growth capital. However, unlocking this will both require knowledge and an appropriate risk appetite to the growth and scaleup economy.

Therefore, to ensure that efforts across Government and the private sector have maximum impact, knowledge asymmetries must also be addressed across the whole value chain – including within suppliers of capital and intermediaries. This requires attention through the escalator – from angel to IPO.

Increasing scaleup investor Knowledge

In our recent Future of Growth Capital Report, we explicitly highlight the supply side knowledge challenge and the importance of addressing it if deeper pools of growth capital are to be deployed to maximum effect in ways that can benefit UK businesses and supercharge local economic growth.

Investment from institutional funds will need to be supported by appropriate aggregation models, and it is essential for these to be well resourced with the right analytical capacity to support deployment to scaleups and ‘scaling’ innovative high growth companies. They must also be able to crowd in local expertise. Early identification of scaling firms using data to greater effect is vital. The learnings of the DECA project on which the SUI collaborated with Government to connect scaling firms to relevant resources should be extended to funding and investment opportunities as part of this work.

Knowledge asymmetries have long been recognised on the demand side for equity but supply side knowledge gaps and a lack of expertise about the nature of the UK growth economy also serve to amplify an embedded culture of ‘risk caution’ amongst institutional investors. This represents a critical vulnerability within wider plans for the deployment of UK based institutional capital, even if regulatory and ‘structural’ barriers are removed.

If left unaddressed, it is likely that institutional money will flow to asset classes that are already well understood by institutional investors – such as infrastructure projects – rather than toward UK based high growth firms and scaleups. This kind of investor behaviour is also evident within the sectoral analysis we have highlighted above.

As further noted in the recent FinTech Strategy Review “absence of a strong domestic growth-oriented investor base has led the UK’s capital environment to be less welcoming and experienced than asset managers focussed on US markets for example.”10

One approach that has been suggested to address some of these challenges is a focus on ensuring there are enough appropriate examples of successful growth firms to shift perceptions within the investor community. The ScaleUp Institute’s ScaleUp Index has been designed to address some of these issues and has been published annually since 2017. We will be expanding this further, including looking at an index of pipeline companies and accounting for the challenges of the Covid-19 period with a refreshed version in January 2022. While greater numbers of examples will be beneficial, alone they will not resolve some of the structural challenges identified in the investment community, and there is a risk that a siloed picture of the growth economy will emerge if not placed in appropriate context.

We believe that a multi-pronged approach, as outlined below, backed by detailed research, should be undertaken to increase awareness, capability and capacity at each link of the investor value chain. Education for investors themselves and boosting the analytical capacity within investment funds will be key to this effort, as will more holistic approaches to address culture within the UK investment community.

- Boosting analytical capacity and fostering scaleup focused funds in the UK

Accelerate the unlocking of institutional and corporate funding, seeking to develop an aggregator structure with relevant back office analytical and distribution capability. Such a structure could be pursued by transforming British Patient Capital (BPC) into a joint-venture vehicle with the private sector. The Government would deploy further seed capital as necessary. Their role in this is to convene and catalyse, with the private sector crowding in around it. This could draw upon the Tibi Model that has been implemented in France, to encourage international funds to locate in the UK, and make it a requirement for these funds to have staff located in the UK to allocate the money they are deploying. Such anchoring of human capital here in the UK will help to create a critical mass of investment activity, and a wider halo effect within the scaleup economy as staff move between different funds and scaleup businesses.

It is vital that the UK analyst community have connections to, and understanding of, growth businesses and local economies. As noted by the BIA, the US currently has more extensive analyst coverage of growth companies while the UK lags behind. This includes dedicated and specialist sector and high growth teams which the UK should seek to emulate.

It is important for a pool of up and coming, diverse and regionally focused analysts to be fostered within the private sector, and bolstered by relationship teams focused upon the growth economy. Additional resources to enable the British Business Bank and British Patient Capital to connect and encourage this kind of resource could also help to address this market challenge.

It is also important to ensure that the UK is training the next generation of analysts and fund managers, and providing the right incentive framework for this new talent to be adopted within the UK investment community. This could include a specific incentive or credit (possibly Tax/R&D) for larger institutional funds to encourage them to bring in fresh talent with knowledge of the growth economy. Additional effort should also be taken to encourage wider finance modules to be accessible across multiple science degree programs: Ask UK universities to allow students in traditional Science, Technology, Engineering and Mathematics (STEM) degree programs to take a handful of business and finance courses offered by other departments or business schools. It is very easy for a US undergraduate majoring in biochemistry to take a course in finance or business.

Create Fellowship programs to accelerate development of talent: this could be based on the existing No 10 Innovation Fellowship program. For example, the Kaufmann fellowship provides an interesting model for helping individuals begin careers in the venture capital industry.

Greater uptake of the Chartered Financial Analyst qualification should also be encouraged so as to ensure that the right skillsets on how to build a balanced portfolio of growth companies are available to institutional investors over the medium and long term.

Connecting the role of development banks in backing VC investors to the Growth Economy with the burgeoning talent challenge could also be a powerful tool. This could include well structured internships for junior analysts into sector ‘hubs” and those entities that are backed by the British Business Bank, and wider efforts to facilitate the flow of talent and ideas between entities that already understand and actively invest in the growth economy, and institutional investment when this comes on-stream.

- Education for Investors

Education programmes should take account of particular growth sectors which face recognised knowledge challenges (such as Creative Industries; Life Sciences; clean tech; fintech etc) and also ensure there is a clear understanding of innovative high growth potential businesses overall.

It is essential to address this through structured education programmes at a regional and national level, backed by detailed information on the growth economy.

Working with UKBAA, the British Business Bank and IUK, the ScaleUp Institute has been involved in the development of an in-depth education programme on the Creative Industries for investors. This is responding to the identified gap in the investor base into the creative sector, and is designed to provide specific education to increase the pool of early stage and follow on investment into the creative industries and investor understanding of the sector overall.

This programme of education is based around a peer to peer learning model delivered via an online tutorial package with five modules, developed with edited video content, infographics and animations, taking investors through the key steps of the investment process and providing market knowledge, insights, and template documentation and checklists (e.g. for due diligence and legal considerations). This will enable investors to increase their understanding of the CIs and sub-sectors through listening to peers. The toolkit is backed by a programme of investor capacity building events, locally and nationally. The BIA has also recently developed an Investor Guide for Life Science.

These initiatives are applicable across the value chain, including institutional investors and trustees, and could be adapted to provide much needed information on other growth sectors and crucial information about the growth economy overall. Further adaptations could also be undertaken to provide training modules for analysts and others at later stages of the investment ladder.

- Education for Regional Managers, and Intermediaries

Intermediaries are key elements of the investor community, and will need up to date knowledge of the UK’s growth economy and the best finance on offer for scaleup businesses, and high growth ‘scaling’ businesses that they deal with.

In conjunction with the British Business Bank, SUI and its partners have delivered a series of seminars and wider education sessions focused upon this aspect of the finance ecosystem to more than 400 investors, advisors and ecosystem players. These have the goal of improving knowledge of growth companies and finance at this key connection point between the supply and deployment of capital and the demand for it amongst companies that are ready to grow.

We believe it will be important for this kind of education to become a standard part of ongoing CPD requirements for regional managers and their teams in banks, and amongst other trusted advisory professions as part of ensuring the right knowledge and expertise is available to deploy increased levels of equity and growth capital to best effect at a regional level.

- Developing a Dedicated High Growth / Scaleup Team to engage with scaleup businesses

It is proven in the private sector and in the public sector such as Denmark that having a dedicated High Growth (Scaleup) Team across an entity be it a bank, institutional investor, or public sector makes a tangible impact on engagement and connectivity to scaleup businesses. The Government could follow this model more, as well as others in the private sector. Examples in the private sector of such a model are; Barclays Bank High Growth team, the LSEG’s Main Market High Growth Segment, and the manner in which the BGF was set up.

INNOVATION

Scaleup businesses continue to be highly innovative – 75% have invested in Innovation and R&D. They also cite Innovate UK as the number one Government agency from which they seek support.

The commitment in the Autumn Budget 2021 of a significant increase in core Innovate UK programmes, reaching £1 billion per by 2024-25 (doubling core IUK expenditure since the start of this parliament), is therefore very welcome.

The budget document notes that every pound the government spends on R&D stimulates, on average, around £2 of private investment. Firms participating in UK Research and Innovation funded projects have been shown to grow employment and sales around 25% faster over six years than comparable firms. This is strongly in line with broader scaleup business outcomes and suggests that across all UKRI projects, scaleup businesses are driving substantial returns on this investment.

The Government’s Innovation Strategy further emphasises the importance of this area, setting a welcome mandate for joint work between Innovate UK and the British Business Bank on an Innovation Hub to connect up sources of information on funding available from both entities, and help demystify the process of application for scaleup businesses. In implementing this, learnings from the British Business Bank Finance Hub which has had proven impact should be an important part of its development. Investors seeking better referrals have suggested that they would welcome Government catalysing such a hub particularly as a ‘platform-based’ solution which can use private sector expertise, and this could prove a useful part of that solution. We welcome this progress and will continue to work with both parties and the Government as this is realised.

There have also been substantial announcements on improvements to the R&D Tax Credit scheme, including the inclusion of cloud and data services within it. In implementing these changes it will be important to ensure that scaleups have access to R&D experts, including trusted experts in the R&D tax credit system, embedded in locally-rooted hubs and emerging clusters across the whole of the UK to improve uptake of the scheme.

IN SUMMARY

Finance is an essential part of scaling up, and in a time of global uncertainty it is right for the Government to take substantial action to ensure that companies have access to the right capital to enable their growth. We are very pleased with the clear and concerted effort which is being undertaken by the Government in this area, and we note that the majority of our Growth Capital Report recommendations have now been put into effect. As the UK continues to chart a forward path to economic recovery, it is essential for appropriate growth capital to be factored into this. We believe that aggregation vehicles – potentially built around a public / private sector model – are a key part of enabling substantial capital to be deployed, once regulatory barriers and other factors have been overcome.

Alongside these efforts, the flagged replacements for EU Structural funds through the Shared Prosperity Fund and the Levelling Up fund are an important part of the finance landscape, as are the newly expanded British Business Bank regional funds. As these are deployed it is critical that local infrastructure and existing programmes with impact for scaleups are not lost in this changeover. Once fully deployed, it will be important for these initiatives to be given appropriate longevity, and be flexible to the needs of scaleup businesses to ensure that they can continue delivering for the businesses that will be best placed to create jobs, export and boost regional economies across the UK.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Previous

Previous

Share