Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Introduction

Scaleup businesses are a critical part of driving growth and productivity across our economy…

Executive Overview

On the threshold of a new decade it is time to take stock of where we have come since our founding in 2015.

Introduction

Lord Smith of Kelvin, Chair, British Business Bank, Alliance Trust plc, IMI plc and Forth Ports Ltd; Chancellor, University of Strathclyde

Simon Edmonds, Deputy Executive Chair & Chief Business Officer, Innovate UK

As this Review highlights, scaleup businesses are a critical part of driving growth and productivity across our economy.

Over four years we have seen a 35% rise in the number of high growth businesses, up to 36,510 in 2017. Collectively scale-ups generate 20% of all turnover, and 20% of employment growth amongst all existing businesses.

This Review highlights the strong progress made, and some of the crucial opportunities and challenges to address moving forward to help businesses unlock their potential and scale up.

The British Business Bank takes this challenge very seriously, and over the course of the past 5 years has put in place a series of initiatives to address the scaleup finance challenge. This includes our Finance Hub, providing clear information to scaleup businesses on growth capital, our UK Network engaging with local areas to boost demand, and the launch of British Patient Capital boosting the supply of long term finance for innovative, fast growing firms.

The ScaleUp Institute continues to make a real impact on scale ups across the country through their research and education programmes.

Lord Smith of Kelvin

Chair, British Business Bank, Alliance Trust plc, IMI plc and Forth Ports Ltd; Chancellor, University of Strathclyde

High growth and scaling businesses are core to future economic growth. At Innovate UK, part of UK Research and Innovation (UKRI), we remain resolutely committed to making the UK one of the very best places in the world for such businesses to innovate and scale, at pace. To us, this matters because business-led innovation is how we will maximise the economic and societal benefits of new ideas over the long term.

To best support those businesses we focus on creating an enabling environment that encourages innovation in all businesses with the potential to grow and scale, right across the country. We are placing more emphasis on identifying and investing in high-growth SMEs with the potential and ambition to grow through innovation. This is reflected in the way we assess and fund innovation projects and the wider support delivered, including for high potential scaleups.

To best support those businesses we focus on creating an enabling environment that encourages innovation in all businesses with the potential to grow and scale, right across the country. We are placing more emphasis on identifying and investing in high-growth SMEs with the potential and ambition to grow through innovation. This is reflected in the way we assess and fund innovation projects and the wider support delivered, including for high potential scaleups.

In this year’s ScaleUp Index it is pleasing to see that grant funding made by Innovate UK of £205m has leveraged a further £2.8 billion from the private sector thus enabling 642 scaling businesses to break through the £10 million turnover barrier to visible scale and on-going growth.

Alongside the significant efforts of the regional offerings in this space, mapped previously by the ScaleUp Institute, our own national scaleup service has just passed £25m in funding rounds for previous cohorts (28 companies) and is creating over 300 jobs, while the 2019 cohort (another 20 companies) are poised to receive support from our scaleup director team, with further funding rounds of £8m in progress.

By working together with expert partners we can continue to help ambitious businesses to grow their revenues and employees, penetrate new markets at home and overseas, connect with potential investors and customers and overcome their barriers to growth. Within UKRI this is our key specialism and focus.

We look forward to continuing our partnership with the ScaleUp Institute, our joint events with the London Stock Exchange and other activities in the scaleup ecosystem over the next year, including greater involvement with our Catapult Centres.

Simon Edmonds

Deputy Executive Chair & Chief Business Officer, Innovate UK

Chair's Foreword

Sherry Coutu

Chair, ScaleUp Institute

This Review marks three major milestones in the UK’s scaleup journey.

It is six years since the Government asked me to write the Scaleup Report on UK Economic Growth, five years since I made 12 recommendations to pave the way for the UK to become a scaleup economy and four years on from when I co-founded the ScaleUp Institute to work with ecosystem stakeholders to increase the proportion of businesses that scaleup in the UK.

With the publication of this 2019 Annual Review, I complete my term of office as pro-bono Chair of the ScaleUp Institute. The moment is right to take stock of the progress we have made together since 2014 and set down some markers for the future journey.

When I was commissioned to write the Scaleup Report on how to stimulate UK economic growth, I reflected that: “Competitive advantage doesn’t go to nations that focus on creating companies, it goes to nations that focus on scaling companies.”

That report drew together academic research from hundreds of sources, interviews with several hundred practitioners and policymakers world-wide and a survey of 363 scaleup CEOs in the UK.

The evidence was stark: the UK economy was lagging behind the US and other leading economies in the extent to which our companies scale. It was a major issue for the UK, I warned, because scaleup companies are crucial to national competitive advantage in that they drive economic growth, job creation, and productivity in the longer term.

Evidence I shared was overwhelming. RBS analysis suggested that in the short-term 238,000 jobs and £38 billion additional turnover was possible within three years of reversing the scaleup gap. Long-term the prizes could be even greater. I identified three pillars that should be the focus of future efforts to sustain ambitious companies: the need to share data and evidence, the vital role of education and the ability to create an enabling ecosystem – both local and national.

The messages in the 2014 report produced a wave of enthusiasm. The response was overwhelmingly positive – from business, academia and Government. Insights into how we could close the UK scaleup gap that featured in my report became the big ideas of a significant number of roundtable discussions. A spirit of “let’s get this done” was generated and in this stimulating environment the ScaleUp Institute was born.

Five years on, it is pleasing to bear witness to the total number of scaleups having increased by 35% today in the UK compared to 2013. Our reach has extended further into the political and global arena. Year on year, more organisations are stepping to focus on scaleups to help realise their potential as engines of growth. At our urging, we have seen the creation of a Ministerial Champion for Scaleups and scaling up has been a significant element in Government reports, announcements and Budgets.

We have forged valuable partnerships with ONS and HMRC to develop innovative ways of using data to identify businesses that need specific scaleup support. We are working closely with Innovate UK and the British Business Bank to deal with the fundamental challenges of scaling businesses.

Far from being the poor cousin, international organisations have increasingly been looking to the ScaleUp Institute for leadership and advice regarding initiatives and activities they should consider adopting to drive their cities’ or countries’ economic growth.

Looking back, a lot has been achieved. Looking forward, it is clear that there is still more to do. The ScaleUp Institute’s latest survey has identified that the issue which is the fastest-rising for scaleups is access to markets. This is very significant at a time of global uncertainty. We are tracking hundreds of initiatives and it is clear that the UK is still falling short in its response to scaleups’ demands for more market access both in terms of corporate and government procurement and international programmes.

Government and large corporates need to do more to work with scaleups not through corporate responsibility but sound business sense – working with productive, innovative businesses is a win-win and more opportunities should be created to help them sell overseas.

The ScaleUp Institute has long argued that City Mayors need to take a lead in promoting their scaleups nationally and internationally. It is great to see Manchester introduce a scaleup focus on its international trade mission, following the example set by London which we endorsed in our case studies. Newcastle is looking at a similar proposal and I would urge other cities to adopt this approach as a priority.

Across the UK, regional disparities remain and there are too many areas stubbornly lagging in scaleup growth. The evidence from Chapter 3 of this review is that clustering works and that there are initiatives and programmes that are having a significant impact. If they have not already done so regions must build scaleups into their local industrial strategies. The guiding principle should be to build on what exists and is effective rather than spend time and energy reinventing new schemes. Vitally, government must ensure that the public sector should invest in what works and that the public-private sector replicates those programmes which are currently EU-led.

I continue to believe that the power of data is the key to unlocking scaleup potential and the accompanying economic growth that results from it. Releasing and harnessing available data will be vital to monitor the efficacy of the scaleup interventions and policies across the private and public sectors that have sprung up to address this national crisis, as well as to connect scaling businesses to the resources they need.

We have made a significant start in this area, but the UK must do more to highlight what is working most effectively so we can help cities and areas that need a boost. In the UK economy, there are talented entrepreneurs who are scaling multiple times. Let’s find them and ensure they get the finance to sustain their businesses and build the momentum that will create the UK giants of the future as well as the networking opportunities that allow them to grow and spread their influence to other ambitious business leaders. That’s the glittering prize for the UK economy.

I am thrilled that we have made such progress in just five years – progress that I could only have hoped to achieve when we first came together in the ScaleUp Institute. I leave as Chair of this institute I co-created knowing it is an effective and influential organisation with talented and dedicated staff and supporters who are making a difference for ambitious businesses. I will continue to remain a member of and an ambassador for the scaleup movement, positive about what we can achieve as ecosystem – indeed must achieve – as we enter challenging economic times.

Working together we have the power, the ambition and the commitment to achieve our goal of making the UK the global leader for scaleups.

Executive Overview

Irene Graham

CEO, ScaleUp Institute

On the threshold of a new decade it is time to take stock of where we have come since our founding in 2015. The ScaleUp Institute has been the catalyst for significant action by national, regional and local governments, as well as by the finance, education and corporate sectors, to implement practical solutions which tackle the challenges faced by our scaling businesses. However, our work has really only just begun.

Successive national Governments have embedded scaleups as a priority in their economic policies and the evolving Industrial Strategy. Leading government agencies – notably the British Business Bank and Innovate UK – have adopted strategies that are making scaleups a core element of their propositions. At a local level, the devolved nations, local authorities and Local Enterprise Partnerships are placing greater emphasis on scaling businesses, services and programmes.

From our outset, we have recommended the targeted segmentation of scaleups. A number of sectors central to the UK’s economic success – such as creative, life sciences, tech and finance – have heard our call and taken action. The finance sector – from banks to venture capital firms to angel investors – have sharpened their focus on scaling firms including those pertinent to female founders1. The international community has taken notice of our work and we are seeing several countries already adopting what we have learned into their own policies and actions, and are working with us to respond to the needs of international scaling businesses.

At this moment it is critical we do not fall into complacency. We still have many significant and entrenched issues to resolve and many hurdles to overcome.

We can be heartened by the progress that we have made over the past five years in creating a scaleup ecosystem. Now our focus must be on maturing it. Scaleup leaders need an ecosystem that is sustainable and agile enough to ensure it can meet the present and future challenges of their fast-growing companies. We need to recognise that the recorded growth in scaleups is potentially fragile as there have been recent signs that growth is slowing. We will monitor this situation closely.

We are entering a time of economic challenge and unpredictability. This is underlined by the overwhelming perception by scaleup leaders that Brexit will have a negative impact on their businesses. Scaleups are also giving us a very strong signal that the UK is failing to make enough headway to close the talent and market access gaps. Half are worried about the future of the UK as a place for doing business and many still do not feel there is sufficient support available to them – particularly outside of London and the South East. In our own mapping of the scaleup support landscape, we find a notable lack of solutions for companies trying to tackle the challenges of access to markets.

So the clear message is that this is no time to drop our guard if we want to close the scaleup gap with competitors and increase the UK’s share of global trade. This is the time to double down on collective action to overcome the scaleup challenges.

Local action and a step up in collaboration remain imperative.

The ScaleUp Institute set out to collaborate and build alliances with diverse players across the ecosystem. It is only by working together and spreading awareness of what works that we can break down the barriers scaleups face. Our three Driving Economic Growth through Scaleup Ecosystems (DEG) education programmes, supported by Goldman Sachs 10,000 Small Businesses UK, Innovate UK and most recently the British Business Bank, have had a galvanising impact.

We have now shared well-evidenced insights into how to help scaleups flourish with 37 LEP or devolved government areas, 34 Growth Hubs, nearly 200 ecosystem leaders, 22 universities and business schools, and five science parks and infrastructure hubs. All attendees have either taken action or launched programmes that should make a difference to scaling businesses.

- 50 initiatives were set up as a direct result of the DEG courses and these are directly engaging with 2,500 scaleup business leaders covering 37 sectors and producing average business growth ranging between 21 and 66%.

- Universities who participated – and they are such important members of the ecosystem – have launched activities including a Scale Up MBA, scaling programmes, peer networks and targeted engagement with businesses.

- Local government players have begun to look at what they can do to simplify their procurement procedures and support the growth of scaleup companies on the international arena.

These new programmes need to be sustainable and capable of growing to cater for demand. So, too, does coverage of impactful programmes that address the barriers of access to talent and access to markets. This is a deficiency that needs to be resolved.

In succeeding Reviews we have highlighted those programmes we consider to be exemplars to spread knowledge about what works and encourage best practice. This year we are taking our mission a step further by launching an interactive nationwide ScaleUp Support Finder alongside the 2019 Review.

This ScaleUp Support Finder contains the details of over 200 national and local programmes mapped by the ScaleUp Institute. It has been designed to be a dynamic tool. Business leaders will be able to search for local programmes, seek to apply to them as well as rate those they have attended. It is vital that busy scaleup leaders can search and find information about relevant programmes easily and we hope this tool will make an increasingly powerful contribution. The finder also enables parties to request the ScaleUp Institute to carry out a detailed evaluation of a specific programme and conclude whether it should be endorsed or not.

Where we are now

There is evidence of steady progress being made across the country. Every area is witnessing a growth in scaleups. When the ScaleUp Institute first started to conduct this data analysis, nine local areas were reporting decreases in their scaleup numbers. The findings from this year’s scaleup survey also shows that inroads are being made in tackling some of the key challenges – such as leadership.

A number of significant themes emerge:

- Making HMRC data on scaleups visible is having an impact. Identifying scaling businesses that are not visible to the local ecosystem and helping to connect businesses to relevant tailored scaleup resources remains a critical objective. Our pilots, in which HMRC contacted scaleups signposting them to dedicated scaleup services arising from SUI work have demonstrated that businesses do take notice of such communications and respond to messages that focus on growth and direct them to relevant services. Timing is vital; as the case study of Insight Technology shows. More work on this is planned in 2020.

- The ongoing development of dedicated scaleup services across the country is resulting in new areas such as Cornwall & Isles of Scilly, D2N2, Enterprise M3, Heart of the South West, Oxfordshire and Sheffield City Region joining our existing exemplar LEPs. It is vital that an increasing number of LEPs include scaleups in their Local Industrial Strategies as well as having them embedded within strategic economic plans – this must continue to be the priority.

- The number of programmes supporting scaleups that the ScaleUp Institute can endorse, having examined and tested their evidence, continues to rise. In the 2016 Review we endorsed 13 and this review endorses 44 including international programmes – a rise of 238%. The development of evidenced impactful programmes must be sustained and leveraged.

- A global focus is beginning to emerge in programmes and initiatives. These include the Innovate UK ScaleUp Director service and their Global Business Innovation Programme, and from City Mayors such as Manchester following the example of the Mayor of London in providing a dedicated international service for scaleups.

- As our mapping shows, and our annual scaleup survey reinforces, there is simply insufficient action and co-ordination of initiatives to help scaleups address the access to markets gaps on procurement, collaboration and internationalisation. Much more needs to be undertaken by the Government and the private sector in this area if we are to properly address these deficiencies. More practical solutions need to be brought to bear and better engagement models deployed: it is the fastest growing concern for scaleups. The work of the EUREKA Global Innovation Network and Enterprise Europe Network overseen by Innovate UK, as well as IUK’s Global Business Innovation Programme and 2019/20 strategy plan, are steps in the right direction on the international agenda. So, too, is the implementation of the DIT Export Strategy – which needs to be stepped up.

- Patient capital remains vitally important for scaleup businesses and work is underway with last year’s initial wave of investments from British Patient Capital. However, there is still more work to do to unlock UK institutional investment and to make sure regional disparities, sector funding gaps and knowledge gaps are closed.

- Infrastructure hubs and science parks – especially where they have established research links with universities – are playing a significant part in supporting scaleups. They provide wrap-around peer groups, mentors, investors, and guidance from which others can learn. There is still work to do on peer-to-peer networks, talent and market connections – these are areas in which such hubs can play a vital role.

- There is a growing significance of sector initiatives focused on those areas of the economy that are proving fertile for scaleups – particularly in the tech, life sciences, creative and social sectors. The programmes deployed by Tech Nation will be important to maintain and foster while the Creative Sector ScaleUp pilots with combined authorities will be a good testbed for further such bespoke sector initiatives.

The 2019 Review draws on the thematic work of the ScaleUp Institute’s Committees and the findings of the latest survey of scaleup leaders to present a comprehensive picture of the national and local landscape for scaleups. As in 2018, it also contains a Public Procurement Index, identifying total public expenditure with visible scaleups and exemplars of impactful programmes which now reside on the ScaleUp Support Finder.

Our partnership with the Office for National Statistics (ONS) continues to provide vital information for our work. Once again we have examined closely the detailed datasets that demonstrate how different areas are performing, allowing us to identify where local authorities still need to take action. The evolving HMRC work with DECA is bearing fruit and will remain a key focus in 2020.

Combined with other research we have carried out during 2019, regular meetings and engagements with scaleups and local business ecosystem leaders, the results of the 2019 survey and the Scaleup SME Finance Monitor – with over 4,000 insights – the evidence lays bare a consistent pattern and provides insights and learning for continued work in 2019.

Our major conclusions for 2019 are:

- Scaleup businesses are growing – for the first time, all regions of the UK are experiencing a growth rate of greater than one additional scaleup per 100,000 of population, according to the most current data (2017). There are now 36,510 scaleups – a rise of 34% on the previous year. This trend in ONS data is also evidenced in our latest ScaleUp Index with Beauhurst, which shows a 23% increase in number of scaleups achieving Companies House reporting threshold levels of £10.2m turnover. While this is encouraging, there is no room for complacency because the progress may be fragile. There has been some slowing of the ONS average annualised rate of 9.3% between 2013 and 2016 and there is some suggestion that 2018 data could show a decline in numbers.

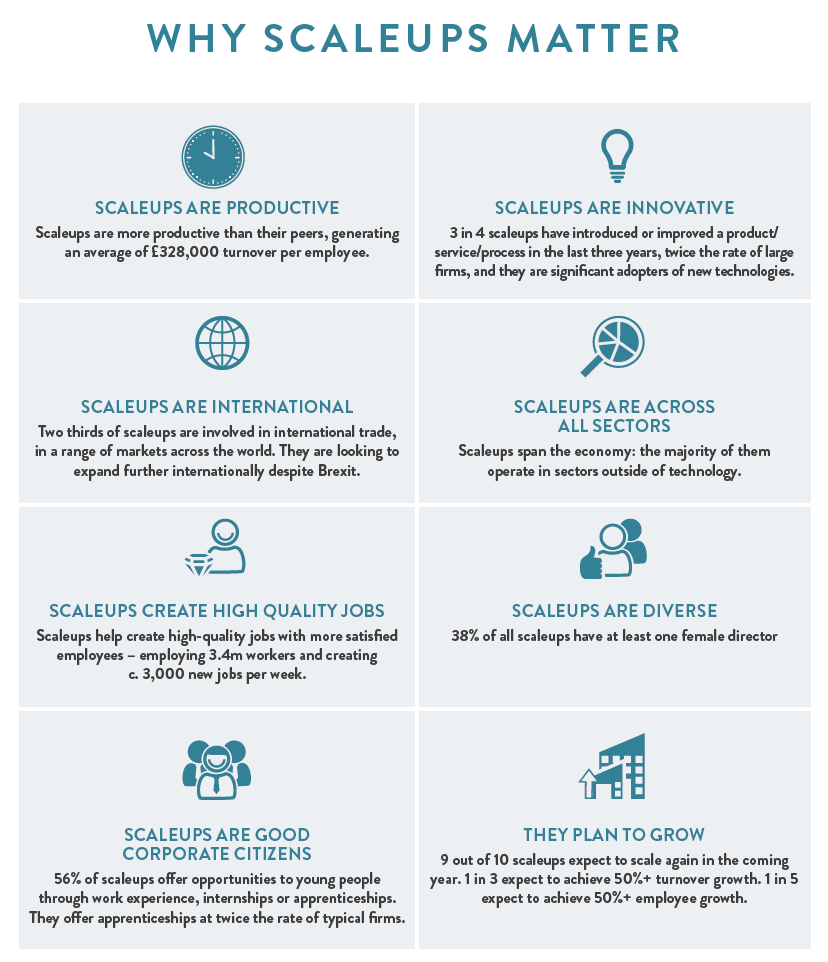

As the ONS 2017 data is based on the first full year following the EU referendum, the ScaleUp Institute will monitor how subsequent developments affect ability to scale and the ecosystem’s level of adaptability to evolve to meet scaling business needs. In particular, we need to know how programmes currently funded by the EU will be replaced. Scaleup business leaders are savvy enough to know how existing programmes are funded and are concerned about their sustainability. - Scaleups are our Growth Champions. The value that scaleups contribute to the national economy remains significant, particularly in relation to other SMEs. Turnover is substantial in comparison; scaleups employed 3.4 million people in 2017, generating a total turnover of £1.3trn for the UK economy with an average turnover per employee of £380,000. Yet, according to the ONS, the total turnover for all SMEs in 2017 was £1.9trn. On average, scaleups are 42% more productive than their peers and they are present across all sectors of the economy. These findings emphasise the critical need for segmentation and tailored policy, solutions and services for scaling firms in our public, private and education sectors.

- Scaleups keep scaling. Since 2001 two-thirds of scaleups have scaled more than once over the period, with 43% scaling three or more times. Turnover scaleups were likely to scale turnover repeatedly, and employment scaleups were likely to scale employment repeatedly. In addition, most employment scaleups scaled their turnover. Three quarters of employment scaleups also scaled turnover at least once over the period – however the same was not true of turnover scaleups, where a lower proportion scaled employment.

- Despite national scaleup growth regional disparities do remain. In the three-year period 2014-216 the areas with the fastest growth rates are York, North Yorkshire and East Riding and Oxfordshire while there has been some slowing of the growth rate in Scotland. Tees Valley remains one area of the country where there are fewer than 40 scaleups per 100,000 of population. This reinforces the imperative for local intervention and action. These datasets increase our understanding of scaleups, and also reinforce the need for more real-time information to enable more effective private and public sector engagement to scaling businesses at every level. This is work we continue to progress with Government.

- Scaleup leaders are ambitious, innovative and international. Nine out of ten expect to grow further in 2020. One in three expect to grow turnover by 50% or more and one in five expect to grow their number of employees by 50% or more; three in four introduced a new or significantly improved product in the last three years (74%) and five out of ten scaleups export and want to do more. They are also significant adopters of new technologies. These ambitions highlight the importance of growing the support for collaboration and internationalisation as well helping scaleups access a wide range of talent with modern skills for the workplace and peer networks.

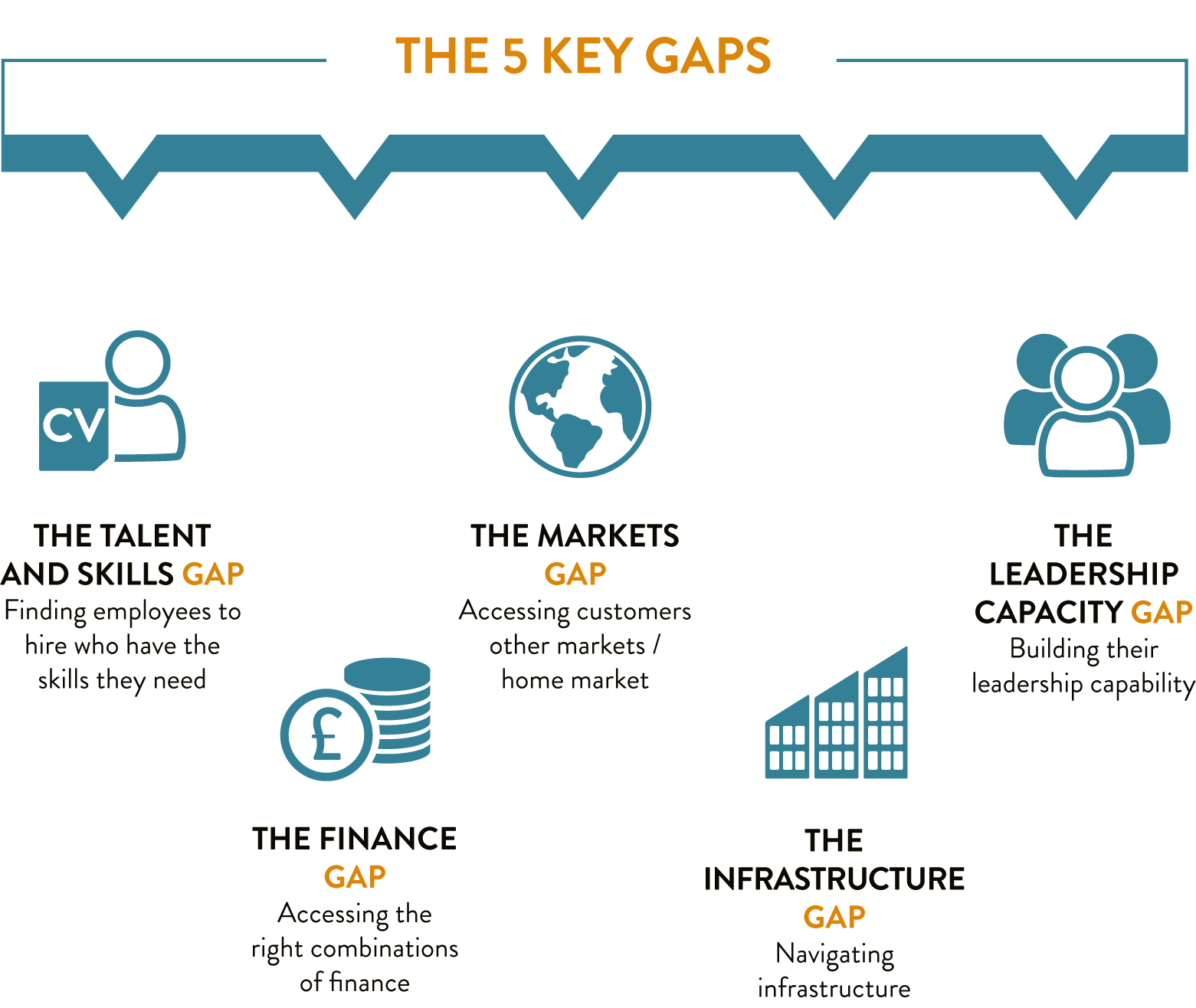

- The core challenges remain but access to markets and finding talent stand above other challenges for scaleups. Concern over access to markets is accelerating as an issue with it now overtaking access to talent when scaleup leaders were asked to identify their barriers to growth; eight out of ten scaleups identify this as a major issue just ahead of the challenge of recruiting the right talent. Access to talent becomes the biggest issue when asked to name their top three. These two barriers are now significantly ahead of all other challenges cited by scaleups and are critical priorities to address.

- Opportunities to collaborate with Government, corporates and universities and need to be boosted. Access to R&D and Innovate UK services are seen as vital pillars to scaling although scaleups are not yet collaborating enough with universities; only two in ten business leaders said they had collaborated with universities or research institutions to develop a new product or service in the past three years. This points to the need for universities to do more to reach out to scaleups, providing research, education and facilities to help them test products and bring them to market.

- Procurement and collaborative opportunities need to be increased and simplified Public sector bodies awarded £0.9bn worth of contracts to 423 scaleups in 2018, but more remains to be done as scaleups only account for 1.2% of the total value awarded. Central Government, in particular, has room to improve. It is currently only responsible for 12% of awards given to scaleups by value. Scaleups continue to cite difficulties in discovering opportunities to bid, as well as finding the process too complex. More can be done to raise awareness and simplify procedures in the public sector sphere – but also significantly in the corporate world.

- A significant proportion of scaleups – four out of ten – still believe there is no relevant support for a company like theirs and seven in ten want to see better coordination of support. With our research showing that one in three of the emerging scaleup initiatives since 2014 (some 200+) are EU co-funded, we need to make sure that not only do we continue to close the gap across all regions and in all barriers but also do not allow any gap to widen by failing to have domestic policy routes which can absorb past EU support for UK scaling businesses. Access to these facilities must be continued or appropriately replaced.

- Regional efforts to improve investment and business support have taken place but scaleup leaders want to see more equality across the country in financing and programmes. They perceive there to be major regional disparities in both of these areas. Six out of ten scaleups – particularly those based regionally – do not feel they have access to the right funding for their needs and ambitions with five out of ten viewing funding as predominantly focused in London and the South East.

- Building leadership capacity through local support remains a constant theme of scaleup business leaders, although it appears that solutions are beginning to have an impact on this challenge. Scaleups reinforce their desire for local leadership provision across disciplines and roles. The value of peer networks to CEOs and executives of scaling businesses sees a further rise in importance, along with their ability to access a cadre of NEDs with experience of growing a business. These needs are growing and the ecosystem will have to respond to them.

- People and place matter most. Scaleup business leaders still most value locally- rooted resources and services to foster their growth. They are looking for local solutions that are easy to navigate and tailored to their specific needs. These include peer-to-peer networks where they can discuss solutions to common challenges with counterparts, stronger access to schools, universities and collaboration partners in the public and private sectors. While scaleup leaders recognise that there are national Government initiatives, they want these delivered locally in a manner much easier to navigate.

As an ecosystem we must:

- Continue to use and refine the data available including HMRC data sets (tax and National Insurance data) to allow better engagement with the scaleup community and fast-tracking of relevant solutions to scaleup leaders. We have evidence that this works. In 2020 we will continue our work with Government and HMRC in piloting the use of data to identify and communicate with scaleups and in driving forward a verification solution including further analysis on a central opt-in or self- identification service.

- Dial up the activity to close the market and talent gaps, which includes overcoming the obstacles to collaboration, procurement and exporting. We must break down the barriers to collaboration; both public and private and education bodies should review their practices, learn from examples, make procurement more transparent, simpler and easier to navigate for scaling firms, and report on procurement involving scaleups. Dedicated scaleup trade missions should be the ‘norm’ in every major city/ region. We have refreshed our corporate procurement checklist with Nesta and recommend it as a tool for improved engagement with scaleups in the supply chain. In 2020 we will continue to monitor progress and highlight best practice as a part of our ongoing work.

- Encourage universities to play a greater role in growing scaleups by offering executive education, insights, research and facilities.

- Continue to act at a local level to overcome continuing disparities and act in a targeted manner. Scaleup needs and solutions must be high on the agenda of every local area and authority. Detailed ONS datasets demonstrate where the challenges lie and where action needs to be taken. In 2020, the ScaleUp Institute will continue its work with partners to address this.

- Continue to better segment scaleup-centric and hub solutions at a local and national level. We must segment businesses according to their growth, aspiration and potential, and have a client-centric approach to solutions for scaling firms that intensifies support as businesses move up the scaleup trajectory; and provides scaleups with account managers who can work with them to understand their developing needs as they grow. All Local Industrial Strategies should have a clear scaleup component. Local account managers should be put in place to curate relevant activities and help scaleup business leaders navigate impactful private and public sector initiatives tailored to meet their needs. Scaleup enablers who can join up the ecosystem, such as those deployed in West of England and Greater Manchester, should be emulated.

- Link scaleups to capital and local spaces to enable them to grow faster. We must maintain the impetus to close the finance gap, by moving forward on British Patient Capital, unleashing institutional monies, continuing to address regional disparities and focusing on sector needs as we have seen in social scaleups, the creative sector, life sciences and female founders. Further consideration should be made to the establishment of a Sovereign Wealth Fund.

- Join up tailored solutions leveraging what has already been tried and tested rather than expend time and resources on reinventing new programmes that may be sub-scale.

- Champion scaleups, spreading awareness of their successes and identifying role models to inspire and motivate more entrepreneurs and to help develop peer networks in which challenges and solutions can be discussed.

- Ensure that no gap in scaleup solutions emerge as a result of ongoing EU dynamics and that we continue to access – or replicate – the necessary funding and collaboration tools.

In the rest of this report we examine:

- Chapter 1: The national and local scaleup landscape, identifying numbers, sector and growth trends, including setting out what our scaleup leaders are telling us.

- Chapter 2: Well-evidenced programmes that are working to overcome the challenges faced by scaleups that we endorse for local ecosystem leaders to emulate or incorporate into support they are providing for their fast-growing businesses.

- Chapter 3: How participants of the ScaleUp Institute’s Delivering Economic Growth courses are progressing in creating comprehensive locally-based ecosystems for scaleups. Local Scaleup Briefings which draw together various sources to provide insight into the local picture are included for all areas and devolved nations as an annex.

- Chapter 4: Progress on our previous policy recommendations, the work of the ScaleUp Taskforce and the further actions we need to take in 2020 and the next decade if we are to dismantle the barriers that are holding back scaleups from growing faster.

- Chapter 5: The prospects for scaleups in 2020 and the work that the ScaleUp Institute and its partners need to promote and support.

- Scaleup Stories: As a new feature in this year’s review we champion the scaling stories of some of our leading scaleups from around the UK.

In summary

Scaleups are making an immense contribution to the UK economy but we cannot be complacent. We still have to meet the challenge set by our international competitors and climb to the top of the OECD rankings. We do not yet hold the trophy in our hands.

While we can be heartened by the progress made over the past five years we need to focus on maturing the scaleup ecosystem to ensure it is sustainable and can meet the demands of scaleup companies and the core challenges that they face. Scaleups are giving us a very strong signal that the ecosystem is failing to make enough headway to close the talent and markets gaps. These two challenges will be a priority focus for us in the coming 12 months.

As we continue our mission to drive forward awareness of scaleup challenges and the actions needed to address them, we will also put better collaboration with government and big business at the top of the agenda.

We will promote solutions to overcoming the main barriers to collaboration cited by scaleups; time-consuming and complex procurement processes, and the lack of identifiable opportunities. This includes encouraging large corporates to adopt a ten-point toolkit for effective collaboration. We also want to see national and local Government and large corporates reporting on the proportion of their procurement with scaleups – if you do not measure it, you cannot begin to improve it. With a more concerted effort across the UK and better reporting all of these issues could be solved.

We recognise how important it is to join up the international ecosystem to help scaleups make valuable links with overseas supply chains, customers and organisations as well as peers so we are planning an international summit for the first quarter of 2020.

In pursuing our vision that local must be imperative we have been examining the local drivers that influence scaleup growth. Early indications from our research are that access to a sizeable market, the presence of other highly innovative firms and the density of finance will have a significant impact. We will publish this full research in the New Year.

To tackle the disparities that remain in scaleup financing across the UK we will deepen our engagement with the British Business Bank’s regional arm and strengthen our connections with the business angels’ organisation UKBAA.

We will also continue to develop closer engagement with the education sector and organisations working to link classroom with workplace to ensure that the needs of scaleups are forefront of thinking in careers and enterprise education.

And we will be working to ensure that programmes specifically designed to support scaleups are provided equally across the country, further collaborating with Innovation UK and encouraging the further development of peer networks as well as helping link up more talented, experienced non-executive directors with fast growing companies.

It is a full agenda but it is what our ambitious businesses deserve and need. All those who want to see the UK take its place in this new era as the best nation in which to scale a business are invited to join us in driving this forward.

Page URL: https://www.scaleupinstitute.org.uk/articles/introduction-landing-page/

2019 Recommendations

2019 Recommendations

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share