Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

2020 Scaleup Leaders’ Views

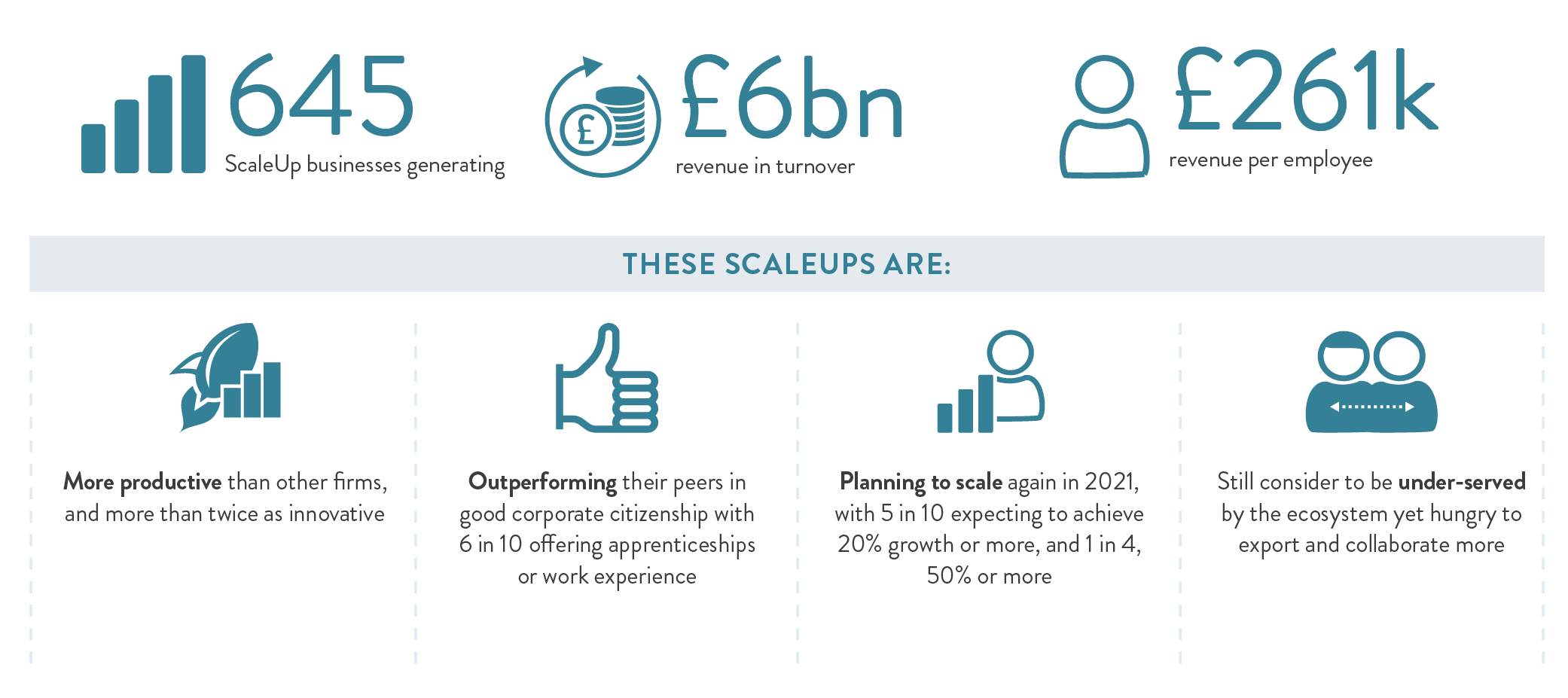

2020 sees our largest ever ScaleUp Survey, completed by 645 scaleup CEOs. This shines a light on the barriers they are facing while scaling up their businesses, including a front line perspective of impacts from the onset of the Covid-19 pandemic. In this section we reveal the insights of our most ambitious scaling businesses, from a diverse set of sectors across the country – 3 in 4 of whom expect to grow even further in 2020 despite the economic fallout from Covid, with 5 in 10 scaling up beyond 20% or more and 1 in 4 beyond 50%.

In the following pages we focus on the survey responses from scaleup business leaders whose companies are cumulatively generating £6bn in turnover – a significant and diverse group.

In addition to rapid growth, scaleups are sizeable and often well-established companies. Despite Covid uncertainties these scaleups remain highly innovative, international, and focussed on the future; including how they leverage technology advancements. They have pivoted and evolved, and are planning their way ahead for 2021 – irrespective of the pandemic. They are focused on growth, on R&D (75% have invested in innovation and R&D), on moving into new markets (6 in 10 plan to export next year and over half already export) and on getting ahead in their current home market.

The 2020 ScaleUp Survey provides detailed and comprehensive insight into the issues that scaleups regard as vital to their future growth and development.

The key issues and barriers remain consistent, but Access to Markets at home and abroad has now become the biggest issue these leaders are grappling with – outstripping significantly the talent challenge for the first time.

While Access to Talent remains a key priority, in 2020, following the onset of the coronavirus pandemic, concern on Access to Finance and Growth Capital has now dialled up to be on par. Other barriers around Leadership and Infrastructure continue to remain a concern but it is recognised that progress is being made to address them – an acknowledgement of the inroads that have collectively been made in these past 5 years.

Key Takeaways

- Scaleups remain resilient, ambitious and looking forwards – despite the Covid challenge

- While the pandemic has had a negative impact on 56% of scaleups, 7 in 10 are now focused on the future.

- Over the course of 2020 they have pivoted their business models, processes and practices, and increased their focus on innovation and R&D activity.

- They have utilised all forms of Covid Support Schemes, from Loans to Innovation grants, and the Future Fund to the Furlough scheme – showing the diversity of their size, scale and needs – and the importance of these interventions being made.

- However there remains significant concerns on the path ahead with the headwinds of Brexit. And, unsurprisingly, confidence is knocked over the conditions for growth and whether the UK will become harder to do business in.

- Scaleups expect to grow, despite the effects of Covid-19 and ongoing perception that Brexit will have a negative impact on growth.

- Three quarters of scaleup leaders expect some form of growth next year, with:

- 5 in 10 expecting to scale up their turnover and/or employee headcount again in 2021

- 1 in 4 expect this growth to be over 50%

- Turnover growth is expected by 7 in 10 scaleups in the next 12 months. 2 in 3 expect to grow by employment.

- 45% of scaleup leaders believe it is now harder to grow a business than it has been in the past with the same proportion worried that the UK will remain a good location for doing business. Four in ten feel underserved by the business support on offer.

- Three quarters of scaleup leaders expect some form of growth next year, with:

- Scaleups are highly innovative and they are significant adopters of new technologies but they want more support.

- Three out of four scaleups have introduced a new or significantly improved product/process/service in the last 3 years. A similar proportion have invested in areas linked to innovation and 6 in 10 introduced significantly improved forms of organisation, structures and processes.

- Already significant users of collaborative tools, one in five scaleups are currently using big data or AI as part of their day to day operations. In the future they plan to further exploit these technologies for growth even more with 4 in 10 expecting to use AI, one third planning to use big data, and one quarter dialling up the use of robotics (24%).

- Scaleups are increasingly looking for support from Innovate UK. This is now the number one ask from our scaleup leaders with almost half (44%) seeing their support as vital or very important. In addition, four in ten want public sector funding for innovation and R&D. Improving access to university and corporate R&D facilities and expertise is also a key ask.

- Maintaining access to innovation and R&D funding schemes provided by the EU, or replacing these with similar homegrown offerings, is seen as important to six in ten scaleup leaders. Such schemes often facilitate innovative longer-term projects.

- Scaleups are focused on markets at home and abroad but issues surrounding market access are now the most pressing barriers for scaleup leaders

- Access to Markets is now the foremost challenge for our scaleups – 81% stating that it is a vital or very important factor in the future growth, significantly outstripping all other barriers in 2020.

- Collaboration rates remain stubbornly low, despite their innovative nature and scaleups desire to collaborate far more with the academic, public and private sectors, only 3 in 10 scaleups have collaborated with large corporates or universities in the past three years, while 2 in 10 have collaborated with government.

- Scaleups are international. Half of scaleups currently export – reinforcing the international nature of their footprint compared to SMEs generally. The EU remains their largest market but an increasing number are looking to other markets – 42% now trade with countries outside the EU up from 32% in 2019. 61% of scaleups are seeking to engage in international trade in 2021. They see key opportunities in Australasia, the Middle East, China, India and other parts of Asia.

- Access to talent remains a key barrier to enable growth along with key senior leadership development opportunities although there is recognition of some progress on the latter.

- When force-ranked, access to talent has now fallen behind access to markets as a barrier to future growth and is on par with access to finance. While it is perhaps too early to tell, the onset of the coronavirus pandemic in 2020 is a likely cause in this shift of focus.

- Scaleups are significant employers of UK nationals (95%) and it is worth noting that 57% hire people from the EU, while 38% hire people from outside the EU. Of those who hire from the EU 56% believe it is very important or vital for them to continue doing so and support a fast track visa system.

- Critical Thinking is the most desired future skill, in demand by 70% of scaleup leaders, followed by service orientation. However, only 3 in 10 are confident that they will be able to source employees with this vital skill in the future.

- Scaleups are seeking greater support to take on new employees and ensure that they possess the right mix of skills and attributes. Grant funding for training, apprenticeships and placements and changes in the ways in which educational institutions offer careers advice and entrepreneurial education all have an important role to play.

- Greater access to a cadre of NEDs who have experience of growing a business (56%) and networks of peers (46%) remain key forms of valued support to scaleup leaders. As is the access at a local level via growth hubs to national government services. Scaleups recognise that innovation and R&D along with a number of scaleup support programmes are often underpinned by EU funding – and the majority want this funding suitably replaced by UK initiatives if access to EU schemes is not available.

- Finance and access to growth capital is becoming a higher priority issue for scaleups.

- They remain far more likely to use external finance than their SME peers, 84% of scaleups use external funding as part of their growth strategy – yet 4 of 10 scaleups do not feel they have access to the right funding for their needs.

- Perceptions of regional disparities persist. 4 out of 10 scaling companies continue to feel that the majority of funding resides in London and the South East. However the number of companies using equity is increasing – 47% of scaleups in London use equity, while 28% of businesses outside the capital have received equity investment, up from 32% and 18% respectively.

- Angels and VCs remain key early stage investors with 5 in 10 scaleups either currently having that investment or looking for such investors going into 2021.

- Scaleups value relationship management and being ‘put on the map’.

- Six in ten (62%) of scaleups would like a single point of contact to act as a relationship manager for them when dealing with the public and private sector.

- 62% of scaleup leaders want to be identified as a scaleup on public record on an opt-in basis. 5 in 10 would welcome the government sharing internally with other government departments that they were a scaleup or fast-growing company.

The Top Challenges

- Access to markets – both at home and abroad – has emerged as the most significant issue in the 2020 ScaleUp Survey that our scaleup leaders are grappling with. For the first time, it significantly outstrips the talent challenge. Scaleups want greater opportunities to collaborate with, and the ability to sell into, the public sector and large corporates however barriers still remain. Not enough scaleups are getting the opportunities to supply to large corporates or work with Government. Collaboration rates remain woefully low with only two in ten collaborating with government and just three in ten collaborating with large corporates or universities – yet 6 in 10 desire greater engagement with universities and access to their R&D capability.The main barriers to collaboration scaleups continue to cite as needing to be resolved are time-consuming and complex procurement processes, and a lack of identifiable opportunities. Action and concerted effort is needed now to resolve these issues.Half of scaleups export and 6 in 10 want to do more. This places them firmly in the vanguard of the UK’s trade ambitions. The EU remains their largest market but an increasing number are looking to other markets. However, more support is needed – seven in ten want better introductions to buyers in overseas markets by DIT and five in ten want a single point of contact for scaleups with greater market insights and dedicated trade missions. With the end of the transition period now very much in sight, Brexit uncertainty remains a considerable concern, with 56% believing it will have a negative impact on their business.

- Access to Talent – whether this means the social and technical skills of their workforce, the ability to recruit from overseas or having the talent to secure international business, scaleups have consistently highlighted the need to be able to attract the right skills and experience as a major barrier to growth. It remains a key issue in 2020 but, when force-ranked, it has fallen behind access to markets and is on par with access to finance. Scaleups are seeking greater support to take on new employees and ensure that they possess the right mix of skills and attributes: 55% would value grants for taking on trainees and seek improved careers advice and linkage to entrepreneurship in schools. In relation to skills required from school leavers and graduates joining the workforce, technical skills are ranked as the most important. Critical thinking is the most desired future skill, in demand by 70% of scaleup leaders followed by service orientation. However only three in ten are confident that they will be able to source employees with this vital skill in the future.

- Access to finance and growth capital has risen in priority as an obstacle to growth in 2020. It is now on a par with access to talent. Scaleups remain far more likely to use external finance than their SME peers: 84% of scaleups use external funding as part of their growth strategy, although 4 of 10 scaleups still feel they do not have access to the right funding for their needs. Perceptions of regional disparities persist; four in ten scaling companies feel that the majority of funding resides in London and the South East (compared to five in ten in 2019). The number of companies using equity is increasing: 47% of scaleups in London and 28% outside the capital use equity; this is up from 32% and 18% respectively. Of those using external finance, 5 in 10 are using equity or plan to use it in the near future – with VCs and Angels identified as the key sources of equity provision.

- Building leadership capacity through local support has been the focus of concerted efforts in recent years and while it appears that this demand is being met more fully, greater access to NEDs and networks of peers remain key forms of valued support to scaleup businesses. Scaleups are also increasingly looking for support from Innovate UK. This is now the number one ask from our scaleup leaders as regards the public sector, along with public sector funding for R&D. The majority of scaleups wish to be relationship managed, with proactive engagement and contact and a specific scaleup website. Six in ten scaleups want a named single point of contact as a local relationship manager.

- Infrastructure – scaleup leaders consistently indicate the importance of infrastructure – space to grow – as critical to their business, alongside good broadband. Connectivity between different players in the scaleup ecosystem is vital for growth as is access to facilities and expertise for R&D at large corporates and universities. Hubs at which scaleups can work, meet and collaborate is seen as vital to a thriving scaleup ecosystem.

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share