Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Access to Markets

The importance of access to markets, at home and abroad, continues to rise.

For the first time, access to UK markets has overtaken access to talent as the most vital or very important factor for future growth and it is clear more needs to be done to meet the aspirations of our scaling firms.

Domestic Markets

Large corporates and government play an important role in the scaleup ecosystem. Scaleups want to forge more partnerships with government and large corporates yet insufficient traction and/or options occur at present.

- More than half of scaleups sell to large corporates in the UK (53%), demonstrating the importance of the links between scaleups and larger companies. Only 28% of scaleups have collaborated with large corporates in the past three years to develop a new product or service.

- One in four scaleups are part of a supply chain to large corporates in the UK, while 40% have aspirations to sell to large corporates in the future.

- One in ten scaleups sell directly to the UK Government or have collaborated with government, while one in five scaleups sell to local or regional government (20%). Three out of ten scaleups have aspirations to sell to government in the future.

Facilitating greater collaboration is a vital part in fostering a more dynamic and innovative scaleup ecosystem.

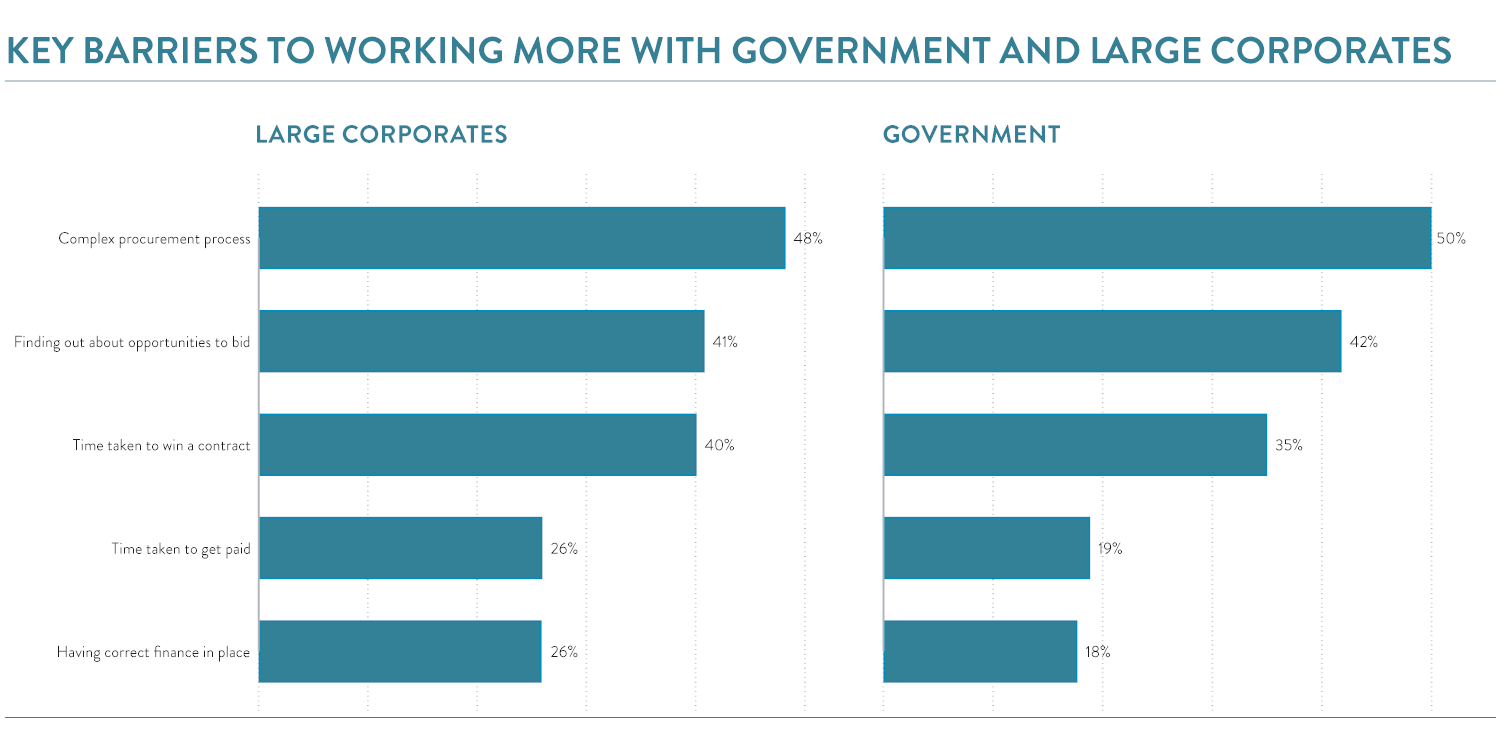

The complexity of the procurement process, the difficulty of finding out about opportunities to bid, and the time it takes to win a contract are seen as the most significant barriers to further work with government and large corporates.

Increasing the efficiency of the procurement process and using scaleup data to identify high-growth businesses would help to reduce these barriers and further strengthen the scaleup ecosystem.

International Trade

As a concern for scaleup leaders, gaining access to international markets continues to be a key issue.

Of respondents to the scaleup survey:

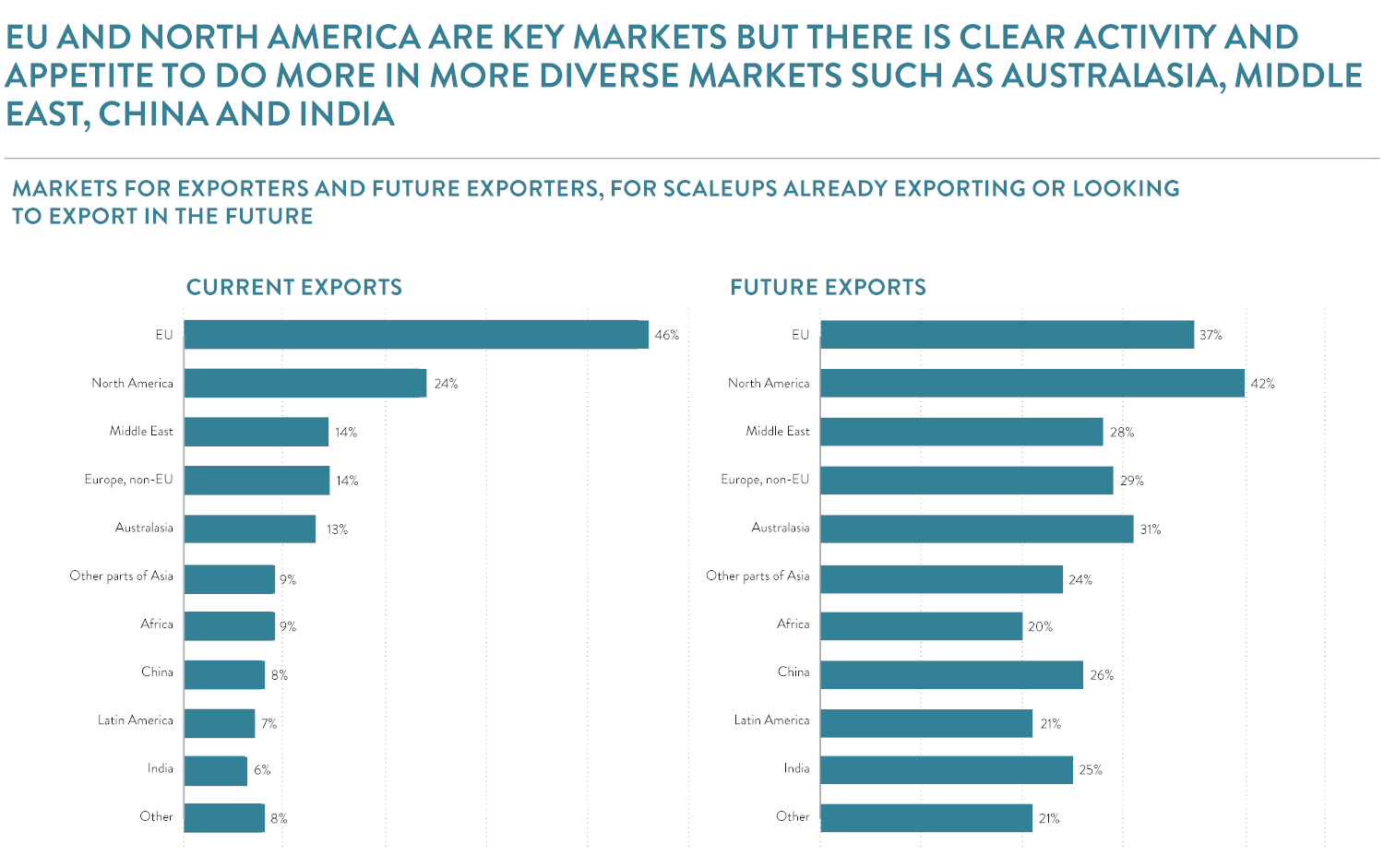

- 53% export – 46% to the EU and 32% outside the EU.

- The EU is currently by far the most important international market for scaleups.

- There is a growing appetite to expand more aggressively into many other markets, notably North America, Australasia, Middle East, China and India.

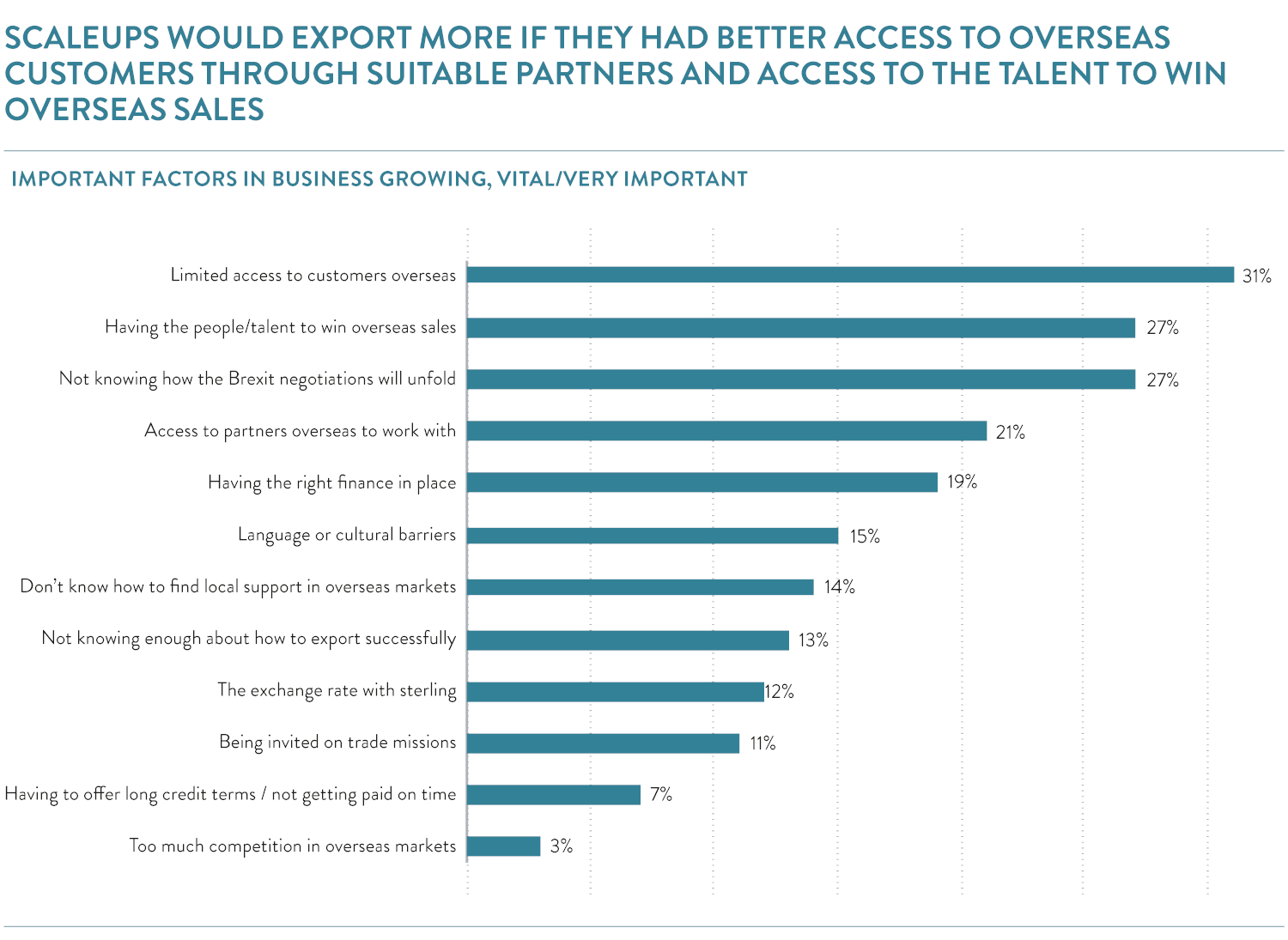

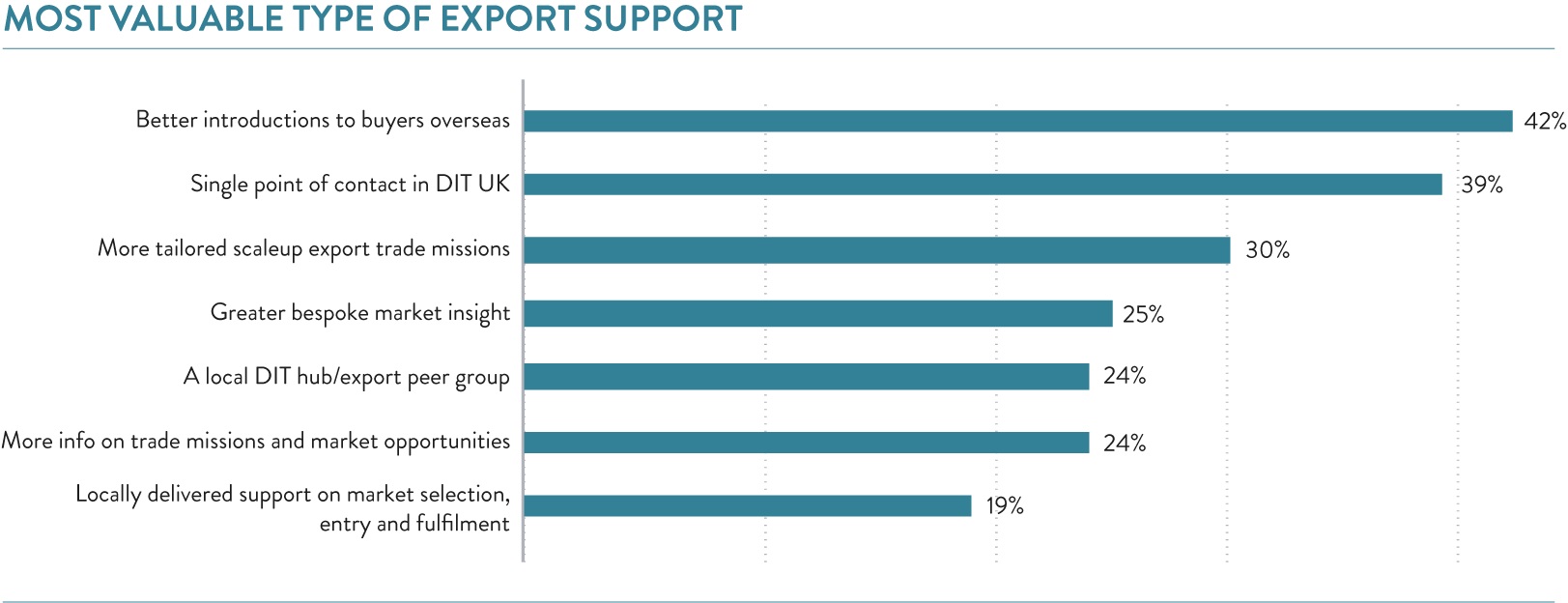

Scaleup leaders face a variety of challenges as they develop their international business, citing limited access to overseas customers (31%), lack of talent to make overseas sales (27%) and uncertainty over Brexit (27%) as the biggest barriers to exporting more. Many also struggle with finding overseas partners: 42% of scaleups who are already exporting would like better introductions to buyers in overseas markets, either from DIT or from their existing corporate customers.

Breaking down the barriers to exporting

Exporting is one of the prime enablers of scaling, so it is vital to reduce these barriers to export. Looking at what would help these scaleups export more, two-fifths of scaleups (42%) wanted better introductions to buyers overseas (either from the public sector or corporates/ financiers) and a single point of contact with the Department for International Trade (DIT) in the UK (39%).

Page URL: https://www.scaleupinstitute.org.uk/articles/access-to-markets/

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share