Explore the ScaleUp Annual Review 2021

Select a section to expand and explore this year's review.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Access to finance

Access to appropriate finance and growth capital dialled up as a challenge for scaleups in 2020 and in 2021 remains the third key priority after access to markets and talent.

In 2021 8 in 10 of scaleups (82%) have used external finance, they remain far more likely to use external finance than their peers. However, despite the broad range of forms of external finance used, 5 in 10 (45%) did not feel they have the right amount of funding in place for their current growth ambitions.

Perceptions of regional disparities persist with. 41% of scaling companies in other regions continue to feel that the majority of funding resides in London and the South East, compared to 20% among their peers in London and the South East. However, whilst scaleups in the North of England are somewhat less likely to be using equity finance (19%) there is little difference in use between those in London and the South East (30%) and those in other parts of the UK (from 24% in the devolved nations to 34% in the Midlands).

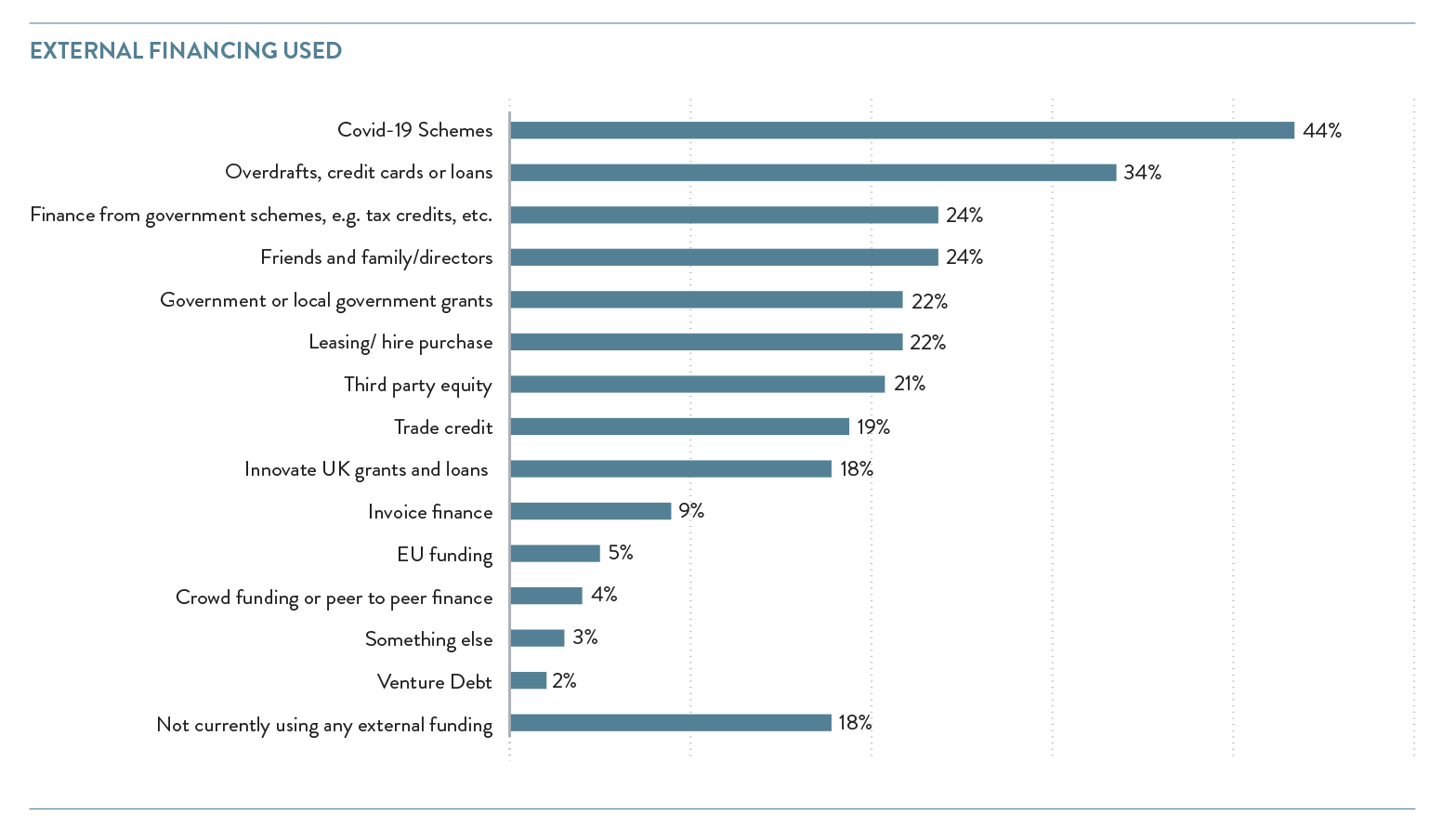

External financing used

As witnessed in 2020, Covid-19 support schemes continue to be the most common source of external finance with 44% of scaleups using them. Scaleups use a variety of other funding sources: 34% use overdrafts, credit cards or loans; 24% have received cash injections from friends and family, or directors; 24% received finance from government schemes.

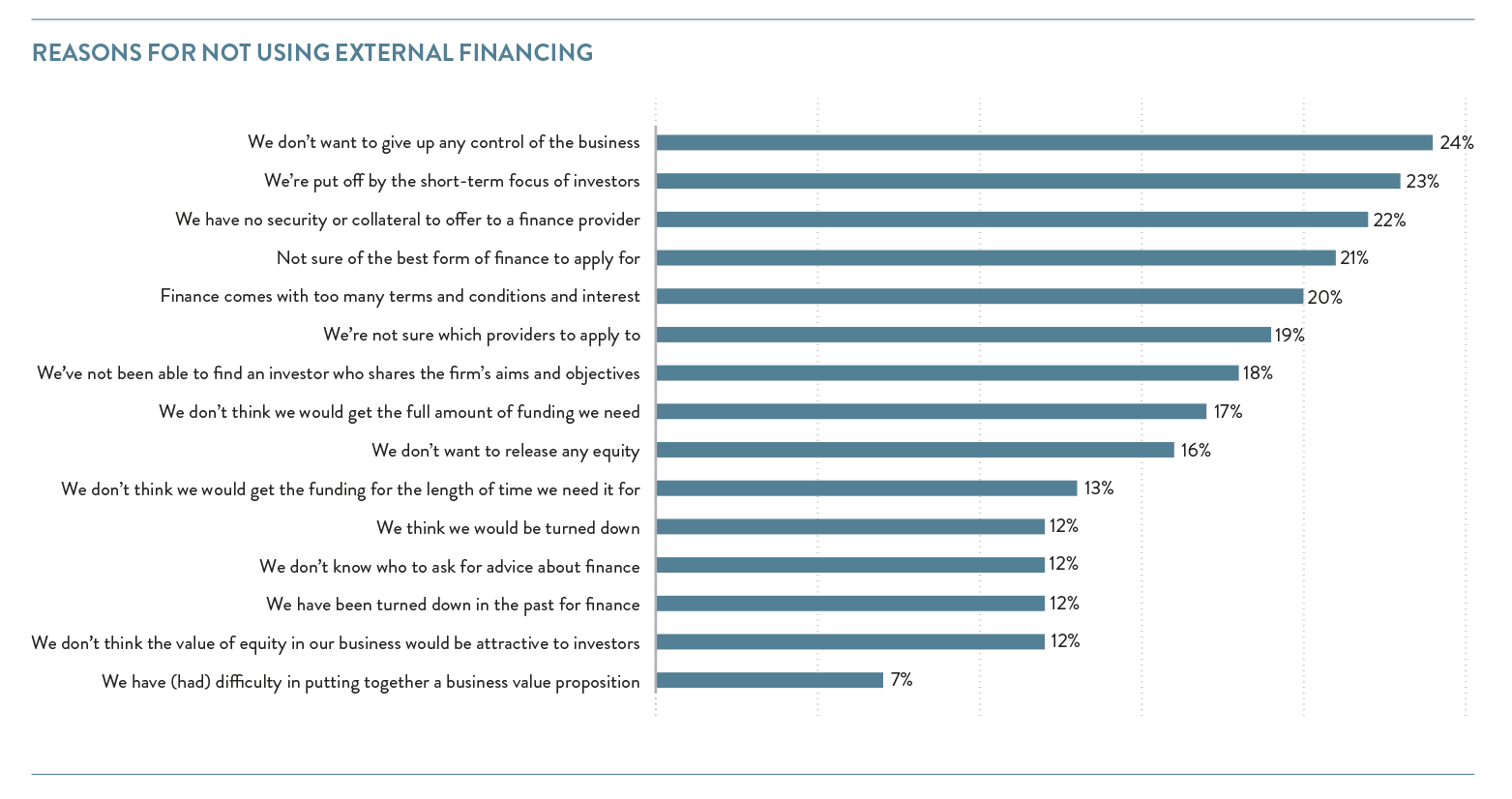

Of the scaleups not currently using finance, or who do not feel they have the right amount available to them, the reasons given for this include a reluctance to give up control of the business (24%), the perceived short-term focus of investors (23%) and lack of collateral (22%). These sit alongside uncertainty about making an application, whether this is who to apply to (19%) or what type of finance to seek (21%).

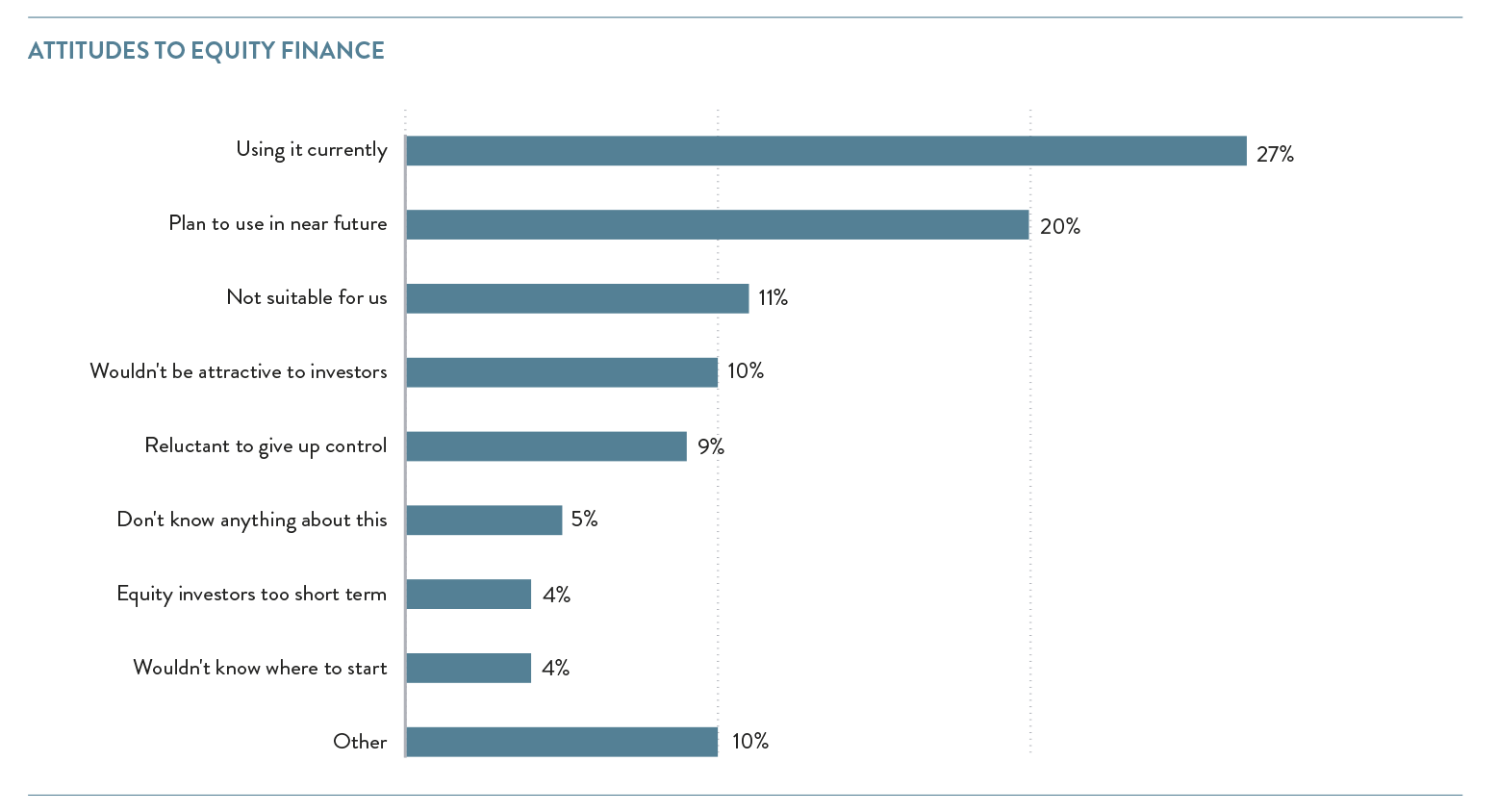

Attitudes on equity finance vary considerably across firms

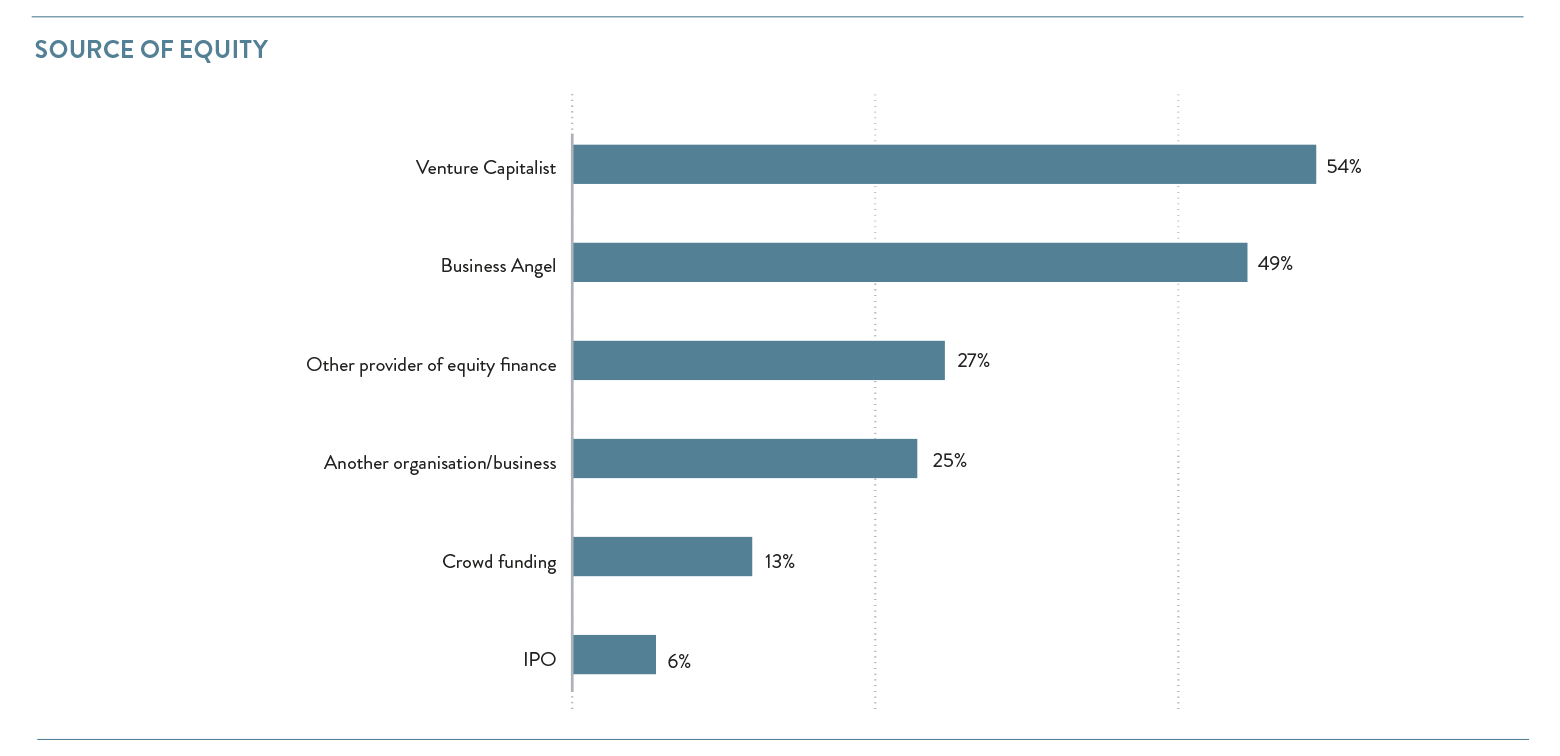

Of the scaleups using external finance, 5 in 10 are currently using equity or planning to use it in the future. Scaleups are using a variety of forms of equity finance with venture capitalists (54%) and angel investors (49%) most common.

The most common reasons for not using equity include a belief that equity finance is not suitable for their needs, that they wouldn’t be attractive to investors, or an unwillingness to lose control, each cited by around 1 in 10 scaleup leaders.

In recent years we have seen signs that the knowledge gap about equity finance is closing. The percentage of those who say they do not know anything about equity finance fell from 10% in 2019 to 5% in 2020 and was unchanged in 2021. This is a positive indicator of the impact of the ongoing finance education that is taking place and access to tools – such as the work underway with the British Business Bank – are making a difference.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Previous

Previous

Share