Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

2019 Scaleup Leaders’ Views

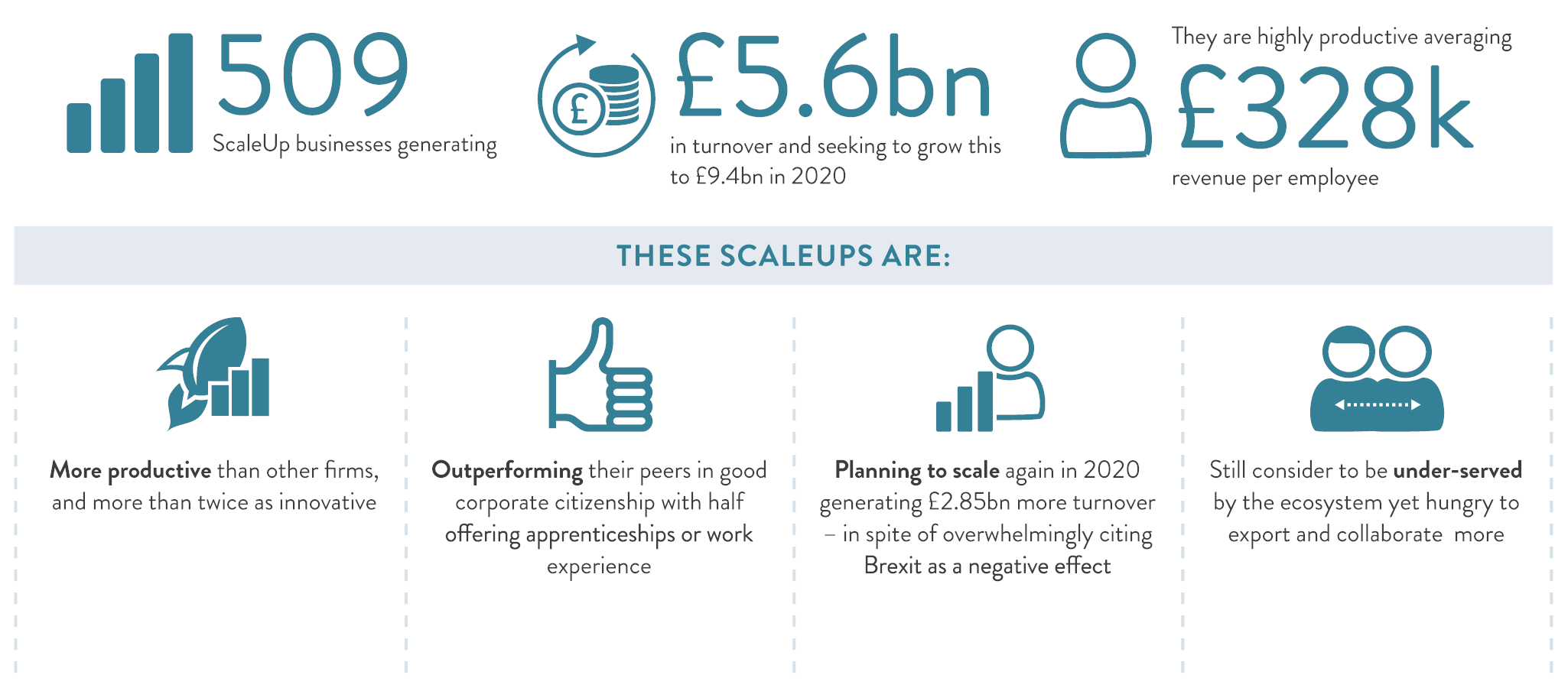

The 2019 ScaleUp Survey was completed by 509 scaleup CEOs. It provides insights into the views of our most ambitious scaling businesses, from a diverse set of sectors across the country – 88% of whom expect to grow even further in 2020 despite their expectations that Brexit will have an overwhelmingly negative effect.

In the following pages we focus on the survey responses from scaleup business leaders whose companies are cumulatively generating £5.6bn in turnover – with 1 in 5 increasing turnover by 40% or more last year – and who plan to generate a further £3bn in 2020.

In addition to their rapid growth, scaleups are sizeable and often well-established companies. They are more than twice as likely to be innovative as typical companies. Scaleups are also great corporate citizens, significantly outperforming their peers in the provision of apprenticeships.

The 2018 ScaleUp Survey provides detailed and comprehensive insight into the issues that scaleups regard as vital to their future growth and development.

The key issues and barriers remain consistent, but access to markets at home and abroad continues to significantly rise in importance and as a key barrier to overcome.

While access to talent when force ranked remains the priority issue for the majority of scaleups – access to UK markets is the single barrier that has had a significant rise in challenge for our scaleup leaders and is going up the ladder in terms of their ‘growing pains’. Other barriers continue to remain significant concerns but it is recognised that some progress is being made to address them.

Key Takeaways

- Scaleups are highly innovative and international and they are significant adopters of new technologies.

- Three quarters of scaleups introduced a new or significantly improved product, process or service in the last three years, while 70% invested in areas such as internal R&D or equipment linked to innovation. Scaleups are also innovative when it comes to organizational change. 64% introduced new or significantly improved business structures or marketing strategies in the past 3 years. This compares to 30% for typical UK firms and 39% for large UK firms, according to the 2017 UK Innovation Survey.

- 5 out of 10 scaleups export – reinforcing the international nature of their footprint compared to SMEs generally. While Europe is the largest market in which they export today in the future they expect North America to be a key market and more expansion into Australasia, the Middle East, China and India to occur.

- Access to talent remains a vital barrier to break down to ensure continued growth. When force-ranked, access to talent was the single factor identified by scaling businesses as hindering their growth followed by the rising challenge around access to markets – which follows closely behind talent as a major barrier.

- It is worth noting that 57% hire people from the EU, while 33% hire people from outside the EU, and 7 in 10 believe it is important to bring in talent and people from the EU (69%).

- Demand for peer networks, NEDs and mentoring is high and increasing, particularly for easy access to them at a local level. Peer-to-peer networks remain the single most important form of external help that scaleups value, with many commenting that they wish to see such peer networks expand beyond just CEO / Founder level to the senior leadership team.

- Access to Markets issues both at home and abroad are rising as a barrier to growth. Significantly, eight out of ten scaleups view this area as a key issue, particularly in regard to collaboration with, and selling to, the private and public sectors in the UK itself. It is notable that:

- Only 1 in 10 had collaborated with government to develop a new product or service in the last 3 years.

- 2 in 10 had collaborated with universities or research institutions to develop a new product or service in the past 3 years.

- 3 in 10 had collaborated with large corporates to develop a new product or service in the past 3 years, while 30% had collaborated with international partners to do so.

- Despite the view by our scaleup business leaders that Brexit will have a negative impact on their growth, and 5 in 10 worrying whether the UK will be a good location for business in coming years, their expected growth in 2020 is substantial.

- 9 in 10 scaleups expect to grow further next year (88%), with:

- 1 in 3 expecting to grow turnover by 50% or more, and

- 1 in 5 expecting to grow their number of employees by 50% or more.

- 9 in 10 scaleups expect to grow further next year (88%), with:

- Access to R&D and Innovate UK services are seen as vital pillars to scaling up; as is the access at a local level via growth hubs to national government services. Scaleups recognise that innovation and R&D along with a number of scaleup support programmes are often underpinned by EU funding – and the majority want this funding suitably replaced by UK initiatives if access to EU schemes is not available.

- Scaleups value relationship management and being ‘put on the map’: Seven in ten (69%) of scaleups would like a single point of contact to act as a relationship manager for them when dealing with the public and private sector.

- On finance: Scaleups are far more likely to use external finance than their SME peers, three-quarters of scaleups use external funding as part of their growth strategy – yet – strikingly:

- 6 out of 10 scaleups – particularly those based regionally – do not feel they have access to the right funding for their needs and ambitions with 5 out of 10 viewing funding as predominantly focused in London and the South East.

- Regional disparities persist – 47% of scaleup leaders believed that most of the finance and business advice resides solely in London / South East.

- Of those using equity, angel investors (63%) and venture capitalists (44%) are most important – but given the view that most of these are based in London there is a need to dial up regional capacity and awareness.

The Top Challenges

- Access to Talent – whether this means the social and technical skills of their workforce, the ability to recruit from overseas or having the talent to secure international business, scaleups have consistently highlighted the need to be able to attract the right skills and experience as the biggest challenge to their future growth. While this remains the most significant challenge when force-ranked, it is marginally less of a pain point than in 2018. In relation to skills required from current employees, social skills continue to outweigh technical skills. Critical thinking and service orientation are deemed the most important for the future workforce.

- Access to Markets – when force-ranked, this is identified as the second most important barrier to growth for the third consecutive year. However, at 82%, it outstrips talent for the first time when respondents were asked simply about their barriers to growth. In particular, access to UK markets in 2019 is seen as much more challenging than ever before. The demand from scaleups for greater collaboration with, and the ability to sell into, the public sector and large corporates is not being met. There is great potential still to be addressed with today only 1 in 10 scaleups collaborating with government, 2 in 10 with universities, and 3 in 10 with corporates. More than half of scaleups sell to large corporates and many more have aspirations to do so in the future.

The main barriers to collaboration scaleups continue to cite as needing to be resolved are: time-consuming and complex procurement processes, as well as a lack of identifiable opportunities. With a more concerted effort across the UK, all of these issues could be solved.

Half of scaleups export and want to do more. This places them firmly in the vanguard of the UK’s trade ambitions. The key barriers to international trade are accessing overseas customers, talent and partners. Uncertainty over Brexit is also a considerable concern, with 20% citing it as one of their three main barriers to exporting. Four in ten want a single point of contact for scaleups and better introductions to buyers in overseas markets by DIT.

- Building leadership capacity through local support continues to be a constant theme of scaleup business leaders although it appears some of the solutions being brought to bear are addressing this particular scaleup gap. Peer networks remain the most important form of support to scaleup businesses.Scaleups reinforce their desire for local leadership provision across disciplines and roles. The value of peer networks to CEOs and executives of scaling businesses sees a further rise in importance, along with their ability to access a cadre of NEDs with experience of growing a business. These needs are increasing and continue to need attention.

Scaleups continue to want easier access to public sector funding for innovation and R&D; Innovate UK, alongside general co-ordinated business support from such entities as Growth Hubs. They value also how banks and financial suppliers can provide a wide level of guidance – rating these above professional services as key.

Seven in ten scaleups state that a named single point of contact as a local relationship manager would improve their route through to national government and private sector initiatives designed to foster growth. Four out of ten exporters exporters want this service specifically from the Department of International Trade (DIT).

- Access to finance and growth capital is not seen as the main obstacle to growth and scaleups use external finance more than their SME counterparts. However, the percentage of scaling businesses who do not think that they have access to the right amount of finance to meet their needs has increased from 40% last year to 60% in this year’s survey. Regional disparities persist: scaleups in London and the South East are more likely to use equity finance, and half of all scaleups regarding London and the South East as the region where the majority of equity funding resides. The knowledge gap about equity finance appears to be closing – the percentage of scaleups who do not know anything about this form of finance has fallen from 17% to 10%. One in four scaleups currently use equity and one in ten expect to use it in the near future.

- Infrastructure – scaleup leaders consistently indicate the importance of infrastructure and broadband to their business. It complements other key factors in a thriving scaleup ecosystem.

Seven out of ten want the government to internally share information to identify them as a scaleup and thus fast-track services for them. Scaleups recognise that EU funding is a key plank to various support mechanisms and want to see public and private sector partnerships filing the anticipated gap in EU funding.

Scaleup aspirations remain high – nine in ten scaleups are expecting to grow again next year – but half worry about the future of the UK as a place for doing business and four in ten feel there is not enough support for their business.

Page URL: https://www.scaleupinstitute.org.uk/articles/2019-scaleup-leaders-views/

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share