Explore the ScaleUp Annual Review 2021

Select a section to expand and explore this year's review.

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Access to markets

Scaleups access a broad range of markets, from direct sales to consumers and other businesses, participating in supply chains, collaboration, winning contracts via procurement and exporting. However gaining access to these markets remains a critical challenge to our scaleups.

Since 2019, access to markets has been the most vital or very important factor for future growth for scaleups, this is seen once again in 2021 for 8 in 10 scaleups. The longstanding issues highlighted in previous years have still not been addressed – now more than ever as the UK grows back from the pandemic and trade arrangements are finalised is it essential that we break down these persistent barriers and meet the aspirations of our scaleup community.

Domestic markets

Access to domestic markets remains a key issue for scaleup leaders, with nearly two thirds rating this as a vital or very important factor in their future growth (63%).

Amongst the 76% of scaleups selling primarily to other businesses, large corporates and government have an important role in the scaleup ecosystem. There need to be greater opportunities for scaleups to gain traction, collaborate and sell to these institutions.

Almost 6 in 10 of B2B scaleups sell to large corporates in the UK (57%), demonstrating the importance of the links between scaleups and larger companies. 4 in 10 have aspirations to sell to large corporates in the future. However as with last year only 3 in 10 scaleups have collaborated with large corporates in the past three years to develop a new product or service.

Only 1 in 10 scaleups sell directly to the UK Government, (14%) while a quarter of scaleups sell to local or regional government (24%). While not a prevalent customer currently, almost double that – 3 out of 10 scaleups have aspirations to sell to government in the future (28%). Similarly to 2020, only 2 in 10 have collaborated with government, showing an increase from 1 in 10 in 2019 – but there remains far greater scope to do more.

Scaling businesses are found throughout the supply chain – 1 in 3 are part of a supply chain to large corporates in the UK, while half that number (15%) are in a supply chain selling to the government.

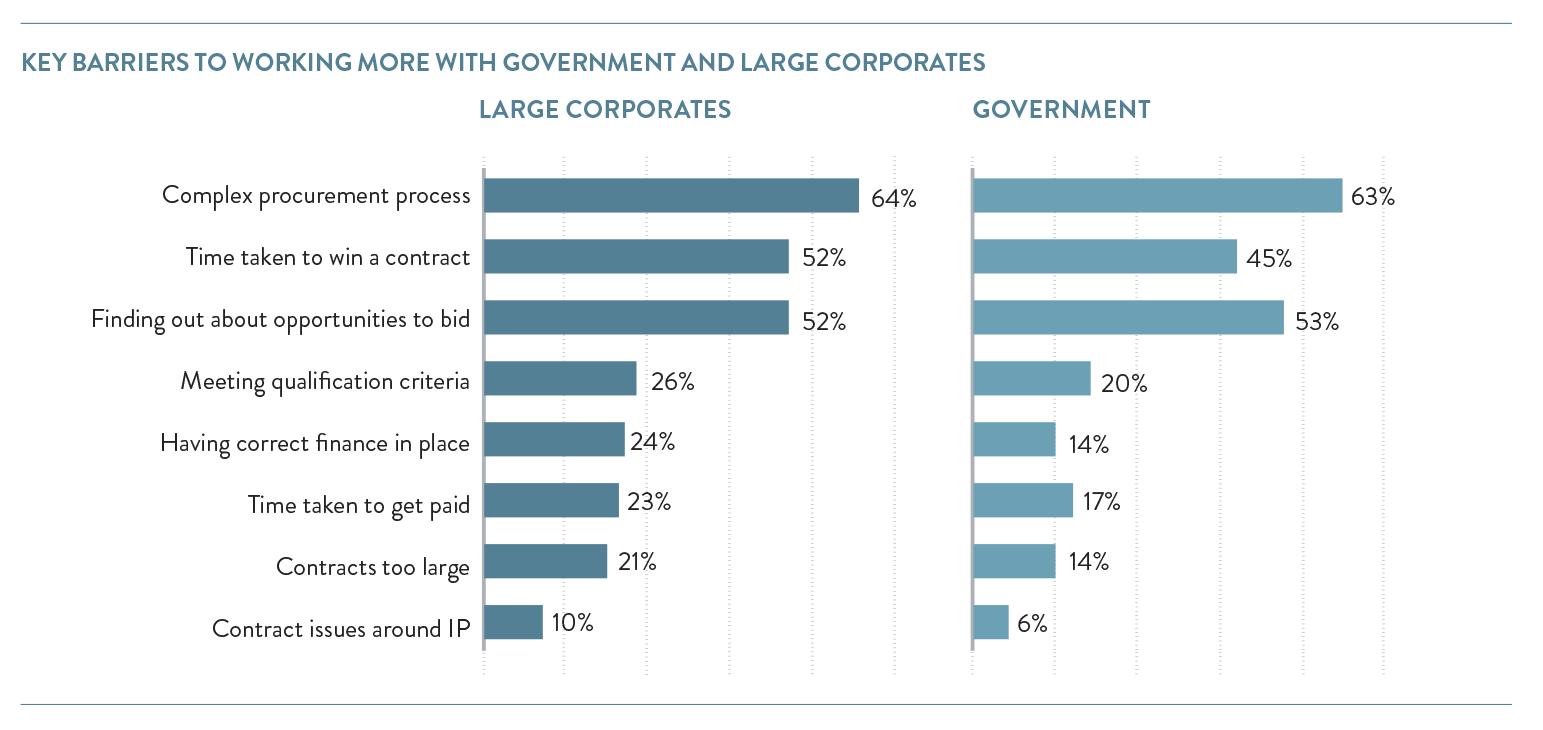

The top barriers to working with corporates and government are persistent. Complexity in procurement processes, the time it takes to win a contract and finding the opportunities to bid for remain the most significant challenges. We need to foster greater collaboration between scaleups and other players in the economy if we wish to develop a more dynamic and innovative scaleup ecosystem.

Procurement processes need to be improved to increase their efficiency and ease access for scaleups. Data, as supported by scaleups, should be leveraged to identify scaling businesses early and to proactively engage with them on opportunities.

For those scaleups primarily selling direct to consumers the key barriers to their ongoing growth are brand awareness, finding the right marketing channels in order to reach their target customer base and the costs associated with advertising. These scaleups also cite the competition they face from more established large corporates for a market share.

International Trade

57% of respondents to the scaleup survey are currently exporting with 4 in 10 scaleup leaders considering access to international markets as a vital or very important factor in their future growth.

The EU remains the most important international market for scaleups with 50% trading within the bloc. However, continuing the trend seen in 2020 an increasing number are looking to markets further afield with 46% now trading with countries outside the EU, having grown from 32% in 2019.

Going forward, 7 in 10 scaleups are seeking to engage in international trade. They see key opportunities in North America, Australasia, the Middle East, China, India and other parts of Asia and overall, 62% aspire to export (more) to countries outside the EU.

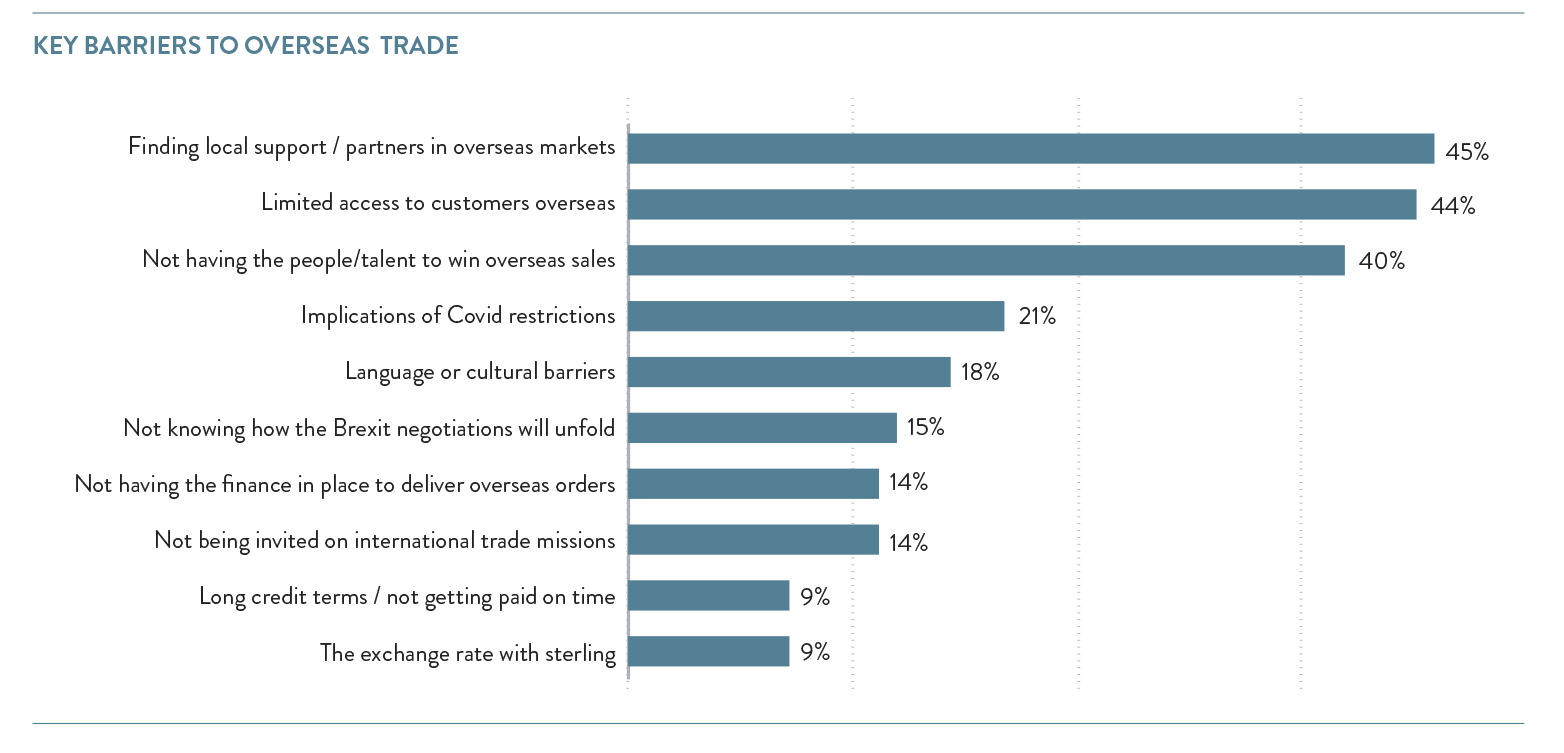

Scaleup leaders face a variety of challenges as they develop their international business, citing limited access to overseas customers (44%), difficulties in finding local support (45%) and lack of talent to make overseas sales (40%) as the biggest barriers to exporting more.

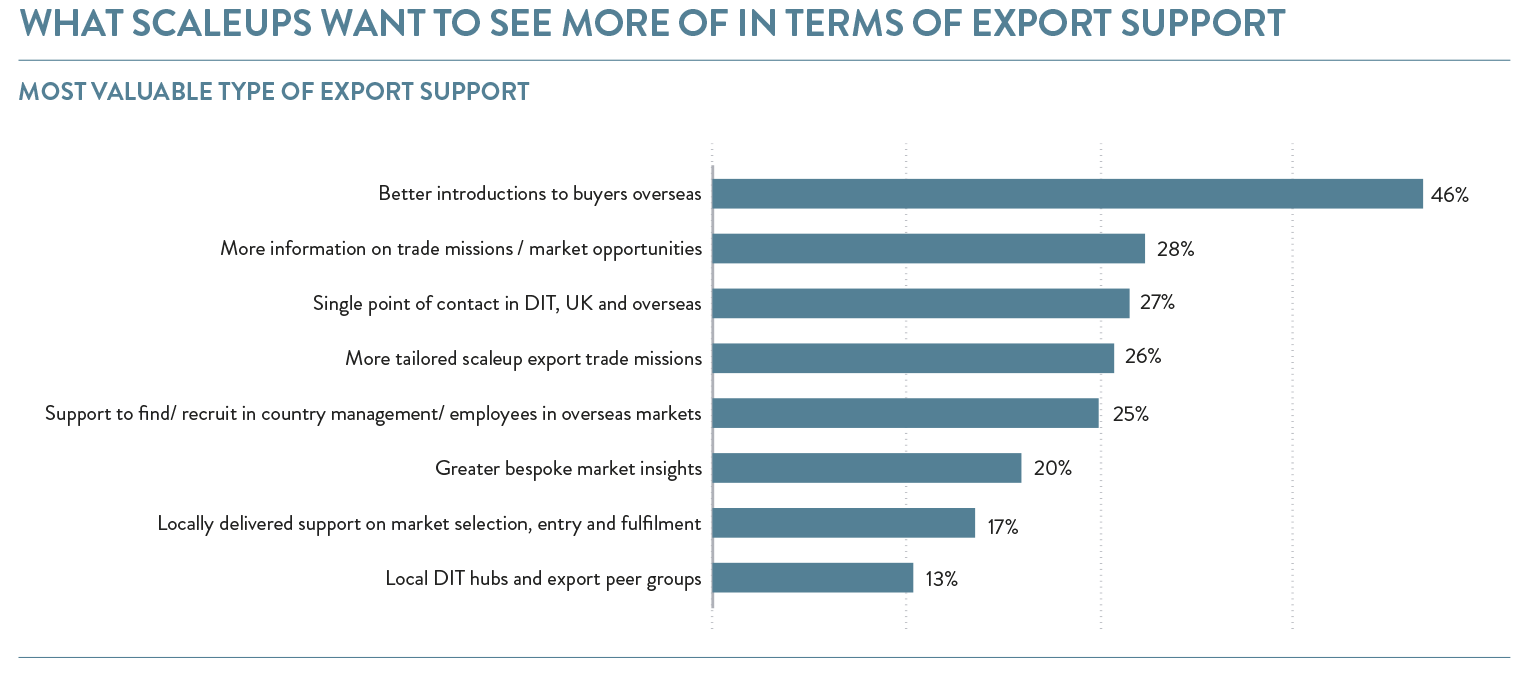

Breaking down the barriers to exporting – what do scaleups want more of?

In order to meet their international aspirations scaleups want, in particular, greater support in:

- introductions to overseas buyers and partners:

- more proactive information on trade missions and market opportunities

- a single point of contact with the Department for International Trade (DIT) to relationship manage their needs at home and abroad;

- more tailored export trade missions and

- support to recruit management/employees in overseas markets

WHAT SCALEUPS WANT TO SEE MORE OF IN TERMS OF EXPORT SUPPORT

CONTENTS

Introduction 2021

Chapter 1 2021

The ScaleUp Business Landscape

Chapter 2 2021

Leading Programmes Breaking Down the Barriers for Scaleups

Chapter 3 2021

The Local Scaleup Ecosystem

Chapter 4 2021

The Policy Landscape

Chapter 5 2021

Looking forward

Annexes 2021

Scaleup Stories 2021

Previous

Previous

Share