Explore the ScaleUp Annual Review 2021

Select a section to expand and explore this year's review.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Scaleup survey 2021

This report focuses on the views of 519 scaleup leaders. Scaleups are a key engine for growth in the UK economy: the scaleups in our survey generated on average £198,000 of revenue per employee.

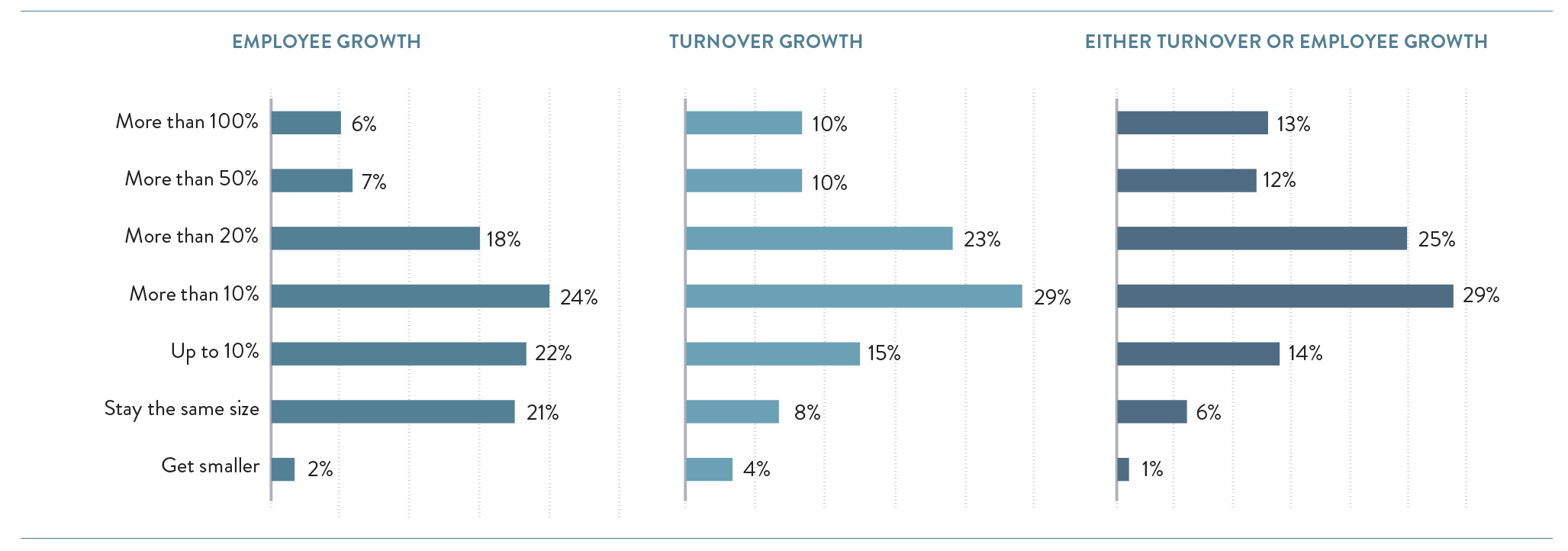

They are ambitious businesses and hungry for further growth: despite the challenges continuing to be experienced by many in 2021 9 out of 10 expect some form of growth next year, with 5 in 10 scaleups expecting to scale again beyond 20% and 1 in 4 expecting growth over 50% in 2022.

There are clear signs that these businesses are expecting to grow post-pandemic. Almost all (87%) expect to grow their turnover next year with 7 in 10 expecting to grow their turnover by 20% or more. Three quarters expect to grow their employee headcount with half expecting scaleup growth. Recent estimates in the wider SME population have shown that growth is only expected by 36% of SMEs.1

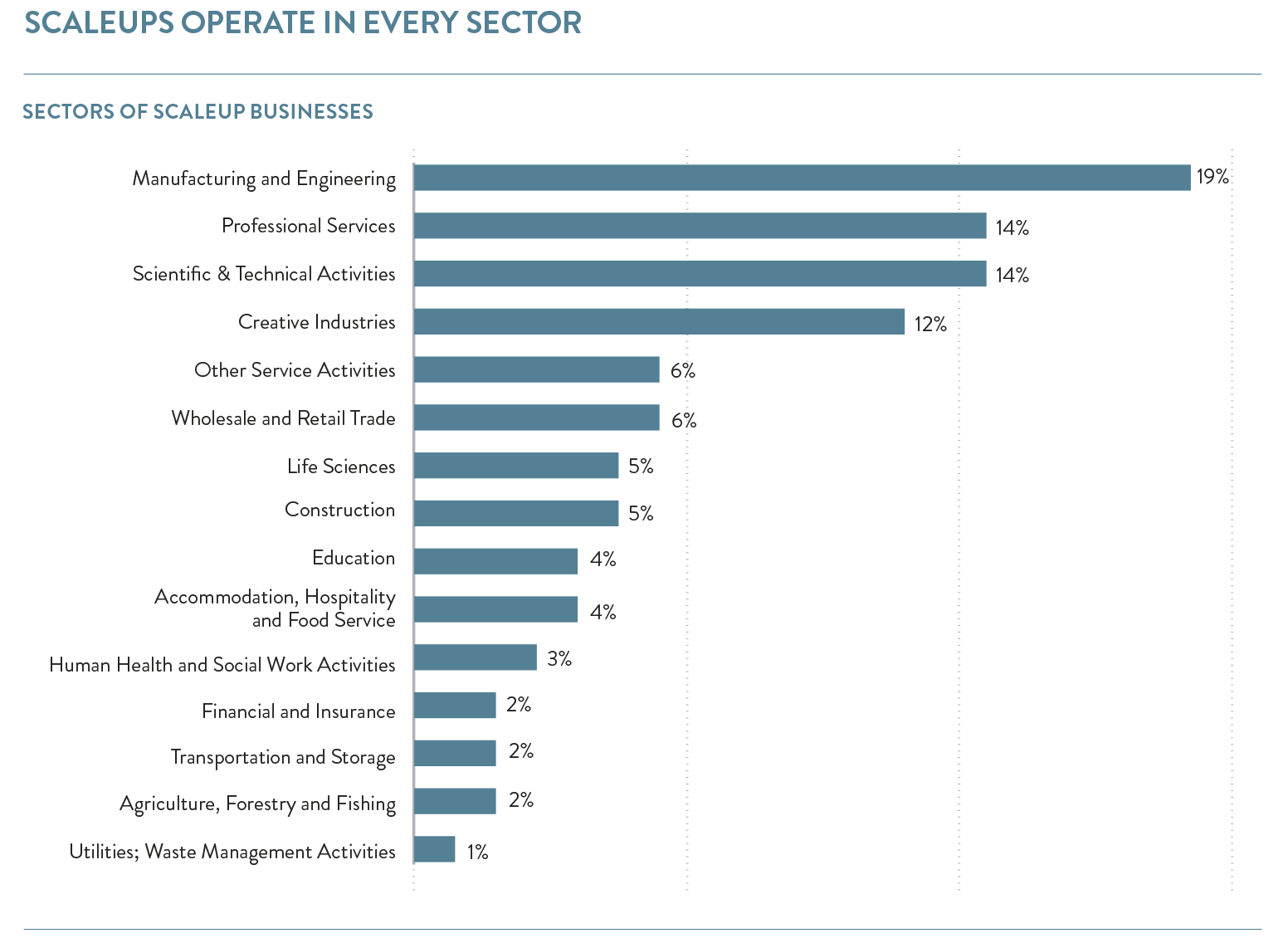

Scaleups Operate in Every Sector

Scaleups cover the entire economy in diverse sectors from manufacturing to life sciences, and from professional services, scientific and technical activities to construction and the creative industries.

Reflecting current trends, 3 in 10 scaleups reported operating in the green economy (31%), and a similar proportion considered themselves a social business (29%), while 32% considered themselves ESG compliant (Environmental, Social and Governance). Overall, over half of scaleups (55%) felt they met at least one of these criteria.

Scaleups are focused on the future

The challenges facing scaling businesses over the past 20 months have been unprecedented with Covid-19 pandemic and transitions to new international trade arrangements with Europe and beyond. Throughout this period of uncertainty scaleups have remained resilient as demonstrated by their expectations of continuing growth.

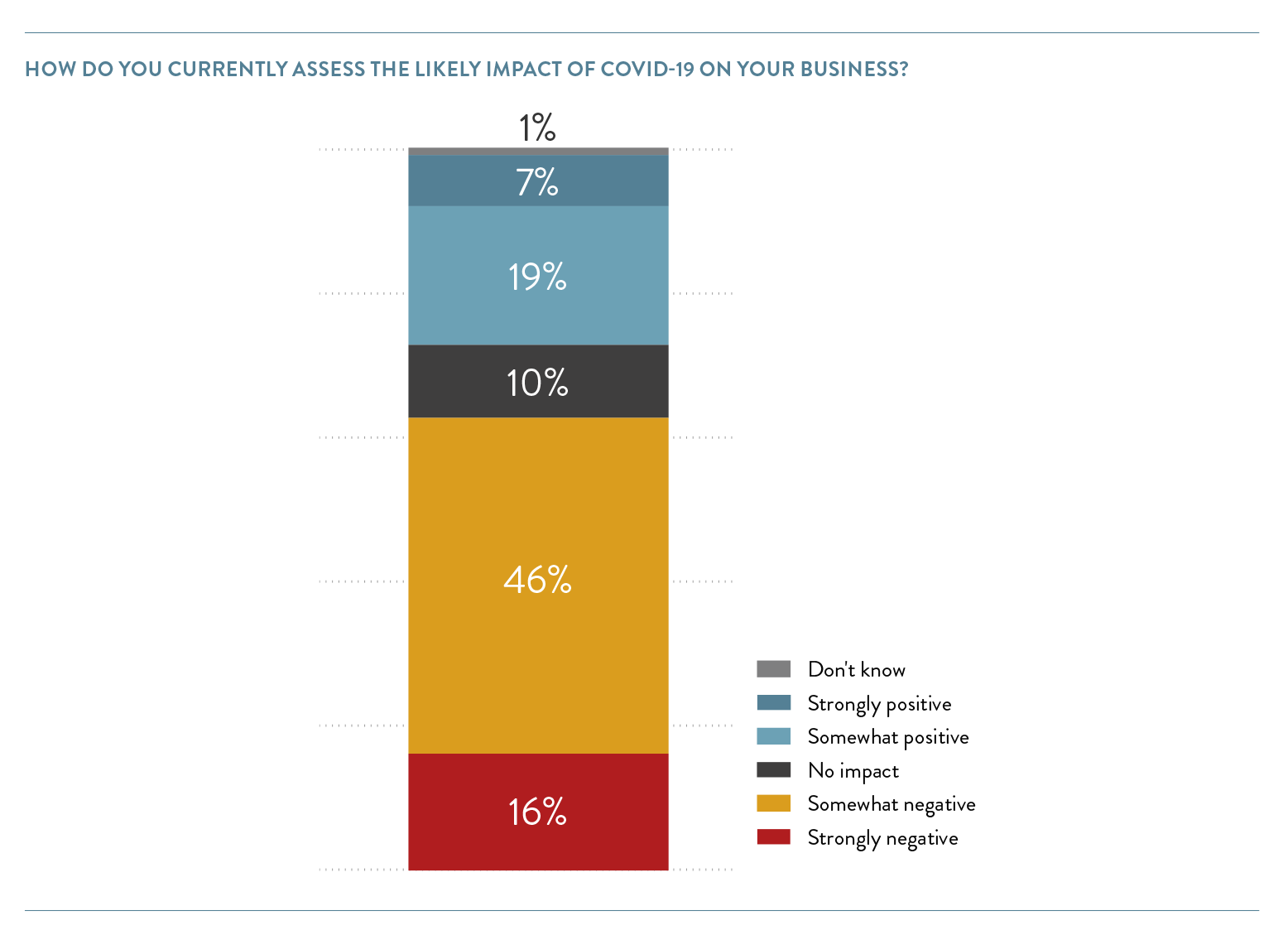

6 in 10 scaleups (62%) feel that the pandemic has had a negative impact on their business. However, for a significant minority the pandemic has brought opportunities, whether in their existing business model or through innovating and adapting to the new conditions, with 26% saying that Covid has had a positive impact.

Perhaps unsurprisingly across different sectors only health and lifescience scaleups described the pandemic as have a strongly positive impact in double digits (15%). Those perceiving a strongly negative impact were in sectors where limited interaction with customers and co-workers cause the greatest issues in maintaining usual business practices, these included accomodation and food services (48%), construction (27%) and the creative industries (26%).

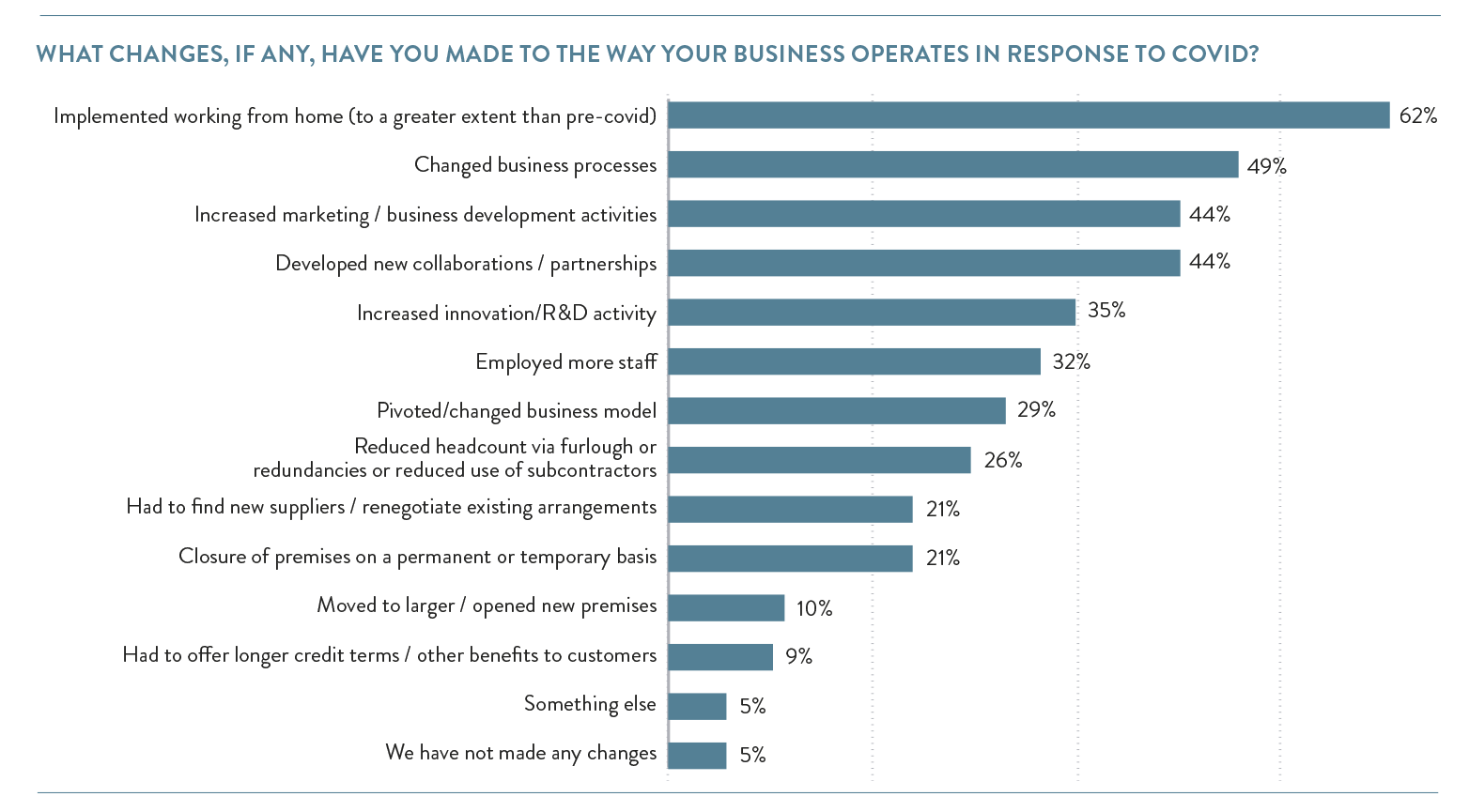

The pivoting of business practices and innovations seen last year have continued among the scaleup population with 4 in 10 developing new collaborations and partnerships and a third increasing their innovation or R&D activity. A significant number have changed their business model, processes and practices in response to the pandemic, while others reported increasing their marketing and business development or building new partnerships to move their business forward. Whilst 26% had reduced their headcount through furlough or redundancy, others had seen positive opportunities with 1 in 3 employing new staff (32%) and 1 in 10 moving to larger or new premises. As expected, increased uptake of flexible and home-based working was reported by 6 in 10 scaleups: whereas pre-Covid working from home was a very rare event in 58% of scaleups, looking forward just 1 in 5 (19%) expect their staff to rarely if ever work from home in future.

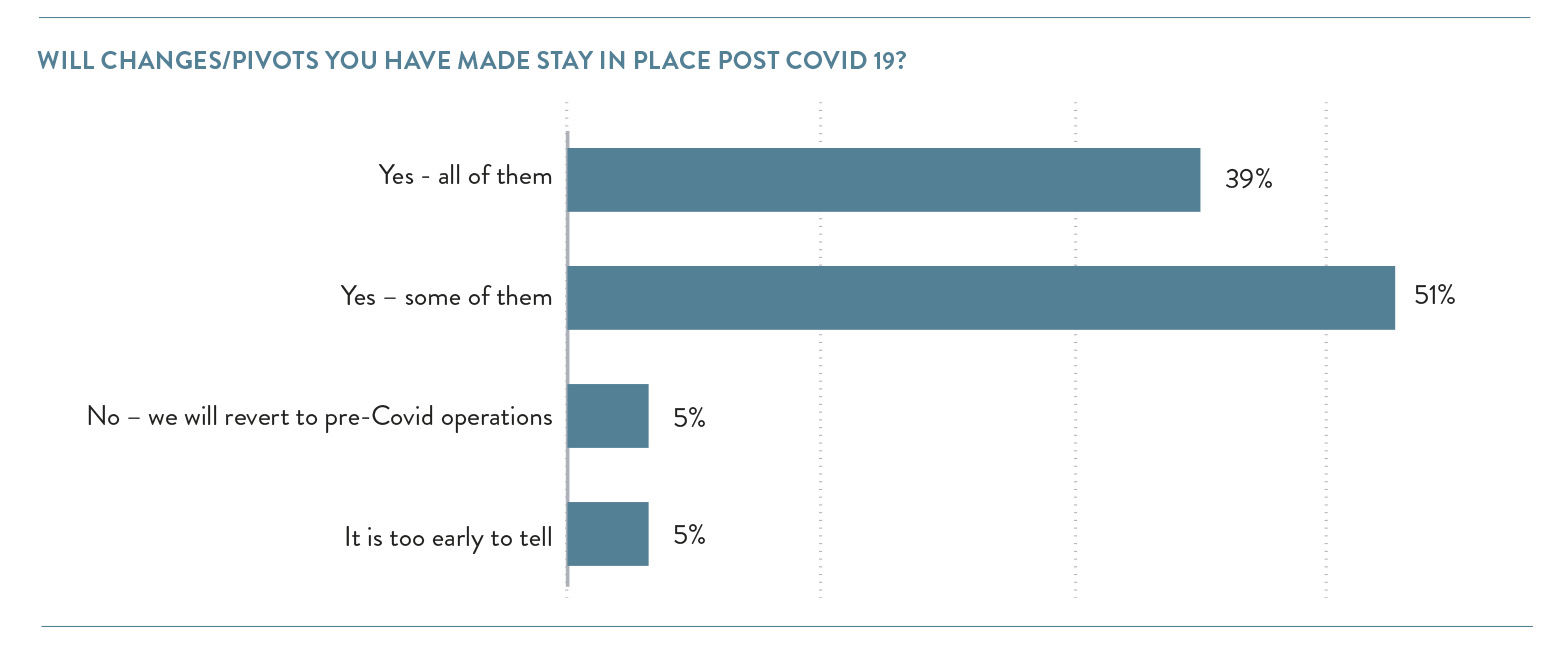

A year on, almost all scaleups expect the changes made to their business during Covid to last. 9 in 10 expect at least some of these changes to remain permanent, including 4 in 10 who expect to keep all the changes they have made (up from 2 in 10 last year), while just 5% expect the business to revert back to pre-Covid.

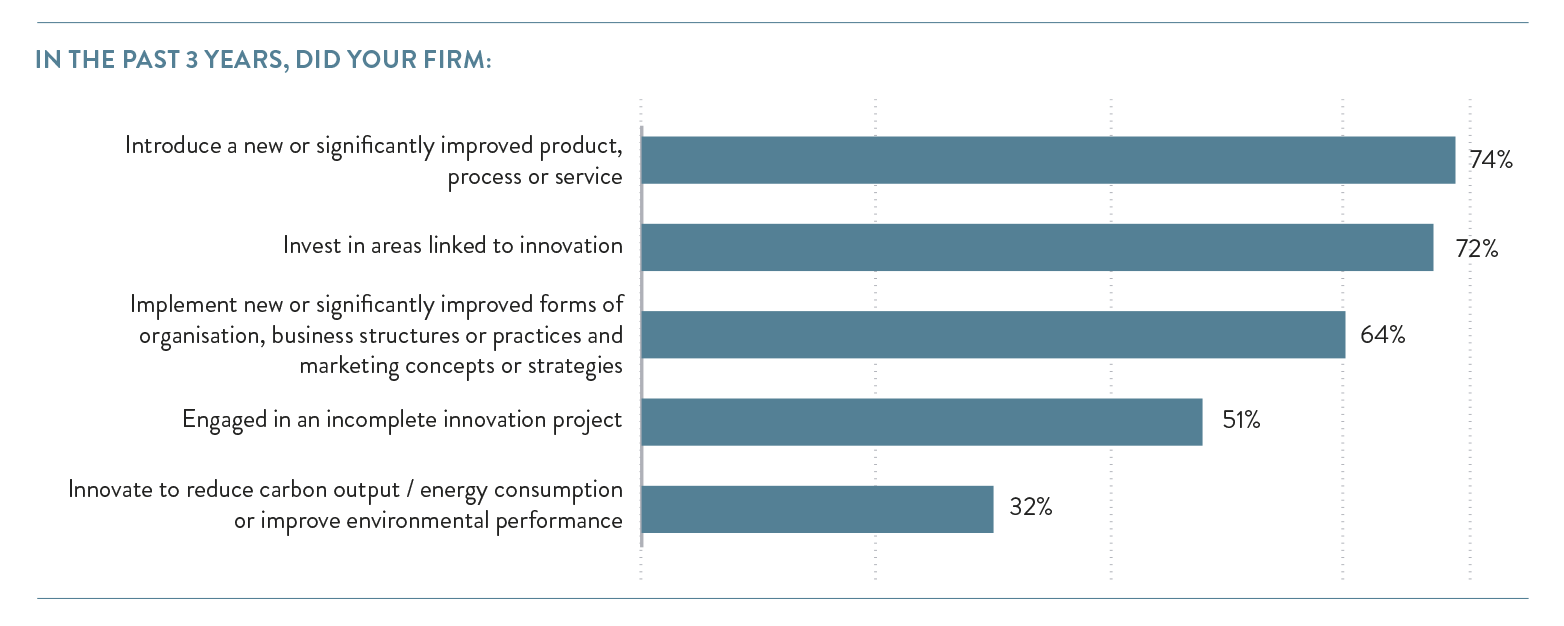

Innovation is at the core of for scaleups with 9 in 10 involved in some innovative activity in the last 3 years. 3 in 4 introduced a new or significantly improved product/process/service in the last 3 years and a similar proportion have invested in areas linked to innovation, while 6 in 10 introduced significantly improved forms of organisation, structures and processes. This shows that scaleups remain ambitious and are continuing to adapt to the ongoing challenges of Covid. They are also looking at how they can tackle wider societal challenges with 3 in 10 innovating to reduce their carbon output and energy consumption or improve environmental performance.

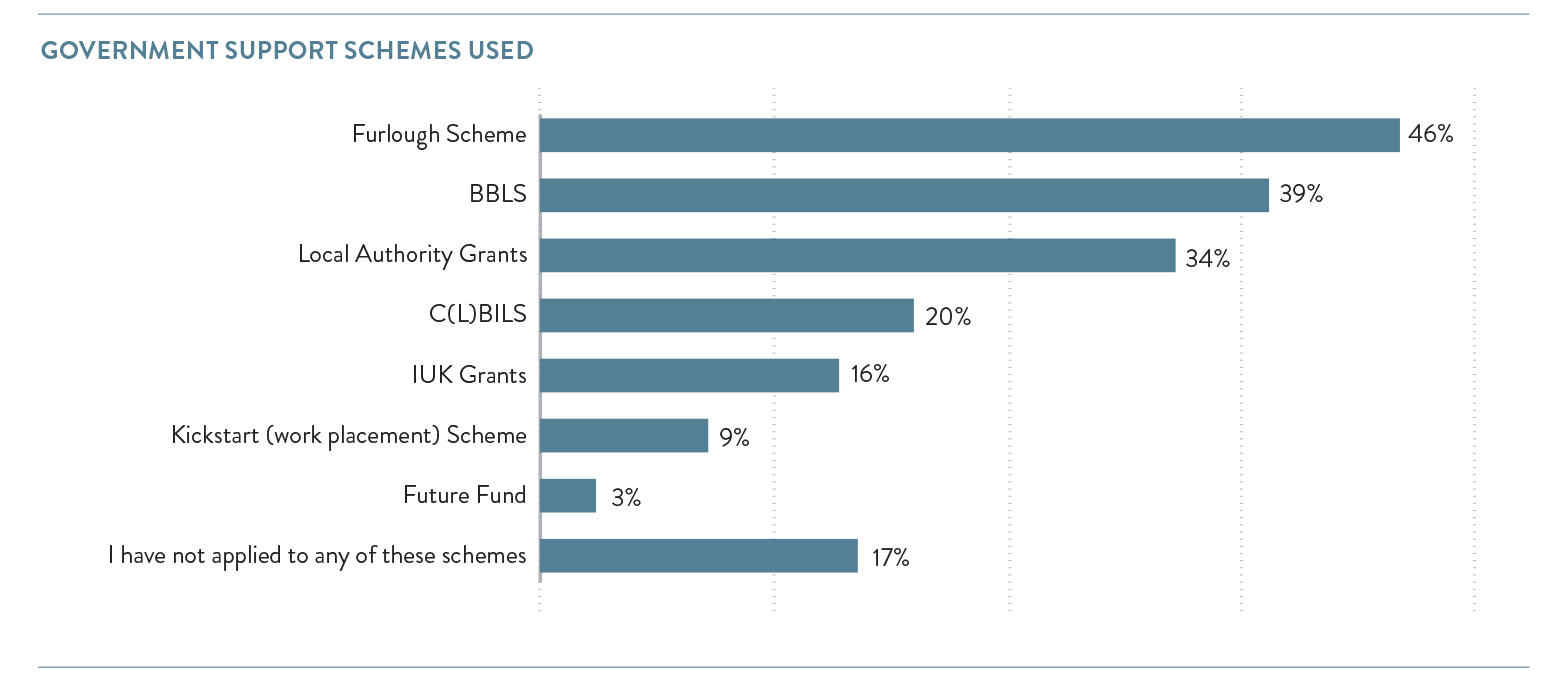

Scaleups have used all forms of Government support established in response to the pandemic. This highlights the importance of the interventions being made and the diversity of the size, scale and needs of scaleups.

As with 2020 the Furlough Scheme was by far the most commonly used scheme, being utilised by 46% of scaleups. Scaleups have utilised each of the government loan schemes, with over half (53%) accessing the various loan schemes.

34% of scaleups have made use of local authority grants – in particular those operating in the accommodation and food service sector and other service activities. 16% have used Innovate UK grants, with manufacturing and engineering businesses the largest users of these grants. 3% of scaleups who are pre-revenue and pre-profit are using the Future Fund. Overall, 87% of scaleups accessed one or more of the forms of support available, which also included the Kickstart scheme.

In addition to the impact of coronavirus in 2021, the impact of the UK’s exit from the EU is still being felt.

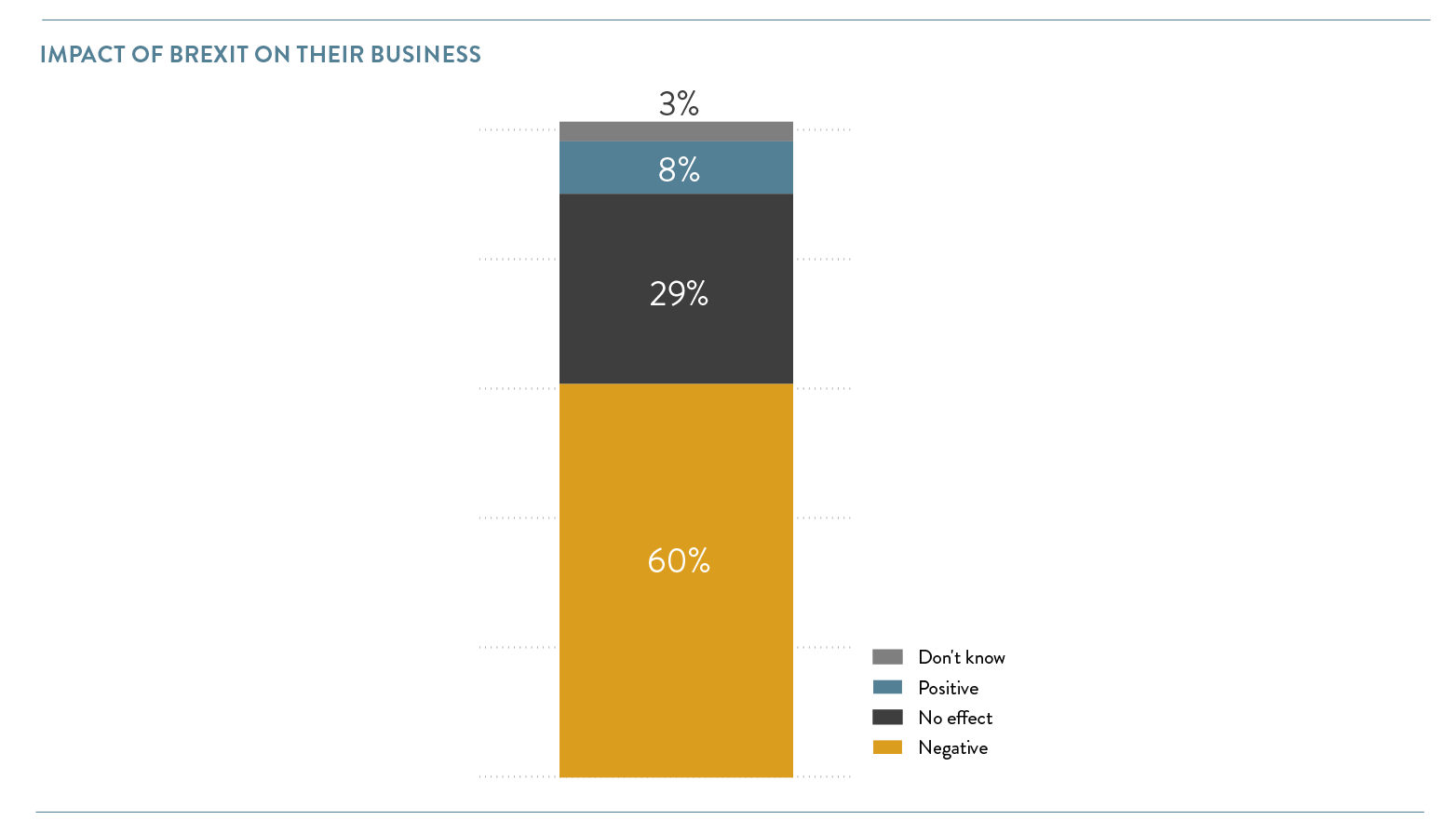

Following the end of the transition period in January 2021, scaleups continue to perceive that Brexit is having a negative impact on their business (60%) including 21% saying it has had a significant negative impact. Only 8% felt Brexit had a positive impact on their business. Despite this, scaleups continue to grow and are optimistic about the prospects for future growth: three quarters of those planning to grow are confident that they will achieve their growth ambitions (74%).

Despite the headwinds of transitioning to new trading arrangements, scaleups remain highly international, with 57% of them currently exporting and 65% planning to trade (more) overseas in the future. However, this makes them particularly vulnerable to increased barriers to international trade, given that 50% are currently exporting to the EU. 1 in 5 (21%) said uncertainty around Covid lockdowns was a barrier to them exporting (more) and 1 in 7 (15%) cited uncertainty around the outcome of international trade negotiations.

Scaleups are well established and can be sizeable businesses

- 55% of scaleups have been trading for ten years or more

- 1 in 10 in this cohort of CEOs have a turnover in excess of £10 million

- 39% have 20+ employees, with 19% have over 50 employees and 9% having 100 or more.

Scaleups are leveraging emerging technologies for growth

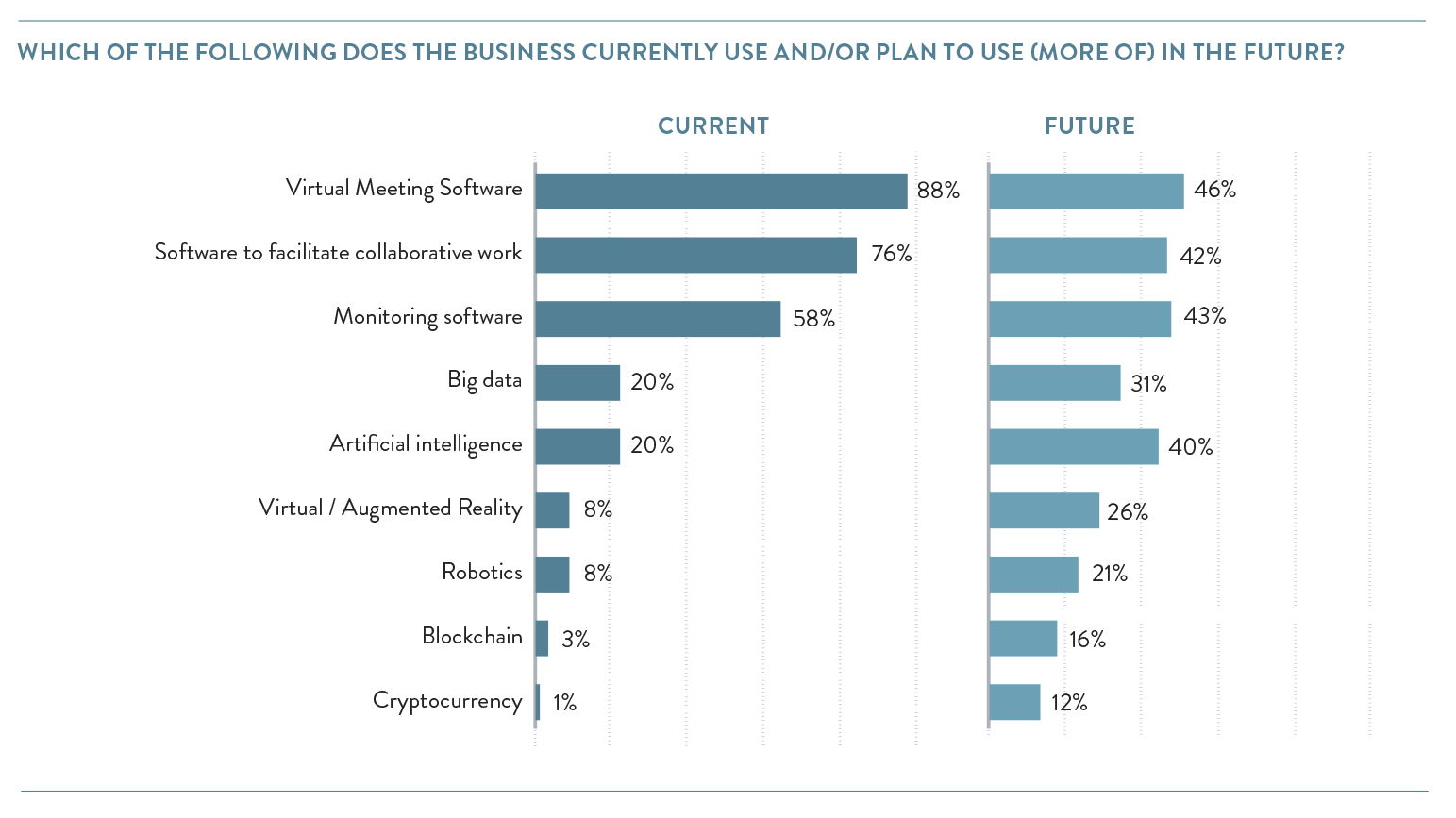

As seen in 2020, scaleups are using technology to support new ways of working with many making permanent changes to their operations by enabling staff to work flexibly from home. 9 out of 10 (88%) are keeping in touch with employees, customers, investors and stakeholders through virtual meetings. Three quarters (76%) use software to facilitate collaborative work, and 6 in 10 (58%) use it to monitor staff productivity and activity. Big data and AI are features of day to day operations in one in five scaleups.

In the future, scaleups are predicting less reliance on virtual meetings but they plan to further exploit AI, Virtual / Augmented Reality and robotics, with use of big data also dialling up.

Relationship management is critical, scaleups want their growth and needs to be recognised and ‘put on the map’

6 in 10 (63%) scaleups want a relationship manager for their business to act as a single point of contact. They want easy access to information about the support available to businesses like theirs. Having a dedicated ScaleUp website to act as a hub of information is in demand, with 6 in 10 (59%) valuing this type of resource.

They want to be identified as a scaleup as this is perceived to be helpful to further business growth. Two thirds (64%) of scaleup leaders state that their scaleup status should be shared on public record on an opt-in basis and 5 in 10 would welcome the government sharing internally with other government departments that they were a scaleup or fast-growing company.

Access to markets in the UK and internationally continues to be the most important factor for business growth, but access to talent is more often the top ranked priority

When asked to rate the greatest barriers to growth and their priorities to address, access to markets was top. It was seen as vital/very important by 78% of scaleups, significantly ahead of the talent challenge (66%). However, when asked to pick their number one priority amongst all these factors, access to talent has regained top spot (33%) ahead of access to markets (24%) reflecting the current pressures on recruitment and staff availability.

Access to finance and growth capital remains in third spot, both in overall importance and as a number one priority. Challenges around leadership and infrastructure (space to grow) are also recognised by scaleup leaders but as in 2020 these appear to be abating. However, there remains consistent demand by scaleups for peer support and access to Non-Executive Directors and mentors.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Previous

Previous

Share