Explore the ScaleUp Annual Review 2020

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Accessing Finance

Access to appropriate finance and growth capital is a core part of scaling a business. It was one of the top five challenges for scaling businesses in 2014 and remains so today. It is particularly acute for scaleups outside London and the South East. Scaleups want a vibrant and connected finance market which is easily accessible in their region and has products suitable to their needs as scaleup businesses. They also seek long term patient capital as they fully realise the potential of their business.

Scaling businesses consistently point to the problems of finding the right finance for their needs. In 2019, six out of ten do not perceive they have all of the right finance for their future growth plans – this represents an increase from 2018 – and scaleups need to be able to easily and locally navigate these finance options. They particularly highlight the need for locally rooted, accessible patient growth capital.

Our annual survey and analysis of the SME Finance Monitor shows that scaleups are more happy than other SMEs to use external finance to help the business grow (40% compared to 28%). However, our survey finds that the largest proportions of scaleups are, like their peers, finding resources from traditional sources: 38% use overdrafts, credit cards or loans, 23% use leasing or hire purchase and 32% have received cash injections from family and friends or directors. Only 24% received equity from a third party investor and 16% from Government funding.

Of those using equity, angel investors (63%) and venture capitalists (44%) are the most important sources but regional disparities persist – with five in ten scaleup leaders perceiving that most of the finance resides in London and the South East. This emphasises the ongoing imperative for dialling up regional capacity and awareness. These are key issues that the British Business Bank, working with the private sector, must continue to address.

Reservations about the use of equity finance also remain. There are perceptions of complexity and/or unsuitability and fears of having to “give up control” – all are still cited as reasons for not progressing such a finance option. On a positive note, better understanding of equity as an asset class appears to be growing. This education process must continue alongside financial providers working more closely with local communities in order to provide tailored solutions for scaleups where they are based.

Certain sector challenges also still persist. In life sciences, business models dictate the need for deep pools of knowledgeable long term capital where the UK lags behind the US. In the creative sector – which is more project and IP-based – better understanding in the investor community is needed. Scaling businesses led by female founders, as highlighted by the Rose Review to which the ScaleUp Institute contributed, represent a further group which needs more focus from investors.

The roles of the British Business Bank and Innovate UK in these key sectors remains critical. In the last year, Innovate UK’s grant schemes enabled 642 scaling companies to realise their growth trajectory, unlocking an additional £3bn in private capital on top of the £205m of grants provided.

With rising political uncertainty in the EU and around the world, there is ever more need for policy makers to maintain investor and business confidence. Concerted effort must be made to ensure that policies that work are continued and brought to full fruition – and that market, investor and scaleup confidence is sustained.

As we move into a new decade and a new Government, if we are to fully close the scaleup finance gap we must continue and double down on the work already underway. That means investing further in the key agencies of the British Business Bank and Innovate UK so they have the necessary resources to deliver an ambitious agenda. It requires the evolving of innovative models to deal with the UK patient capital conundrum through the unlocking of institutional funds. In this regard, further serious consideration should be made to a UK Sovereign Wealth Fund – backed by institutional monies – with an explicit remit to be active in the scaleup space. It also remains essential to continue to close the regional and knowledge gaps.

PROVISION OF PATIENT CAPITAL

Ongoing progress to address the provision of patient capital in the UK is welcome and we continue to support the intent of the Patient Capital Review and the response to this by Government in both the 2017 and 2018 Budgets. However, the focus to unlock institutional investment and open up deep pools of connected capital for innovative high-growth businesses must not slip.

As the joint Oliver Wyman and British Business Bank report on The Future of Defined Contribution Pensions1 concludes, there is a strong case for defined contribution pension schemes to support high-growth, innovative UK companies2. Further progress must be made to unlock UK-based institutional money if the UK is to remain competitive in a challenging global environment. We hope that the recommendations outlined within the report – to increase the level of information, boost the level of education, appropriately adjust regulations and spur wider industry change – are taken fully on board.

If we are to make significant and meaningful progress, a particular priority must be the redoubling of efforts by government and regulators to tackle the area of regulation identified by the Patient Capital Review’s Pensions Taskforce. By 2025, defined contribution pension schemes will have become one of Britain’s largest reserves – with close to £1trn in capital3. If invested into UK enterprises and scaling businesses, the effect could be enormous. Patient capital is key to unlocking long-term sustainable growth across the economy and is vital to the continued investment in the UK’s scaleup companies.

A coordinated approach to this is important. We support calls for the creation of a future-based initiative in the space of a UK Sovereign Wealth Fund, attracting private institutional capital, to be directed at future industries and innovation.4

In parallel to progress on pooled investment, this last year has seen the first wave of investments by British Patient Capital (launched initially in June 2018) to funds focused upon later stage innovative businesses5. These investments are a positive first step towards the creation of a patient capital ecosystem in the UK. It is encouraging that growth stage deals for funds supported by British Patient Capital are larger than the wider private equity/venture capital market, and that British Patient Capital is on track to meet their annual goal of investing between £300-350m for 2019, and the long term goal of £2.5bn over the next decade.

However, while continuing to meet this pace it is vital for this money, and the ecosystem it is seeking to build, to open up investment to a diverse range of scaling companies, and make sure that scaleup needs are met and unique scaling sector challenges, as identified above, addressed.

THE INVESTMENT ENVIRONMENT

The importance of the Enterprise Investment Scheme (EIS), Venture Capital Trusts (VCTs) continues to be noted by many scaleups as a cornerstone of early stage growth capital and follow on funding. As seen in our 2019 survey for the scaleups using equity the majority is from angel and VC investors, and notably, approximately 80% of total investment in angels’ investment portfolios were made through these schemes in 20156.

However, continuous change to EIS, the Seed Enterprise Investment Scheme (SEIS) and VCTs creates confusion, increases the cost of implementation of the schemes and reduces confidence amongst investors, and entrepreneurs.

At this time of political, EU and global economic uncertainty, it is ever more important to maintain business and investor confidence by keeping key policy measures constant. We must ensure that EIS, SEIS and Venture Capital Trusts remain stable and able to support growth. In the Spring Statement 2019, the Chancellor highlighted that amendments would be made to the current EIS-approved fund rules to focus investment on knowledge-intensive companies and that this change would take place in 2020 following implementation through the 2019 Finance Bill. Clarity around these incentives – alongside Entrepreneurs’ Relief – is paramount to maintain long-term investor confidence about the availability of these instruments in order for them to remain a key component of the funding ladder.

To truly support growth across the whole of the UK economy, it is important to recognise that the current time limit placed upon these schemes limits the scope for impact. In the next Parliament, thought should be given as to whether an extension of time horizon to approximately ten years is applied, for example:

- It is often assumed that innovation and growth comes only from young companies. However, the 2019 ScaleUp Index is the evidence that shows that many high-growth and innovative firms are much older than the seven year time horizon currently applied. Family firms or other firms where a change in management has occurred, and may spur growth, lose out under current rules.

- Younger firms that may have the opportunity to make an acquisition of an older firm may also be deterred from doing so as they will lose tax benefits, causing them to delay or avoid growth. Artificial time limits also create a risk that businesses that reach scale are sold prematurely at exactly the point that they are making the greatest contribution to employment and GDP.

More broadly, the ScaleUp Index research shows that equity investment going into a company is more likely to facilitate continued scaleup growth. As we seek to ensure scaling businesses understand the merits of equity it is also important to ensure impediments to its use are removed. It is worth reassessing the tax treatment of equity to better align the tax system with the wider policy of bolstering UK growth. At present:

- Equity is taxed four times (Corporation Tax, Capital Gains, Stamp Duty, Dividends) which can make it seem unappealing for companies, even if it is more suitable for their stage of growth or the sector.

- By comparison debt can be advantageous from a tax perspective, but can be impractical or unavailable for businesses which are innovative and IP rich but poor in physical assets.

THE EUROPE EFFECT

The ‘Europe Effect’ analysis from the British Business Bank shows that significant amounts of regional equity funds are backed by EU money: the largest single investor class in the UK from 2010 – February 2019 was the EIF (23%). It is important that money has been identified to fill any potential EIF shortfalls here for 2018/2021. The EIF has been an important provider of growth capital in the UK market and any gaps created by its absence will need ongoing assessment to ensure the finance ecosystem is able to meet the needs of businesses with scaleup ambitions. Additionally, the joint initiative between the EIB and the European Commission has provided vital pools of capital and research collaboration for life science businesses and other innovative sectors under the Horizon 2020 and COSME programmes. As matters evolve and the UK relationship with the EU is clarified, access for UK innovative businesses should be maintained to these schemes, or they must be replicated as part of the UK replacement EIB/EIF arrangements through the British Business Bank and ongoing broader work of Innovate UK.

ADDRESSING REGIONAL DISPARITY7

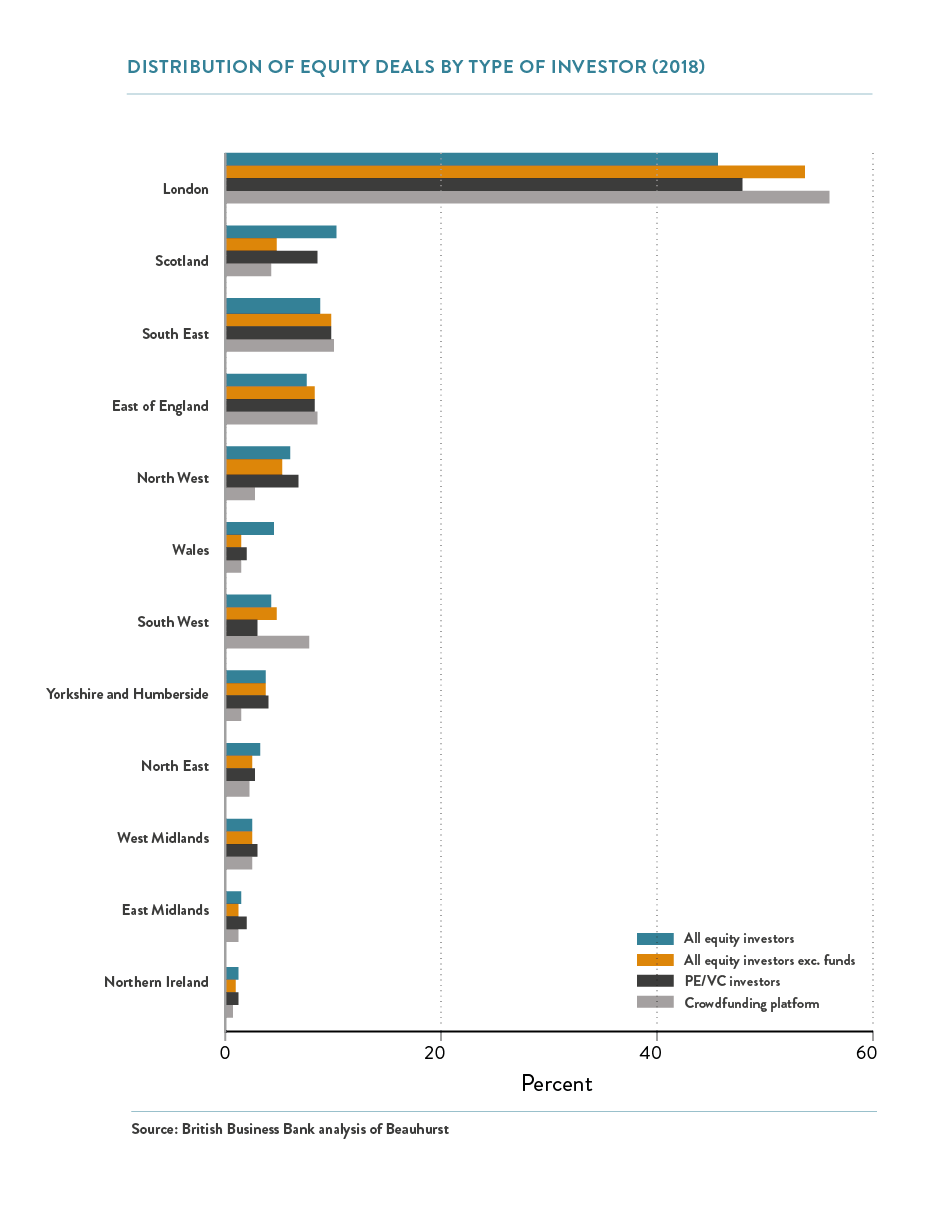

Regional disparities across the UK persist and London continues to be the focal point for equity finance in the UK – although measures taken appear to be showing early stages of fruition.

For example, while the number of equity deals in the UK fell overall in 2018, there were increases in many regional areas. This is important given the desire to address the regional imbalances. The number of deals increased the most in the North East, which grew by 65%, followed by Yorkshire and Humber (15%) and Wales (11%). East of England and East Midlands also experienced smaller increases in equity deal numbers.

Outside of London, investment value increased by £616m (29%) to £2.8bn. This was driven by increases in deal sizes, especially at the growth stage and by large increases in investment values in the East of England (118%), the North East (115%) and the West Midlands (81%). These changes resulted in London’s share of investment value dropping from 66% to 59%.

| Table 4 – Equity Investment and business population shares | ||||

| Source: ONS, BEIS, British Business Bank Analysis of Beauhurst | ||||

| Region | UK deal share (2018) | UK investment share (2018) | UK high growth business share (2017) | |

| London | 46% | 59% | 20% | |

| South East | 9% | 8% | 15% | |

| South West | 4% | 5% | 8% | |

| East Midlands | 1% | 1% | 6% | |

| West Midlands | 3% | 3% | 8% | |

| East of England | 7% | 12% | 10% | |

| Yorkshire and Humberside | 4% | 2% | 8% | |

| North East | 3% | 4% | 3% | |

| North West | 6% | 3% | 10% | |

| Northern Ireland | 1% | 0% | 2% | |

| Wales | 4% | 1% | 4% | |

| Scotland | 10% | 3% | 6% | |

| UK Excluding London | 54% | 41% | 80% | |

| UK Total | 100% | 100% | 100% | |

| British Business Bank Equity Tracker 2019 (analysis of Beauhurst data) |

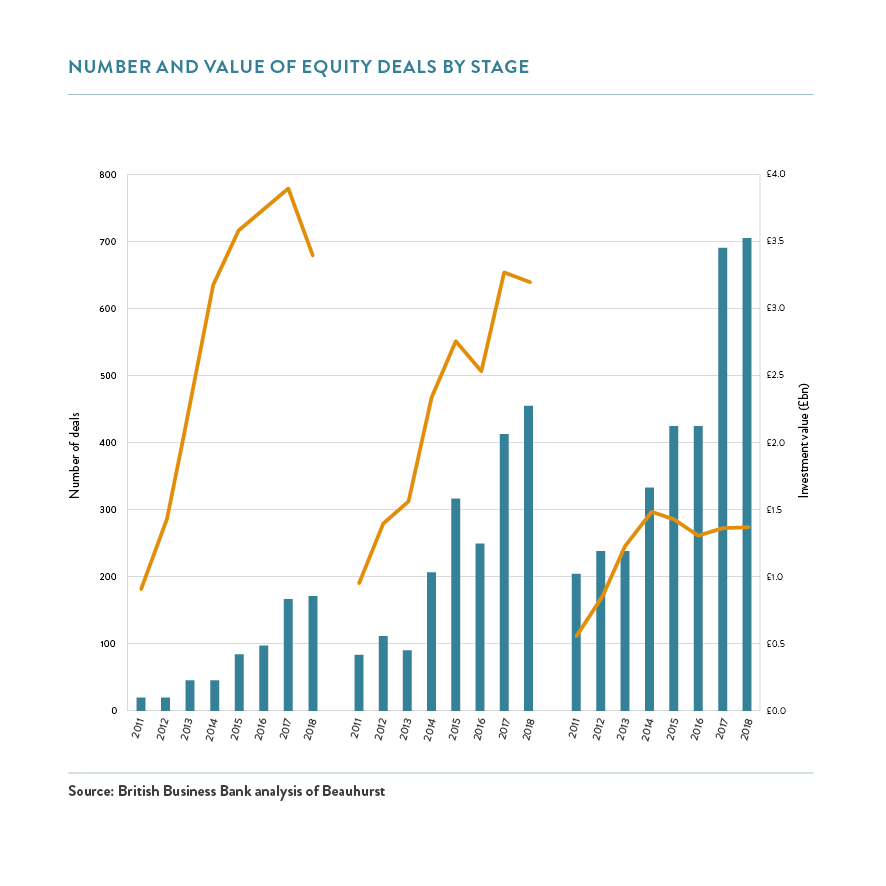

The proportion of deals going to venture stage companies has increased over the same period, from 33% of all deals in 2016 to 40% in 2018. The proportion of deals going to growth stage companies while remaining around 17% since 2016 makes up the largest proportion of UK SME equity investment, with 53% of all investment in 2018 going to growth stage, scaling companies which is encouraging.

Focus on regional imbalances needs to be maintained through the work of the British Business Bank working jointly with the private sector, including ensuring those being co-invested with have a regional intent. The British Business Bank’s Regional Angel Funds programme, aimed at creating clusters of business angels outside London and the South East, remains an important component to help address regional imbalances. So, too, does the requirement to ensure regional EU funds disseminated through ERDF and Horizon programmes and others are replaced with relevant UK alternatives. In that regard, the British Business Bank’s existing regional funds provide a good foundation from which to build a wider set of activities across the whole country.

British Business Bank Equity Tracker 2019 (analysis of Beauhurst data)

KNOWLEDGE AND DEMAND

Equity is often a key part of a company’s growth. Increasing the provision of education about growth capital and myth-busting common perceptions is also vital to ensure that scaleup leaders are fully aware of all the available finance options as they make choices about their growth.

Our research shows that the more equity investment a company has received, the more likely its revenue is to grow at a rate quicker than 100% a year8. It is therefore important to continue the work to encourage other scaling businesses to consider equity finance as an option for growth.

In this regard we continue to collaborate with the British Business Bank and wider stakeholders including the London Stock Exchange on the Finance Hub9 – which provides an impartial source of knowledge on growth finance – to help close the knowledge gap. We will also work together on regional education initiatives such as that undertaken in Northern Ireland this year with InvestNI and the BBB.

The ScaleUp Institute has also worked closely with the British Business Bank’s UK Network team to embed their relationship managers at a local level. Our work has included a series of regionally focused roundtables which have explored gaps present at a local level, enabling the bank to work with local institutions to better connect capital between locations and scaling businesses, and identify specific local market gaps. There have been some core themes that have emerged from these sessions as highlighted below which will be a focus of work in 2019.

One key fact to emerge is the essential need to increase knowledge and awareness amongst the business and advisory community of the latest developments in the marketplace and to support them in enabling referral of businesses that are not yet quite right for investment or that require alternative types of finance. One of the reasons for SUI creating an online scaleup support tool in 2019 has been to try and aid this journey. We will continue to evolve this in 2020, working with the private and public sectors.

FUNDING INNOVATION

Innovate UK’s role in fostering the UK’s most innovative businesses across sectors and geographies is evidenced again in the 2019 ScaleUp Index. It shows that Innovate UK has played a critical investment role in 642 of the visible scaleups this year (an 86% increase in the number supported from the 2018 Index) to a value of £205m (a 173% increase from 2018). This role must be maintained and built upon.

THE SECTOR DYNAMIC

Across 2019 the ScaleUp Institute has focused in greater detail on a number of particular sectors. This has included the publication of a report focused upon the challenges faced by scaleups in the social business sector. This identified that at least £446m of equity investment has gone into UK social businesses since 2015 but more needs to be done particularly to inform them of all available finance. Further, there is an unmet need for growth capital. Just under two-thirds of social scaleups (62%) say they do not have the right amount of finance in place and they are more likely to identify access to bank finance and equity finance as vital/very important barriers to growth. As only a quarter of social businesses currently use equity finance, there is an opportunity to better serve businesses that plan to use it in the near future, don’t know where to start in the process or don’t know enough about this type of finance.

We have also been working very closely with DCMS, UKBAA and three local areas on the development of a tailored, two-year programme targeted directly at scaleups in the creative sector and building a more robust, knowledgeable investor base to serve them. Through the creation of a more robust mapping of current investor activity and potential clusters, it will be possible to develop tailored engagement with investors and a more robust understanding of these IP rich, innovative businesses within the investor community. This programme will be data driven and deliver an investor education programme as we seek to enhance overall investor interest in this sector. It should serve as a blueprint for wider sector focused initiatives which we hope to explore in 2020.

In the current market environment it is vital that we remain vigilant to sectors and demographics that may be under-served by the finance community.

IN SUMMARY

A combination of initiatives with a high degree of coordination to maximise impact are needed to address ongoing scaleup finance challenges. It is also essential for the interactions between financiers and wider scaleup challenges to be better enabled. Creating better linkages between financiers will help scaleups to find better solutions to the challenges which they have identified, and will also create opportunities for those finance players that are able to connect up appropriate finance offerings with wider programmes of support meeting scaleups needs.

Above all it is important to realise that the UK is not operating in a vacuum. Many countries are placing more effort and resources into supporting their scaling firms with substantial support from their Governments seeking to attract UK companies overseas.

As a country we have attracted record overseas investment over 2018/2019, in part driven by the current valuation of sterling. This emphasises the importance of unlocking UK institutional funds if we are to build a competitive UK ecosystem that is not reliant on overseas investors and which has deep pools of connected capital and regional diversity. This will be vital for the UK to retain a competitive advantage in a global environment characterised by uncertainty. The work of the British Business Bank and British Patient Capital must move forward at pace. We must also be open to actively exploring new solutions such as a sovereign wealth fund as we seek to maintain and, over time advance a globally competitive position across key sectors and geographies.

We shall monitor carefully the impact of current and recently announced initiatives as they are implemented and work with organisations to ensure that funding is targeted towards and reaches scaling businesses. Maintaining a clear trajectory of progress is fundamental to this, and we therefore continue to recommend:

10 |

Government and industry ensure progress is made closing the finance gap for scaleups by continuing the work to implement the Patient Capital Review and maintenance of key policy measures and initiatives such as EIS/ SEIS/ BBB/ IUK. Consideration should be given to creation of a SWF to further address depth of UK Investor pools and the tax treatment to equity to ensure its Growth finance to be included as core curriculum in all local scaleup leadership programmes enabling them to seek out and secure the most appropriate funding at each stage of their company’s growth. The status of current EU sources of funding needs to be monitored, and replaced as appropriate. |

Page URL: https://www.scaleupinstitute.org.uk/articles/accessing-finance/

CONTENTS

Introduction 2020

Chapter 1 2020

The Scaleup business landscape

Chapter 2 2020

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2020

The local scaleup ecosystem

Chapter 4 2020

Shaping policy to foster UK scaleups: Breaking down barriers

Chapter 5 2020

Looking Forward

Scaleup Stories 2020

Annexes 2020

Previous

Previous

Share