Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Access to Markets

Since the initial Scaleup Report in 2014, the issue of access to markets has accelerated significantly. It is now consistently seen as either the first or second biggest challenge by scaleup businesses. As the UK forges new relationships on a global scale over the coming years, the drive to bolster our innovative exporting companies and provide them with the right programmes and incentives both internationally and domestically must be a national priority.

This year 82% of scaleup CEOs stated that access to markets, whether at home or abroad, is the most critical issue to their growth. This corresponds to gaps identified in our mapping of UK Support for Scaleups where there continues to be a lack of impactful private/public sector programmes geared towards government and corporate procurement / collaboration and internationalisation to meet demand from scaleup companies across the country.

As we have consistently highlighted, accessing appropriate markets is a cornerstone for ongoing scaleup growth. This is further corroborated in new research by the World Bank (May 2019) which notes “firms that introduce new products and export are significantly more likely to experience a high-growth episode than firms that introduce new products only in the domestic market.”1

It is striking that The Pink Book: 2019, published on 1 November notes that “the UK current account deficit widened to 4.3% of nominal gross domestic product (GDP) in 2018, from a deficit of 3.5% of GDP in 2017, and remains high by historical standards”. Further highlighting “this is driven mostly by the widening in the trade deficit from 1.2% to 1.8% of GDP in 2018 – the largest trade deficit since 2010.”2

In this context the Office for Budget Responsibility specifically warns that the current risks related to uncertainty could become a longer term structural challenge for the UK, with “increased barriers to trade, migration and foreign direct investment … also likely to have further adverse dynamic effects – persistent effects on the growth rate of potential output – for example, by impeding technology transfer and slowing innovation and technological progress.”3

It is this challenge for UK plc which makes the particular access to market barriers faced by scaling business – who are our innovators, exporters and ambitious firms – ones we have to urgently resolve and address.

It is entirely within the scope and capability of our Government and private sector players to address these market shortfalls. Now is the time for action.

EXPORTING FOR GROWTH

The Export Strategy was published on 21 August 2018 and sets an ambitious goal to increase exports as a share of UK GDP from 30% to 35%.

Encouragingly, the Export Strategy recognised the importance of scaleups as a segment for intensive engagement as part of the ‘High Potential Export Businesses category’4 and through the Enhanced International Trade Adviser (EITA) service. However, work needs to be stepped up on its implementation – and at pace. At present, our programme mapping shows there are only 14 international initiatives dedicated to scaling firms.

This strategy needs to realise its intent and make sure that its implementation properly addresses the needs identified by our scaling businesses – of account management, better buyer introductions, market insights and more tailored trade missions. As evidenced in our surveys, scaleups place great value on a constant and consistent account management approach rooted in local areas – so the EITA service is a key deliverable in taking this forward. This level of engagement should also translate into appropriate, modern and dynamic online tools and provide businesses with bespoke opportunities and relevant market content on a timely basis. In addition, the Export Strategy said that it would look at some form of export voucher scheme; this is a recommendation that the ScaleUp Institute and others have made.

A robust CRM system is needed to link up the various levels of contact between government and exporting businesses. This will also facilitate engagement with overseas opportunities and connections across Government services. Government should also seek to learn from and integrate appropriate initiatives from the private sector. For example, we have previously noted the ‘Google Market Finder’ tool (launched in 2017)5 which provides a simple three-step approach for businesses looking for potential export markets.

In 2019 the ScaleUp Institute continues to endorse the Mayor of London’s International Business Programme as a clear example of a focused service for scaling businesses. We have consistently recommended that both central and local government seek to emulate this and tailor it to their local scaleup sectors and needs. It is therefore very pleasing in 2019 to see the launch of Global Scale-Up in Greater Manchester which has used the learnings from the London programme to develop a bespoke service for locally based scaleups with a first cohort of 33 businesses engaged. Collaboration is also now taking place between the two cities on future joint international initiatives. Work is also underway on a North East export initiative. One encouraging central initiative is the Department for Digital, Culture, Media & Sport (DCMS) Go Global series, intended to build stronger partnerships internationally around the ‘Tech for good’ agenda. The ScaleUp Institute will monitor these initiatives including the forthcoming Tech Competitiveness Study which we are engaged with. It is vital to leverage what works, as opposed to constantly reinventing, and optimise what works through funding of proven models.

Data will also be key in driving these initiatives forward in the optimal way. In 2020 we will be working with partners on how we evolve an Export Data Lab to further harness data sources towards scaling exporters and their needs.

UK EXPORT FINANCE

The ScaleUp Institute has worked closely with the banking industry in the evolution of UKEF facilities, the broadening of its product range and deployment of direct lending in support of export activities. However, there is still work to be done – making it smoother and simpler to access, and improving the customer experience. This means simplifying documentation and simplifying access, as well as ensuring the right regulatory framework exists to support export finance.

UKEF was awarded the title of ‘Best export credit agency’ by Global Trade Review and Trade Finance Global this year (for 2017) and received a 9/10 rating for the products it offers6. It is also good that 79% of businesses supported are reported to be SMEs (up from 77% in 2017-187). The substantial growth in volume this year to £6.7bn is positive following the previous drop between 2016/17-2017/18. However, while the total number of businesses supported directly, indirectly or via referral is reported to have increased to 263 with an additional 400 UK companies being connected to seven multinational contractors this year, the number of direct applicants has actually fallen slightly in each of the last three years8. Further, if the new measure introduced for 2018/19 of companies supplying to a project supported by UKEF is excluded, direct applications and export assists combined have fallen year on year since 2015-16.9

Over the last five years the largest number of companies in a single year helped directly and via referral by UKEF was 275 in 2015-16. This absolute number represents a small proportion of the number of visible scaleup businesses that are exporting year on year, and a tiny fraction of UK exports overall (235,800 UK businesses were exporting abroad in latest figures available).10

There is a significant opportunity to increase the number of UK firms that export. But it is vital to provide tailored advice through effective segmentation and this must extend both to the way that UKEF engages with other government departments and agencies, and with businesses directly.

UKEF must be connected more explicitly to the practical implementation of the UK Export Strategy. Elements of this are noted within the UKEF Business Plan for 2017-2020, but better alignment will be key to ensure that the UK can be an exporting powerhouse.

It is critical for the UK to have export products and services that can be used at the various stages of economic and business cycles, and to support businesses that are growing quickly. The new General Export Facility11 has important potential in this regard and we will monitor it closely over the coming year. UKEF also needs to have strong country risk coverage, particularly in the post-Brexit environment. We agree with other parties, including the finance industry, that a review of country risk coverage should be undertaken with a view to expansion and extension of both the countries in scope and amounts. UKEF should also look to support scaleup exporters with short-term risks for all destinations.

Additionally, it is important to note that Letter of Credit Guarantee Schemes (LCGS) can currently only operate if goods touch UK shores. Modern manufacturing supply chains mean that businesses often now produce items overseas for further sale in other overseas markets. In this connected marketplace it is not economic to route products via the UK for onward shipment. It is therefore vital that the government allows UKEF’s LCGS to have greater flexibility in its support to UK businesses. As such, the ‘touching-UK-shore’ rule should be removed in favour of the more general need to ensure the goods have 20 per cent of UK content drawn from a broad definition.

ACCESSING UK CUSTOMERS: IMPROVING PROCUREMENT AND COLLABORATION

For two years running, UK scaleup businesses have highlighted access to markets, both at home and abroad, as a priority issue. Significantly seven out of ten scaleups say this is a key issue in regards collaboration with the private and public sector in the UK itself. It is notable that of the 509 scaleup businesses responding to our 2019 survey:

- Only one in ten had collaborated with government to develop a new product or service in the last 3 years; while two in ten sold into them.

- Two in ten had collaborated with universities or research institutions to develop a new product or service.

- Three in ten had collaborated with large corporates to develop a new product or service in the past three years; while five in ten sold to them.

Given the stated aims by Government and the private sector to improve engagement in this area, there is a big gap between demand and supply. There is a real opportunity to address this issue by developing programmes to address scaleup needs in a more consistent and coordinated manner and foster the inherent benefits from working with our most innovative firms. Lessons can be drawn from SVC2UK, the FCA Sandbox and the private sector corporate stars (as evidenced in Chapter 2 of this report) on how to better engage with scaling businesses. We can also learn from the US Small Business Administration. A priority for any new Government must be to accelerate the opportunities for collaboration and procurement with scaleups, leveraging procurement champions, deploying more of the Industrial Challenge and Collaboration Funds and Institute for Collaborative Working Standards.

Government should encourage public sector organisations to ensure that their procurement contracts are listed on Contracts Finder, advertised in good time, broken into smaller components where possible, and do not impose unnecessarily high qualification criteria upon suppliers. More fundamentally, Government should consider how it might help public sector organisations offset the additional risk (real or perceived) of procuring from scaleups.

UNLOCKING CORPORATE COLLABORATION AND PROCUREMENT

The complexity of the process (46%), the time it takes (40%) and finding the right opportunities (42%) are the biggest barriers highlighted by scaleup businesses in our survey to collaborating with corporates. This shows the significant need for larger corporates to look more explicitly at how they can lower barriers to enable procurement from scaling firms – as well as understanding the scaleups they already buy from. The ScaleUp Institute continues to recommend a series of steps for larger corporates to follow to improve the way in which they engage with scaleups. This is based upon the learnings from assessment with the corporate stars and includes: ensuring board sponsorship for engagement with scaleup businesses; dedicated senior level scaleup champions across functions to ensure that risk, compliance, legal, IT and wider departments do not create complexities and uncertainties for scaleup businesses; the development of dedicated scaleup ‘units’ to aid in engagement with scaleup businesses across product development including sharing resources and connecting clients; and, fast-track options or other practices – such as preferential payment conditions – to make collaborating with a larger client more directly appealing for businesses that are looking to grow.

The following best practice procedures in procuring from scaleups should be adopted more widely:

- Reduce the time taken to register as a new supplier (most say it takes fewer than two weeks)

- Pay suppliers promptly (always within three months and in some cases within one week)

- Avoid asking for ISO certification or financial indemnities because of the burdens these impose

- Establish dedicated legal teams or fast-track processes for start-ups and early stage growth companies, potentially including template agreements, tailored due diligence processes and technical upskilling programmes

- Create mechanisms for scouting scaleup firms

- Recognise that most barriers to open innovation are internal

- Work to find a balance between corporate culture and short-termism in decision-making.

Demystifying the way in which corporate collaborators operate is also vital for both corporates and suppliers alike. Early steps such as GoPartner12 – an initiative being run by Co-Cubed – to create a clear way for suppliers to provide corporates with structured anonymised feedback with an agreed taxonomy, are useful. This could be more widely developed in order to build a clear, robust dataset on UK corporate collaboration. This can then be used to build targeted programmes which can help scaleup companies increase their engagement with corporates as well as educating corporates about their own performance in this respect. We plan to explore this further in 2020.

The role of supply chains in scaling up

As larger corporates focus on their core competencies the GVA to the UK economy is increasingly coming from the supply chain and scaleup businesses, so their growth should be a targeted area of focus. The larger corporates have a key role to play in the development of this supply chain, both as a route to market and as a source of critical information for scaling businesses to help them step up to ever increasing expectations of leadership, operational capability and financial needs. Celebrating those that do this well is to be encouraged.

One initiative that is making significant inroads in the aerospace industry is Sharing in Growth outlined in Chapter 2. This programme works to transform the way that the aerospace industry supply chain functions, delivering training and opening up opportunities across the UK, and enabling the businesses within the programme to gain access to new contracts worth £4.4bn. Other industries should review this model and see how it can be replicated. Productivity through People has a role to play in this regard and we continue to monitor its effect on scaling businesses. Large infrastructure projects also create local supply chain opportunities and engagement that fosters businesses scaling up. Hinkley Point is embracing this in its hub approach which we continue to monitor for learnings that others can follow.

THE ROLE OF GOVERNMENT AS AN ANCHOR CLIENT, CONVENOR AND CONNECTOR

Government is in a unique position to improve UK market access for scaleup companies. It is able to both lead by example and use its significant buying power to encourage good behaviour across those Tier 1 suppliers with which it has enduring relationships. In this role it should act as a catalyst for change and build on its convening power to increase the visibility of scaleup companies from whom others can buy. It should seek to shine a light on whole supply chains to allow for more appropriate engagement between different parties, stimulating innovation and new opportunities, and align incentives for wider institutions – such as in the education sector – to ensure that these are as open as possible to scaling innovative firms.

While the Government intends to do more with smaller, scaling businesses, at present progress remains slow and the scaleup gap remains significant.

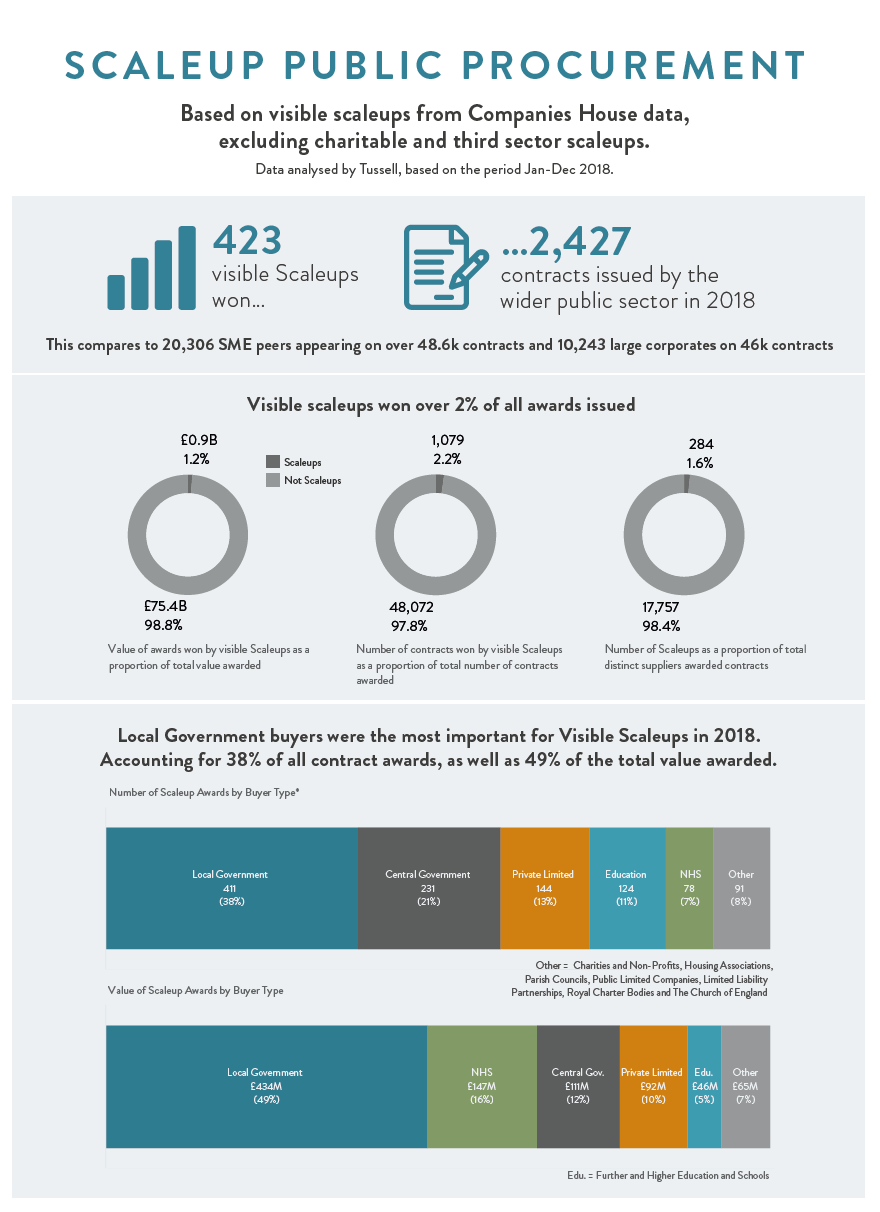

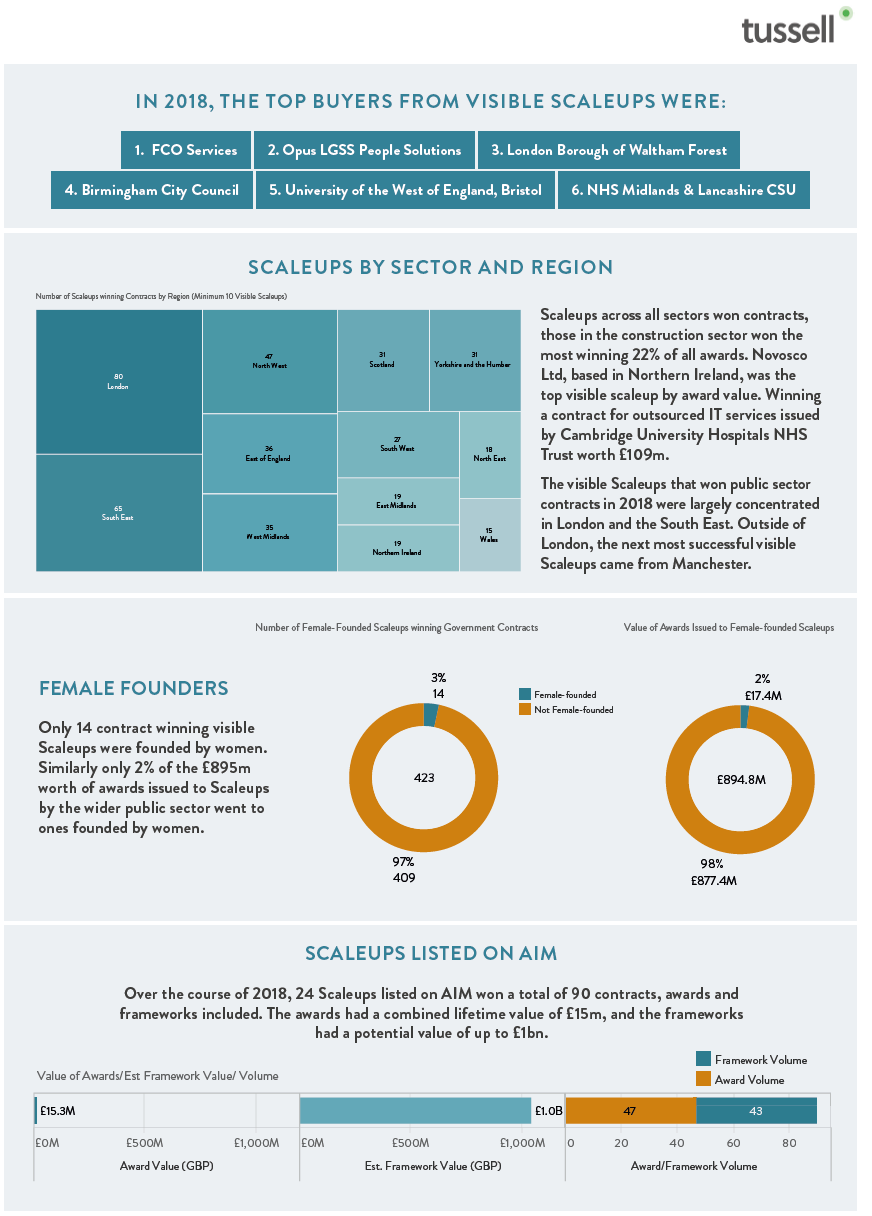

This is further corroborated by our Public Procurement Index of visible scaleups compiled in partnership with Tussell. Public sector bodies awarded £895m worth of contracts, against a total available pool of £75bn, to 423 scaleups in the 2018 calendar year with scaleups only accounting for 2.1% of the total value awarded. In particular, central government has room to improve; it is currently only responsible for 20% of awards given to scaleups by value compared to local government at 49%.13

While Contracts Finder and procurement champions should assist scaling businesses to identify opportunities, scaleups still view the procurement process with Government as overly complex (50%), difficult to find opportunities to bid (42%), and time consuming (35%). This is perhaps why we see just a small number of our scaling businesses reporting collaboration with, or selling into, Government. It highlights just how much work still needs to be done in getting the approach right and unlocking the opportunities that exist.

One of the challenges which central Government still needs to tackle better is the development of a codified approach to procurement ‘champions,’ enabling them to be assessed and coordinated effectively by the Crown Commercial Service across each Government department.

As we have called for in previous years, these champions should work to an agreed cross-departmental job description. They should have clear and meaningful KPIs. A central CRM system should ensure consistent approach to engagement with business. Steps are under way for each Government department to publish further information on procurement, such as the detailed HMRC 2018-19 SME action plan14, which should help to facilitate better engagement. We will monitor this over the coming months.

Champions should also be much more visible, both within departments and externally to scaleup businesses. Lessons can be drawn from the Institute of Collaborative Working and the US Small Business Administration. In 2020 we would like to see more detailed training given to these champions, using these standards, on their approach to procurement and collaboration from scaling firms.

In seeking to further demystify the domestic procurement process and identify the opportunities more quickly, there is a need to review how the ‘Meet the Buyer’ activities run by Government departments and local areas are undertaken. At present action that is being taken centrally is not cutting through as effectively as it might to our scaling businesses. Lessons can be drawn from exemplars such as SVC2UK, Greater Manchester and the FCA Sandbox. Government can seek to replicate these proven methods. It should also leverage the UKRI / Innovate UK and growth hub infrastructure to better coordinate collaborative opportunities.

PROVIDING NEW OPPORTUNITIES TO INNOVATE

Scaleup businesses are significantly more innovative than other firms, with three quarters having introduced a new or significantly improved product, process or service in the last three years, and 70% investing in areas such as internal R&D or equipment linked to innovation.

It is therefore important that Innovate UK’s strategy and 2019-20 Delivery Plan15 has a clear focus on scaling businesses with a segmented offering to tackle the issues which scaleups face across each of the identified challenges.

Innovate UK is very well placed to engage with the UK’s scaleups through their Enterprise Europe Network, including the Global Business Innovation Programme, and EUREKA partnership. The continuation of their programme utilising Scaleup Directors is also welcomed; it provides a pathway from local scaleup initiatives to one which offers openings to global collaboration and international markets – ‘the scaleup escalator of support’. Its grant funding is also vital to scaleup success. The 2019 ScaleUp Index shows that Innovate UK has provided £205m in grants to UK scaleups who have leveraged, on average, £2.8m more in investment than companies not backed by Innovate UK. (Equity investment received by IUK-backed companies secured an average of £11.0m, while non-backed IUK backed companies received £8.2m.)

The pivotal role UKRI and Innovate UK as a nexus between government, academia, business and localities, both at the UK and international level, will be critical as we move into this next era. It provides the platform for fostering greater collaboration between scaleups and academia to address the significant industrial and societal challenges we face. The agency is also vital in addressing any effects that arise from future Brexit scenarios.

With the link to academia, UKRI is also in a unique position to influence how better connections are made between universities, business schools and scaleups and how R&D and research activities are deployed appropriately to support the development of our scaleup community.

In 2020 we plan to undertake further work with Innovate UK to address the continuing markets gap including the talent dynamics.

The Sandbox Effect

In 2019 we have fully endorsed the FCA Sandbox as a programme providing clear impact for scaleups, and through the role it is now performing on the international stage with the Global Financial Innovation Network launched in January 2019. We are also encouraged that our recommendation for a similar model to be adopted across health, defence and other heavily regulated sectors has been progressed in 2019 following the Innovate UK Regulators’ Pioneer Fund launched in 201816 in line with the Industrial Strategy.

Notable examples of the 15 projects announced as part of this include:

- The UK Civil Aviation Authority launched its sandbox in May of this year and it is encouraging that six projects are now underway to trial innovative solutions that do not fit within the existing scope of regulation in a safe environment.

- The Health Data UK programme – supported through UKRI Challenge Funds and in line with the Government Industrial Strategy – is a new sandbox looking at how the UK’s wealth of health-related data can be used more innovatively. It has launched this year with a cohort of 7 projects.

- The Information Commissioner’s Office launched a sandbox in July with an initial cohort of ten to look at innovative uses of information and data.

As these progress it will be important that these initiatives effectively segment, target, and engage with scaling businesses which we will closely monitor.

IN SUMMARY

Across the last three years, access to domestic and international markets has significantly moved up the order of issues and challenges faced by scaleup leaders. It is now alongside talent as the most significant barrier to further growth.

It is entirely within our control as a country to boost access to our domestic markets. There are also clear, identifiable steps that can be taken to ensure that our companies have the ability to find and access markets abroad. The research that the ScaleUp Institute has undertaken shows an insufficient range of solutions at local level to address scaleup ‘access to markets’ demands. The private and public sector need to intensify their focus and services on scaling businesses to make sure they can achieve their fullest potential both at home and abroad. It is vital to ensure that we leverage and invest in what works and that there is a better alignment amongst existing programmes. The private and public sector need to continue to break down barriers and make further efforts to simplify the process and create awareness of opportunities. Corporates need to look at better engaging with their supply chains, and developing more appropriate internal processes for scaleup businesses.

We therefore continue to make the following recommendations:

6. |

We recommend that Central Government implements its export strategy and ensures a significant portion of resources to scaleups including the EITA service and trade missions for scaleups. All local areas should be encouraged to set up a local exchange programme for scaling businesses, such as that developed by the Mayoral ‘Go to Grow’ campaign in London. |

7. |

We recommend that public bodies use the Visible Scaleup Public Procurement Index to further improve their understanding and reporting on the procurement from UK scaleups, including scaling businesses not yet visible at Companies House.

All public bodies should improve the way opportunities are promoted to scaleup companies by significantly raising awareness of procurement champions and ensuring their roles have objectives and measurements. The Government should increase the promotion and continue the evolution of Contracts Finder to become a smart platform and the development of ‘meet the buyer’ events and more sandbox environments. |

8. |

Large companies should report on the level of collaboration and procurement they source from scaleup companies. Any procurement contracts with Government should require an increase in the amount of business undertaken with scaleups as part of the contracting process which should be monitored. |

Page URL: https://www.scaleupinstitute.org.uk/articles/access-to-markets-2/

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share