Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Access to Finance

Scaleups use a range of forms of external finance and are far more likely to use external finance than their peers. While finance is not seen as the major barrier to growth, it does consistently rank in the top five barriers to overcome; in 2019 while three quarters of scaleups use external finance (more than double their peers), six out of ten did not feel they have the right amount of funding in place for their current ambitions.

This is significantly greater than last year, when four out of ten scaleups believed this to be the case.

In addition regional disparities persist with 5 in 10 scaling companies viewing the majority of funding residing in London and the South East. Of those using equity, 32% reside in London and the South East, while 18% of those elsewhere use it.

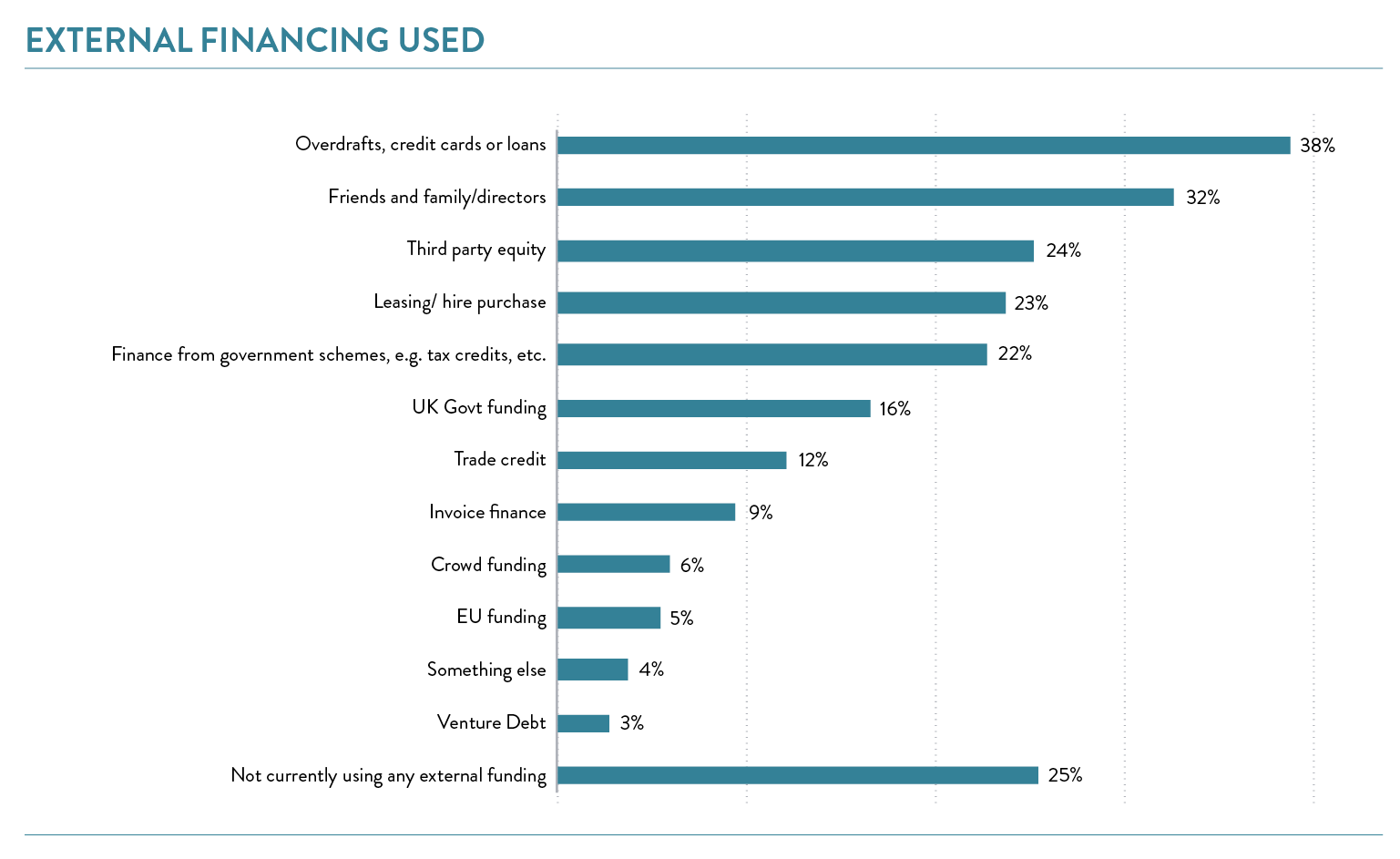

Scaleups use a variety of funding sources: 38% use overdrafts, credit cards or loans; 23% use leasing or hire purchase; 32% have received cash injections from friends and family, or directors. 24% received equity from a third party investor and 16% achieved government funding.

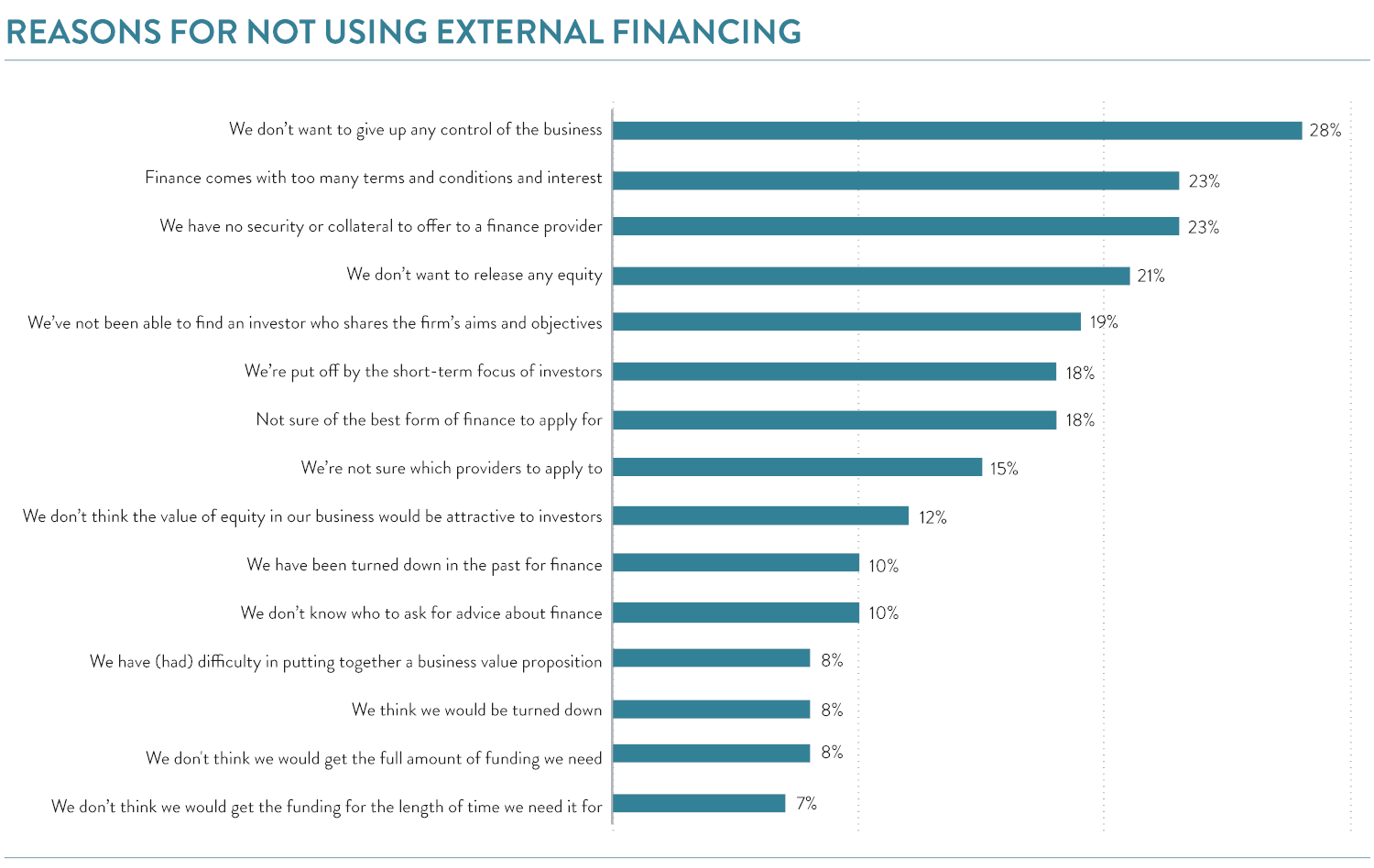

Those who do not use finance, or do not feel they have the right amount available to them cite not wanting to give up control of the business (28%), finance coming with too many terms (23%), or a lack of collateral to provide (23%).

ATTITUDES ON EQUITY FINANCE VARY CONSIDERABLY ACROSS FIRMS

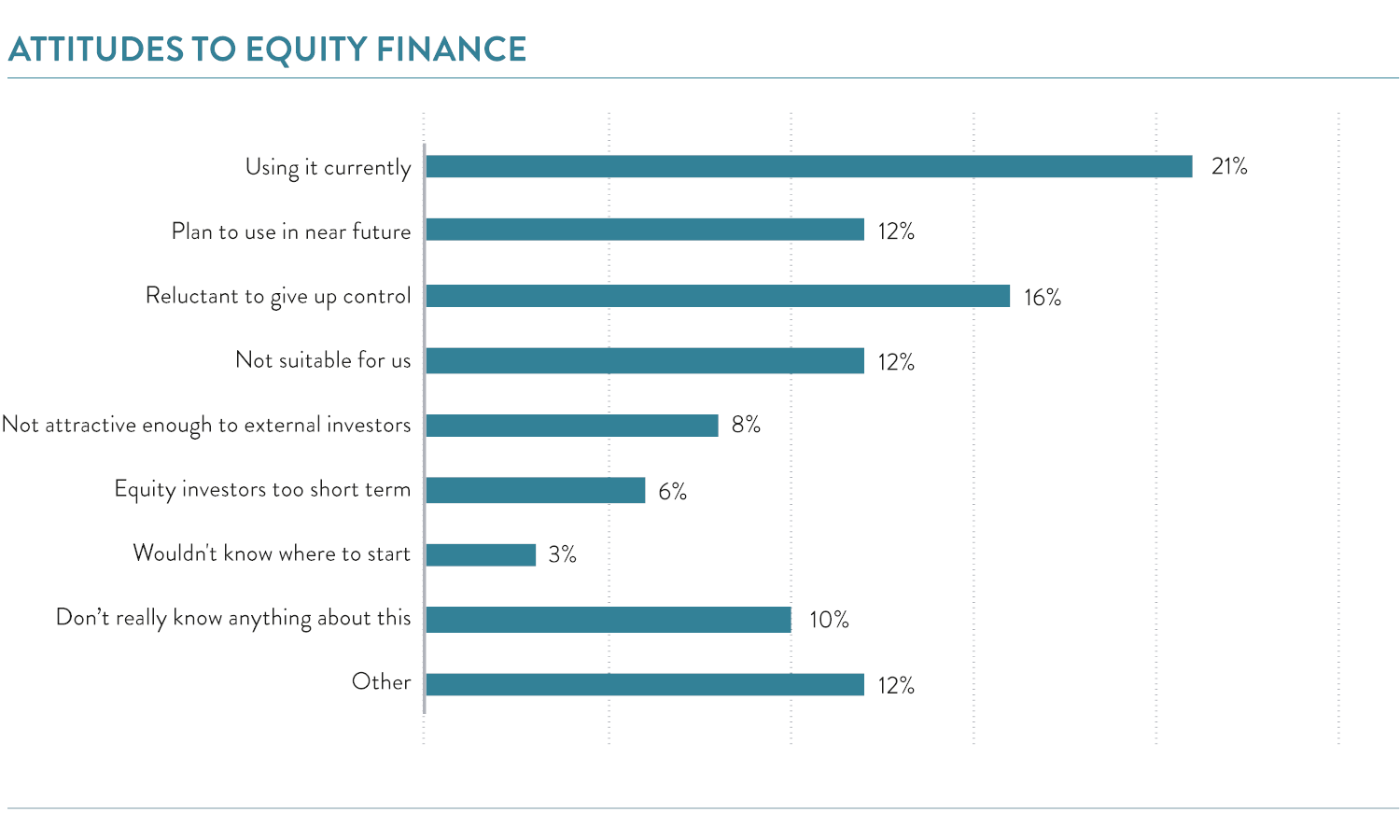

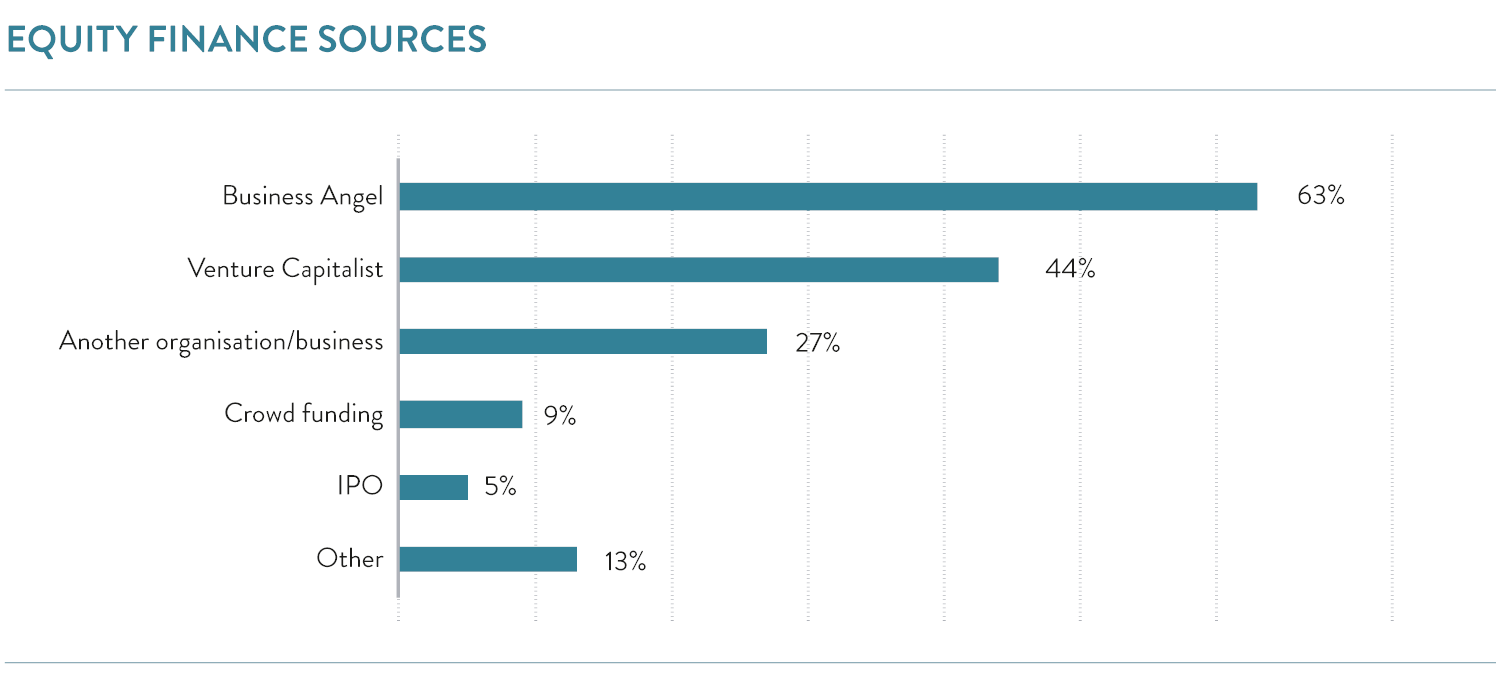

Of the scaleups using external finance, one in five currently use equity and one in ten expect to use it in the future. Scaleups use a variety of forms of equity finance with angel investors (63%) and venture capitalists (44%) most common.

Those who do not use equity finance have a variety of reasons: 16% are reluctant to give up control, while 12% believe that equity finance is not suitable for their needs.

Encouragingly, the knowledge gap about equity finance appears to be closing. The percentage of those who say they do not know anything about equity finance has dropped from 17 to 10% compared to last year’s Scaleup Survey. This is a positive indicator of the impact of the ongoing finance education that is taking place and that access to the tools – such as the British Business Bank Finance Hub – are making a difference.

Though attitudes towards equity finance are relatively similar across the UK, 10% of those outside London believe that the value of equity in their business would not be attractive to external investors. This figure was only 3% for businesses in London and the South East.

Page URL: https://www.scaleupinstitute.org.uk/articles/access-to-finance/

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share