Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

SME Finance Monitor – The ScaleUp Perspective

Since 2011, the SME Finance Monitor from BVA BDRC has provided independent and impartial data on SME access to finance. This data is used by Government, the banks, business groups and other interested parties to inform the debate on this crucial part of the economy.

Since 2016 we have been working with the ScaleUp Institute on the scaleup companies within this database and analysing their perspective as compared to SME peers. This led in 2017 to publication of the inaugural SME Finance Monitor – the ScaleUp Perspective and since then the Monitor has encapsulated scaleups into ongoing analysis with the ScaleUp Institute and the ensuing publications.

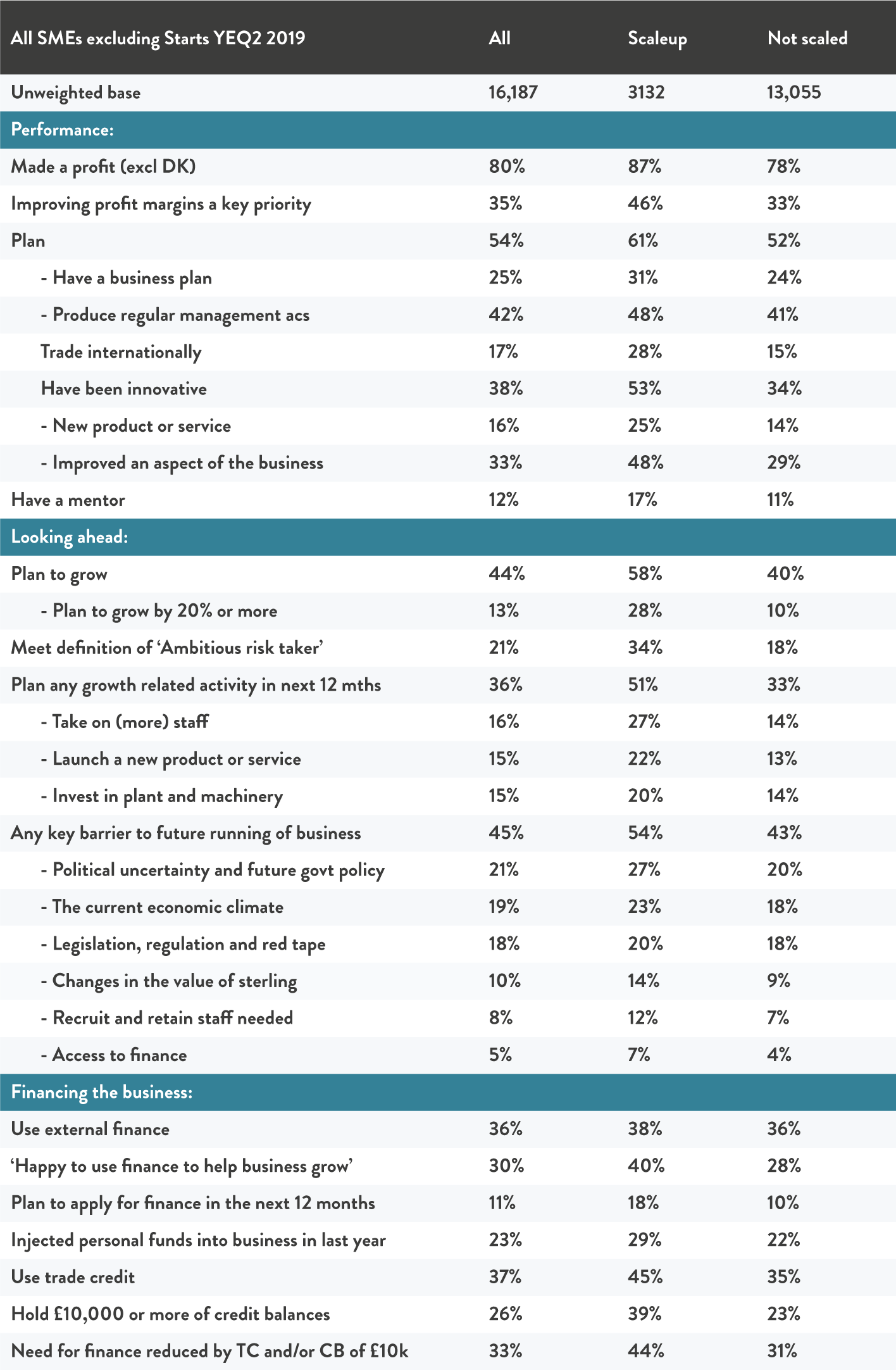

In the first half of 2019 we have interviewed a further 3,132 scaleup SMEs and 13,055 other established SMEs who have not scaled (startups are excluded from the analysis).

The results of these interviews chime with the key themes from the annual ScaleUp Institute survey of dynamic, innovative and international businesses looking to grow further. While they are slightly more likely than their peers to be using finance, they are far more likely to expect to use finance to help the business grow (4 in 10); bigger users of trade credit (5 out of 10); and more likely to view themselves as ‘ambitious risk takers’. They are also more likely to have credit balances, and/or inject personal funds into the business. In terms of barriers to growth, picking up the anxieties around Brexit in the Monitor, interviews of our ScaleUp SMEs see a dialling up of political uncertainty and economic climate as barriers, but nonetheless they remain ambitions to scale further.

Context:

- Scaleup SMEs are found across all sectors and regions but were slightly more likely to be found in Property/Business Services (31% v 26% who hadn’t scaled) and in London and the South East (37% v 33% who hadn’t scaled)

- A third of Scaleup SMEs met the definition of an “Ambitious risk taker” – an SME that is happy to take risks to grow and wants to be a considerably bigger business (v 18% of those that hadn’t scaled)

- Scaleup SMEs are far more innovative (53% v 34% who hadn’t scaled) and international (28% v 15%) than their peers

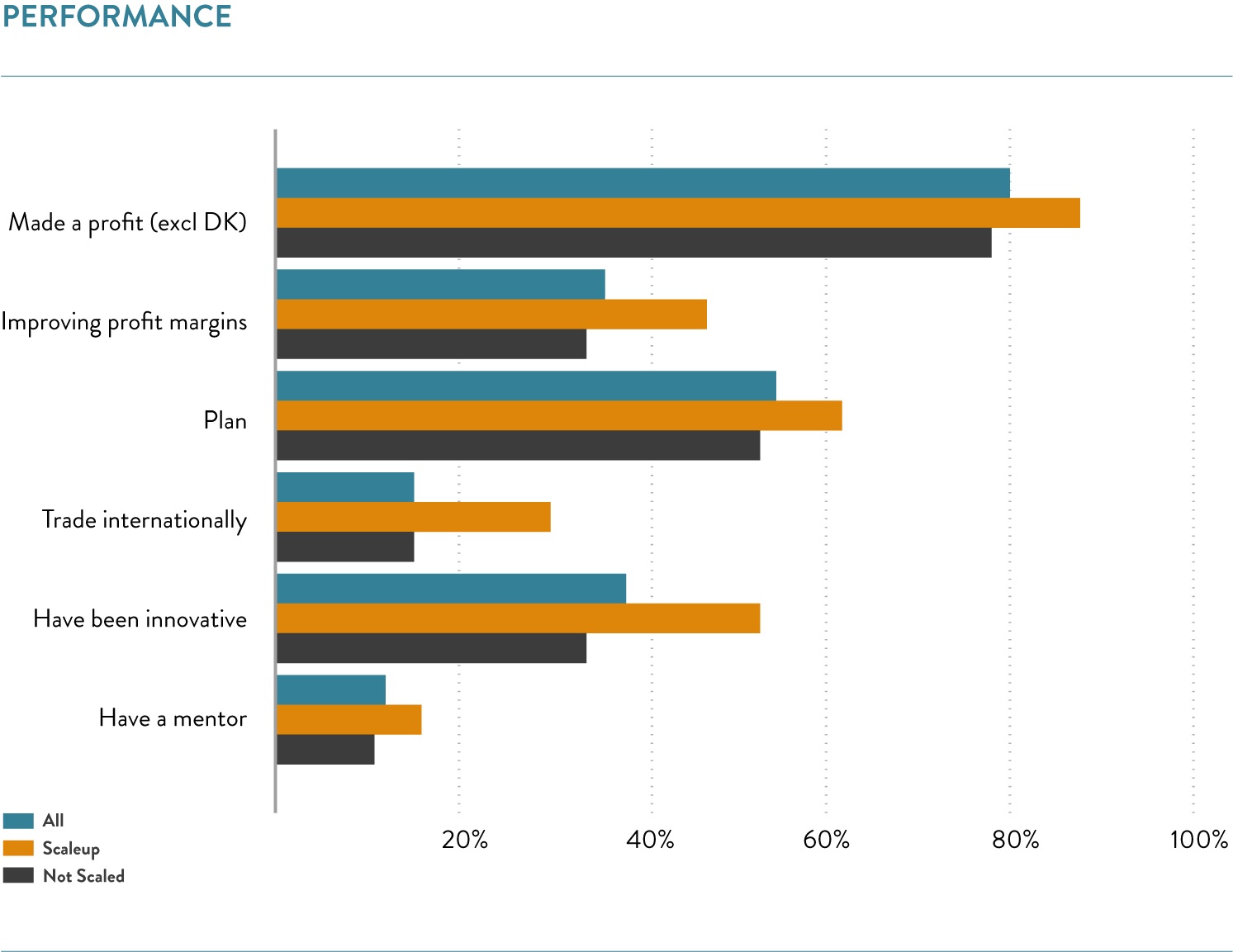

Performance:

- Scaleup SMEs were more likely to have made a profit in the previous 12 months (87% v 78% who hadn’t scaled), but were still keen to do more with 46% saying that improving profit margins was a priority for the coming year (v 33% of those who had not scaled)

- These are more structured/developed businesses: they were more likely to plan (61% v 52% of those who hadn’t scaled)

- And, reinforcing their ambitions, Scaleup SMEs are more likely to be planning a growth related activity in the coming year than their peers (5 out of 10 v 3 out of 10)

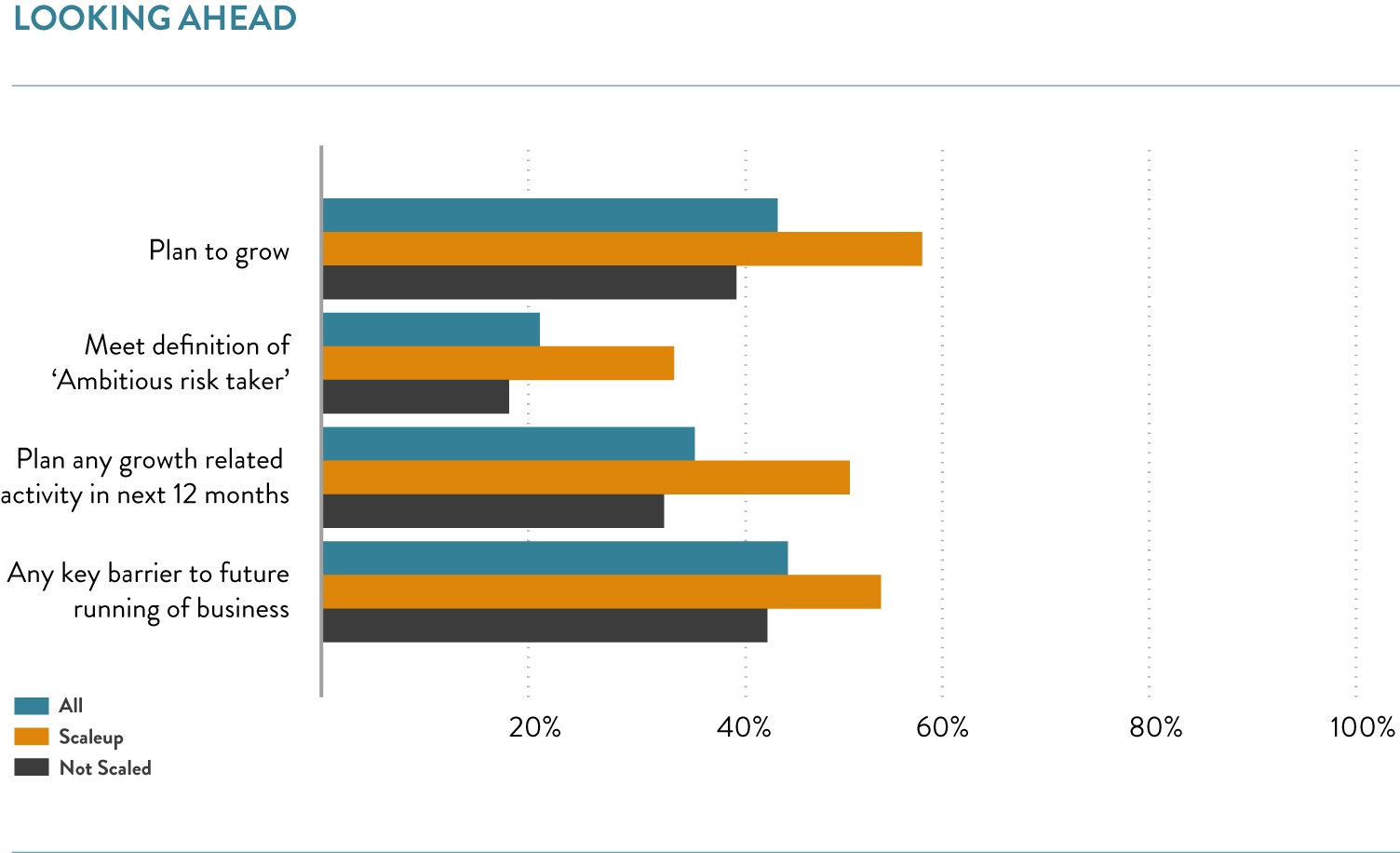

Looking ahead:

- These SMEs remain ambitious: 6 in 10 Scaleup SMEs expected to grow again in the coming year (58% v 40% of those that had not scaled) with 28% planning to grow by 20% or more (v 10% of those that hadn’t scaled)

- 51% of scaleup SMEs were planning a growth related activity (v 33% who hadn’t scaled), including 27% planning to take on staff (v 14%), 22% looking to launch a new product or service (v 13%) and 20% looking to invest in plant and machinery (v 14%)

- This said, 54% of scaleups rated one or more of a number of barriers as a major obstacle to running their business in future (v 43% that hadn’t scaled). The key barriers, as overall, were ‘political uncertainty and government policy’ (27% rated this a major obstacle v 20% who hadn’t scaled), ‘the current economic climate’ (23% v 18%) and ‘legislation, regulation and red tape’ (20% v 18%). Compared to those that hadn’t scaled, scaleups were more likely to see changes in the value of sterling (14% v 9%) and/or being able to recruit and retain staff (12% v 7%) as barriers

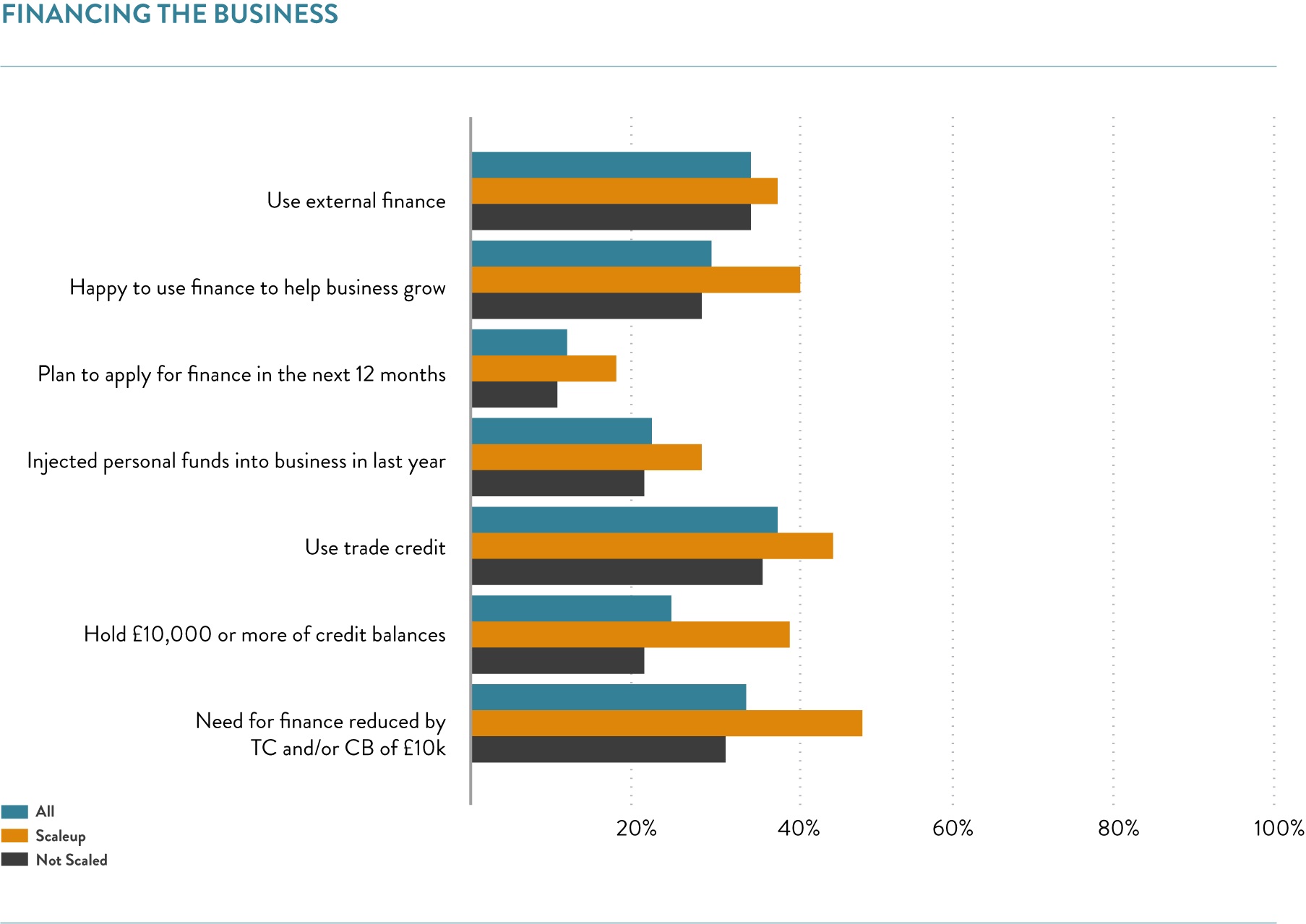

Financing the business:

- Attitudinally scaleups are more likely to be happy to use finance to help the business grow (40% v 28% of those that hadn’t scaled) and no more likely to feel it would be difficult for them to get finance (37% v 35%). They were though slightly more likely to say that an increase in the cost of credit would put them off applying (54% v 46%). 2 in 10 planned to apply for (more) finance in the next 12 months (v 1 in 10 that had not scaled).

- This level of use of finance among scaleup SMEs that are ambitious and developing may be because they have alternative sources of funding:

- 29% have injected personal funds into the business (v 22% who have not scaled)

- 45% used trade credit (v 35% of those that have not scaled)

- 39% held £10,000 or more of credit balances (v 23% of those who hadn’t scaled) including 23% who held £25,000 or more of balances (13% of those who hadn’t scaled)

- 44% of all scaleup SMEs said their need for external finance was reduced by either trade credit and/or holding £10,000 or more in credit balances (v 31% that had not scaled)

Page URL: https://www.scaleupinstitute.org.uk/articles/sme-finance-monitor-the-scaleup-perspective/

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share