Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Access to Growth Capital

Appropriate finance and growth capital are central elements within the scaling journey of a business. Access to finance has consistently been one of the top five challenges to scaling since 2014, and it is a key indicator of scaleup growth at a local level1.

In 2020, with the impacts of an unexpected pandemic under way, the need for access to relevant growth capital for scaleups has been brought into sharp focus. For the first time our scaleup community is ranking Access to Finance as an equal priority to Access to Talent.

Whilst this is partly a reflection of the current, acute, cyclical challenges present in both the UK and global marketplace – specifically the tightening of liquidity due to Covid-19 – this indication of importance also reflects the deeper structural challenges that continue to persist in the UK, in regard to access to patient institutional funds as well as regional and sector disparities.

As our 2020 ScaleUp Survey reflects scaleups remain resilient and are hungry to grow – in spite of the pandemic. The majority of scaleups are still planning to grow in 2021 and half are expecting to scale again (at 20%+ growth) with a further quarter planning to grow at more than 50%. These sentiments are reinforced in our latest ScaleUp Sentiment Tracker, based on analysis of the SME Finance Monitor, which reflects that scaleups use external finance more than other SMEs, and that demand is dialling up in the current climate.

Throughout the pandemic scaleups of all forms have made use of the various Covid-19 financial support packages, from Loans to Innovation grants, the Future Fund to the Furlough scheme. This shows the diversity of scaleups’ size, scale and needs and the importance of the interventions being made. These interventions have allowed the businesses to keep operating and, importantly, to keep growing.

Scaleups are increasingly turning their attention to 2021 and beyond. Significantly 5 in 10 are using some form of equity finance, or plan to use it in the near future. Angels and VCs are key sources of equity provision – BGF was the top investor to visible scaleups by number of investments with 124 deals between 2011 and 2020. The top investor by value was the Softbank Vision Fund which invested £1.8 billion across four deals over the same period. This highlights the importance of these asset classes in the escalator of finance to enabling scaleup success.

However, 4 in 10 scaleups are clear they do not currently have sufficient capital to meet their growth ambitions and a similar number perceive that funding access resides mainly in London and the South East.

It is important to recognise that within these numbers there are also wider sectoral and diversity challenges that have been exacerbated by the current circumstances. In particular, many businesses that are pre-profit or that have invested heavily in innovation, such as some life sciences firms, were not initially eligible for Government Covid-19 measures such as loan facilities or the Future Fund due the interpretation of ‘undertaking in difficulty’ guidelines. Whilst these have now been relaxed for some businesses2, these issues continue to impact larger firms. In a market environment where liquidity is strained it is important to ensure that highly innovative firms are not forced to look elsewhere.

If scaleups are unable to access the right finance for them their growth may stall, or they may look to move their assets, staff and production overseas to find the patient capital that they need. This can destabilise the whole value chain of growth from seed stage, right the way through to IPO.

It means also that we must take action to close the growth capital gap across all asset classes (Angel, Venture Debt, Venture Capital), geographies and sectors – there is no one silver bullet.

That is why in August of this year the ScaleUp Institute refreshed our prior analysis undertaken, working with Innovate Finance, Deloitte3 and industry, and published the Future of Growth Capital report. This report highlights that the current Covid-19 crisis has doubled the UK’s long standing patient capital gap to £15bn annually with a large proportion of the unfunded opportunities residing outside of London.

It also emphasises that the current crisis and associated liquidity constraints have exacerbated the four structural challenges that have persisted within the UK for some time, namely: i) An uncoordinated approach that has created regulatory and policy barriers that impede the flow of funds; ii) A lack of capacity and depth in the regions beyond London and the South East to deliver growth funding – across asset classes; iii) Lack of scale and depth in follow-on funding due to limitations in current range of funding mechanisms, including a lack of venture debt and a nascent Angel market outside of London and the South East, and ; iv) Information, collaboration and connectivity asymmetries limiting the use of external capital to realise full growth potential.

This widening growth capital gap is now pressing and the structural challenges outlined above must be addressed to avoid the risk of a lost generation of innovative businesses unable to access the right capital to continue to scale and go global, at a time where growth is more crucial than ever.

The fundamentals of growth are the same fundamentals needed for recovery. Mitigating the risk of economic scarring by focusing upon scaleup businesses should be at the heart of UK plans for our post pandemic economy. This means, in the finance ecosystem, building upon what works now – specifically core institutions such as the British Business Bank and Innovate UK so that they are embedded for the long term; working to unlock the institutional funding needed to help meet the needs of UK growth companies (across pension, insurance and corporate funds); and increasing education between investors, analysts and scaleup sectors and between investors and scaleups, including building local regional investment capacity.

Finance is a central ingredient to growth, but – as we highlighted in our Future of Growth Capital report – this does not necessarily mean more Government money. It does mean ensuring that regulatory policy is aligned to growth, and that Government uses its convening power to unlock private sector capital at a time when significant uncertainty and risk is permeating global markets.

In this light, and aligned with the Future of Growth Capital recommendations, it is positive that the Government has signalled its intent to launch a Long-Term Asset Fund within the next year to aid in the investment of illiquid and unquoted assets and encourage pension funds to deploy capital towards country’s economic recovery4. It is also positive that the Chancellor clearly signalled ambition to set up new vehicles, including a new Sovereign Green Bond5, to establish the UK as a destination for green investment and to establish a Listings Taskforce, which should also recognise the value chain behind achieving changes. These are in line with the recommendations that we made as part of the Future of Growth Capital report, and we will monitor the way that this is deployed with interest.

Whilst these moves are positive, it is also essential to realise that there is no single silver bullet on finance. Initiatives must be designed to work in concert and at scale if we are to close the gap. Further, in an environment defined by uncertainty, initiatives to unlock institutional capital need to be actively driven with clear direction provided by government to achieve outcomes that can support UK businesses to scale. These must also take account of, and seek to rectify, existing information asymmetries, diversity barriers and regional disparities.

As noted in Recommendation 4 of this report, developing regional and place specific scaleup ecosystems will be a key part of addressing these issues and should include the deployment of further resources to Innovate UK and the British Business Bank. This also presents an important opportunity to further develop scaleup clusters around promising technologies and sectors in particular localities, such as in Manchester, Bristol and Edinburgh.

THE INVESTMENT ENVIRONMENT

The Covid-19 pandemic has placed severe pressure upon existing fault lines in the UK investor ecosystem. As liquidity and wealth capacity tightens in line with global market impacts, investor engagement in innovating pre-revenue and R&D intensive firms in the UK has changed. Angels and VCs are focusing on ensuring they have capacity available to provide additional working capital or follow on money for companies already in their portfolio, placing funding pressure on earlier stage scaling firms and smaller quoted companies.

There have been some significant raises on the public markets – such as The Hut Group (THG)6 – but it is important to ensure that the entire value chain from seed through to IPO is well protected to ensure that the UK is able to develop a clear pipeline of companies capable of going global.

The Angel community has already estimated a gap of £200 million in unmet investment demand in the first two quarters of 2020 and the latest data, identified that over 50% of business angels cited a negative impact on their level of investments and the value of initial and follow on investment having fallen by 41% during 2020 and follow-on investments by 34%7. There are also indications that the number of new VCT deals is down across the year.

The number of seed-stage deals in Q3 dropped 20% from Q2 2020 and 6% from Q3 2019. Just £128 million was invested into seed-stage businesses, the lowest amount since Q3 2017. Perhaps most concerning is that first-time fundraising fell to a new low with just 87 first-time raises completed between July and September. This is a 59% decline from a high of 214 in Q2 2014. First time rounds represented just 22% of all investment in Q3, compared with 31% in Q3 20198.

The importance of the Enterprise Investment Scheme (EIS) and Venture Capital Trusts are consistently identified by many scaleups as a cornerstone of early stage growth capital and follow-on funding with much of the use from angel and VC investors. Changes to such schemes are costly and cause confusion; at a time of challenge, stability in policy measures is important as is the consideration of how proven routes of funding can be used even more strongly to ensure that funding is available.

As noted in our ScaleUp Index, a majority of the investment firms supporting scaleups are backed by Government entities – with 29 backed by the British Business Bank and/or its devolved equivalents of the Scottish Investment Bank (SIB), Development Bank of Wales and Invest NI. This also includes the important geographically located funds of the Northern Powerhouse, the Midlands Engine and the Cornwall and Isles of Scilly Investment Funds – signifying the importance of locally rooted sources of capital.

EUROPE AND THE INTERNATIONAL PERSPECTIVE

Analysis from the British Business Bank shows that significant amounts of regional equity funds are backed by EU money: the largest single investor class in the UK from 2010 – February 2019 was the European Investment Fund (EIF) (23%). It is important that money has been identified to fill any potential EIF shortfalls here for 2018/2021. The EIF has been an important provider of growth capital in the UK market and any gaps created by its absence will need ongoing assessment to ensure the finance ecosystem is able to meet the needs of businesses with scaleup ambitions. This is particularly so at the regional level where European funds have been heavily used. It will be important to maintain existing regional funds present now backed by British Business Bank and an assessment should be undertaken on where else these may be needed, something that will also need to be factored into the future work on a Shared Prosperity Fund, and future Comprehensive Spending Review.

Additionally, the joint initiative between the EIB and the European Commission has provided vital pools of capital and research collaboration for life science businesses and other innovative sectors under the Horizon 2020 and COSME programmes. As matters evolve and the UK relationship with the EU is clarified at the end of this year, the impact of changes for UK innovative businesses will need to be recognised within wider growth capital considerations and the implementation of the R&D Roadmap.

As we look beyond Europe, we should continue to ensure we are an attractive economy for overseas investors to engage and for international scaleups to reside. As a consequence we should make sure we are promoting our capability, and take learnings from others such as the French Tech Mission, KfW and the US Small Business Administration.

SECTOR INVESTMENT PERSPECTIVE

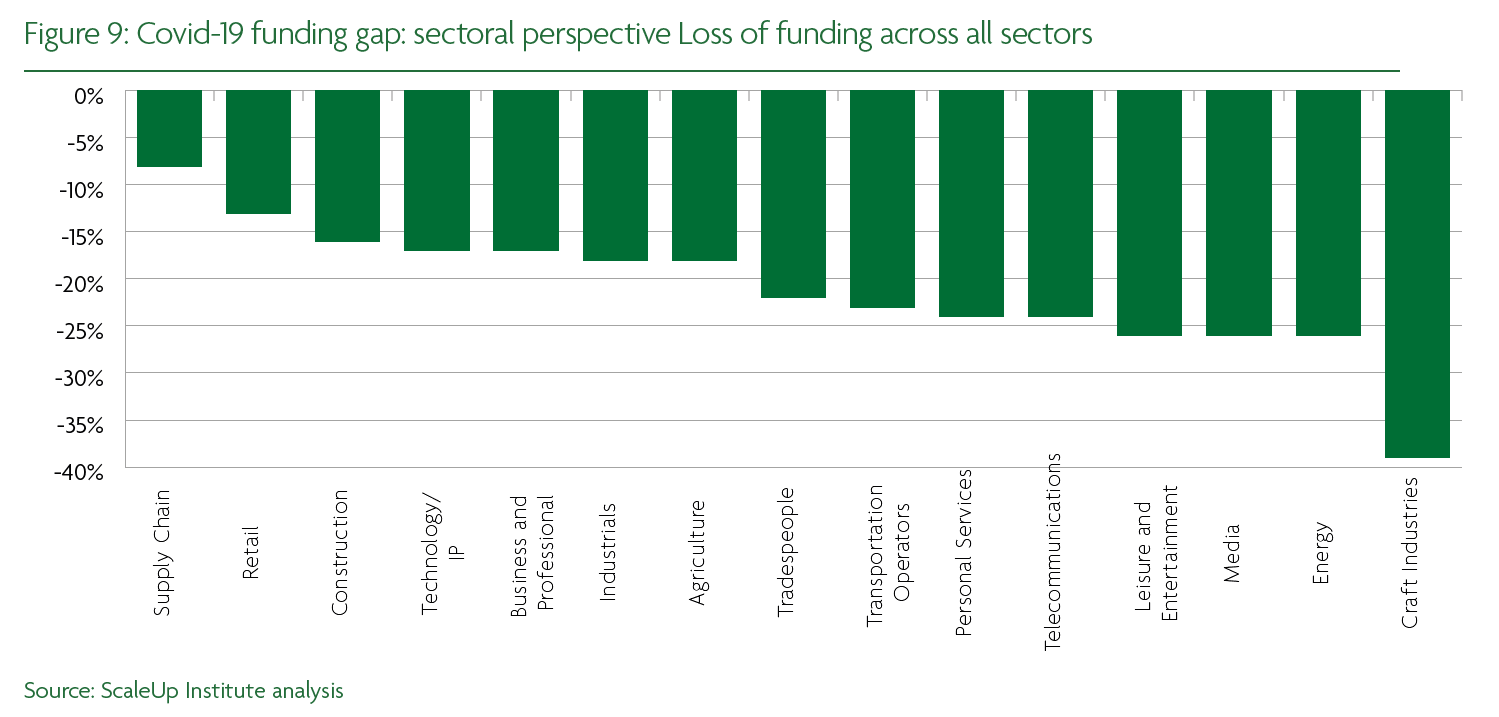

Whilst growth sectors have had investment as noted in the chart below, it is significantly down year on year with some hit harder than others. In practical terms the impact of Covid-19 on investment has varied significantly across sectors. Creative sector businesses and hospitality businesses have been significantly impacted. However, there has been a more mixed picture in other sectors such as Life Sciences. The counter-cyclical nature of the sector and biomedical interest of the pandemic has attracted some of the capital that has been pulled away from other sectors such as leisure and retail, which have been more impacted by the short-term disruption. This means that some established life-science companies – especially those with Covid-19 products in development – have attracted record sums of public and private capital, but this masks a wider challenge for the sector in seed and early-stage investment with, seed funding dropping from £11m in Q1 2020 to £2m in Q2 2020, and Series A investment down from £49m to £9m over the same period9.

The social business sector represents an increasingly important sector of the UK economy and it is one of the fastest growing investment opportunities. However it is also a sector in which access to finance was already seen as a greater challenge before the Covid-19 crisis. The social investment market is currently estimated to be worth approximately £3.5 billion and has been growing at around 17% per annum. The effects of Covid and the UK’s exit from the European Union are yet to be seen. However, in order for this market to reach its full potential all members of the investment community, including the traditional players, must think harder about how to reach out more effectively to social scaleups and to enable greater levels of investment. Many more investors are looking at social impact as a core consideration for their investment decision following the pandemic.

REGIONAL DISPARITIES

As highlighted previously and in the Future of Growth Capital report, regional disparities continue to persist, with attitudes and perceptions of the availability of finance also differing by region.

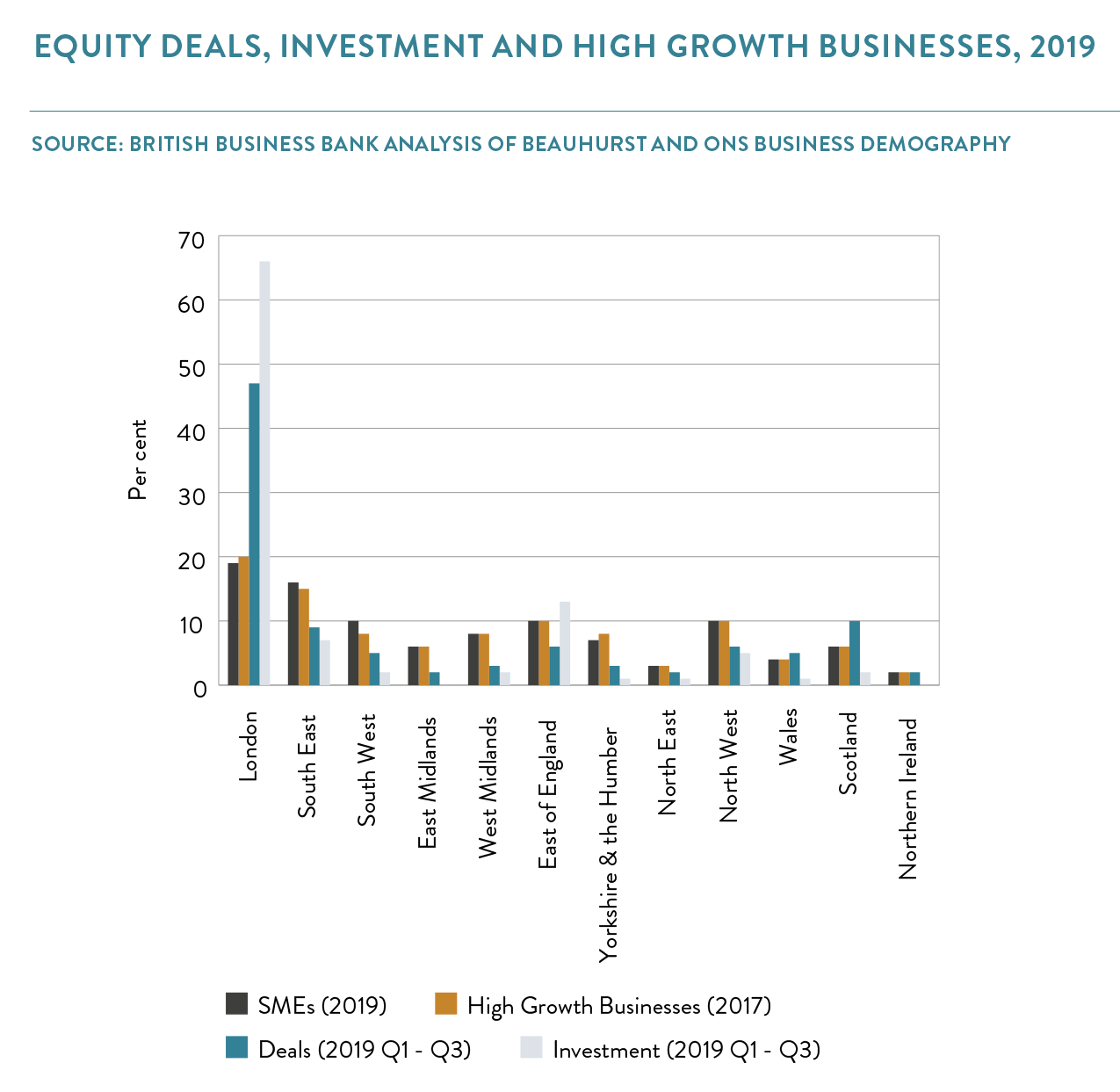

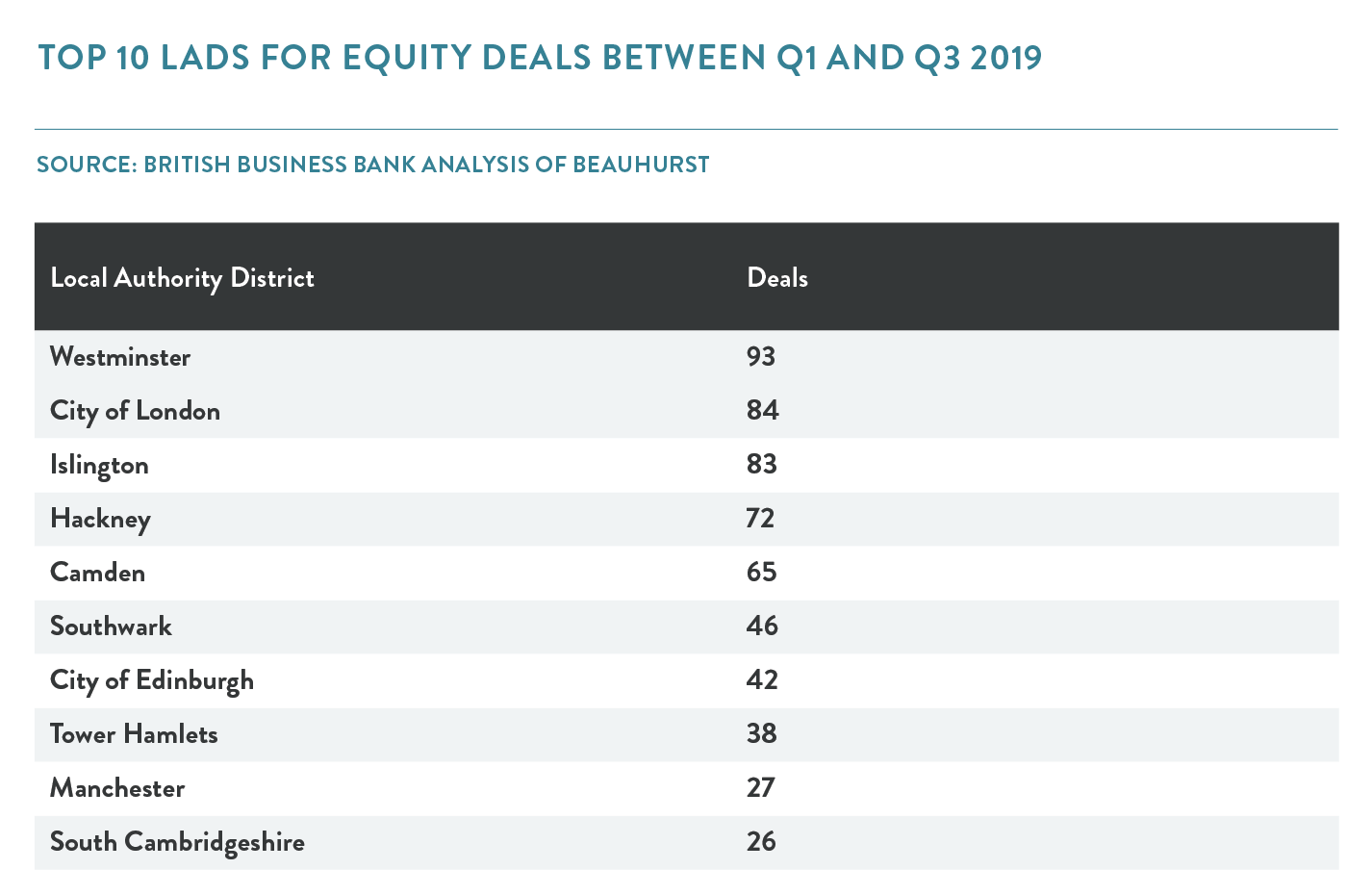

While pre-Covid there was a steady year-on-year increase in the number of deals both in London (4%) and outside of London (5%), the value of deals within London increased significantly (37% year on year to 2019) compared to areas outside of London (6% year on year)10. There has been a significant an increasing amount of equity available outside of London but London’s shares of deals and investment still outstrip its share of scaleup businesses. Looking at more granular pre-Covid data, it is notable that 7 of the top 10 Local Authority Districts are within London, with Edinburgh, Manchester and South Cambridgeshire also making the top 10.

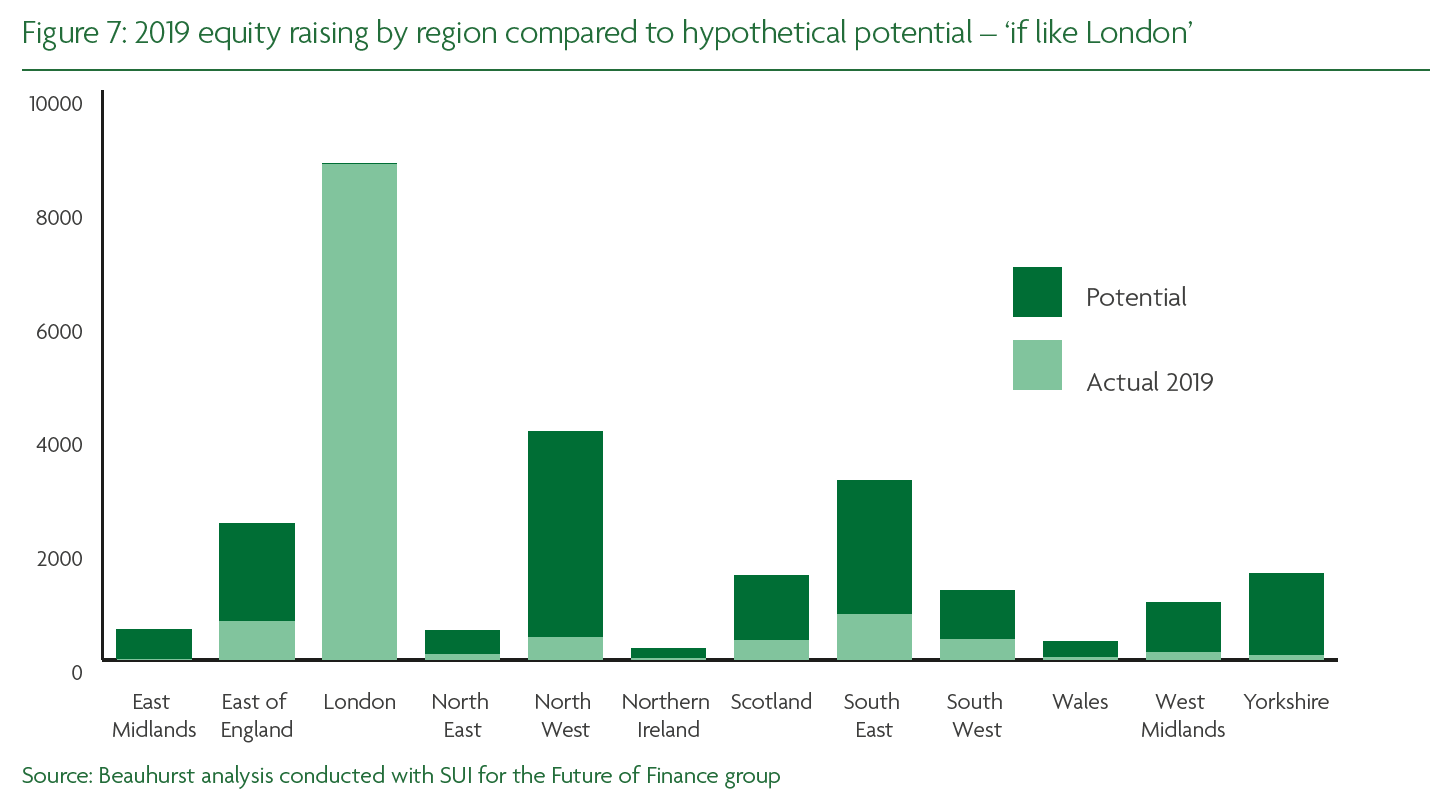

In our Future of Growth Capital report published in August, we highlighted the latent potential in many areas of the UK.

Approximately 25% of funding opportunities in London are matched annually by equity raising. The above chart uses this as a baseline to show the potential that could be met in other areas of the UK if sufficient equity were to be released in those areas.

We know from our detailed analysis of angel ecosystems across the UK, that there are substantial differences in the depth of capital available at different stages of the value chain, including individual Angel groups on a regional basis. The recent British Business Bank and UK Business Angel Market Report identified that 56% of angels are based in London and the South East and over half of all UK angel investment. In Cambridge one syndicate alone undertakes £30m investments annually, whereas in analysis we have undertaken with UKBAA in Greater Manchester, West Midlands and West of England, across 20 angel networks in these areas a combined total of circa £29m is deployed. This evidences the nascence of the market outside of the Golden Triangle and London, with this equalling more than the total investment of multiple groups in other regions.

As we have highlighted elsewhere, a whole ecosystem approach with integrated engagement between programmes tackling talent, markets and infrastructure helps to increase understanding and uptake of finance. This is further emphasised by the British Business Bank in both its Small Business Finance Markets report, which explicitly recognises the importance of strengthening regional ecosystems to address imbalances. In separate research, the British Business Bank also suggests that the range of business support options available in London is part of the reason for ongoing strong demand for equity: firms outside of London and the South East are more likely to highlight difficulties in putting together the business value proposition (50% compared to 40% in London and the South East) and a lack of suitable investors in their local area (46% compared to 30% in London and the South East)11. This highlights the need to continue focussed efforts, such as with the Creative ScaleUp Pilot Programme (see the separate Insight article) to increase investment capacity building and investment readiness in the regions, particularly when this is overlaid with sector and diversity challenges.

THE VALUE OF UNLOCKING INSTITUTIONAL FUNDS TO SUPPORT PATIENT GROWTH CAPITAL

When we review our international counterparts, we note several factors among those who are ahead of us in the scaleup league table – long term, at scale, government entities to work with the private sector; easier access to institutional funds as exemplified in Australia and notably Canada; and often a sovereign wealth fund.

The conundrum for the UK of – how we unlock our institutional money in a way that can work across the finance ecosystem whether co-investing with Angels, VCs or growth funds, or directly into scaling businesses – is not a new one. It has been explored in multiple reviews including most recently the Government’s Patient Capital Review, supported by input from the Buffini Report in 2017 .The recommendations at that time remain as valid now as then – and are further updated this year in both our joint Future of Growth Capital report and in the BGF report From survive to thrive12.

As highlighted in both these recent reports, which garnered extensive cross-industry input, it is now imperative that we move forward at pace to:

- adjust the regulatory and legislative barriers that are impeding the release of such capital,

- alongside working closely with the industry to develop models for analysis, aggregation and deployment. These models must support ‘cultural anomalies’ and include the right sector and scaleup knowledge to address analytics asymmetries that hinder the risk appetite of some of these entities to invest in perceived illiquid assets.

A key source of potential funding is from private pension funds, including both defined contribution (DC) and defined benefit (DB) occupational schemes, as well as retail investors and insurers. Total pension wealth in the UK was estimated by the ONS to be in excess of £6 trillion during the April 2016 to March 2018 period, and is one of the largest components of UK financial wealth. The yearly contribution to close the scaleup growth capital gap, as outlined in our analysis for the Future of Growth Capital report, is a very small fraction of this standing at 0.5% percent of assets under management13.

It is again encouraging that, aligned to our August recommendations, the Government is now looking at Solvency II through detailed consultation which itself recognises the importance of Patient Capital, and the potential to harmonise the interests of insurers looking at longer term investments, with the Government’s own goals of supporting growth. It is also positive that the Bank of England, who were engaged with our review, also has a mandate to look at barriers to productive finance ensuring that companies are able to achieve scale as set out in their latest Financial Stability Report14. Since the Future of Growth Capital report launch we have been able to participate in further structured dialogue on what we need to do to take matters forward which likely needs further collective action – such as through a Taskforce Implementation Group, which we believe is now needed. Such a group can also assess the role of British Patient Capital and Equity Growth Funds.

The ScaleUp Institute has also had the opportunity to participate in the FinTech Strategic Review and supports the recommendations it is putting forward which will both support that sector and others.

Unlocking institutional money should also be coupled with the development of a strong regional framework which works hand in glove with ecosystem players. It is vital for this to in-source relevant expertise of scaleups, of local areas, and of the diverse sectors that make up the UK scaleup economy, as well as building an effective culture to ensure that capital can be effectively deployed.

Recognising the deep pool of capital available through the UK’s capital markets, there must be a continued encouragement of scaleups to recognise the merit of an IPO – whether on AIM or the main market – and we hope that through the Listings Taskforce areas that currently present barriers compared to our international counterparts can be addressed e.g. free float and dual class shares.

INNOVATION

Scaleup businesses continue to be highly innovative, even in the current highly unstable market conditions that they face, with scaleups citing Innovation (followed by job creation) as the top reason by both volume and amount for raising money in the first half of this year. This is further evidenced by the results of our 2020 Survey.

We know that the Innovate UK challenge “business-led innovation in response to global disruption” which was launched in April in response to Covid-19 was one of the most oversubscribed challenges that they have run.

With this in mind, it is therefore less surprising that Innovate UK is seen as a ‘kite mark’ by angel investors looking at earlier stage growth firms. This is further evidenced in our latest ScaleUp Index which shows that 1,262 grants were made by Innovate UK to visible scaleups, with £286m leveraging a further £5.21 billion from the private sector.

With its proven leverage of private sector funding, as we move forward this finance support from IUK across its Investor Partnerships and grant activities will be key to continue and develop at scale if we are to achieve our global scaleup ambitions.

DIVERSITY

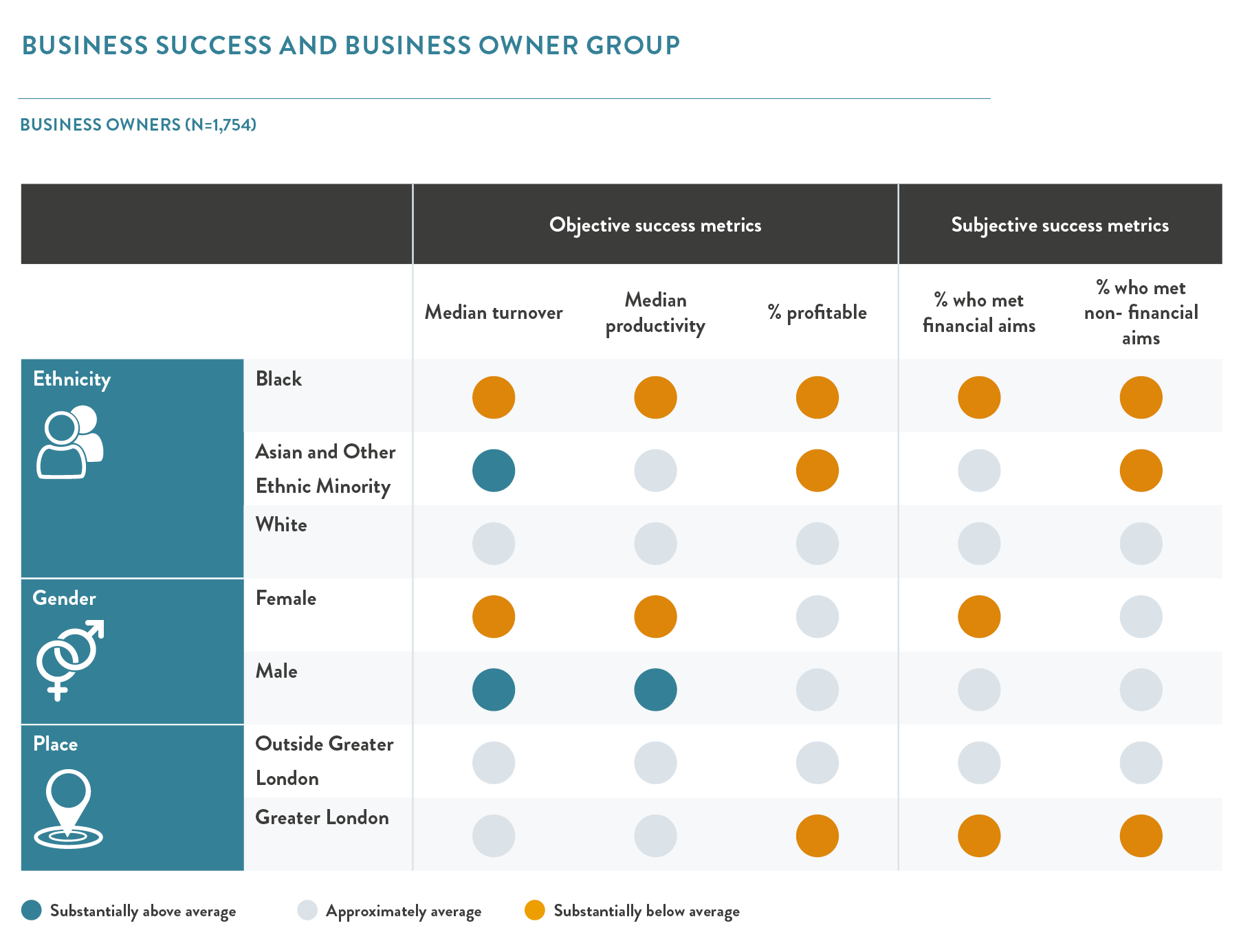

In seeking to tackle the UK’s Growth Capital challenge, and ensure that scaleup businesses are able to accessing the finance they need to continue their growth, it is also vital to ensure that these outcomes are equally available to entrepreneurs regardless of gender or ethnicity. On average, UK entrepreneurs that are white and male are more likely to be successful than women or Black, Asian or Other Ethnic Minority Entrepreneurs. It is essential for efforts to be made to increase the number of diverse founders that are able scale their businesses. This must include a recognition of additional steps that should be taken by institutions to avoid unintentional or unconscious bias, and to avoid reliance on existing well-trodden networks to disseminate advice rather than working to engage with broader communities. This should also be true of new and emerging initiatives.

The recent Alone Together Report15 shows the substantially different outcomes that different groups achieve.

Further, the Rose Review in 2019, and wider research by the British Business Bank, showed that all female founder teams get less than 1% of venture capital (VC) funding, and mixed teams getting only 10%18. This suggests that the UK economy is also missing out on a huge pool of talent, and inspiring future female and BAME founders and therefore an extensive missed opportunity for innovation and job creation. However, it is positive that we have seen the number of female founded businesses in our visible scaleup index double this year. The new Investing in Women Code will enable access to new data on the level of investment in women founders and encourage best practice approaches. A significant number of Angel groups, VCs and banks have now signed the code.

INFORMATION ASYMMETRY

Whilst scaling businesses are much higher users of equity and finance than their SME counterparts, reservations about the use of equity finance do persist. Perceptions of complexity and/or unsuitability and fears of having to “give up control” remain – all are still cited as reasons for not progressing such a finance option. Increasing the provision of education about growth capital and myth-busting common misconceptions is vital in order to ensure that scaleup leaders are fully aware of all the available finance options as they make choices about their growth. Financial providers working more closely with local communities are necessary in order to provide tailored solutions for scaleups where they are based.

In recent work that the ScaleUp Institute has conducted with UKBAA and the British Business Bank network teams in regional roundtables, the following information asymmetry themes have consistently been raised as needing resolution.

IN SUMMARY

Finance has always been a key part of a scaleup journey, however, with substantial and ongoing market shocks occurring domestically and internationally, liquidity is strained. As the UK charts a forward looking economic recovery plan, it is essential for appropriate growth capital to be factored in to this.

This means concerted action from government to work with the private sector and unlock institutional funding. It also means that Government must carefully catalogue and replace the elements of EU money that currently cornerstone equity funding across UK regions. Further, core institutions such as the British Business Bank and Innovate UK who are each front line agencies for scaleup businesses, need clear longevity as part of this process to ensure that they are able to continue delivering for the businesses that will be best placed to create jobs, export and boost regional economies across the UK.

2020 RECOMMENDATION:

10. CLOSE THE GROWTH CAPITAL GAP

Government should use its convening power to work with the private sector through a ‘Taskforce Implementation Group’ to accelerate the unlocking of institutional (pension and insurance) funds and corporate funding to address the widening growth capital gaps across the funding ecosystem from angel to IPO. This should include progressing amendments to legislation; removal of regulatory barriers; and addressing information, knowledge and regional asymmetries, to enable the crowding in of existing significant private sector capital. The Government should expand and build upon the British Business Bank by strengthening the regional presence with empowered decision making deployed under a national framework, and continue the developments of its products along with Scottish Investment Bank (SIB), Development Bank of Wales and Invest NI. The role and scale of Innovate UK and its direct deployment of innovation capital to our most innovative, early stage and scaling businesses should also continue and be expanded. No gap in scaleup support provision should be allowed to arise in light of the UK’s changing relationship with the EU. Growth finance should be included as core curriculum in all local scaleup leadership programmes enabling them to seek out and secure the most appropriate funding at each stage of their company’s growth.

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share