Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Scaleup Survey 2020

This report focuses on the views of 645 scaleup leaders. Scaleups are a key engine for growth in the UK economy: the scaleups in our survey generated on average £261,000 of revenue per employee.

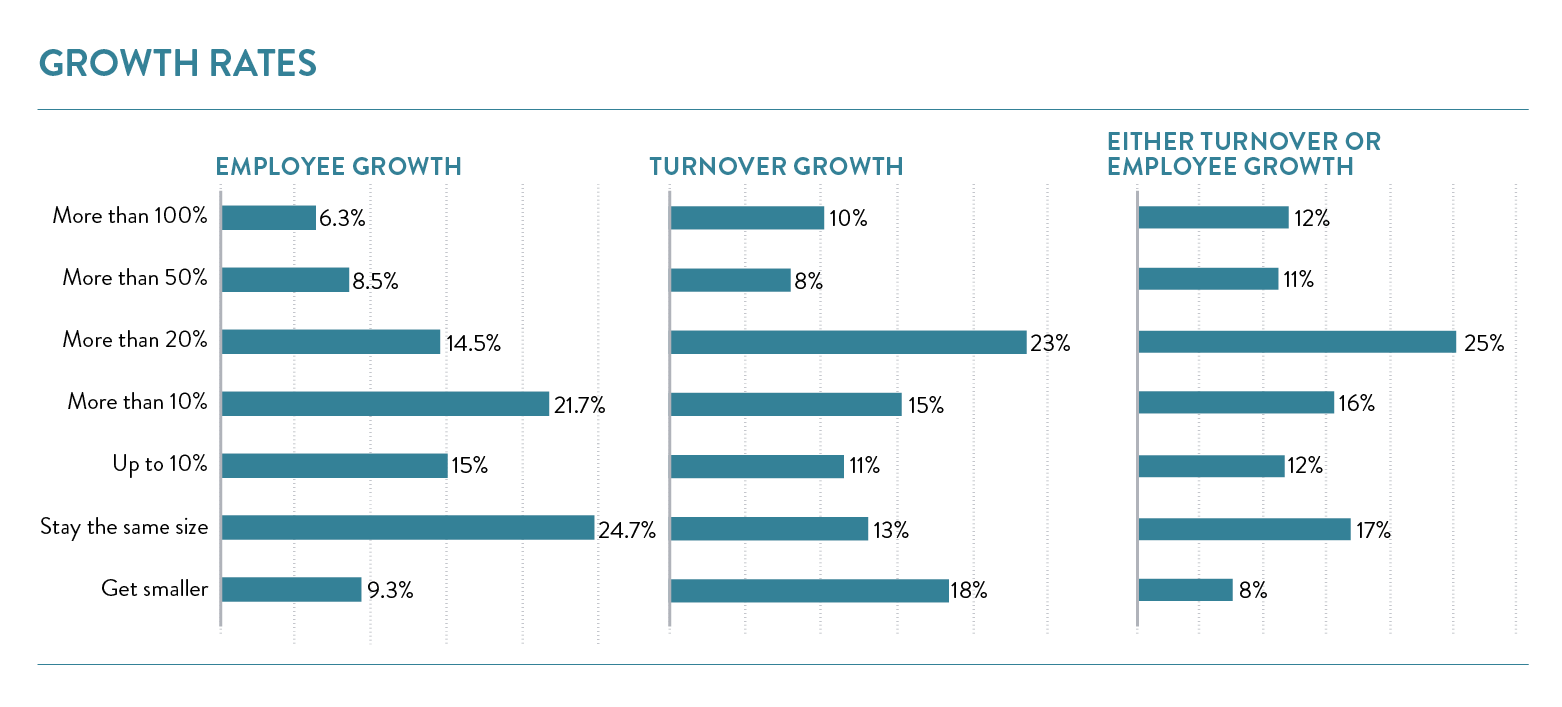

They are ambitious businesses: despite the unprecedented challenges experienced by many in 2020 8 out of 10 expect some form of growth next year, with 5 in 10 scaleups expecting to scale again beyond 20% and 1 in 4 expecting growth over 50%.

When it comes to their turnover, 7 in 10 expect to grow next year with 4 in 10 expect to grow by over 20% or more. Two thirds expect to grow their employee headcount with one third expecting scaleup growth. Recent estimates in the wider SME population have shown that growth is only expected by 2 in 10 SMEs.1

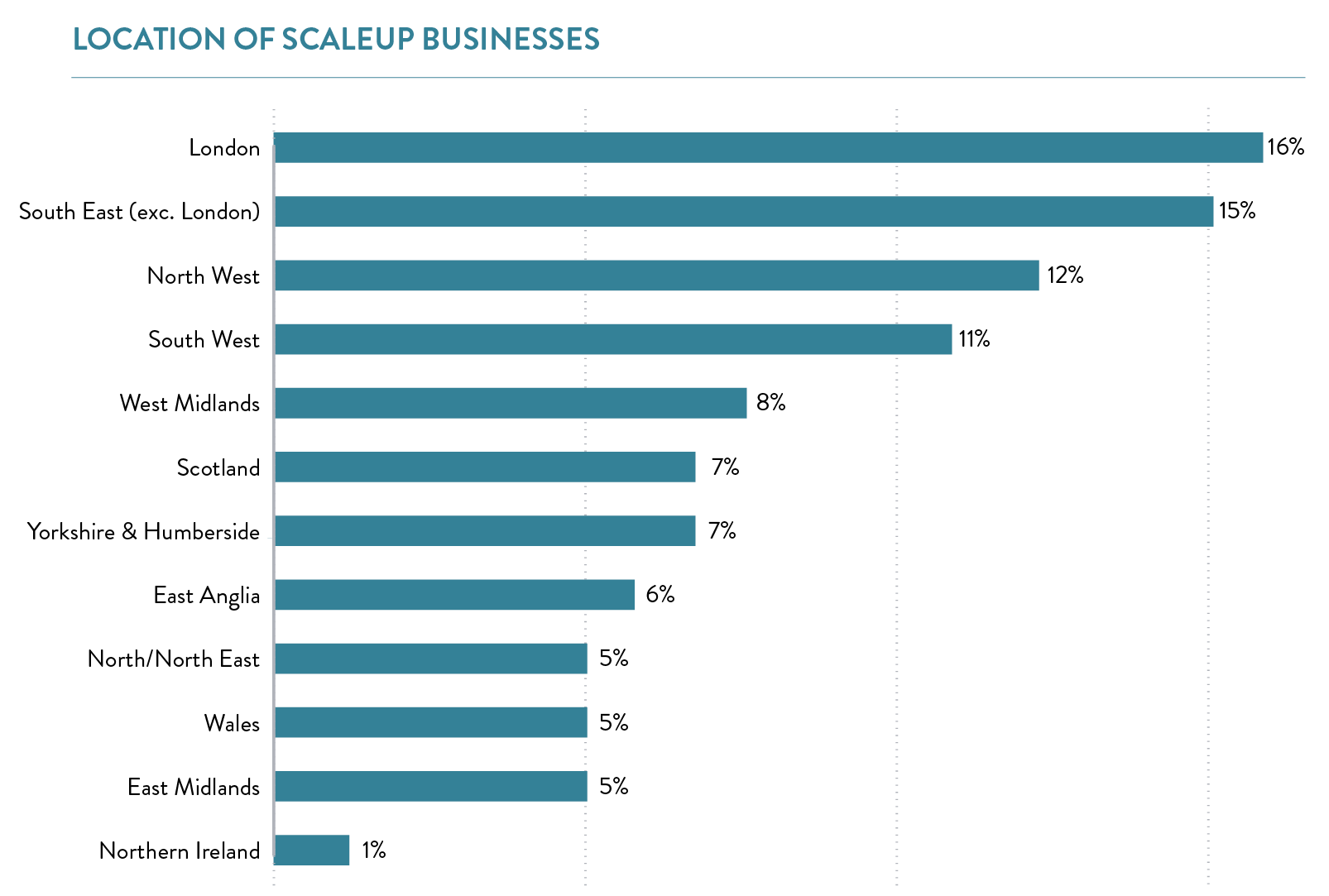

Scaleups are found across the UK, and broadly in line with the location of UK businesses overall.

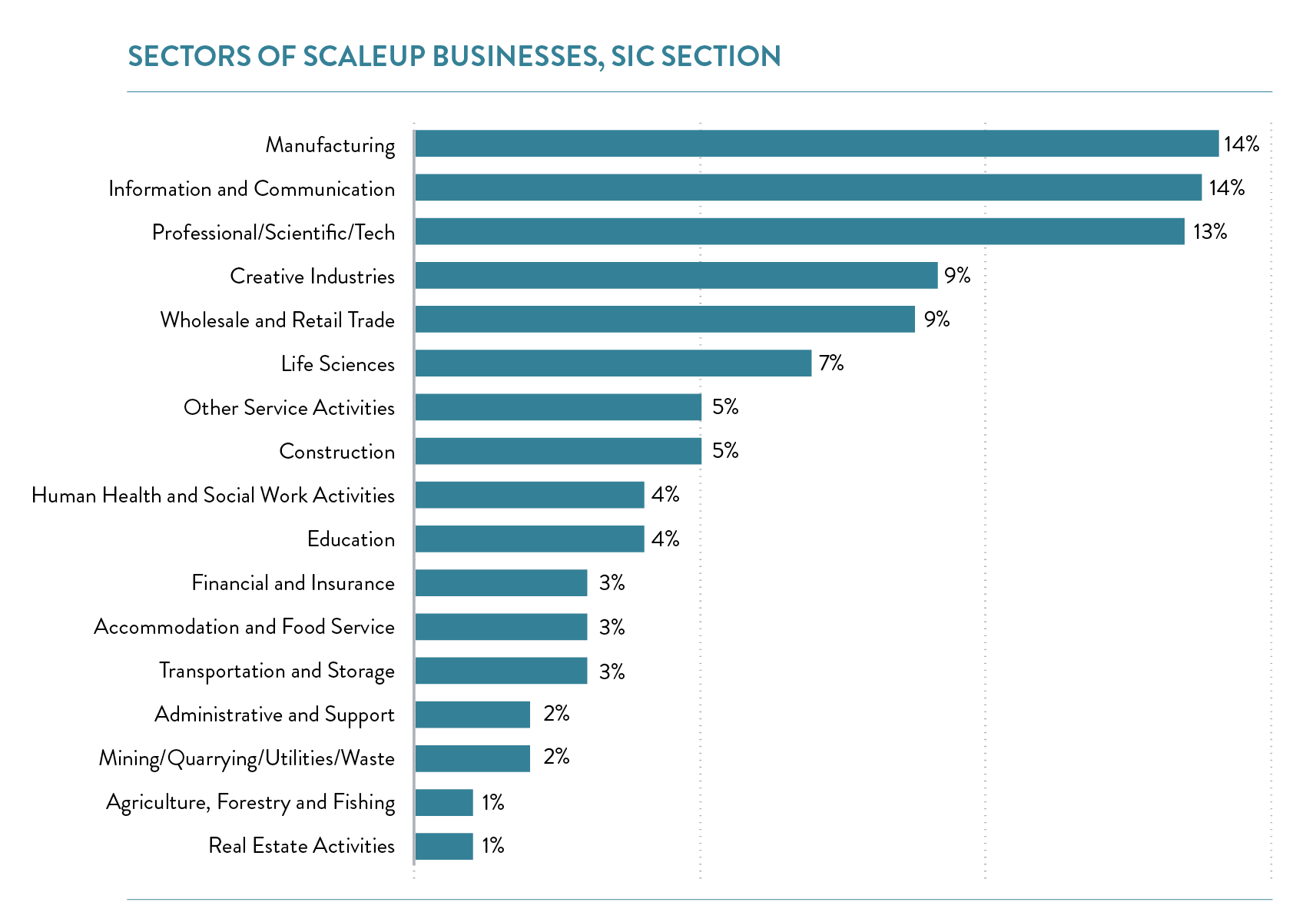

Scaleups Operate in Every Sector

Scaleups cover the entire economy in diverse sectors from manufacturing to life sciences, and from professional and scientific and the information and communication sectors to retail and the creative industries.

IRRESPECTIVE OF THE CHALLENGES OF COVID OR THOSE PERCEIVED WITH BREXIT – SCALEUPS ARE LOOKING FORWARD

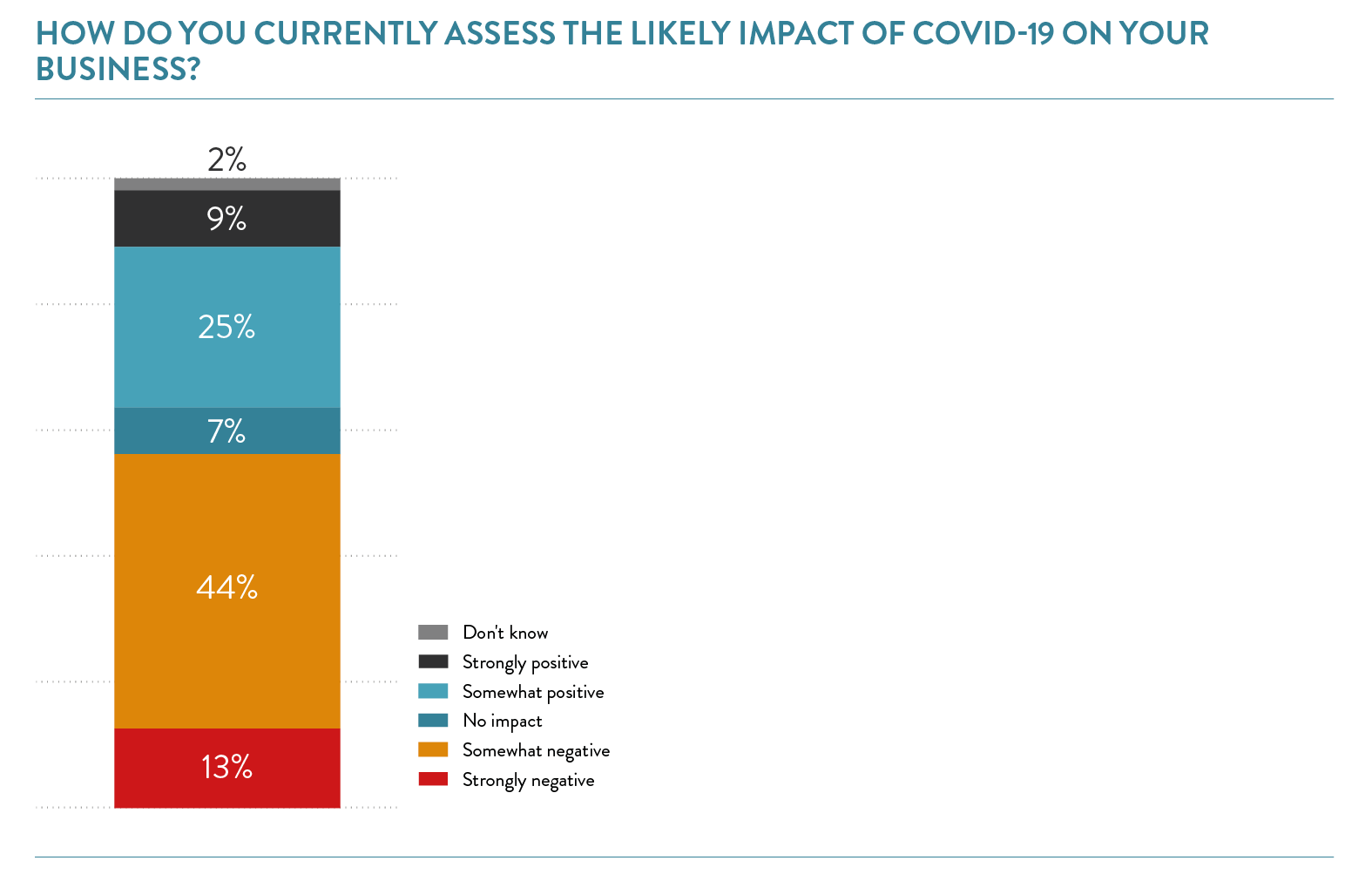

Scaling businesses are facing an unprecedented challenge with Covid. Just over half of scaleups (56%) feel that the pandemic has had a negative impact on their business. However, for a significant minority the pandemic has brought opportunities, whether in their existing business model or through innovating and adapting to the new conditions, with 35% saying that Covid has had a positive impact.

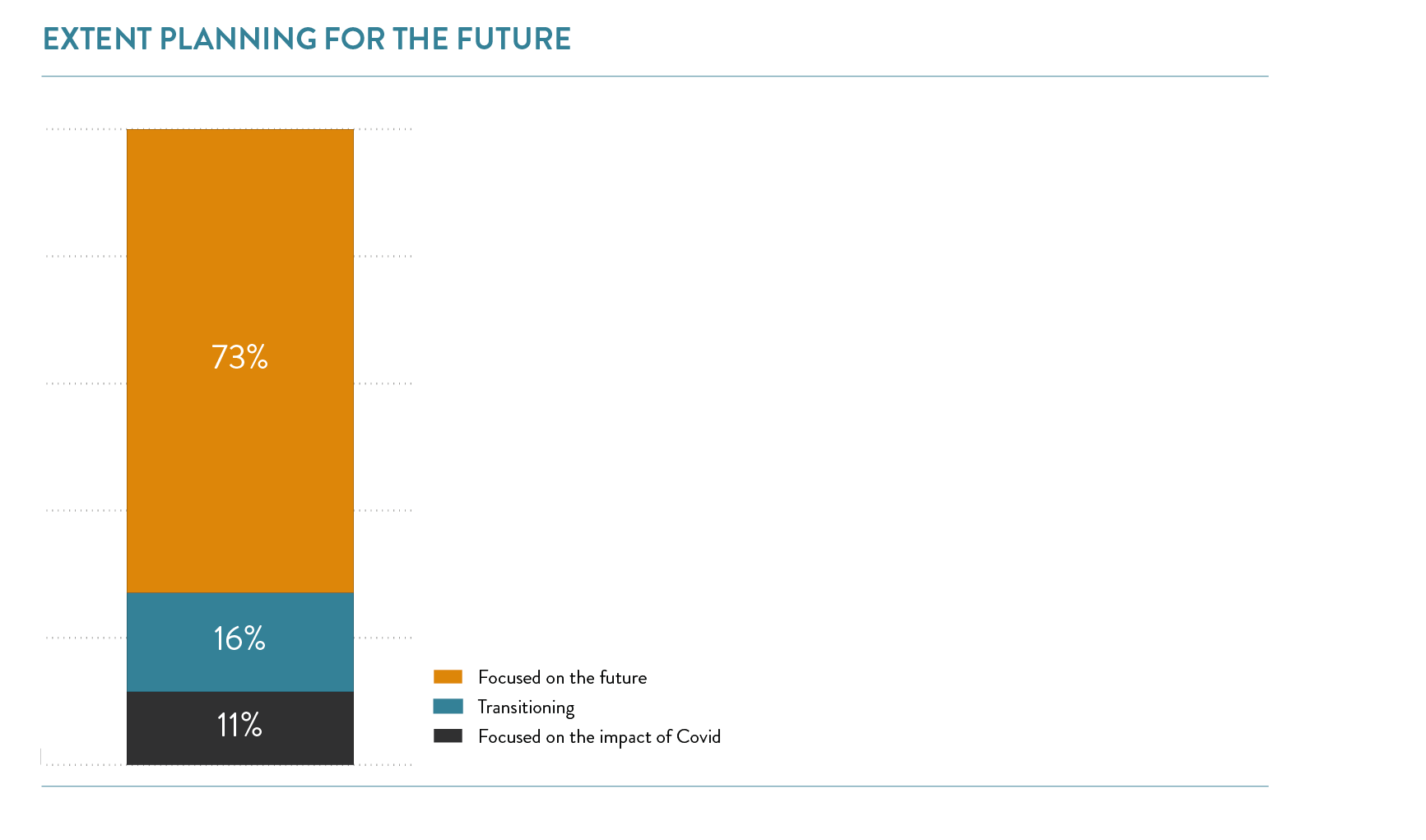

Despite any setbacks and negative consequences of the pandemic, scaleups are looking forward and planning for the future, with 7 in 10 scaleups are focused on the future of their business post lockdown. 1 in 10 scaleups remain focused on the immediate issues caused by the onset of the pandemic, while 2 in 10 scaleups are currently transitioning between Covid and post-lockdown.

Across the different sectors of the economy Covid has had varied effects with 22% of administrative and support scaleups and 18% of wholesale and retail trade scaleups have said that it has had a strongly positive impact on their business. Unsurprisingly, sectors most reliant on direct interaction with consumers, including accommodation and food service scaleups and creative scaleups, have experienced the most significant negative impacts, with 41% and 25% describing this as strongly negative.

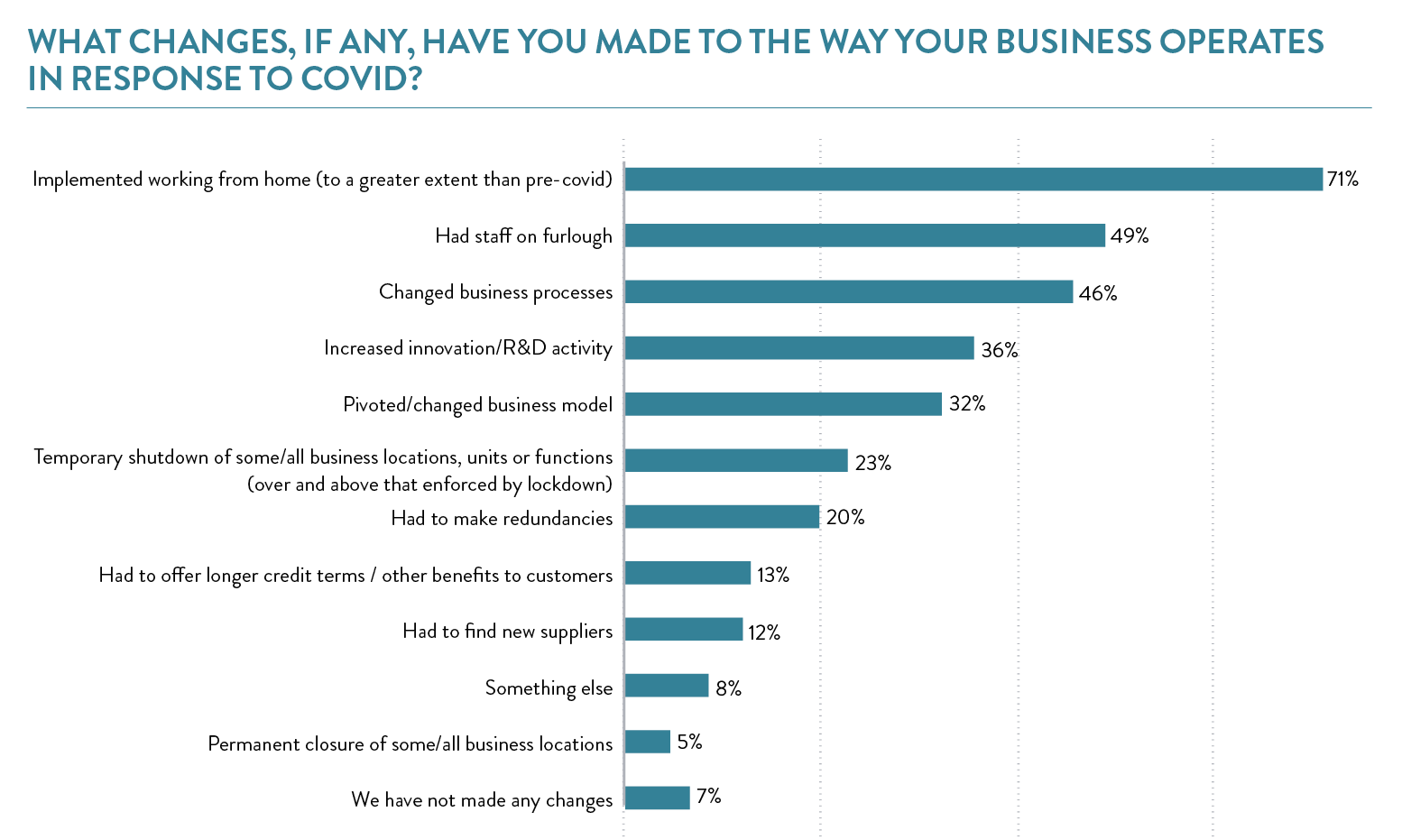

However, scaleups have pivoted and continued to innovate through Covid with 4 in 10 increasing their innovation or R&D activity. A significant number have changed their business model, processes and practices in response to the pandemic, and as to be expected increased uptake of flexible and home-based working was reported by 7 in 10 scaleups. Many also commented that they had opportunities for growth, including winning new contracts and taking on more staff.

While scaleups of all sizes have continued to innovate, 55% of larger scaleups (20+ employees) have changed business processes compared to 40% of smaller scaleups (under 20 employees). Overall, half of scaleups have furloughed staff – two-thirds of larger scaleups furloughed employees, compared to 4 in 10 for smaller scaleups. 84% of larger scaleups have started working from home, compared to 64% for smaller scaleups.

Most scaleups expect the changes to business during Covid to last. While 8 in 10 expect at least some of these changes to remain permanent, only 1 in 10 expect the business to revert back to pre-Covid. There was differentiation between sectors. Wholesale and retail and real estate scaleups were the most likely to say that all of the changes will be permanent (29%), suggesting longer term sectoral shirts. Other sectors more likely to expect business conditions to revert back to pre-Covid included 40% of scaleups in agriculture, 33% in mining/quarrying/utilities/waste and 29% in transportation and storage.

Scaleups remain focused on innovation. 3 in 4 introducing a new or significantly improved product/process/service in the last 3 years. A similar proportion have invested in areas linked to innovation and 6 in 10 introduced significantly improved forms of organisation, structures and processes. This shows that scaleups remain ambitious and are continuing to adapt to the challenges of Covid.

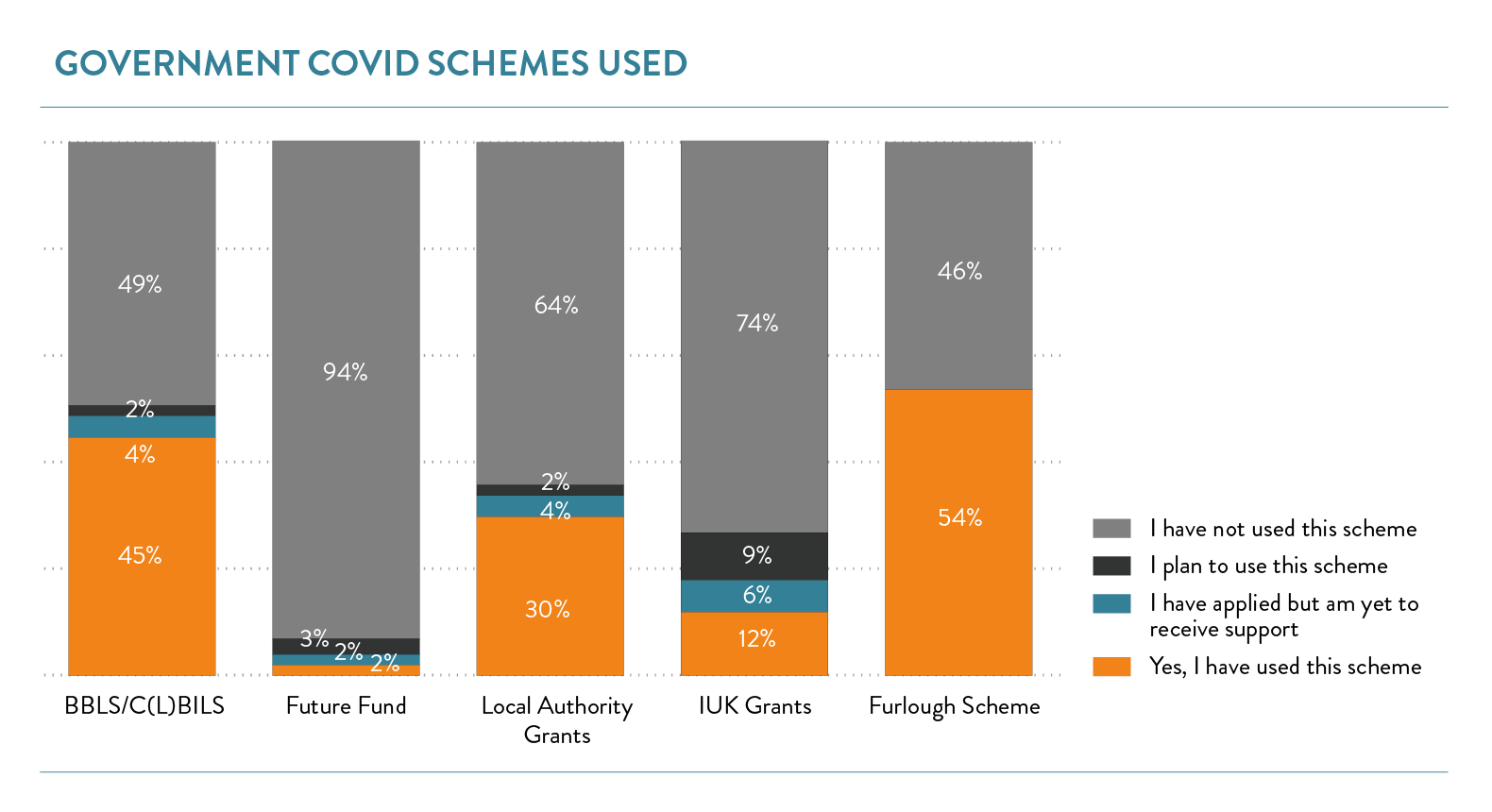

In staying resilient, scaleups have utilised all forms of Covid support schemes. This highlights the importance of the interventions being made and the diversity of the size, scale and needs of scaleups.

The Furlough Scheme is by far the most commonly used scheme, being utilised by 54% of scaleups. Across all sectors, scaleups used government loan schemes, with 45% utilising the various loan schemes.

Grants have also been important, with 30% making use of local authority grants – many of those were in creative industries and accommodation and food services. 12% have used Innovate UK grants, with life sciences the largest user of these grants. 2% of scaleups who are pre-revenue and pre-profit are using the Future Fund.

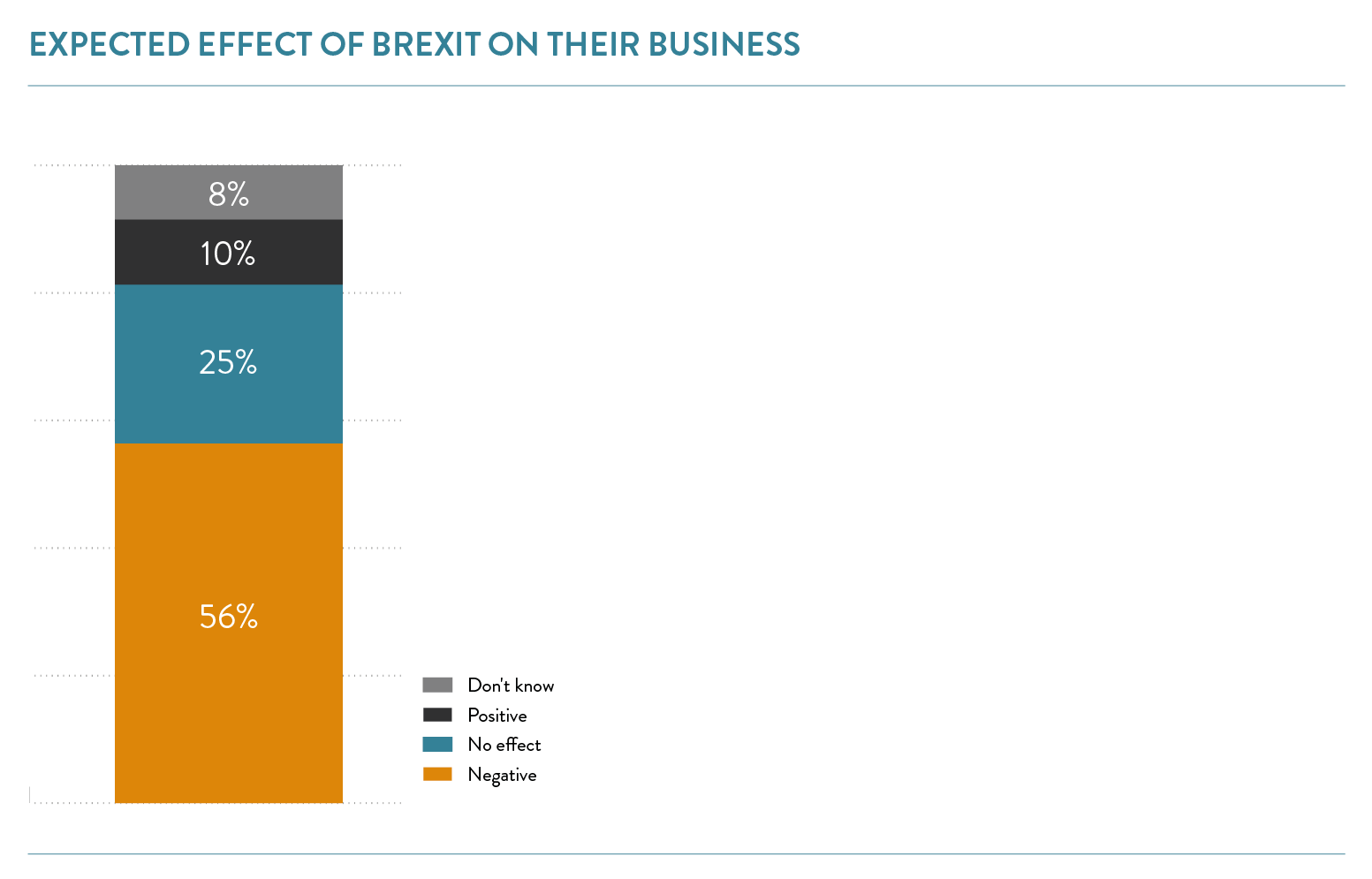

In addition to the impact of coronavirus in 2020, the UK’s exit from the EU remains a concern.

Scaleups continue to perceive that Brexit will have a negative impact on their business with 15% saying it will have a significant negative impact. Only 10% expect Brexit to have a positive impact on their business. Despite this, scaleups continue to grow and are optimistic about the prospects for future growth: 6 in 10 are confident that they will achieve their growth ambitions (59%).

Scaleups are highly international, with 53% of them currently exporting and 61% planning to trade overseas in the future. This makes them particularly vulnerable to increased barriers to international trade. The ongoing uncertainty about the outcomes of Brexit trade negotiations is still considered a top barrier to exporting by 4 in 10 scaleup leaders; factors relating to Covid were highlighted as a barrier by a quarter of scaleups.

Scaleups are well established and can be sizeable businesses

- 51% of scaleups have been trading for ten years or more

- 14% have a turnover in excess of £10 million

- 37% have 20+ employees, with 19% have over 50 employees and 9% having 100 or more.

Scaleups are leveraging emerging technologies for growth

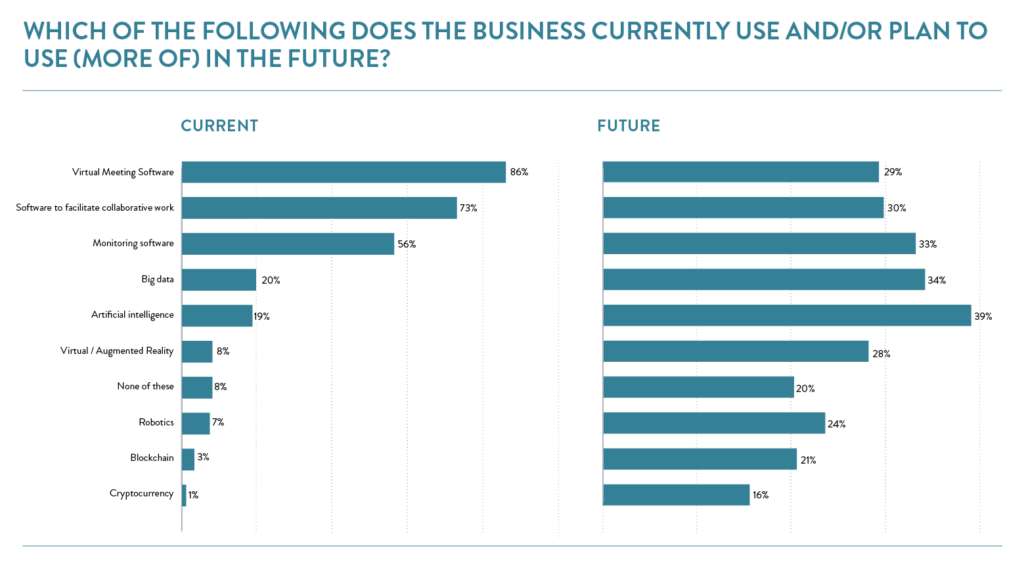

Alongside the rise in remote working 2020, scaleups are increasingly using technology to support this transition – 9 out of 10 are keeping in touch with employees, customers, investors and stakeholders through virtual meetings, and three quarters (73%) use software to facilitate collaborative work. One in five scaleups are now using big data or AI as part of their day to day operations.

In the future they plan to further exploit these technologies for growth even more with 4 in 10 expecting to use AI, one third planning to use big data, and one quarter dialling up the use of robotics (24%). Future use of software for meetings and collaboration is not as high as its current use however it is likely to remain a key tool for our scaleups.

Scaleups value relationship management and being ‘put on the map’

Having a single point of contact is valued by scaleup leaders with 6 in 10 (62%) wanting a relationship manager for their business. Having information about the support available is also valued, five out of ten (54%) want to be able to access information on a dedicated ScaleUp website.

Being identified as a scaleup is perceived to be helpful to further business growth. With two thirds (62%) of scaleup leaders stating that their scaleup status should be shared on public record on an opt-in basis and 5 in 10 would welcome the government sharing internally with other government departments that they were a scaleup or fast-growing company.

Access to markets in the UK and internationally is now the most important factor for business growth

When asked to force-rank the greatest barriers to growth and their priorities to address, access to markets was top – significantly outstripping the talent challenge for the first time. Talent and skills remains a key barrier to growth however due to the onset of the pandemic concern on access to finance and growth capital has increased since last year to be on par.

While considering which factors are most important to future growth, the picture is similar to 2019 with 81% stating that access to UK or international markets was very important or vital to their business growth. The Leadership and infrastructure (space to grow) challenges appear to be subsiding – as private and public sector initiatives take root, albeit there remains high demand by scaleups for peer to peer support and access to Non-Executive Directors.

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share